As filed with the Securities and Exchange Commission on November 6, 2014

Registration No. 333-198073

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO.2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SECOND SIGHT MEDICAL PRODUCTS, INC.

(Exact name of registrant as specified in its charter)

| California | 3845 | 02-0692322 | ||

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer | ||

| incorporation or organization) | Classification Code Number) | Identification No.) |

12744 San Fernando Road, Building 3

Sylmar, California 91342

(818) 833-5000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Robert Greenberg, M.D., Ph.D.

President and Chief Executive Officer

Second Sight Medical Products, Inc.

12744 San Fernando Road, Building 3

Sylmar, California 91342

(818) 833-5000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Aaron A. Grunfeld | Andrew Hudders Carl Van Demark | |||

Law Offices of Aaron A. Grunfeld & Associates 11111 Santa Monica Boulevard, Suite 1840 |

Golenbock Eiseman Assor Bell & Peskoe LLP 437 Madison Avenue, 40th Floor | |||

| Los Angeles, California 90025 | New York, NY 10022 | |||

| (310) 788-7577 | (212) 907-7300 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Non-accelerated filer o | Accelerated filer o | Smaller reporting company x |

| (Do not check if a smaller | |||

| reporting company) |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of

Securities to be Registered |

Proposed Maximum

Aggregate Offering Price(1) |

Amount of

Registration Fee(8) |

||||||

| Common Stock, no par value per share (2) | $ | 36,225,000 | (2) | $ | 4,665.78 | |||

Long Term Investor Right (3)(4)(5) |

$ | 0 | — | |||||

| Common Stock, no par value per share (4)(5)(6) | $ | 0 | — | |||||

| Underwriter Warrant(5)(6)(7) | $ | 100 | — | |||||

| Shares of Common Stock underlying Underwriter Warrant | $ | 9,056,250 | $ | 1,166.45 | ||||

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. See “Underwriting” beginning on page 86 of the prospectus contained within this registration statement for information on underwriting arrangements relating to this offering. |

| (2) | Includes the aggregate offering price of additional shares that the underwriter has the option to purchase, amounting to 15% of the shares and rights offered to the public to cover over-allotments, if any. |

| (3) | Represents and registers the Long Term Investor Right to receive additional shares of common stock pursuant to the terms of this offering. See “Description of Capital Stock”. |

| (4) | Includes up to 4,025,000 shares that may be issued in connection with the non-transferable Long Term Investor Rights described under “Description of Capital Stock – Long Term Investor Right to Receive Additional Shares” for no additional consideration two years from the closing date of this offering. |

| (5) | No registration fee required pursuant to Rule 457(g) under the Securities Act of 1933. |

| (6) | Represents and registers a warrant to be granted to the underwriter to purchase shares of common stock in an amount equal to 20% of the number of the shares sold to the public. See “Underwriting” beginning on page 86 of the prospectus contained within this Registration Statement for information on underwriting arrangements relating to this offering. |

| (7) | Pursuant to Rule 416 under the Securities Act of 1933, as amended, there is also being registered hereby such indeterminate number of additional shares of common stock of the registrant as may be issued or issuable because of stock splits, stock dividends, stock distributions, and similar transactions. |

| (8) | Previously paid . |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment, which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND WE ARE NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, DATED November 6, 2014

PRELIMINARY PROSPECTUS

3,500,000 Shares of Common Stock

With a Non-Transferable Investor Right to Receive Additional Shares

SECOND SIGHT MEDICAL PRODUCTS

We are offering 3,500,000 shares of our common stock, no par value, coupled with a non-transferable contractual right for the registered holder of these offered shares to obtain up to one additional share of common stock for each share purchased, at no additional expense, on the second anniversary of the closing date of this offering, as more fully described under “Description of Capital Stock” in this prospectus. The common stock is being offered in a firm commitment underwriting.

This is an initial public offering of our common stock. We expect the public offering price to be $9.00 per share. There is currently no public market for our common stock. We have applied for listing of our common stock on the Nasdaq Capital Market under the symbol “EYES”. We expect that listing to occur upon consummation of this offering. If our application to the Nasdaq Capital Market is not approved or if we otherwise determine that we will not be able to secure the listing of our common stock on the Nasdaq Capital Market, we will not complete the offering.

We are an “emerging growth company” under the federal securities laws and will have the option to use reduced public company reporting requirements. Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 17 for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

If we sell all of the common stock we are offering, we will pay the underwriter $1.26 million, or 4% of the gross proceeds of this offering and an accountable expense allowance up to a maximum of $200,000. Please see “Underwriting.” We have agreed also to issue to MDB Capital Group, LLC a warrant to purchase shares of our common stock in an amount up to 20% of the shares of common stock sold in the public offering, with an exercise price equal to 125% of the per-share public offering price. The shares of common stock underlying the warrant exclude the Long Term Investor RightSM. See “Description of Capital Stock”.

| Per Share | Total | |||||||

| Public offering price | $ | 9.00 | $ | 31,500,000 | ||||

| Underwriting discounts and commissions | $ | 0.36 | $ | 1,260,000 | ||||

| Proceeds to us (before expenses)(1) | $ | 8.64 | $ | 30,240,000 | ||||

| (1) | Excludes an accountable expense allowance of up to a maximum of $200,000 payable to MDB Capital Group, LLC, the underwriter. See “Underwriting” for a description of compensation payable to the underwriter. |

The underwriter may also purchase up to an additional 525,000 shares of our common stock amounting to 15% of the number of shares offered to the public, within 45 days of the date of this prospectus, to cover over-allotments, if any, on the same terms set forth above.

The underwriter expects to deliver the shares on or about _____________________, 2014.

MDB Capital Group, LLC

The date of this prospectus is , 2014 .

| 2 |

| 3 |

Table of Contents

| 4 |

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with additional or different information. The information contained in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock.

No dealer, salesperson or any other person is authorized in connection with this offering to give any information or make any representations about us, the securities offered hereby or any matter discussed in this prospectus, other than those contained in this prospectus and, if given or made, the information or representations must not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any security other than the securities offered by this prospectus, or an offer to sell or a solicitation of an offer to buy any securities by anyone in any circumstance in which the offer or solicitation is not authorized or is unlawful.

| 5 |

This summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information that you need to consider in making your investment decision. You should carefully read this entire prospectus, as well as the information to which we refer you, before deciding whether to invest in our common stock. You should pay special attention to the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections and our consolidated financial statements and related notes included elsewhere in this prospectus to determine whether an investment in our common stock is appropriate for you.

This registration statement, including the exhibits and schedules thereto, contains additional relevant information about us and our securities. With respect to the statements contained in this prospectus regarding the contents of any agreement or any other document, in each instance, the statement is qualified in all respects by the complete text of the agreement or document, a copy of which has been filed or incorporated by reference as an exhibit to the registration statement. Second Sight Medical Products, Inc, is referred to throughout this prospectus as Second Sight®.

