Pixium Vision / Second Sight Medical Products Business Combination January 6th 2021 Exhibit 99.2

Legal Disclaimer Additional Information and Where to Find It In connection with the proposed transaction between Second Sight Medical Products, Inc. (“Second Sight”) and Pixium Vision, Second Sight will file with the United States Securities and Exchange Commission (the “SEC”) preliminary and definitive proxy statements and will mail a definitive proxy statement to its shareholders as of the record date established for voting on the proposed business combination. SECOND SIGHT’S SHAREHOLDERS AND OTHER INTERESTED PERSONS ARE ADVISED TO READ, ONCE AVAILABLE, THE PRELIMINARY PROXY STATEMENT AND ANY AMENDMENTS THERETO AND, ONCE AVAILABLE, THE DEFINITIVE PROXY STATEMENT, IN CONNECTION WITH SECOND SIGHT’S SOLICITATION OF PROXIES FOR ITS SPECIAL MEETING OF STOCKHOLDERS TO BE HELD TO APPROVE, AMONG OTHER THINGS, THE PROPOSED BUSINESS COMBINATION, BECAUSE THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT SECOND SIGHT, PIXIUM VISION AND THE PROPOSED BUSINESS COMBINATION. Second Sight’s shareholders may also obtain a copy of the preliminary or definitive proxy statement, once available, as well as other documents filed with the SEC by Second Sight, without charge, at the SEC’s website located at www.sec.gov or by directing a request to: Second Sight Medical Products, Inc., 12744 San Fernando Road, Suite 400, Sylmar CA 91342. The information contained on, or that may be accessed through, the websites referenced in this presentation is not incorporated by reference into, and is not a part of, this press release. FORWARD LOOKING STATEMENTS This document contains information which includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. The actual business results may differ from expectations, estimates and projections and consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “propose,” “plan,” “contemplate,” “may,” “will,” “shall,” “would,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” “positioned,” “goal,” “conditional” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the intention to pursue the business combination and to announce information regarding the business combination, as well as statements regarding the combined company’s markets and competitive position, and more specifically, on the size of its potential markets. This information has been drawn from various sources or from the companies' own estimates. Investors should not base their investment decision on this information. These statements are not a guarantee of the combined company's future performance. These forward-looking statements relate to the combined company’s future prospects, developments and marketing strategy and are based on analyses of earnings forecasts and estimates of amounts not yet determinable. Forward-looking statements are subject to a variety of risks and uncertainties as they relate to future events and are dependent on circumstances that may or may not materialize in the future. Since forward-looking statements cannot under any circumstance be construed as a guarantee of the combined company's future performance and that the combined company’s actual financial position, results and cash flow, as well as the trends in the sector in which the combined company operates may differ materially from those proposed or reflected in the forward-looking statements contained in this document. Furthermore, even if the combined company’s financial position, results, cash-flows and developments in the sector in which the combined company operates were to conform to the forward-looking statements contained in this document, such results or developments cannot be construed as a reliable indication of the combined company's future results or developments Neither Second Sight nor Pixium undertakes any obligation to update or to confirm projections or estimates made by analysts or to make public any correction to any prospective information in order to reflect an event or circumstance that may occur after the date of this presentation. A description of those events that may have a material adverse effect on the business, financial position or results of the combined company, or on its ability to meet its targets, appears in (i) the sections "Risk Factors" of Pixium Vision’s “Document de Base” filed with the French Autorité des Marchés Financiers and (ii) risks and uncertainties described in or implied by the Risk Factors and in Management’s Discussion and Analysis of Financial Condition and Results of Operations sections of Second Sight’s Annual Report on Form 10-K, filed on March 19, 2020, Form 10K/A filed April 28, 2020, and Forms 10-Q filed June 26, 2020, August 13, 2020, and November 12, 2020, and other reports filed by Second Sight from time to time with the SEC. By attending this presentation or accepting this document, you agree to be bound by the foregoing restrictions set out above.

Speakers on this Call Lloyd Diamond – CEO of Pixium Vision 25+ years experience in the MedTech industry Extensive experience in development, commercial and financing in orthopedic, ophthalmology and other clinical segments Dr. José-Alain Sahel – Distinguished Professor and Chair of the Department of Ophthalmology, University of Pittsburgh School of Medicine Founder of Pixium Vision and Institut de la Vision (Paris) Site Principal Investigator of the Argus clinical trials Guillaume Renondin – CFO of Pixium Vision 30+ years finance experience – Aeronautic, Automotive and Startups Senior Advisor Grant Thornton Executive Matthew Pfeffer – CEO of Second Sight 30+ years experience in Healthcare including former CEO of MannKind Corporation Numerous Board positions

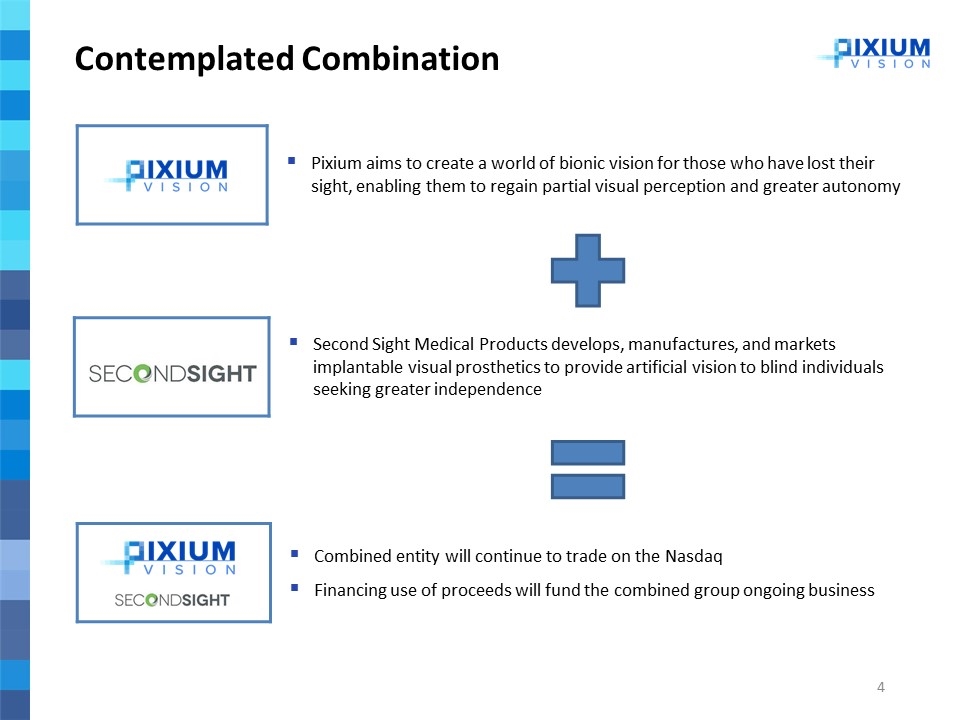

Second Sight Medical Products develops, manufactures, and markets implantable visual prosthetics to provide artificial vision to blind individuals seeking greater independence Contemplated Combination Pixium aims to create a world of bionic vision for those who have lost their sight, enabling them to regain partial visual perception and greater autonomy Combined entity will continue to trade on the Nasdaq Financing use of proceeds will fund the combined group ongoing business

