Exhibit 99.2

NASDAQ: EYES Investor Presentation June 2015 NASDAQ: EYES

NASDAQ: EYES Forward Looking Statements This presentation contains certain forward - looking information about Second Sight that is intended to be covered by the safe harbor for "forward - looking statements" provided by the Private Securities Litigation Reform Act of 1995, as amended. Forward - looking statements are statements that are not historical facts. Words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” “strong,” “up coming,” and similar expressions are intended to identify forward - looking statements. These statements include, but are not limited to, statements regarding our ability to successfully develop and commercialize our products; our ability to expand our long - term business opportunities; financial projections and estimates and their underlying assumptions; and future performance. In this document, we refer to information regarding potential markets for products and other industry data. We believe that all such information has been obtained from reliable sources that are customarily relied upon by companies in our industry. However, we have not independently verified any such information. Forward - looking statements may address the following subjects among others: expected products, applications, customers, technologies and performance, coverage and insurance reimbursements, results of clinical studies, success of research and development and our expectations concerning our business strategy. Forward - looking statements involve inherent risks and uncertainties which could cause actual results to differ materially from those in the forward - looking statements, as a result of various factors including those risks and uncertainties referred to in the Risk Factors and in Management's Discussion and Analysis of Financial Condition and Results of Operations sections of our Annual Report on Form 10 - K as filed on March 17, 2015 and our other reports filed from time to time with the Securities and Exchange Commission. The audience is cautioned not to place undue reliance on these forward - looking statements that speak only as of the date hereof, and we do not undertake any obligation to revise and disseminate forward - looking statements to reflect events or circumstances after the date hereof, or to reflect the occurrence of or non - occurrence of any events. 2

NASDAQ: EYES Second Sight’ s Technology Platform • http://www.bloomberg.com/news/videos/2015 - 05 - 21/bionic - eyes - give - second - sight - to - the - blind Second Sight’s Purpose : Restoring vision to the blind Bloomberg Video: Tech that Lets the Blind See 3

NASDAQ: EYES Second Sight’ s Technology Platform (Cont’d) https:// www.youtube.com/watch?v=CiyGOUHD2nI Second Sight’s Purpose : Restoring vision to the blind YouTube Video: First Implant at Duke Eye Center 4

NASDAQ: EYES Corporate Summary • Restoring vision to the blind with the Argus® II platform technology • Targeting significant addressable market of over 8 million people • Commercial stage – FDA, Canada, EU, & Turkey regulatory approvals • Strong financial position – • Successful IPO in November 2014 (raised gross proceeds of $ 36.2M) • Company is debt free • Shares outstanding – • Total shares outstanding: 35.4M • Fully diluted shares including options and warrants: 39.4M 5

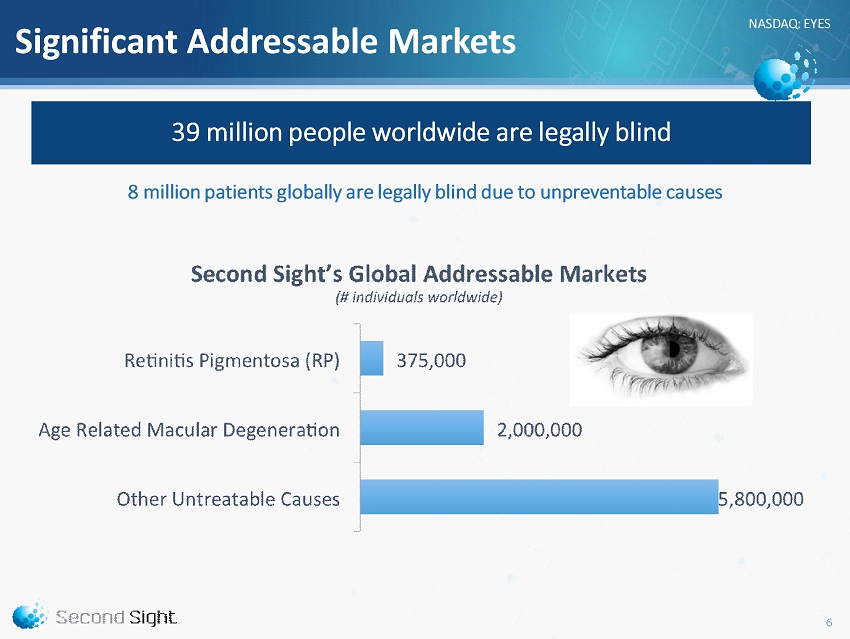

NASDAQ: EYES Significant Addressable Markets 8 million patients globally are legally blind due to unpreventable causes 39 million people worldwide are legally blind 6

