NPM BUSINESS

Company Overview

NPM is a preclinical stage biopharmaceutical company which develops miniaturized, subdermal implants utilizing its proprietary NanoPortal™ technology to enable long-term, near constant-rate delivery of a broad range of medicines to treat chronic diseases. NPM uses this platform technology to develop and commercialize innovative, long-term drug implants, alone or in collaboration with pharmaceutical company partners to address a leading cause of poor clinical outcomes, medication non-adherence. NPM’s drug implants, unlike oral and injectable medicines are able to guarantee adherence by delivering minimally fluctuating drug plasma levels for up to 6 months or the life of the implant.

NPM’s mission is to provide people with the freedom to live healthier. NPM headquarters and operations are located at 5858 Horton Street, Emeryville, California and the company was incorporated in California in December 2009.

Technology Overview

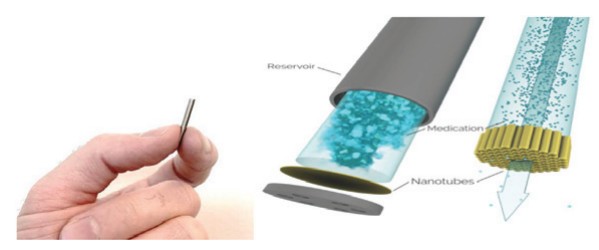

NPM’s technology, which NPM calls NanoPortal, utilizes a space-efficient design that allows a miniaturized implant to provide many months of therapeutic delivery of potent molecules. The technology has no moving parts which results in a minimally fluctuating delivery profile, which is also tunable, over the duration of the implant. NPM has primarily been developing products around peptide therapeutics, but the technology can work across a wide range of molecular types. The key innovative component of the technology is a biocompatible titanium-oxide nano porous membrane which consists of millions of precisely sized nanotubes whose inner diameters represent the only path for drug molecules to exit the reservoir once the implant is fully assembled.

The key to the technology’s ability to achieve near constant release without moving parts is the ability to precisely tune the inner diameter of the nanotubes to the same size range as individual drug molecules. If the inner diameter of the nanotubes was smaller than the size of a given drug, there would be no release at all. If the inner diameter of the nanotubes was much larger than the size of a given drug, the rate at which the drug leaves the reservoir would follow traditional physics and would decrease over time as the drug concentration decreases. However, when the opening is close enough in size to the drug molecules, the drug release is constrained and can result in a variety of desirable delivery profiles including near constant release. NPM’s NanoPortal technology has demonstrated near constant release in animal models.

For drug molecules with adequate potency and stability, NanoPortal can allow minimization of the implant size while extending implant duration. A custom delivery profile can also be achieved by adjusting the number of accessible nanotubes, engineering changes to the implant, and/or changes in formulation parameters. With the design flexibility afforded by the NanoPortal technology, NPM plans to develop a portfolio of drug implants aimed at addressing diseases with high unmet medical needs.

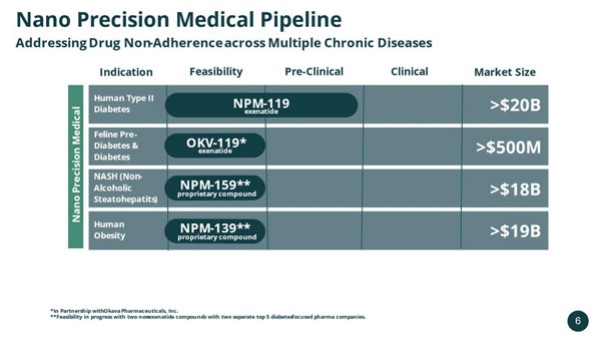

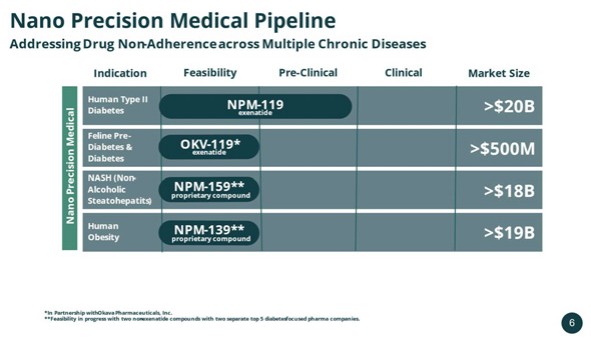

Product Candidates

Although NPM’s proprietary NanoPortalTM implant technology has very broad potential applicability across a wide range of therapeutic molecules and disease areas, the company decided to focus initially on peptide therapeutics for the treatment of patients

175