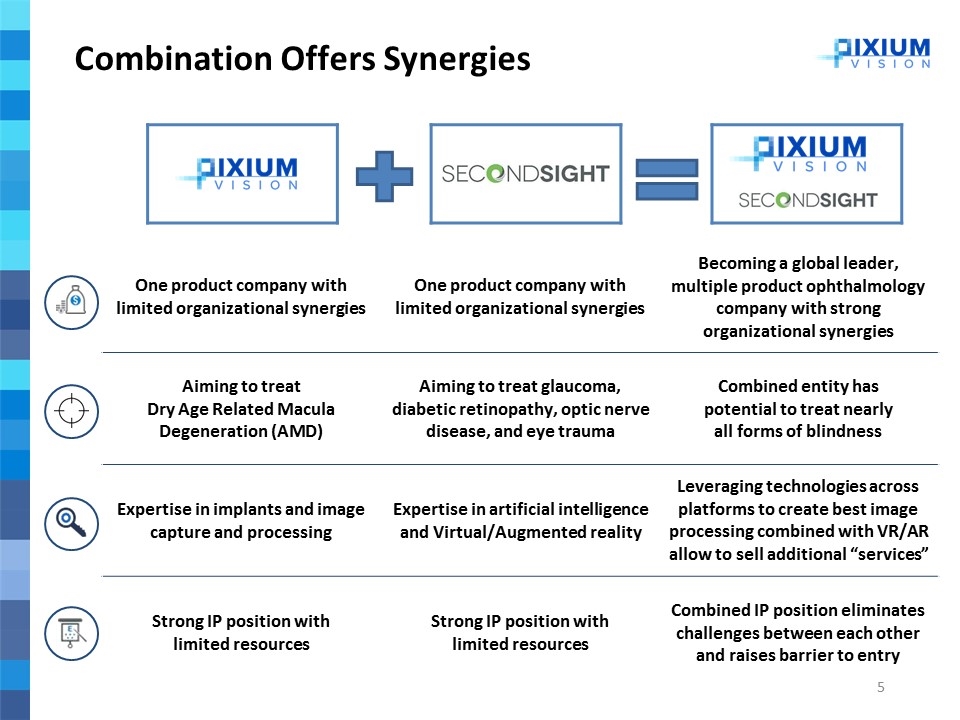

One product company with limited organizational synergies One product company with limited organizational synergies Becoming a global leader, multiple product ophthalmology company with strong organizational synergies Aiming to treat Dry Age Related Macula Degeneration (AMD) Aiming to treat glaucoma, diabetic retinopathy, optic nerve disease, and eye trauma Combined entity has potential to treat nearly all forms of blindness Expertise in implants and image capture and processing Expertise in artificial intelligence and Virtual/Augmented reality Leveraging technologies across platforms to create best image processing combined with VR/AR allow to sell additional “services” Strong IP position with limited resources Strong IP position with limited resources Combined IP position eliminates challenges between each other and raises barrier to entry Combination Offers Synergies

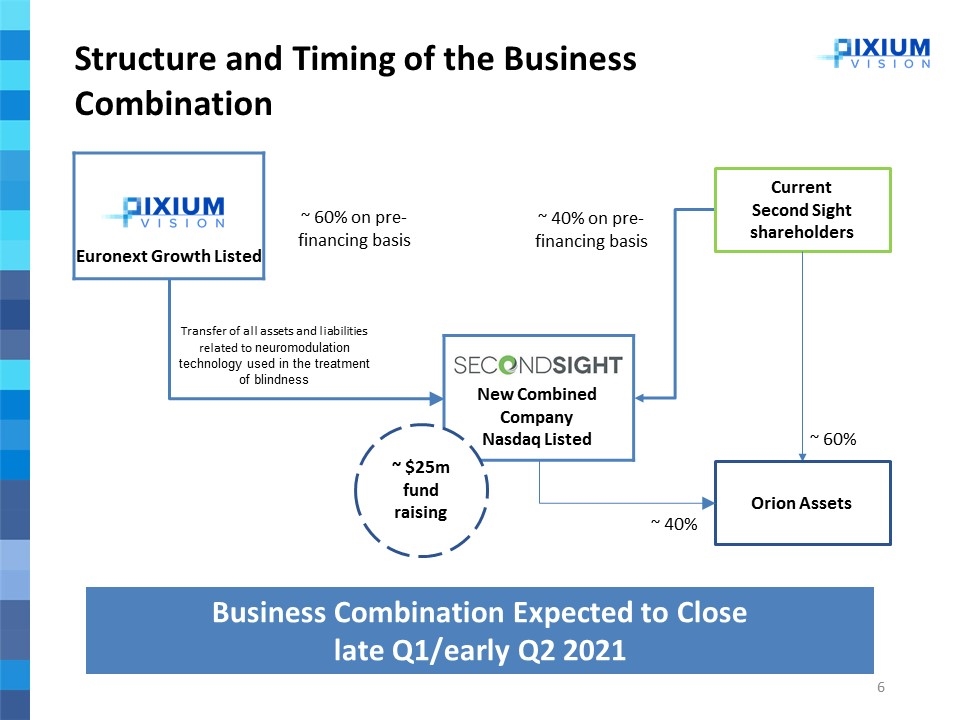

Structure and Timing of the Business Combination Euronext Growth Listed ~ 60% on pre-financing basis Transfer of all assets and liabilities related to neuromodulation technology used in the treatment of blindness Current Second Sight shareholders ~ 40% Orion Assets ~ 60% ~ $25m fund raising Business Combination Expected to Close late Q1/early Q2 2021 New Combined Company Nasdaq Listed ~ 40% on pre-financing basis

Pixium Vision

Pixium Vision Company Overview: Investing Into the Last Stage of Clinical Development Focus: Neuromodulation in ophthalmology Brain-machine technology company leveraging proprietary algorithms and artificial intelligence to develop bionic vision system for the treatment of retinal dystrophies Developing the Prima Retinal Implant System Helps visually impaired patients regain sight through neuromodulation Only ophthalmology treatment modality with the potential to restore vision rather than halt or manage vision decline Progress: Entering the Final Development Stage So far, 7 patients have received treatment with the Prima system The Prima System exceeded its primary endpoint: Demonstrated successful letter reading in the central retinal area Proof of Concept validated in dry-AMD – a disease with no current therapeutic solution We believe the Prima system can become 1st therapeutic solution in Dry-AMD A $1.25B initial market opportunity Next Development Steps PRIMAVERA pivotal study in dry-AMD has been filed, read-out late 2022 PRIMA U.S. Early Feasibility Study (EFS) initiated in Q1 2020: two patients successfully implanted

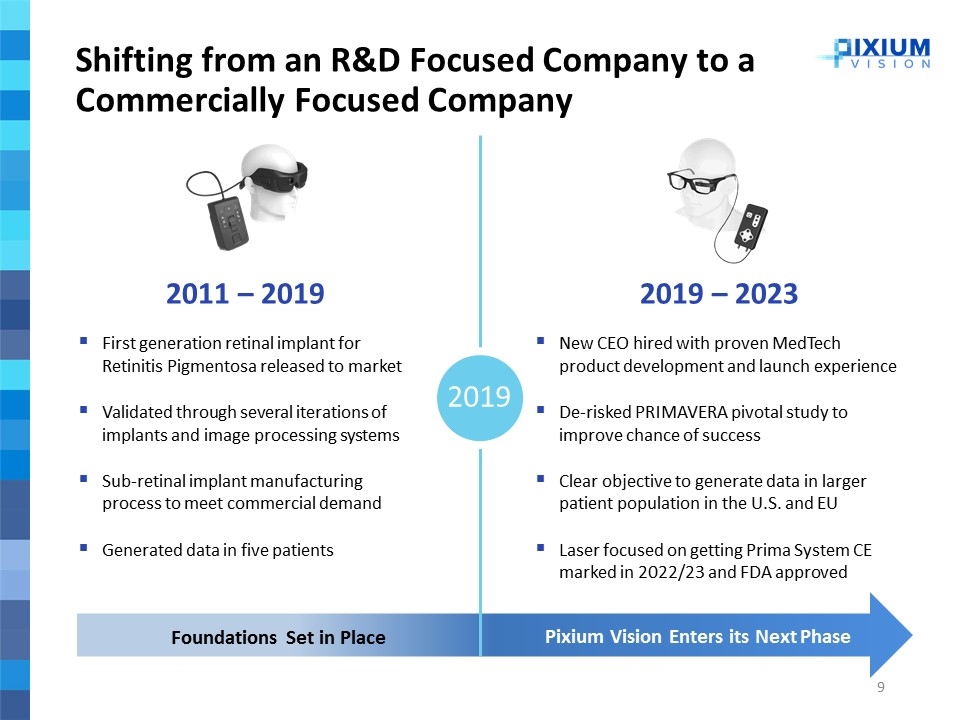

2019 2011 – 2019 First generation retinal implant for Retinitis Pigmentosa released to market Validated through several iterations of implants and image processing systems Sub-retinal implant manufacturing process to meet commercial demand Generated data in five patients Foundations Set in Place 2019 – 2023 New CEO hired with proven MedTech product development and launch experience De-risked PRIMAVERA pivotal study to improve chance of success Clear objective to generate data in larger patient population in the U.S. and EU Laser focused on getting Prima System CE marked in 2022/23 and FDA approved Pixium Vision Enters its Next Phase Shifting from an R&D Focused Company to a Commercially Focused Company