About Second Sight

Overview

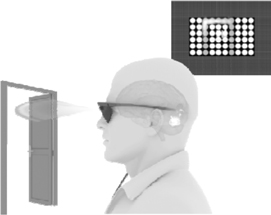

We are a medical device company that develops, manufactures and markets implantable visual prosthetics to restore some functional vision to blind patients. Our current product, the Argus® II System, treats outer retinal degenerations, such as retinitis pigmentosa, which we refer to as RP in this prospectus. RP is a hereditary disease, affecting an estimated 1.5 million people worldwide including about 100,000 people in the United States, that causes a progressive degeneration of the light-sensitive cells of the retina, leading to significant visual impairment and ultimately blindness. The Argus II System is the only retinal prosthesis approved in the United States by the Food and Drug Administration, or FDA, and the first approved retinal prosthesis in the world. By restoring some functional vision in patients who otherwise have total sight loss, the Argus II System can provide benefits which include,

| · | improving patients’ orientation and mobility, such as locating doors and windows, avoiding obstacles, and seeing the lines of a crosswalk, |

| · | allowing patients to feel more connected with people in their surroundings, such as seeing when someone is approaching or moving away, |

| · | providing patients with enjoyment from being “visual” again, such as locating the moon, tracking groups of players as they move around a field, and watching the moving streams of lights from fireworks, and |

| · | improving patients’ well-being and ability to perform activities of daily living. |

The Argus II System provides an artificial form of vision that differs from the vision that normally sighted people have. It does not restore normal vision and it does not slow or reverse the progression of the disease. Results vary among patients. While the majority of patients receive a benefit from the Argus II, some patients report receiving little or no benefit.

As with substantially all implantable medical devices, there are risks for Argus II patients associated with the surgery necessary to implant the device and with the long-term implantation and use of the device. Most side effects, such as eye pain, inflammation and eye redness, are minor in that they resolve on their own or with medication. Since patients with Argus II implants have relatively little to no residual vision, the risk of adverse events in terms of loss of remaining vision is minimal. However, some events, such as low eye pressure or thinning of the tissue over the implant, can require surgery to treat. Adverse events are typically treatable with standard ophthalmic practices and have not prevented continued use of the system.

Our Argus II System employs electrical stimulation to bypass defunct photoreceptor cells and to stimulate remaining viable retinal cells, inducing light and visual perception in blind individuals. The Argus II System works by converting video images captured by a miniature camera housed in a patient’s glasses into a series of small electrical pulses that are transmitted wirelessly to an array of electrodes that are implanted on the surface of the retina. These pulses are intended to stimulate the retina’s remaining cells, resulting in a corresponding perception of patterns of light in the brain. Following the implant surgery patients learn to interpret these visual patterns thereby regaining some functional vision, allowing them to detect shapes of people and objects in their surroundings.

We received marketing approval in Europe (CE mark) for the Argus II System in 2011. We received FDA approval in 2013 to market the Argus II System in the United States. In September 2014 we obtained registration of the product for sale in Turkey. We applied for regulatory approval in Canada and expanded approval1 in Saudi Arabia and anticipate receiving these

1 We currently have approval to sell to one hospital in Saudi Arabia.

| 6 |

approvals before the end of 2014. A substantial portion of our revenue depends on the extent to which the costs of our products are reimbursed by third party private and governmental payers, including Medicare, and other US government sponsored programs, international governmental payers and private payers. In the US we have achieved several important reimbursement milestones that include obtaining:

| · | required federally established codes: including Current Procedural Terminology (CPT) code 0100T to describe the out-patient surgical procedure, and Healthcare Common Procedure Coding System (HCPCS) code C1841 to describe the device, and ICD-9-CM codes 14.81, 14.82, and 14.83 to describe in-patient procedures related to the Argus II, |

| · | payment mechanisms: including Medicare authorized Transitional Pass-through Payment and New Technology Add-on Payment programs, which provide for unique itemized payment for the device in both the out-patient and in-patient settings of care, and procedure assignment to Ambulatory Payment Classification (APC) 0672 (out-patient), and MS-DRG 116 and 117 (in-patient), |

| · | coverage by some Medicare Administrative Contractors (MACs) and Medicare Advantage (MA) and commercial insurance company plans, or on a case by case basis.

|

All three items (coding, coverage, and payment) are necessary to have the surgical procedure and Argus II system reimbursed by payers. It should be noted that while coding and payment are established nation-wide, coverage is not currently being provided by the majority of MACs, MA plans, or commercial plans, although we expect more and more payers to agree to cover over time.

Within Europe, we have obtained reimbursement approval in Germany and France. We also are seeking reimbursement approval in Italy and other countries including England, Netherlands, Switzerland and Turkey.

We launched the Argus II System in Europe at the end of 2011, in Saudi Arabia in 2012, and in the US and Canada in 2014. We are pursuing what we refer to as a Centers of Excellence commercial model, focusing on high quality medical providers. We have concentrated our efforts on recruiting leading retinal surgeons and hospitals, along with raising awareness of the product and brand among potential patients and referring physicians. The Argus II System has the support of Foundation Fighting Blindness (FFB)1 and Retina International2.

We are the world leader in commercializing the restoration of sight by a visual prosthesis in that we have:

| · | implanted about 90 Argus II units, |

| · | extensive follow up history experience with implanted patients, including several who have been using the system for over seven years, |

| · | regulatory approval in both the US and Europe3, |

| · | a significant patent portfolio consisting of approximately 300 issued patents, |

| · | established third party reimbursement for our implanted devices with government and private insurance. |

Additionally, from a competitive standpoint, the Argus II System possesses attractive technical and other features that include:

| · | relative surgical ease of installation, |

| · | a relatively large field of view (20 degrees), |

| 1 | The FFB is the world’s leading non-governmental organization driving research to identify preventions, treatments and cures for people affected by the spectrum of inherited retinal degenerative diseases. The FFB has supported coding and payment applications submitted by Second Sight (in the forms of letters of support and by attending and speaking at meetings with CMS). The FFB has also submitted letters of support and reconsideration requests to help establish coverage for the Argus II. |

| 2 | Retina International is a voluntary charitable umbrella association of 33 national societies each of which is created and run by people with Retinitis Pigmentosa (RP) and other allied retinal dystrophies, their families and friends. Retinal International promotes the search for a treatment for RP and other allied dystrophies. Retina International has supported Second Sight in educating and informing the organizations about Second Sight’s treatment. |

| 3 | The European Union, or EU, is a politico-economic union of 28 member states that are primarily located in Europe. The market approval of Argus II System covers 28 EU member states and Norway, Iceland, Liechtenstein, and Switzerland which also require products to bear the CE mark. In this prospectus we use the term Europe to refer to 28 EU member states, and to Norway, Iceland, Liechtenstein and Switzerland. |

| 7 |

| · | allowing patients to undergo MRI procedures, |

| · | individually programmable electrodes on the prosthesis which can permit further optimization of the device after implantation, and |

| · | upgradeability of the external system to improve the visual experience for current and future users of the Argus II System. |

We have demonstrated the ability to design products with long-term reliability. The Argus I retinal prosthesis, a proof of concept device that was a predecessor to the Argus II, was implanted in six patients in the United States. Argus I patients were implanted an average of 5.8 years, with one patient having used the device for 10 years. The Argus II System has been implanted in about 90 patients. The average implant duration for these patients is 2.9 years with several users continuing to use the system more than seven years following implantation. To date we have successfully implanted patients in the United States, Canada, France, Italy, Germany, the Netherlands, Saudi Arabia, Spain, Switzerland and the United Kingdom.