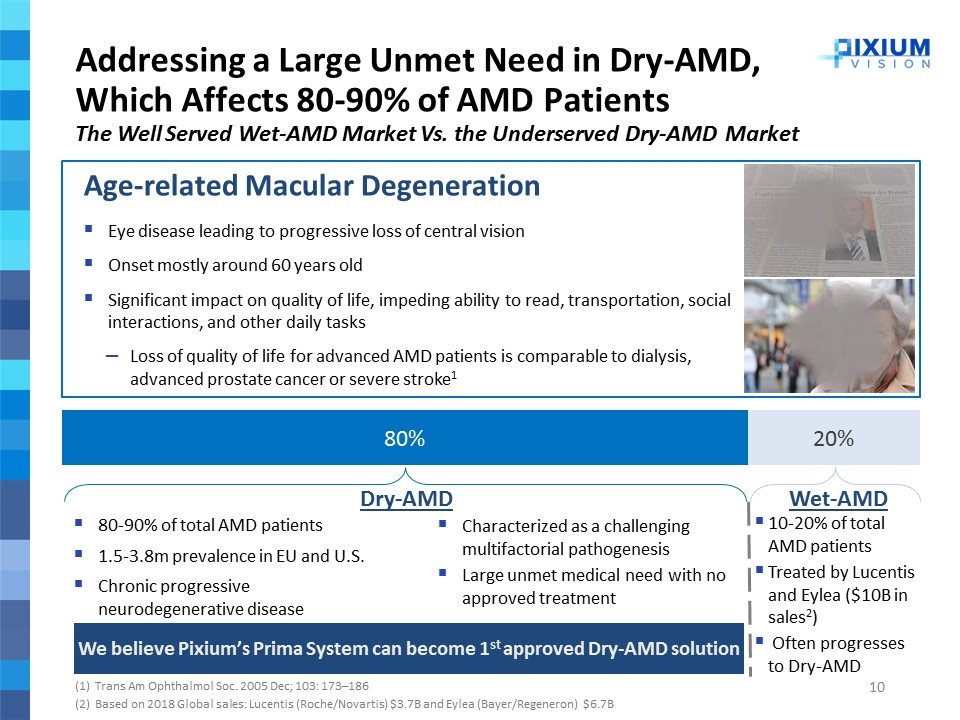

Addressing a Large Unmet Need in Dry-AMD, Which Affects 80-90% of AMD Patients The Well Served Wet-AMD Market Vs. the Underserved Dry-AMD Market (1) Trans Am Ophthalmol Soc. 2005 Dec; 103: 173–186 (2) Based on 2018 Global sales: Lucentis (Roche/Novartis) $3.7B and Eylea (Bayer/Regeneron) $6.7B Age-related Macular Degeneration Eye disease leading to progressive loss of central vision Onset mostly around 60 years old Significant impact on quality of life, impeding ability to read, transportation, social interactions, and other daily tasks Loss of quality of life for advanced AMD patients is comparable to dialysis, advanced prostate cancer or severe stroke1 80-90% of total AMD patients 1.5-3.8m prevalence in EU and U.S. Chronic progressive neurodegenerative disease Dry-AMD Characterized as a challenging multifactorial pathogenesis Large unmet medical need with no approved treatment We believe Pixium’s Prima System can become 1st approved Dry-AMD solution Wet-AMD 10-20% of total AMD patients Treated by Lucentis and Eylea ($10B in sales2) Often progresses to Dry-AMD

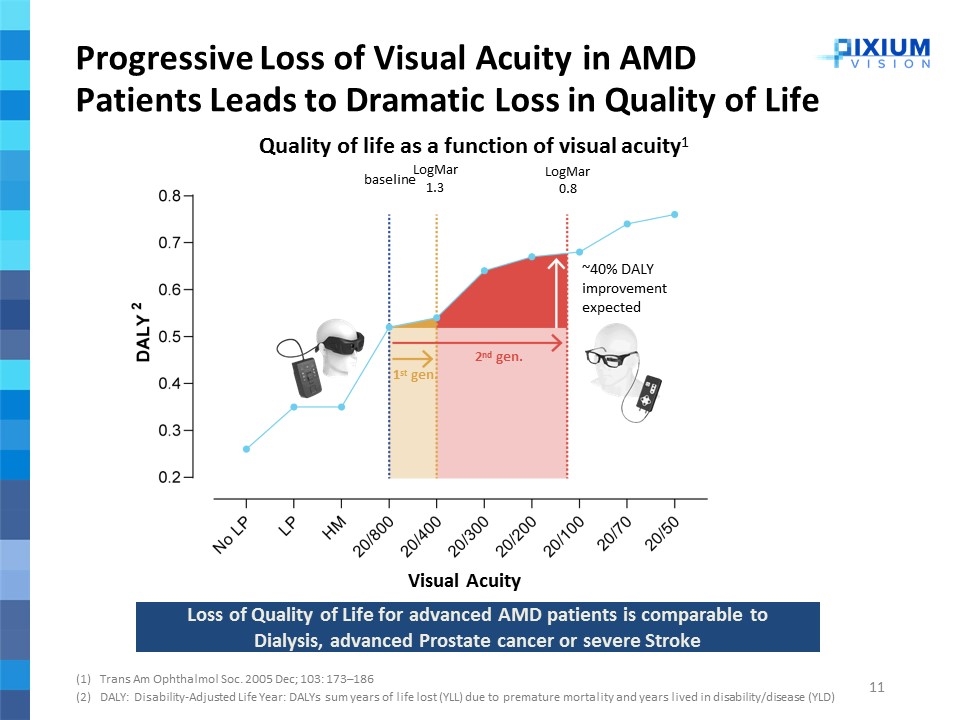

Progressive Loss of Visual Acuity in AMD Patients Leads to Dramatic Loss in Quality of Life Trans Am Ophthalmol Soc. 2005 Dec; 103: 173–186 DALY: Disability-Adjusted Life Year: DALYs sum years of life lost (YLL) due to premature mortality and years lived in disability/disease (YLD) LogMar 0.8 LogMar 1.3 Quality of life as a function of visual acuity1 baseline ~40% DALY improvement expected 2nd gen. 1st gen. Loss of Quality of Life for advanced AMD patients is comparable to Dialysis, advanced Prostate cancer or severe Stroke Visual Acuity

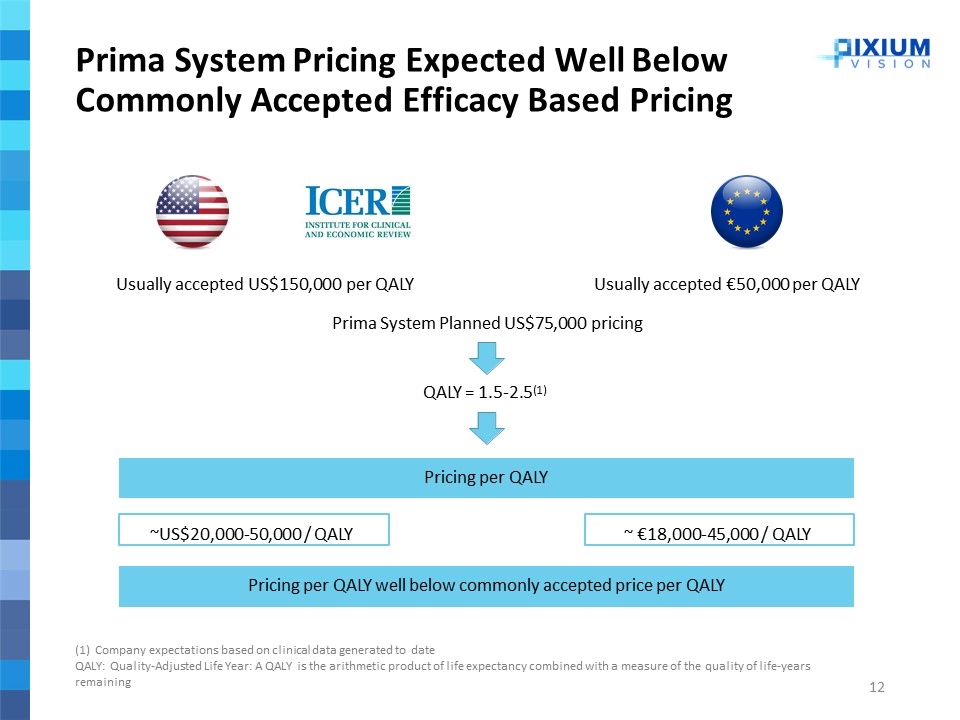

Prima System Pricing Expected Well Below Commonly Accepted Efficacy Based Pricing Usually accepted US$150,000 per QALYUsually accepted €50,000 per QALY Prima System Planned US$75,000 pricing QALY = 1.5-2.5(1) (1) Company expectations based on clinical data generated to date QALY: Quality-Adjusted Life Year: A QALY is the arithmetic product of life expectancy combined with a measure of the quality of life-years remaining ~US$20,000-50,000 / QALY ~ €18,000-45,000 / QALY Pricing per QALY Pricing per QALY well below commonly accepted price per QALY