Over the next 12 to 18 months we intend to introduce the Argus II System in countries other than the US and Europe with the assistance of local partners in some cases. We plan further to conduct a clinical study that is intended to demonstrate the safety and efficacy of the Argus II System for the treatment of age-related macular degeneration, or AMD, which is the leading cause of blindness in people over the age of 65 in developed countries. AMD affects vision for between 20 and 25 million people around the world of whom approximately two million similarly are affected in the United States. In September 2014, we received permission from the British Medicines and Healthcare Products Regulatory Agency or MHRA to commence an AMD Study. We anticipate beginning this study late in 2014 and if we achieve favorable patient outcomes, we estimate that we can obtain regulatory approval for AMD in the US and Europe in 2019, and may be able to market the product to treat AMD during the same year.

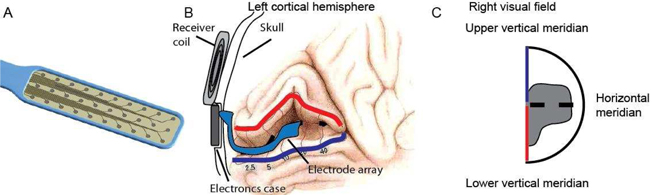

Additionally, we are developing another product for cortical stimulation that we expect will be able to treat nearly all forms of blindness. We refer to this product as the OrionTM I visual prosthesis in this prospectus. As currently planned, the Orion I implant will be based on technology that we currently utilize in our Argus II system. We expect to use the electronics package, coil molding and attachment method, array technology and array attachment method substantially unchanged from the Argus II. We anticipate that we may need to modify the coil shape (round rather than oval) and array shape for cortical stimulation. We intend to further develop a new mounting method for implanting the coil and electronics package. Our objective in designing and developing the Orion I visual prosthesis is to bypass the optic nerve and directly stimulate the part of the brain responsible for vision. We estimate that about 575,900 people in the US, 1.13 million people in Europe, and 5.8 million people worldwide are legally blind due to causes that could be treated by Orion I. If the Orion I visual prosthesis is successfully developed and approved for marketing to those who have severe to profound vision loss, as to which no assurance can be given, we believe that the device’s potential addressable market approaches these market numbers.

We believe that technology developed for the Argus II System also represents a platform for stimulating the nervous system that we may be able to leverage for several other clinical applications outside of vision restoration. There are features of the Argus II System, such as compact size, high electrode count and MRI compatibility, that we believe make it a compelling option to improve existing neuro-stimulation therapies and develop new ones. These possible additional applications may provide further opportunity to increase our revenue in non-core markets through strategic partnerships and/or licensing. Although we are optimistic about our abilities to develop these other clinical applications, no assurance can be given that we will be successful in reaching agreements or licenses with others.

Since 1998 we have received over $29 million in direct grant support from various US federal agencies including the National Institutes of Health, National Eye Institute and Department of Energy. We may seek additional federal and other grant support in the future. However, there is no assurance that we will receive further grants.

Within the past two years, Second Sight and/or Argus II System received the following awards

| · | TIME: Best Inventions of 2013, |

| · | CNN: The CNN 10: Inventions of 2013, |

| · | Medical Device and Diagnostics Industry (MD+DI): 2013 Medical Device Manufacturer of the Year, |

| · | Popular Science: 2013 Innovation of the Year, |

| · | Inc.: The 25 Most Audacious Companies 2013, |

| · | Foundation Fighting Blindness: Visionary Award – Dr. Robert Greenberg, |

| · | Ophthalmology Innovation Summit: Eye on Innovation Award, |

| 8 |

| · | Cleveland Clinic: Top Medical Innovation of 2014, |

| · | World Economic Forum: Technology Pioneer 2014, |

| · | Edison Awards: 2014 Gold Winner – Science/Medical Category – Assistive Devices, and |

| · | MIT Technology Review: The 50 Smartest Companies for 2014. |

In September 2014, we entered into a Joint Research and Development Agreement or JRDA with The Johns Hopkins University Applied Physics Laboratory or APL. The JRDA awarded us a subcontract to conduct applied research under a grant received by APL from the Mann Fund. Under the JRDA, we have agreed to perform research regarding integration of APL research into a visual prosthesis system. In October 2014 APL paid us $4.075 million in one lump sum to conduct our portion of the research. The JRDA also includes a license from APL to us for the life of any patents resulting from APL’s portion of the research. Under the JRDA we have agreed to collaborate with APL over a 36 month period to develop an improved video processing system that will enhance a next generation visual prosthesis. The APL portion of the research includes image processing hardware and software for a visual prosthesis. In exchange for the license, we issued 1,000 shares of our common stock to APL, have agreed to pay APL its patent prosecution costs, and to pay APL a royalty of 0.25% of net sales of licensed products. The Mann Fund was created and largely funded more than 15 years ago by Alfred E. Mann, our Chairman and largest shareholder. No assurance can be given that the outcome of this research and development will prove successful. See “Business — Grants.”

To date, we have not generated sufficient revenues from product sales to achieve positive earnings and operating cash flows to enable us to finance our operations internally. We have significant convertible debt and have incurred recurring operating losses and negative operating cash flows since inception, and we expect to continue to incur operating losses and negative operating cash flows for at least the next few years. For the years ended December 31, 2013 and 2012 we had revenue of $1,564,933 and $1,367,224 respectively, and incurred a net loss of $22,968,925 and $16,279,127 respectively. For the nine months ended September 30, 2014 we had revenue of $1,877,632 and incurred a net loss of $21,624,129. As of December 31, 2013, our accumulated deficit was $117,462,721 and as of September 30, 2014, our accumulated deficit was $139,086,850. In its report on our 2013 and 2012 consolidated financial statements, our independent registered public accounting firm, raised substantial doubt about our ability to continue as a going concern without the proceeds of this offering which will provide operating capital and result in our convertible debt automatically converting into equity.

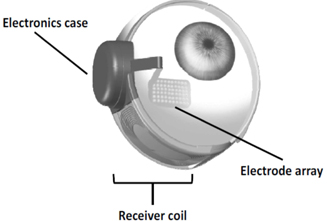

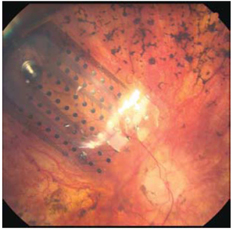

Our Technology

The Argus II Retinal Prosthesis System (“Argus II”) is also sometimes referred to as the bionic eye, artificial retina or the retinal implant. It is intended to provide electrical stimulation of the retina to restore some functional vision in blind individuals. It is indicated for use in patients with severe to profound RP in the US and for severe to profound outer retinal degeneration in Europe. A miniature video camera housed in the patient’s glasses captures a scene. The video is sent to a small patient-worn computer (a video processing unit, which we refer to elsewhere in the prospectus as VPU) where it is processed and transformed into instructions that are sent back to the glasses via a cable. These instructions are transmitted wirelessly to an antenna in the retinal implant – a device which is implanted in and around the eye. The signals are then sent to the electrode array, which emits small pulses of electricity to the patient’s retina – the active part of the eye. These pulses bypass the damaged photoreceptors and stimulate the retina’s remaining cells, which transmit the visual information along the optic nerve resulting in the corresponding perception of patterns of light in the brain. Patients learn to interpret these visual patterns thereby regaining some visual function.

We believe the Argus II System possesses several unique technological advancements compared to the state of the art in other neurostimulation devices. Our implant has 60 independent electrodes to deliver electrical stimulation. The size of the implanted electronics (10.3 mm (0.40”) diameter by 3.2 mm (0.13”) in height) is to our knowledge the smallest multi-channel stimulator FDA approved for any indication. In addition, our product features a patented electrode material we call Platinum Gray that enables it to deliver high charge densities. Higher charge density enables smaller electrodes. The Argus II System currently, to our knowledge, has the smallest neural stimulating electrodes ever approved by the FDA. Each electrode is 0.2 mm (0.008)” in diameter. Several other engineering challenges, including device reliability, extended lifetime, and a safe and effective bio-interface, were overcome during the development of the product and these solutions have been protected both by patents and by trade secrets. As of October 31, 2014, we have 300 issued patents and 176 pending patent applications, on a worldwide basis.

We are planning product and clinical development efforts that may include:

| · | Improvements/upgrades to the externally worn system (glasses, VPU, and software) which may enable more advanced image processing capabilities, higher resolution vision, and possibly color vision. We expect that these enhancements will deliver a better visual experience for existing and future recipients of the Argus II System. |

| 9 |

| · | Expanded indications for use for the current version of the Argus II System, which includes blindness resulting from AMD. |

| · | Development of a visual cortical prosthesis (Orion I) building on the Argus II technology platform to address blindness from nearly all causes by providing neurostimulation directly to the visual cortex of the brain, rather than the retina. |

| · | Leveraging the technology for other neurostimulation applications outside of vision restoration through licensing and/or strategic partnerships. |

Our Market

The Argus II System is currently approved for RP patients with bare or no light perception in the US, and in Europe for severe to profound vision loss due to outer retinal degeneration, such as from retinitis pigmentosa, choroideremia, and other similar conditions. The number of people who are legally blind due to RP is estimated to be 25,000 in the US, 42,000 in Europe, and 375,000 total worldwide. A subset of these patients would be eligible for the Argus II System since the baseline vision for the Argus II System is worse than legally blind (20/200). Scarce epidemiological data on visual acuity below legal blindness make it difficult to determine a precise estimate of the potential patient population for this device.

We believe we can expand the market for the Argus II System beyond RP to patients with severe to profound vision loss due to age-related macular degeneration or AMD. We intend to conduct a pilot study, of about five patients, in Europe beginning in late 2014 to determine the utility of the Argus II System for use in persons suffering from AMD. If this small study yields positive results, then we will conduct a larger pivotal study in Europe and the United States comprising approximately 30 or more patients intended to demonstrate the safety and effectiveness of this therapy. We intend to use these clinical trial data to support regulatory approval in the US and Europe to expand our label to specifically cover AMD, and seek reimbursement in these markets for this expanded indication. We expect these approvals will be obtained in 2019. We estimate the population of people who are legally blind due to AMD to be about 552,500 in the US, 1.08 million in Europe, and two million worldwide. If approved for marketing, the labels will determine the subset of these patients who are eligible.

We believe we can further expand our market to include nearly all profoundly blind individuals, regardless of cause, other than those who are blind due to preventable diseases or due to brain damage, by developing a visual cortical prosthesis. We intend to develop a visual cortical prosthesis, the Orion I visual prosthesis, by modifying the Argus II device. We intend to begin clinical trials of the Orion I visual prosthesis in late 2016. We estimate that there are about 575,900 people in the US, 1.13 million in Europe, and 5.8 million worldwide who are legally blind due to causes other than preventable conditions or AMD. If approved for marketing, the labels will determine the subset of these patients who are eligible.

In addition to expanding the indications for use for our devices, over the next several years in collaboration with distribution partners, we intend to launch the Argus II System in other markets globally, including countries in the Middle East, Asia, and South America.

Commercial Strategy

The Argus II System addresses an unmet clinical need by restoring some functional vision to blind individuals. We believe that we are the worldwide leader in this applied technology.

To date our marketing activities have focused on raising awareness of Argus II System in potential patients, implanting physicians, and referring physicians. Our marketing activities include exhibiting, sponsoring symposia, and securing podium presence at professional and trade shows, securing journalist coverage in popular and trade media, attending patient meetings focused on educating patients about existing and future treatments, and sponsoring information sessions for the Argus II System.

We have employed, and expect to continue utilizing what we refer to as a “Centers-of-Excellence” sales model where we work with prominent eye hospitals, and a predominantly direct sales and support team to serve our patient population. We

| 10 |

believe this model represents an efficient use of capital to promote awareness of our product and systematically to expand our markets. We have added new implanting centers based on criteria which include:

| · | Geographic desirability, |

| · | Facility and surgeon skill and reputation, |

| · | Access to patients, |

| · | Regulatory pathway, and |

| · | Reimbursement environment from government agencies or contractors and third party insurers. |

Second Sight has assembled an experienced team of solution oriented and technically adept scientists and engineers with in-depth medical device experience. We expect that this experienced team, responsible for our ongoing in-house product enhancements and future product development, may allow us more rapid improvements and introduction of innovative product.

We employ an in-house attorney experienced in intellectual property matters to manage our large and growing intellectual property portfolio. We also employ outside legal firms as we deem appropriate. We intend to continue our practice of

| · | comprehensively developing an intellectual property portfolio that will protect our market interests and |

| · | vigorously defending challenges to our patents. |

We manufacture the Argus II System at our corporate headquarters in Sylmar, California. Our manufacturing department employs 46 persons and can produce up to 10 devices per month based on current staffing. We believe our facility can support production of up to 100 devices per month. See “Business – Our Manufacturing and Quality Assurance” below. We have a FDA and ISO 13485 (European and global standard) certified manufacturing facility with an experienced manufacturing and quality assurance team.

We also employ an in-house team of clinical and regulatory affairs professionals, who design and conduct our clinical trials and prepare our worldwide regulatory submissions. This in-house team enables us to maintain close control of our clinical trial data and allows us to rapidly respond or address requests made by regulators and apply for new approvals promptly.

One key to the success of our existing and future business activities will be achieving expanded reimbursement for our products from governmental or third party payers. We have engaged specialist consulting firms and legal firms in the US and Europe to advise and assist us in these matters. In addition, we employ market access professionals to manage these activities in both the US and Europe.

Risk Factors that affect us

See “Risk Factors” beginning on page 17 and other information included elsewhere in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock.

Corporate Information

Second Sight Medical Products, Inc. was incorporated in California in May 2003 as a successor to Second Sight LLC, a Delaware limited liability company formed in 1998. Our principal executive offices and manufacturing facilities are located at 12744 San Fernando Road, Building 3, Sylmar, California 91342. Our telephone number is (818) 833-5000. Our European subsidiary, Second Sight Medical Products (Switzerland) Sàrl, maintains offices at EPFL-PSE A, Route de Jean-Daniel Colladon, CH-1015 Lausanne, Switzerland.