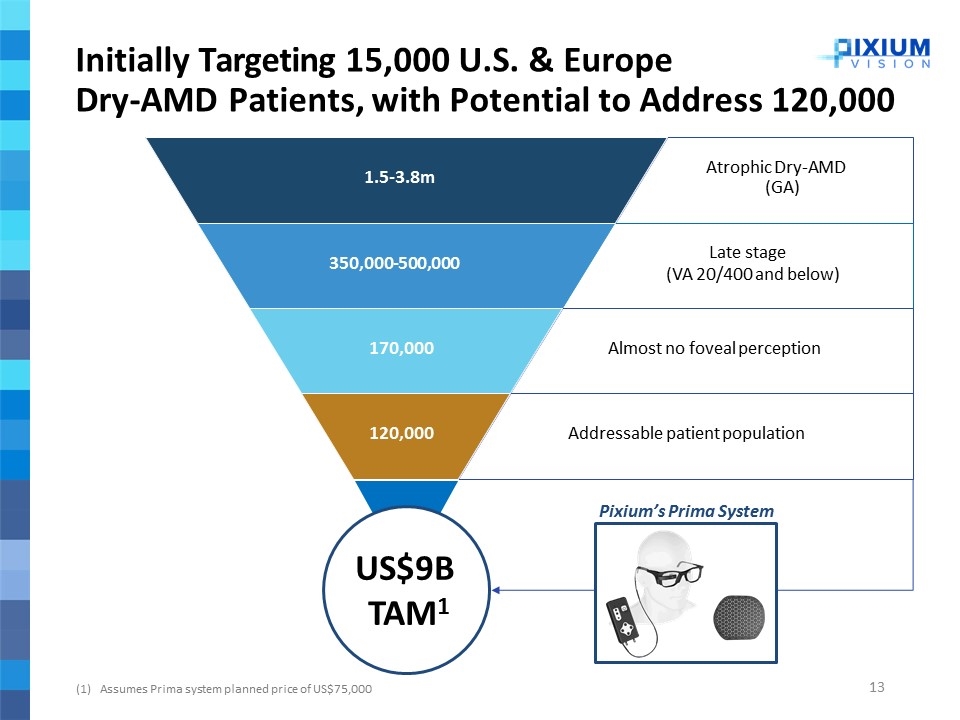

Initially Targeting 15,000 U.S. & Europe Dry-AMD Patients, with Potential to Address 120,000 Assumes Prima system planned price of US$75,000 Atrophic Dry-AMD (GA) 1.5-3.8m Late stage (VA 20/400 and below) 350,000-500,000 Almost no foveal perception 170,000 Addressable patient population 120,000 US$9B TAM1 Pixium’s Prima System

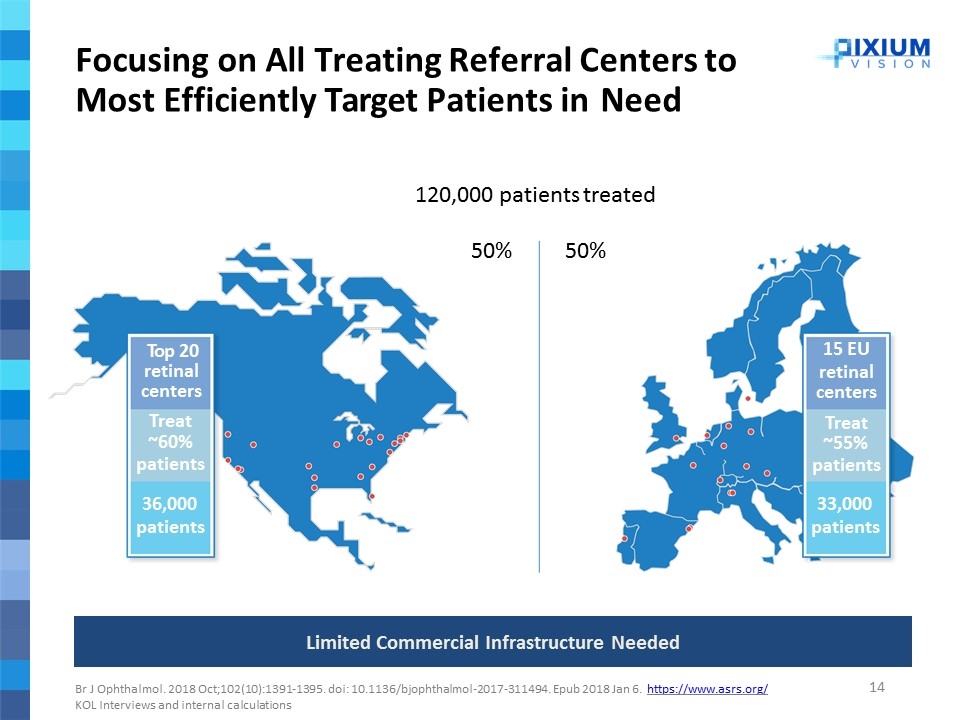

Focusing on All Treating Referral Centers to Most Efficiently Target Patients in Need Top 20 retinal centers Treat ~60% patients 15 EU retinal centers Treat ~55% patients 120,000 patients treated 50%50% 36,000 patients 33,000 patients Br J Ophthalmol. 2018 Oct;102(10):1391-1395. doi: 10.1136/bjophthalmol-2017-311494. Epub 2018 Jan 6. https://www.asrs.org/ KOL Interviews and internal calculations Limited Commercial Infrastructure Needed

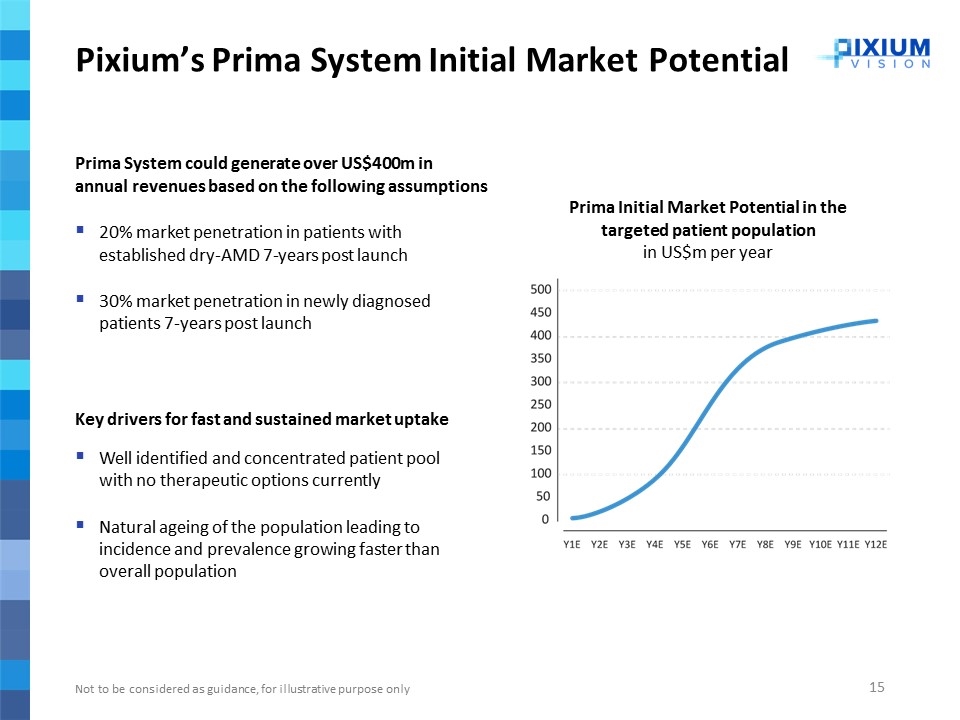

Pixium’s Prima System Initial Market Potential Prima System could generate over US$400m in annual revenues based on the following assumptions 20% market penetration in patients with established dry-AMD 7-years post launch 30% market penetration in newly diagnosed patients 7-years post launch Key drivers for fast and sustained market uptake Well identified and concentrated patient pool with no therapeutic options currently Natural ageing of the population leading to incidence and prevalence growing faster than overall population Prima Initial Market Potential in the targeted patient population in US$m per year Not to be considered as guidance, for illustrative purpose only

Prima System: Breakthrough Machine-brain Interface for Dry-AMD

Universities and Research Institutes Vision Clinics Prima System, a Cutting-Edge Technology Supported by Multi-disciplinary Partners