Our website address is www.secondsight.com. The information contained on, or that can be accessed through, our website is not a part of this prospectus.

Unless otherwise indicated, the terms “Second Sight,” “we,” “us” and “our” refer to Second Sight Medical Products, Inc., a California corporation, and our subsidiaries.

| 11 |

“Second Sight,” “Argus”, “FLORA” and the Second Sight logo are our registered trademarks in the US, EU and Switzerland. Orion is our trademark and “Long Term Investor Right” is a service mark of MDB Capital Group LLC.

Emerging Growth Company

The Jumpstart Our Business Startups Act, or the JOBS Act, was enacted in April 2012 with the intention of encouraging capital formation in the United States and reducing the regulatory burden on newly public companies that qualify as “emerging growth companies.” We are an emerging growth company within the meaning of the JOBS Act. As an emerging growth company, we may take advantage of certain exemptions from various public reporting requirements, including the requirement that our internal control over financial reporting be audited by our independent registered public accounting firm pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, certain requirements related to the disclosure of executive compensation in this prospectus and in our periodic reports and proxy statements, and the requirement that we hold a nonbinding advisory vote on executive compensation and any golden parachute payments. We may take advantage of these exemptions until we are no longer an emerging growth company.

We will remain an emerging growth company until the earliest to occur of

| · | the last day of the fiscal year in which we have $1.0 billion or more in annual revenue; |

| · | the date we qualify as a “large accelerated filer,” with at least $700 million of equity securities held by non-affiliates; |

| · | the date on which we have issued, in any three-year period, more than $1.0 billion in non-convertible debt securities; or |

| · | the last day of the fiscal year ending after the fifth anniversary of our initial public offering. |

Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do not have a class of securities registered under the Securities Exchange Act) are required to comply with the new or revised financial accounting standard. The JOBS Act also provides that a company can elect to opt out of the extended transition period provided by Section 102(b)(1) of the JOBS Act and comply with the requirements that apply to non-emerging growth companies but any such election to opt out is irrevocable. We have irrevocably elected to opt out of this extended transition period provided by Section 102(b)(1) of the JOBS Act. Even though we have elected to opt out of the extended transition period, we may still take advantage of all of the other provisions of the JOBS Act, which include, but are not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, the reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and the exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

For certain risks related to our status as an emerging growth company, see the disclosure elsewhere in this prospectus under “Risk Factors—Risks Related to this Offering, the Securities Markets and Ownership of Our Common Stock—We are an ‘emerging growth company’,” and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.”

| 12 |

The following summary contains basic information about our initial public offering and our common stock and is not intended to be complete. It does not contain all of the information that may be important to you. For a more complete understanding of our common stock and rights, please refer to the sections of this prospectus titled “Description of Capital Stock “and “Description of Capital Stock – Long Term Investor Right to Receive Additional Shares.”

| Issuer | Second Sight Medical Products, Inc. | |

| Common Stock Offered By Us | 3.5 million shares of common stock, no par value per share. | |

| Over-allotment Option | We have granted an option to our underwriter to purchase up to an additional 525,000 shares of common stock, representing 15% of the shares and rights described below, offered to the public, within 45 days of the date of this prospectus in order for this prospectus to cover over-allotments, if any. | |

| Common Stock Outstanding Prior To This Offering | 24,545,741 at September 30, 2014 (31,125,573 after giving effect to shares of common stock issuable upon automatic conversion of convertible notes and related accrued interest on completion of this offering). | |

| Common Stock Outstanding After This Offering | 34,625,573 | |

| Long Term Investor Rights | Each share of our common stock (“Share”) sold in this offering is coupled with a non-transferable contractual right which could allow the original holder to obtain at no additional expense up to one additional Share on the second anniversary of the closing date of the offering (the “Long Term Investor Right”). For an original holder of a Share to benefit from the Long Term Investor Right, the holder must

· hold the Share obtained in the offering after the closing date of the offering, · register the Share in its name, and not in “street name,” no later than 90 days after the closing date of the offering, and · continuously hold the Share in certificate or book entry form during the two years after the closing date of the offering. |

| If the original holder of the Share fails to timely make the registration and to hold the Share continuously for the two years after the closing date of the offering, the Long Term Investor Right will terminate. If the common stock trades on its principal exchange at 200% of the Offering Price or greater on five consecutive trading days during the two years after the closing date of the offering the Long Term Investor Right will terminate. The Long Term Investor Right will convert into common stock if our shares do not trade on their principal exchange at 200% of the Offering Price or greater on five consecutive trading days during the two years after the closing date. The formula to determine the amount of common stock to be issued on a Long Term Investor Right, which shall not exceed one share of common stock per Long Term Investor Right, will be: (i) 200% of the Offering Price minus (ii) the highest average of consecutive closing prices over any 90 calendar day period on the principal exchange during the two years after the Closing Date (the “Measurement Average”) divided by the Measurement Average. For illustrative purposes only: where, for example, the Offering Price is $9.00, 200% of the Offering Price is $18, if the Measurement Average is $12 and if the qualifying IPO Shareholder has retained 1,000 IPO Shares, then (i) $18 minus $12, (ii) divided by $12 results in the qualifying IPO Shareholder receiving an additional one-half of a share of common stock per each Long Term Investor Right, or an aggregate of 500 IPO Supplemental Shares. The Offering Price for purposes of the calculation of the amount of common stock to be issued on a Long Term Investor Right will be subject to adjustment in the event of a reorganization, recapitalization or split-up of our shares, our issuance of a stock dividend or any similar event. We will round up any fractional shares resulting from this formula to the next whole share. See “Description of Capital Stock – Long Term Investor Right to Receive Additional Shares.” |

| 13 |

| Public Offering Price | $9.00 per share | |

| Use of proceeds | We estimate that the net proceeds from the sale of shares of our common stock in this offering will be approximately $29,336,868 (or approximately $33,872,868 if the underwriter’s option to purchase additional shares of our common stock from us is exercised in full), based upon the assumed initial public offering price of $9.00 per share, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. In addition to funding current operating activities, we expect to utilize these funds over the next 18 to 24 months approximately as follows: | |

· $2.0 to $4.0 million to increase sales and marketing activities over the next two years to increase sales coverage and market penetration. · $4.0 million to increase development and clinical efforts to enhance the external hardware and software of the Argus II System. If successful, these enhancements could improve the resolution and other performance characteristics of our system. · $2.0 million to conduct clinical trials to establish the safety and benefit of using the Argus II system to treat patients with AMD. We will start with a feasibility trial in late 2014. With promising results, we will begin a larger scale efficacy trial in early 2016 that could lead to marketing approval for the Argus II system for AMD patients in 2019. We estimate that the cost to complete this additional trial would be approximately $4.5 million. · $5.0 million to conduct pre-clinical development of the Orion I cortical implant. If successful, we will begin testing our Orion I technology in humans in late 2016. The human clinical testing is likely to take the form of a feasibility study followed by a premarket approval pivotal trial. The details of these trials will be determined collaboratively with the FDA at that time. We cannot accurately estimate the timing or exact cost of these trials at this time. | ||

No assurances can be given that our development activities or clinical trials will result in a marketable product or that we will be successful in raising adequate funds to support our future development and marketing activities. To the extent we are able raise funds, it may be on terms that will result in unfavorable dilution to our shareholders. | ||

We intend to obtain these additional funds through a combination of one of more of the following: | ||

· Cash flows from operations. · Sales of our securities · Joint ventures · Research grants · Issuances of debt | ||

| Market And Trading Symbol For The Common Stock | There is currently no public market for our common stock. We have applied for listing of our common stock on the Nasdaq Capital Market under the symbol “EYES”. | |

| Underwriter Common Stock Purchase Warrant | In connection with this offering, we have agreed to sell to MDB Capital Group, LLC and its designees a warrant to purchase up to 20% of the shares of common stock sold in this offering. The shares of common stock underlying the warrant will not include the Long Term Investor Right. If this warrant is exercised, each share may be purchased by MDB Capital Group, LLC at $11.25 per share (125% of the price of the shares sold in this offering). This warrant will have a five-year term and be subject to a six month lock-up from the effective date of the registration statement of which this prospectus is a part. See “Underwriting” for additional information. |

| 14 |

| Lock-Up Agreements | Our officers, directors, and 10% or greater holders of our equity securities as determined pursuant to Rule 13d-3 of the Securities Exchange Act of 1934, as amended, and certain of our consultants will have the securities they own locked up until the first anniversary of the Closing Date (the “One Year Lock-Up”). Currently 22,815,945 outstanding shares of common stock will be subject to the One Year Lock-Up including shares issuable on automatic conversion of convertible promissory notes and the number of shares underlying options and warrants subject to the One Year Lock-Up totals 3,052,201 shares. Employees and certain of our consultants owning 117,248 shares of common stock and owning options to purchase 1,087,096 shares of common stock agreed to lock up their shares for six months after completion of this offering. For more information about the lock-up agreements see “Shares Eligible For Future Sale” and “Underwriting - Lock-Up Agreements” in this prospectus. |

| Offering Termination | If our application to the Nasdaq Capital Market is not approved or we otherwise determine that we will not be able to secure the listing of the common stock on the Nasdaq Capital Market, we will not complete the offering. |

The number of shares of our common stock to be outstanding after this offering is based on 34,625,573 shares of our common stock (including common stock issuable upon automatic conversion of the principal and interest upon completion of this offering) outstanding as of September 30, 2014, and excludes:

| · | 3,252,144 shares of our common stock issuable upon exercise of outstanding stock options; |

| · | 1,180,766 shares of our common stock issuable upon exercise of outstanding warrants; |

| · | 240,793 shares of our common stock, net of exercises, reserved for future grants pursuant to our Plan; |

| · | up to 3,500,000 shares of our common stock that may be issued under the terms of the Long Term Investor Right (and also excluding shares that may be issued under terms of Long Term Investor Right on exercise of the underwriter’s over-allotment option); and |

| · | the shares of our common stock issuable upon exercise of the underwriter’s warrant. |

Except as otherwise indicated, this prospectus assumes:

| · | the automatic conversion of $29,519,162 principal amount of our 7.5% unsecured convertible debt and accrued interest of $3,379,999 into an aggregate of 6,579,832 shares of common stock, of which 5,903,833 shares are payments of principal and 675,999 shares are payments of interest in kind, computed as of September 30, 2014, effective upon the completion of this offering; and |

| · | no exercise of the underwriter’s over-allotment option (nor shares of our common stock that may be issued under the terms of the Long Term Investor Right on the exercise of that over-allotment option). |

SUMMARY SELECTED FINANCIAL INFORMATION

The following selected consolidated financial and other data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited consolidated financial statements and related notes, which are included elsewhere in this prospectus. We have derived the following selected consolidated statement of operations data for the years ended December 31, 2012 and 2013 and the selected consolidated balance sheet data as of December 31, 2012 and 2013 from our audited consolidated financial statements included elsewhere in this prospectus. We have derived the selected unaudited consolidated statement of operations data for the nine months ended September 30, 2013 and 2014, and the selected unaudited consolidated balance sheet data as of September 30, 2014, from our unaudited interim consolidated financial statements included elsewhere in this prospectus. We have included all adjustments, consisting only of normal recurring adjustments, which we consider necessary for a fair presentation of the financial information set forth in those

| 15 |

statements. Our historical results are not necessarily indicative of the results to be expected in the future, and our interim results are not necessarily indicative of the results to be expected for the full year or any other period.

Consolidated Statement of Operations Data:

| Year Ended | Nine Months Ended | |||||||||||||||

| December 31, | September 30, | |||||||||||||||

| 2013 | 2012 | 2014 | 2013 | |||||||||||||

| Unaudited | Unaudited | |||||||||||||||

| Product revenue | $ | 1,564,933 | $ | 1,367,224 | $ | 1,877,632 | $ | 1,001,302 | ||||||||

| Cost of sales | 5,629,320 | 4,396,746 | 2,137,119 | 4,067,342 | ||||||||||||

| Gross loss | (4,064,387 | ) | (3,029,522 | ) | (259,487 | ) | (3,066,040 | ) | ||||||||

| Operating expenses: | ||||||||||||||||

| Research and development, net of grant revenue | 3,248,466 | 3,045,157 | 3,679,667 | 2,436,823 | ||||||||||||

| Clinical and regulatory | 3,215,290 | 3,726,556 | 1,937,562 | 2,568,945 | ||||||||||||

| Selling and marketing | 3,301,452 | 2,194,590 | 4,690,195 | 2,327,225 | ||||||||||||

| General and administrative | 4,167,934 | 4,025,558 | 5,101,504 | 3,262,465 | ||||||||||||

| Total operating expenses | 13,933,142 | 12,991,861 | 15,408,928 | 10,595,458 | ||||||||||||

| Loss from operations | (17,997,529 | ) | (16,021,383 | ) | (15,668,415 | ) | (13,661,498 | ) | ||||||||

| Interest income | 7,454 | 7,512 | 8,417 | 4,986 | ||||||||||||

| Interest expense on convertible notes | (1,588,687 | ) | (138,934 | ) | (1,655,903 | ) | (1,098,774 | ) | ||||||||

| Amortization of discount on convertible notes | (3,424,931 | ) | (128,097 | ) | (4,320,048 | ) | (2,265,580 | ) | ||||||||

| Other income | 34,768 | 1,775 | 11,820 | 29,942 | ||||||||||||

| Net loss | $ | (22,968,925 | ) | $ | (16,279,127 | ) | $ | (21,624,129 | ) | $ | (16,990,924 | ) | ||||

| Net loss per share | $ | (1.02 | ) | $ | (0.74 | ) | $ | (0.91 | ) | $ | (0.76 | ) | ||||

| Weighted average numbers of shares outstanding: | ||||||||||||||||

| Basic and diluted | 22,521,432 | 21,945,580 | 23,647,632 | 22,461,413 | ||||||||||||

Consolidated Balance Sheet Data:

| December 31, | September 30, | |||||||||||

| 2013 | 2012 | 2014 | ||||||||||

| Unaudited | ||||||||||||

| Cash | $ | 62,565 | $ | 144,754 | $ | 977,403 | ||||||

| Money market funds | 8,611,614 | 4,310,038 | 697,341 | |||||||||

| Working capital | 9,104,436 | 4,275,975 | 4,388,417 | |||||||||

| Total assets | 12,673,421 | 7,992,575 | 9,563,886 | |||||||||

| Convertible notes payable | 19,211,112 | 8,273,356 | 25,187,063 | |||||||||

| Stockholders’ deficit | (9,221,071 | ) | (3,043,823 | ) | (19,521,662 | ) | ||||||

| 16 |

We are subject to various risks that may materially harm our business, prospects, financial condition and results of operations. An investment in our common stock is speculative and involves a high degree of risk. In evaluating an investment in shares of our common stock, you should carefully consider the risks described below, together with the other information included in this prospectus.