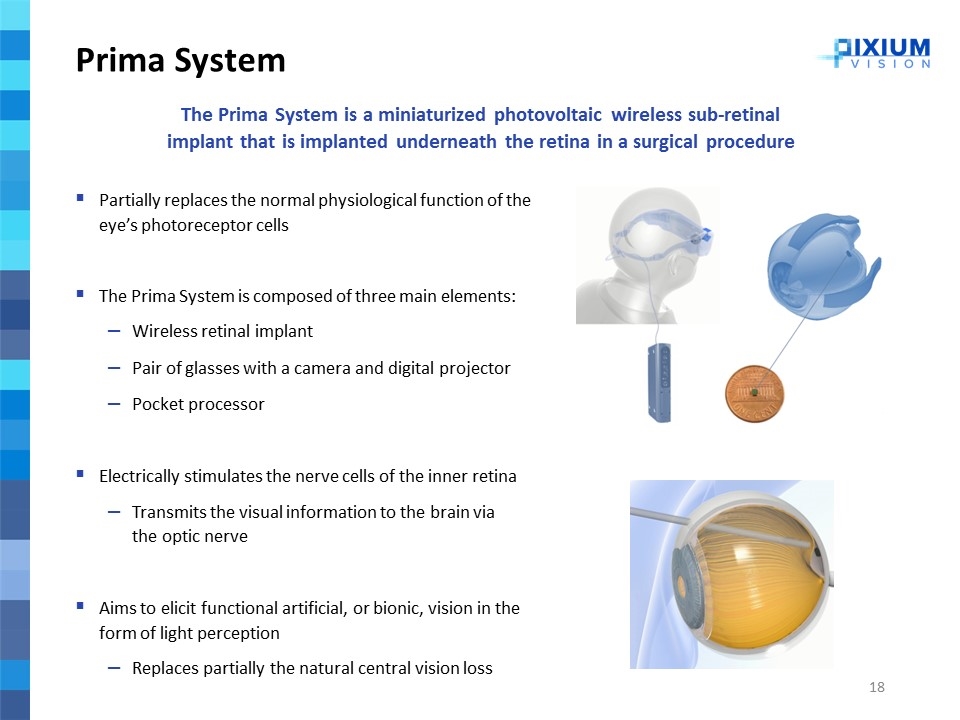

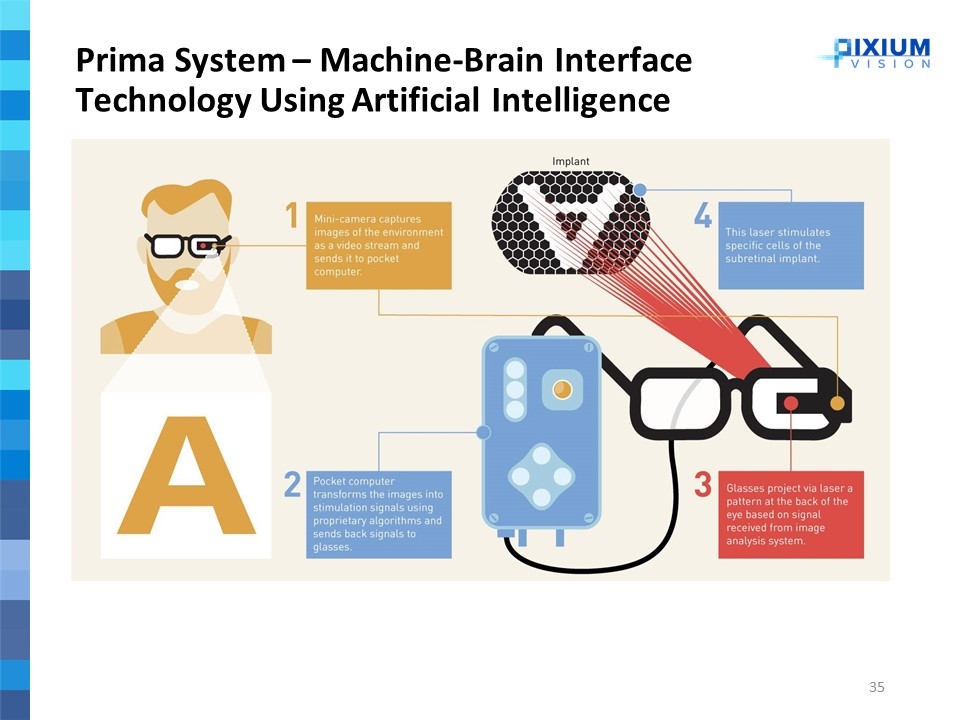

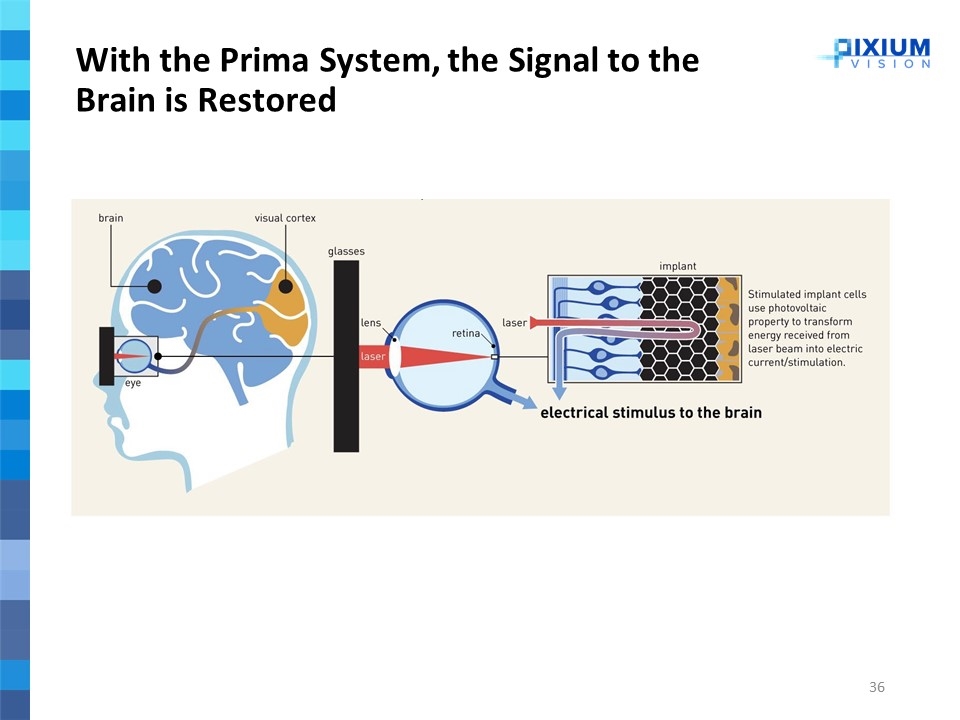

Partially replaces the normal physiological function of the eye’s photoreceptor cells The Prima System is composed of three main elements: Wireless retinal implant Pair of glasses with a camera and digital projector Pocket processor Electrically stimulates the nerve cells of the inner retina Transmits the visual information to the brain via the optic nerve Aims to elicit functional artificial, or bionic, vision in the form of light perception Replaces partially the natural central vision loss The Prima System is a miniaturized photovoltaic wireless sub-retinal implant that is implanted underneath the retina in a surgical procedure Prima System

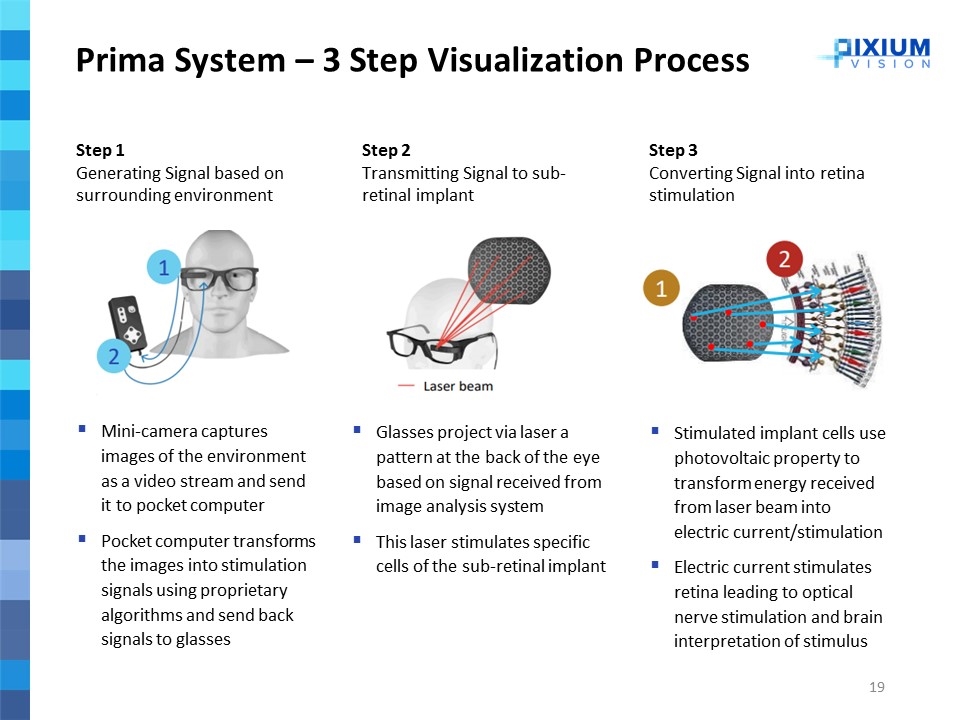

Mini-camera captures images of the environment as a video stream and send it to pocket computer Pocket computer transforms the images into stimulation signals using proprietary algorithms and send back signals to glasses Prima System – 3 Step Visualization Process Step 1 Generating Signal based on surrounding environment Glasses project via laser a pattern at the back of the eye based on signal received from image analysis system This laser stimulates specific cells of the sub-retinal implant Step 2 Transmitting Signal to sub-retinal implant Stimulated implant cells use photovoltaic property to transform energy received from laser beam into electric current/stimulation Electric current stimulates retina leading to optical nerve stimulation and brain interpretation of stimulus Step 3 Converting Signal into retina stimulation