If any of the events described in the following risk factors actually occurs, or if additional risks and uncertainties that are not presently known to us or that we currently deem immaterial later materialize, then our business, prospects, results of operations and financial condition could be materially and adversely affected. In that event, the trading price of our common stock could decline, and you may lose all or part of your investment in our shares. The risks discussed below include forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking statements.

Risks Related to Our Dependence on the ARGUS II System

We depend on the success of our first commercial product, the Argus II System, which received European market clearance (CE Mark) in February 2011 and FDA approval in February 2013, in the United States for RP; and on the regulatory approval of our current product and a new device under development, the Orion I visual prosthesis (a modified version of the Argus II System), to treat other diseases causing blindness, in the US and other countries, which may never occur.

Our future success depends upon building a commercial operation in the US and expanding growth in Europe as well as entering additional markets to commercialize our Argus II System for both RP and AMD. We believe our expanded growth will depend on the further development, regulatory approval and commercialization of the Orion I product, which we anticipate can be used by nearly all profoundly blind individuals. If we fail to expand the use of the Argus II System in a timely manner for other forms of retinal degeneration in addition to RP, or to develop the Orion I product and penetrate the available markets which those applications are intended to serve, we may not be able to expand our markets or to grow our revenue, our stock values could decline and investors may lose money.

Our revenue from sales of Argus II System is dependent upon the pricing and reimbursement guidelines adopted in each country and if pricing and reimbursement levels are inadequate to achieve profitability our operations will suffer.

Our financial success is dependent on our ability to price our products in a manner acceptable to government and private payers while still maintaining our profit margins. Numerous factors that may be beyond our control may ultimately impact our pricing of Argus II System and determine whether we are able to obtain reimbursement or reimbursement at adequate levels from governmental programs and private insurance. If we are unable to obtain reimbursement or our product is not adequately reimbursed, we will experience reduced sales, our revenues likely will be adversely affected, and we may not become profitable.

Obtaining reimbursement approvals is time consuming, requires substantial management attention, and is expensive. Our business will be materially adversely affected if we do not receive approval for reimbursement of the Argus II System under government programs and from private insurers on a timely or satisfactory basis. Limitations on coverage could also be imposed at the local Medicare Administrative Contractor level or by fiscal intermediaries in the US and by regional, or national funding agencies in Europe. Our business could be materially adversely affected if the Medicare program, local Medicare Administrative Contractors or fiscal intermediaries were to make such a determination and deny, restrict or limit the reimbursement of Argus II System. Similarly in Europe these governmental and other agencies could deny, restrict or limit the reimbursement of Argus II System at the hospital, regional or national level. Our business also could be adversely affected if retinal specialists and the facilities within which they operate are not adequately reimbursed by Medicare and other funding agencies for the cost of the procedure in which they implant the Argus II System on a basis satisfactory to the administering retinal specialists and their

| 17 |

facilities. If the local contractors that administer the Medicare program and other funding agencies are slow to reimburse retinal specialists or provider facilities for the Argus II System, the retinal specialists may delay their payments to us, which would adversely affect our working capital requirements. Also if the funding agencies delay reimbursement payments to the hospitals, any increase to their working capital requirements could reduce their willingness to treat blind patients who wish to have our devices implanted. If reimbursement for our products is unavailable, limited in scope or amount, or if pricing is set at unsatisfactory levels, our business will be materially harmed.

Our commercial and financial success depends on the Argus II System being accepted in the market, and if not achieved will result in our not being able to generate revenues to support our operations.

Even if we are able to obtain favorable reimbursement within the markets that we serve, commercial success of our products will depend, among other things, on their acceptance by retinal specialists, ophthalmologists, general practitioners, low vision therapists and mobility experts, hospital purchasing and controlling departments, patients, and other members of the medical community. The degree of market acceptance of any of our product candidates will depend on factors that include:

| · | cost of treatment, |

| · | pricing and availability of future alternative products, |

| · | the extent of available third-party coverage or reimbursement, |

| · | perceived efficacy of Argus II System relative to other future products and medical solutions, and |

| · | prevalence and severity of adverse side effects associated with treatment. |

The activities of competitive medical device companies, or others, may limit Argus II System’s revenue.

Our commercial opportunities for Argus II System may be reduced if our competitors develop or market products that are more effective, are better tolerated, receive better reimbursement terms, are more accepted by physicians, have better distribution channels, or are less costly.

Currently, to our knowledge, no other medical devices comparable to the Argus II System have been approved by regulatory agencies, both in the US and Europe, to restore some functional vision in persons who have become blind due to RP. Other visual prosthesis companies such as Retina Implant AG and Pixium Vision, both based in Europe, are developing retinal implant technologies to partially restore some vision in blind patients. Retina Implant has obtained a CE mark for its Alpha IMS product but has not yet sold it to our knowledge, and to our knowledge neither Retina Implant nor Pixium has filed for market approval with the FDA, nor to our knowledge has either company obtained an Investigational Device Exemption to begin the required clinical trials in the US. These competitive therapies if or when developed or brought to market may result in pricing and market access pressure even if Argus II System is otherwise viewed as a preferable therapy.

Many privately and publicly funded universities and other organizations are engaged in research and development of potentially competitive products and therapies, such as stem cell and gene therapies, some of which may target RP and other indications as our product candidates. These organizations include pharmaceutical companies, biotechnology companies, public and private universities, hospital centers, government agencies and research organizations. Our competitors include large and small medical device and biotechnology companies that may have significant access to capital resources, competitive product pipelines, substantial research and development staffs and facilities, and substantial experience in medical device development.

We may face substantial competition in the future and may not be able to keep pace with the rapid technological changes which may result from others discovering, developing or commercializing products before or more successfully than we do.

In general the development and commercialization of new medical devices is highly competitive and is characterized by extensive research and development and rapid technological change. Our customers consider many factors including product reliability, clinical outcomes, product availability, inventory consignment, price and product services provided by the manufacturer. Market share can shift as a result of technological innovation and other business factors. We believe these risk factors are partially mitigated by the Argus II System being the sole product that is currently available for commercial implantation in the US and Europe. Major shifts in industry market share have occurred in connection with product problems, physician advisories and safety alerts, reflecting the importance of product quality in the medical device industry, and any quality problems with our processes, goods and services could harm our reputation for producing high-quality products and would erode our competitive advantage, sales and market share. Our competitors may develop products or other novel technologies

| 18 |

that are more effective, safer or less costly than any that we are developing and if those products gain market acceptance our revenue and financial results could be adversely affected.

If we fail to develop new products or enhance existing products, our leadership in the markets we serve could erode, and our business, financial condition and results of operations may be adversely affected.