Clinical Development

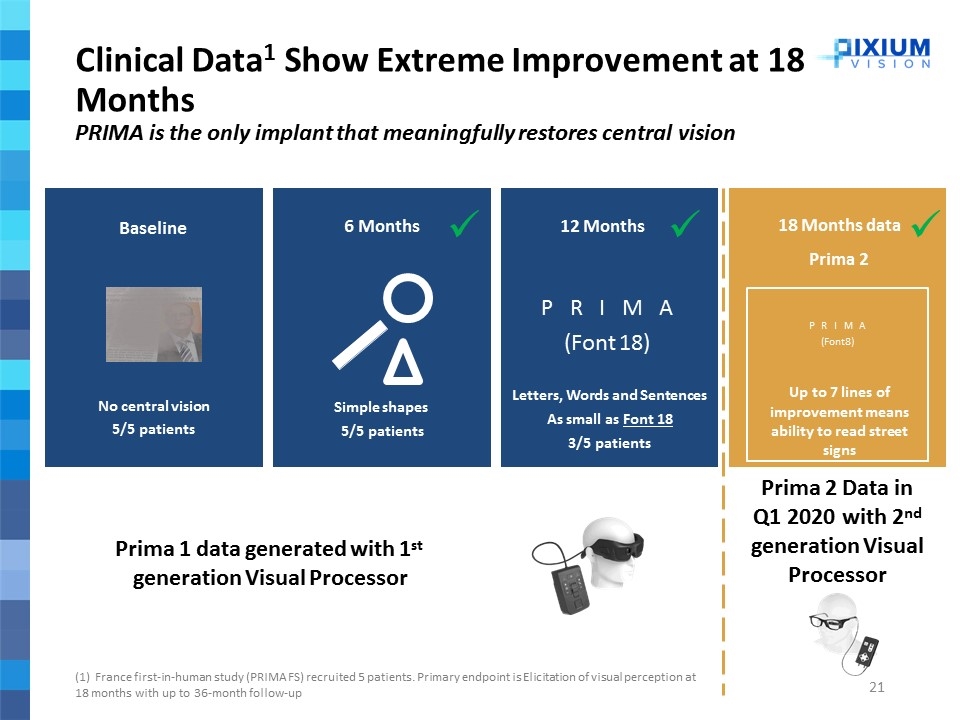

Prima 1 data generated with 1st generation Visual Processor Baseline No central vision 5/5 patients Letters, Words and Sentences As small as Font 18 3/5 patients PRIMA (Font 18) P R I M A (Font 8) Up to 7 lines of improvement means ability to read street signs Prima 2 Data in Q1 2020 with 2nd generation Visual Processor (1) France first-in-human study (PRIMA FS) recruited 5 patients. Primary endpoint is Elicitation of visual perception at 18 months with up to 36-month follow-up 6 Months Simple shapes 5/5 patients ü 18 Months data Prima 2 12 Months ü ü Clinical Data1 Show Extreme Improvement at 18 Months PRIMA is the only implant that meaningfully restores central vision

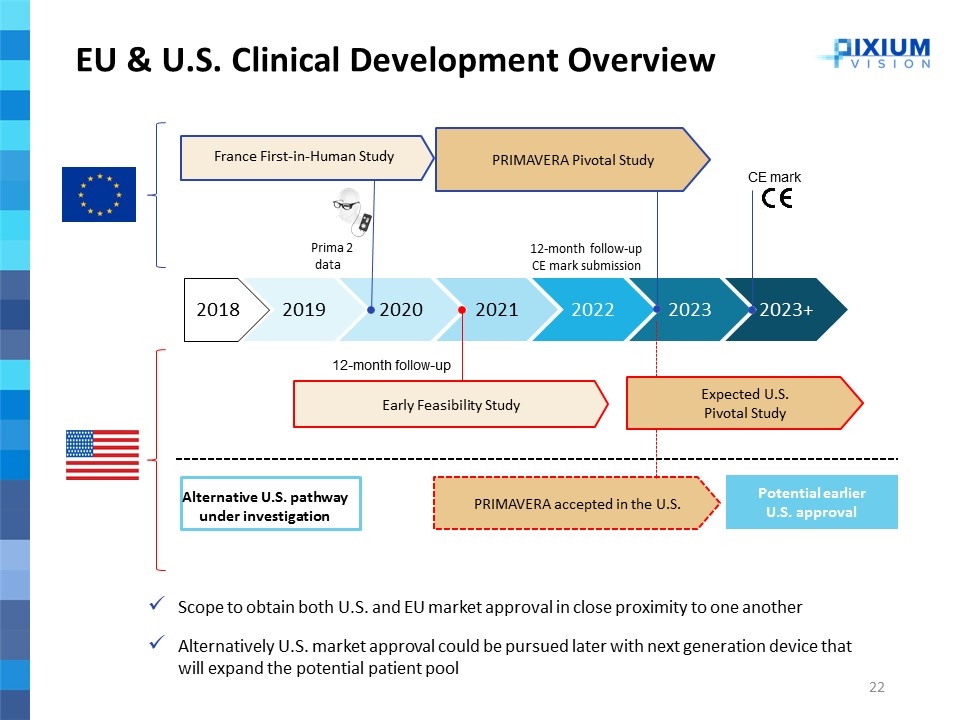

2018 2020 2021 2022 2023 2019 2023+ EU & U.S. Clinical Development Overview 12-month follow-up CE mark submission CE mark France First-in-Human Study PRIMAVERA Pivotal Study PRIMAVERA accepted in the U.S. Prima 2 data 12-month follow-up Early Feasibility Study Potential earlier U.S. approval Expected U.S. Pivotal Study Alternative U.S. pathway under investigation Scope to obtain both U.S. and EU market approval in close proximity to one another Alternatively U.S. market approval could be pursued later with next generation device that will expand the potential patient pool

Conclusion

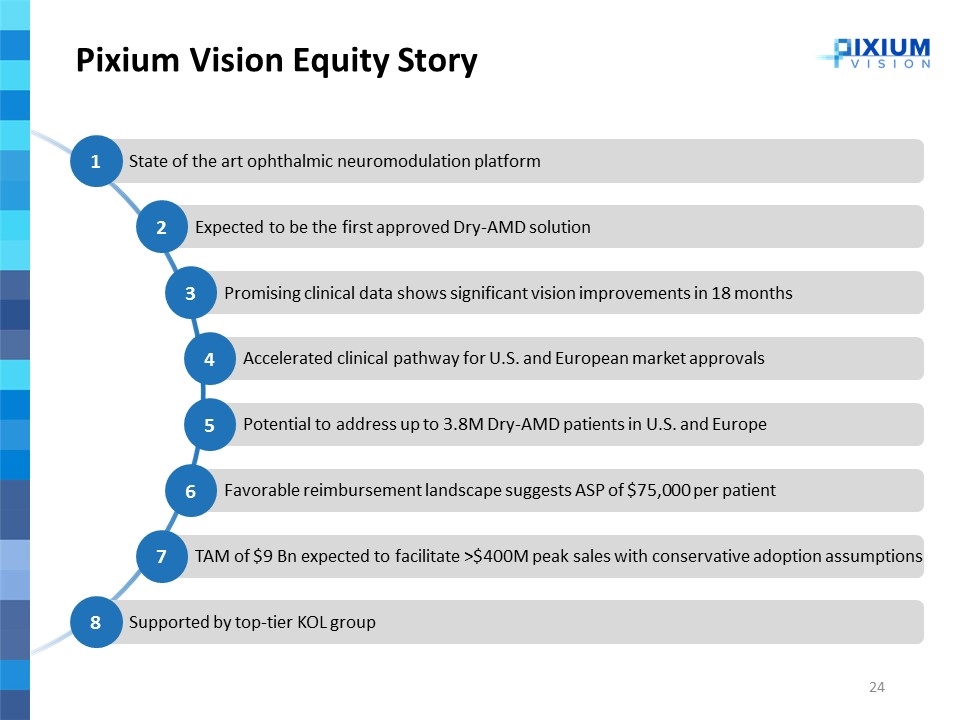

Pixium Vision Equity Story Supported by top-tier KOL group 8 TAM of $9 Bn expected to facilitate >$400M peak sales with conservative adoption assumptions 7 Accelerated clinical pathway for U.S. and European market approvals 4 Favorable reimbursement landscape suggests ASP of $75,000 per patient 6 Potential to address up to 3.8M Dry-AMD patients in U.S. and Europe 5 Promising clinical data shows significant vision improvements in 18 months 3 State of the art ophthalmic neuromodulation platform 1 Expected to be the first approved Dry-AMD solution 2

Second Sight Medical Products

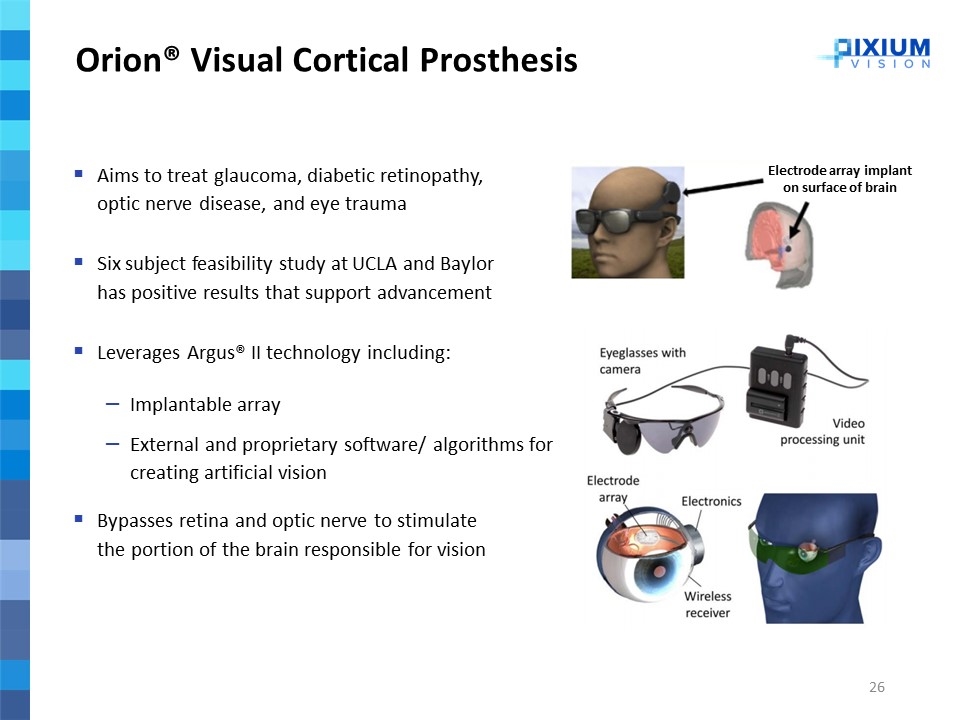

Orion® Visual Cortical Prosthesis 2019 Aims to treat glaucoma, diabetic retinopathy, optic nerve disease, and eye trauma Six subject feasibility study at UCLA and Baylor has positive results that support advancement Leverages Argus® II technology including: Implantable array External and proprietary software/ algorithms for creating artificial vision Bypasses retina and optic nerve to stimulate the portion of the brain responsible for vision Electrode array implant on surface of brain

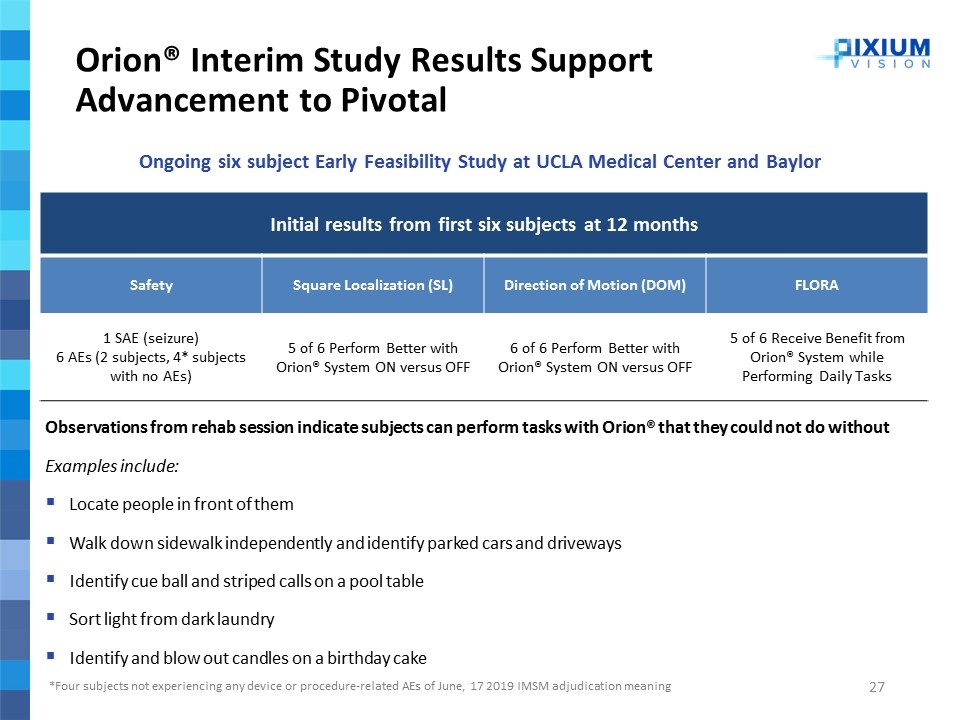

Orion® Interim Study Results Support Advancement to Pivotal 2019 Initial results from first six subjects at 12 months Safety Square Localization (SL) Direction of Motion (DOM) FLORA 1 SAE (seizure) 6 AEs (2 subjects, 4* subjects with no AEs) 5 of 6 Perform Better with Orion® System ON versus OFF 6 of 6 Perform Better with Orion® System ON versus OFF 5 of 6 Receive Benefit from Orion® System while Performing Daily Tasks Observations from rehab session indicate subjects can perform tasks with Orion® that they could not do without Examples include: Locate people in front of them Walk down sidewalk independently and identify parked cars and driveways Identify cue ball and striped calls on a pool table Sort light from dark laundry Identify and blow out candles on a birthday cake *Four subjects not experiencing any device or procedure-related AEs of June, 17 2019 IMSM adjudication meaning Ongoing six subject Early Feasibility Study at UCLA Medical Center and Baylor

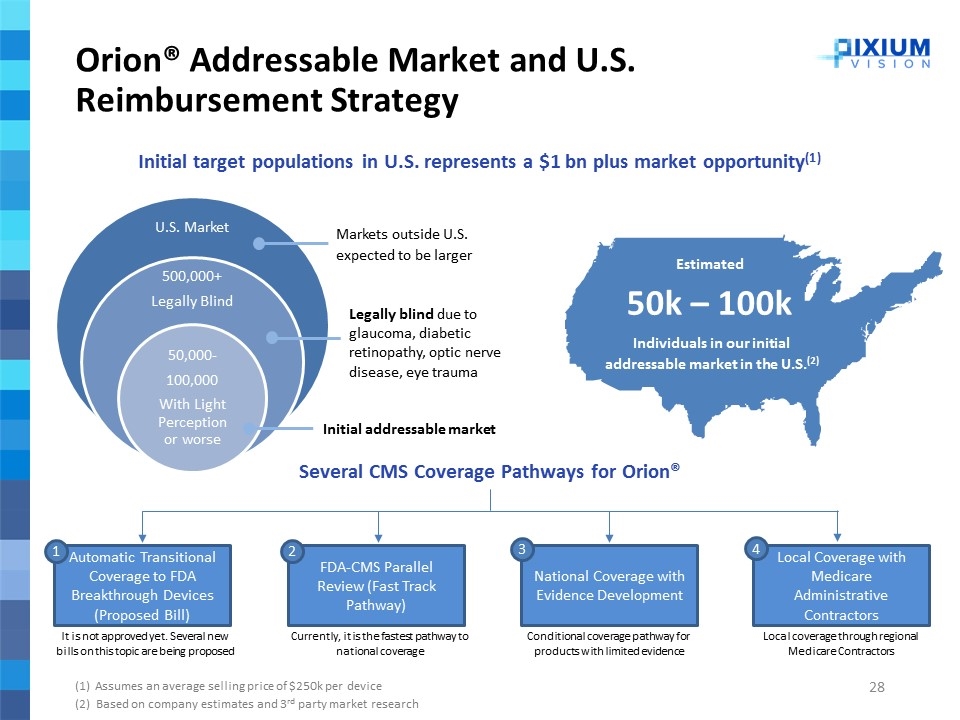

Orion® Addressable Market and U.S. Reimbursement Strategy Initial target populations in U.S. represents a $1 bn plus market opportunity(1) (1) Assumes an average selling price of $250k per device (2) Based on company estimates and 3rd party market research Markets outside U.S. expected to be larger Legally blind due to glaucoma, diabetic retinopathy, optic nerve disease, eye trauma Initial addressable market Estimated 50k – 100k Individuals in our initial addressable market in the U.S.(2) Several CMS Coverage Pathways for Orion® Automatic Transitional Coverage to FDA Breakthrough Devices (Proposed Bill) FDA-CMS Parallel Review (Fast Track Pathway) National Coverage with Evidence Development Local Coverage with Medicare Administrative Contractors 1 2 3 It is not approved yet. Several new bills on this topic are being proposed Currently, it is the fastest pathway to national coverage Conditional coverage pathway for products with limited evidence Local coverage through regional Medicare Contractors 4 U.S. Market 500,000+ Legally Blind 50,000- 100,000 With Light Perception or worse