Risks Related to Our Business and Industry

We have incurred operating losses since inception and may continue to incur losses for the foreseeable future.

We have had a history of operating losses and we expect that operating losses will continue into the near term. Although we have had sales of the Argus II product, these limited sales have not been sufficient to cover our operating expenses. Our ability to generate positive cash flow will also hinge on our ability to correctly price our product to our markets, expand the use of the Argus II System, develop the Orion I visual prosthesis and obtain government and private insurance reimbursement. As of September 30, 2014 we have total stockholders’ deficiency of $19,521,662, and an accumulated deficit of $139,086,850. We cannot assure you that we will be profitable even if we successfully commercialize our products. Failure to become and remain profitable may adversely affect the market price of our common stock and our ability to raise capital and continue operations.

We may be unable to continue as a going concern if we do not successfully raise additional capital or if we fail to generate sufficient revenue from operations.

Our independent registered public accounting firm has issued an unqualified opinion with an explanatory paragraph to the effect that there is substantial doubt about our ability to continue as a going concern. A “going concern” opinion indicates that the financial statements have been prepared assuming we will continue as a going concern and do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets, or the amounts and classification of liabilities that may result if we do not continue as a going concern. The factors giving rise to this unqualified opinion with an explanatory paragraph could have a material adverse effect on our business, financial condition, results of operations and cash flows. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 1 to Notes To Consolidated Financial Statements included elsewhere in this prospectus.

Primarily as a result of our limited revenue, history of losses to date and our lack of liquidity, there is substantial uncertainty as to our ability to continue as a going concern. If we are unable to raise additional capital or if we are unable to generate sufficient revenue from our operations, we may not stay in business. We have no committed sources of capital and there is no assurance that additional financing will be available when needed on terms that are acceptable, if at all. These circumstances may discourage some investors from purchasing our stock, lending us money, or from providing alternative forms of financing. The failure to satisfy our capital requirements would adversely affect our business, financial condition, results of operations and prospects. Unless we raise additional funds, either through the sale of equity securities or one or more collaborative arrangements, we will not have sufficient funds to continue operations. Even if we take these actions, they may be insufficient, particularly if our costs are higher than projected or unforeseen expenses arise.

Our business is subject to international economic, political and other risks that could negatively affect our results of operations or financial position.

We derive a significant portion of our revenues from Europe, and we anticipate that revenue from Europe and other countries outside the US will increase. Accordingly, our operations are subject to risks associated with doing business internationally, including

| · | currency exchange variations, |

| · | extended collection timelines for accounts receivable, |

| · | greater working capital requirements, |

| · | multiple legal Systems and unexpected changes in legal and regulatory requirements, |

| · | the need to ensure compliance with the numerous regulatory and legal requirements applicable to our business in each of these jurisdictions and to maintain an effective compliance program to ensure compliance with these requirements, |

| · | political changes in the foreign governments impacting health policy and trade, |

| 19 |

| · | tariffs, export restrictions, trade barriers and other regulatory or contractual limitations that could impact our ability to sell or develop our products in certain foreign markets, |

| · | trade laws and business practices favoring local competition, |

| · | adverse economic conditions, including the stability and solvency of business financial markets, financial institutions and sovereign nations and the healthcare expenditure of domestic or foreign nations. |

The realization of any of these or other risks associated with operating in Europe or other non-U.S. countries could have a material adverse effect on our business, results of operations or financial condition.

We are subject to stringent domestic and foreign medical device regulation and any unfavorable regulatory action may materially and adversely affect our financial condition and business operations.

Our products, development activities and manufacturing processes are subject to extensive and rigorous regulation by numerous government agencies, including the FDA and comparable foreign agencies. To varying degrees, each of these agencies monitors and enforces our compliance with laws and regulations governing the development, testing, manufacturing, labeling, marketing, distribution, and the safety and effectiveness of our medical devices. The process of obtaining marketing approval or clearance from the FDA and comparable foreign bodies for new products, or for enhancements, expansion of the indications or modifications to existing products, could:

| · | take a significant, indeterminate amount of time, |

| · | require the expenditure of substantial resources, |

| · | involve rigorous pre-clinical and clinical testing, and possibly post-market surveillance, |

| · | involve modifications, repairs or replacements of our products, |

| · | require design changes of our products, |

| · | result in limitations on the indicated uses of our products, and |

| · | result in our never being granted the regulatory approval we seek. |

Any of these occurrences that we might experience will cause our operations to suffer, harm our competitive standing and result in further losses that adversely affect our financial condition.

We have ongoing responsibilities under FDA and international regulations, both before and after a product is commercially released. For example, we are required to comply with the FDA’s Quality System Regulation (QSR), which mandates that manufacturers of medical devices adhere to certain quality assurance requirements pertaining among other things to validation of manufacturing processes, controls for purchasing product components, and documentation practices. As another example, the Medical Device Reporting regulation requires us to provide information to the FDA whenever there is evidence that reasonably suggests that a device may have caused or contributed to a death or serious injury or, that a malfunction occurred which would be likely to cause or contribute to a death or serious injury upon recurrence. Compliance with applicable regulatory requirements is subject to continual review and is monitored rigorously through periodic inspections by the FDA. If the FDA were to conclude that we are not in compliance with applicable laws or regulations, or that any of our medical devices are ineffective or pose an unreasonable health risk, the FDA could ban such medical devices, detain or seize such medical devices, order a recall, repair, replacement, or refund of such devices, or require us to notify health professionals and others that the devices present unreasonable risks of substantial harm to the public health. The FDA has been increasing its scrutiny of the medical device industry and the government is expected to continue to scrutinize the industry closely with inspections and possibly enforcement actions by the FDA or other agencies. Additionally, the FDA may restrict manufacturing and impose other operating restrictions, enjoin and restrain certain violations of applicable law pertaining to medical devices and assess civil or criminal penalties against our officers, employees, or us. Any adverse regulatory action, depending on its magnitude, may restrict us from effectively manufacturing, marketing and selling our products. In addition, negative publicity and product liability claims resulting from any adverse regulatory action could have a material adverse effect on our financial condition and results of operations.

The number of preclinical and clinical tests that will be required for regulatory approval varies depending on the disease or condition to be treated, the jurisdiction in which we are seeking approval and the regulations applicable to that particular medical device. Regulatory agencies, including those in the US, Canada, Europe and other countries where medical devices are regulated, can delay, limit or deny approval of a product for many reasons. For example,

| 20 |

| · | a medical device may not be safe or effective, |

| · | regulatory agencies may interpret data from preclinical and clinical testing differently than we do, |

| · | regulatory agencies may not approve our manufacturing processes, |

| · | regulatory agencies may conclude that our device does not meet quality standards for durability, long-term reliability, biocompatibility, electromagnetic compatibility, electrical safety, and |

| · | regulatory agencies may change their approval policies or adopt new regulations. |

The FDA may make requests or suggestions regarding conduct of our clinical trials, resulting in an increased risk of difficulties or delays in obtaining regulatory approval in the US. Any of these occurrences could prove materially harmful to our operations and business.

We are also subject to stringent government regulation in European and other foreign countries, which could delay or prevent our ability to sell our products in those jurisdictions.