Thank you Lloyd Diamond, CEO | ldiamond@pixium-vision.com

Appendix A: Business Combination Rationale

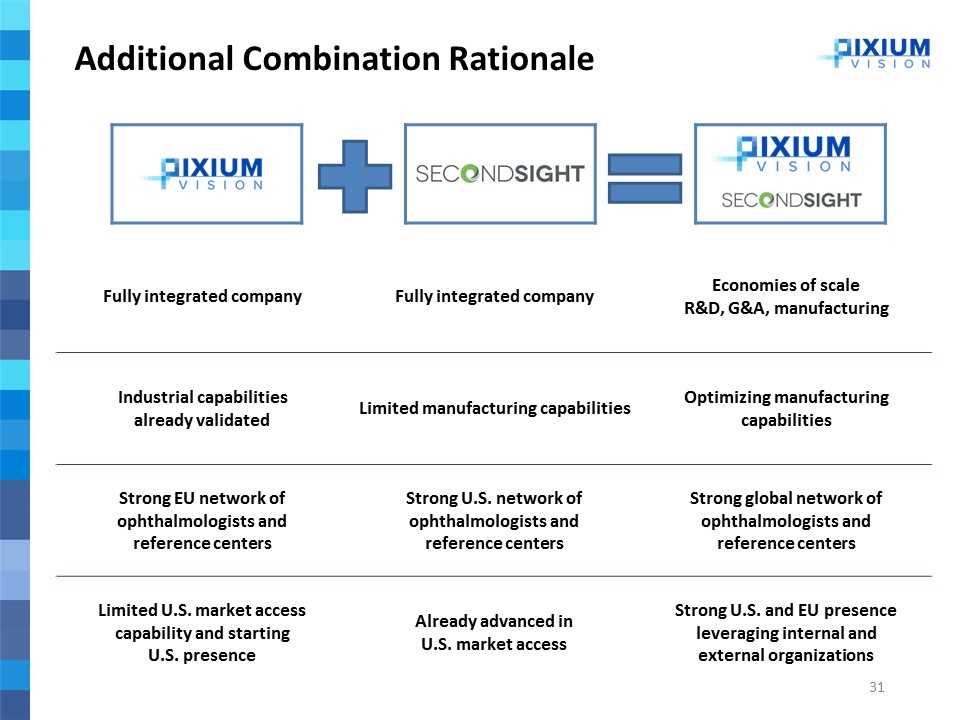

Fully integrated company Fully integrated company Economies of scale R&D, G&A, manufacturing Industrial capabilities already validated Limited manufacturing capabilities Optimizing manufacturing capabilities Strong EU network of ophthalmologists and reference centers Strong U.S. network of ophthalmologists and reference centers Strong global network of ophthalmologists and reference centers Limited U.S. market access capability and starting U.S. presence Already advanced in U.S. market access Strong U.S. and EU presence leveraging internal and external organizations Additional Combination Rationale

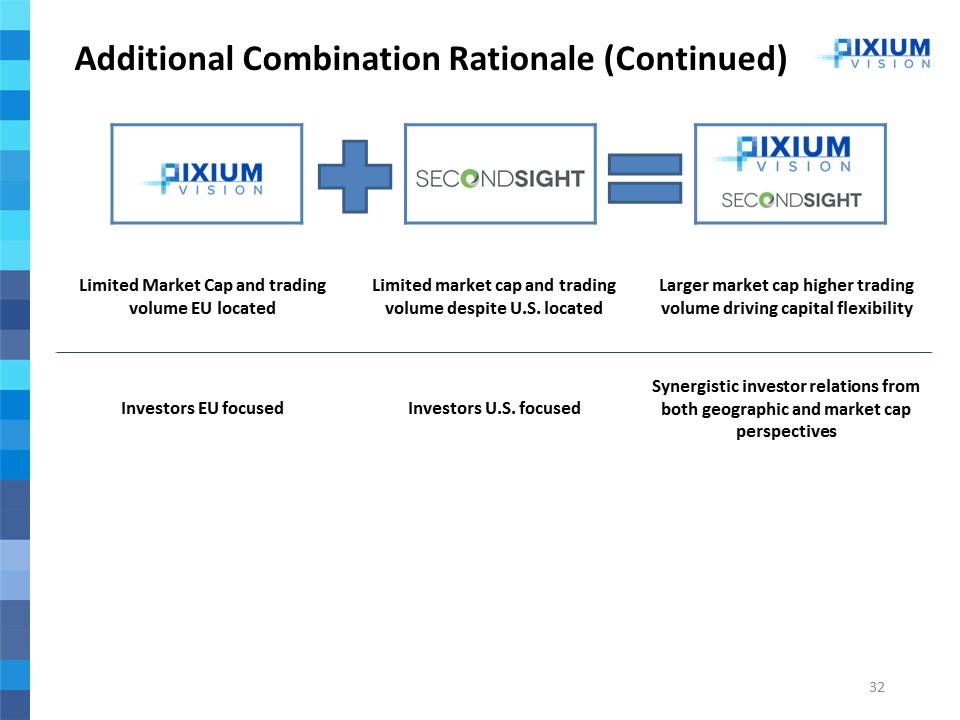

Limited Market Cap and trading volume EU located Limited market cap and trading volume despite U.S. located Larger market cap higher trading volume driving capital flexibility Investors EU focused Investors U.S. focused Synergistic investor relations from both geographic and market cap perspectives Additional Combination Rationale (Continued)

Appendix B: Additional Prima Information

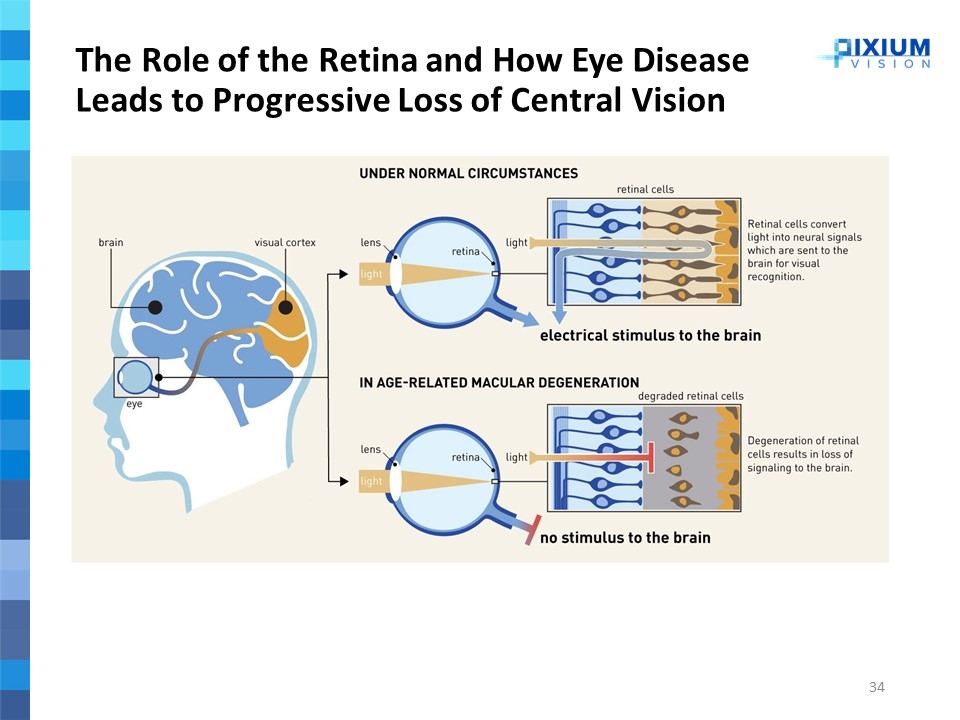

The Role of the Retina and How Eye Disease Leads to Progressive Loss of Central Vision

Prima System – Machine-Brain Interface Technology Using Artificial Intelligence

With the Prima System, the Signal to the Brain is Restored