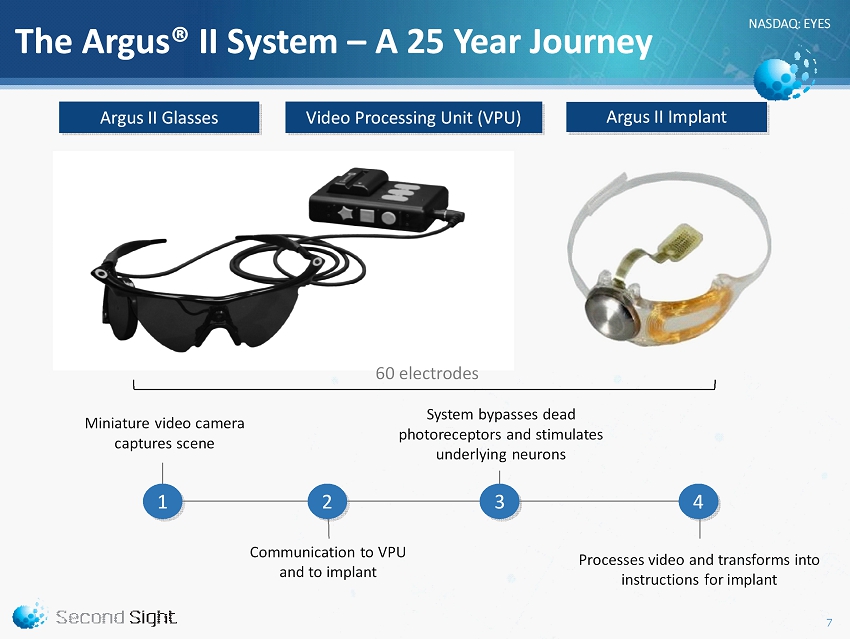

NASDAQ: EYES Argus II Implant Argus II Glasses Video Processing Unit (VPU) System bypasses dead photoreceptors and stimulates underlying neurons Processes video and transforms into instructions for implant Miniature video camera captures scene Communication to VPU and to implant 1 3 4 2 60 electrodes The Argus® II System – A 25 Year Journey 7

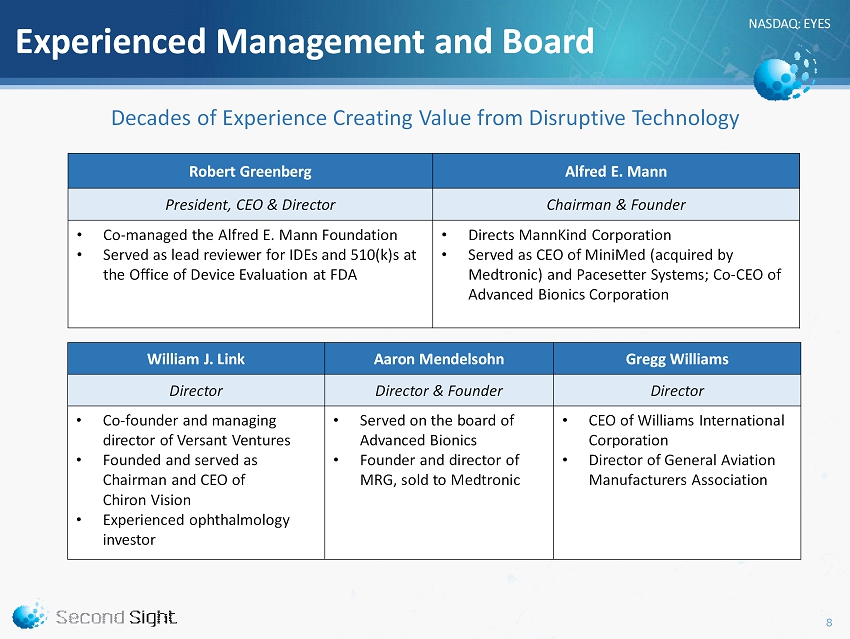

NASDAQ: EYES Experienced Management and Board Robert Greenberg Alfred E. Mann President, CEO & Director Chairman & Founder • Co - managed the Alfred E. Mann Foundation • Served as lead reviewer for IDEs and 510(k)s at the Office of Device Evaluation at FDA • Directs MannKind Corporation • Served as CEO of MiniMed (acquired by Medtronic) and Pacesetter Systems; Co - CEO of Advanced Bionics Corporation William J. Link Aaron Mendelsohn Gregg Williams Director Director & Founder Director • Co - founder and managing director of Versant Ventures • Founded and served as Chairman and CEO of Chiron Vision • Experienced ophthalmology investor • Served on the board of Advanced Bionics • Founder and director of MRG, sold to Medtronic • CEO of Williams International Corporation • Director of General Aviation Manufacturers Association Decades of Experience Creating Value from Disruptive Technology 8

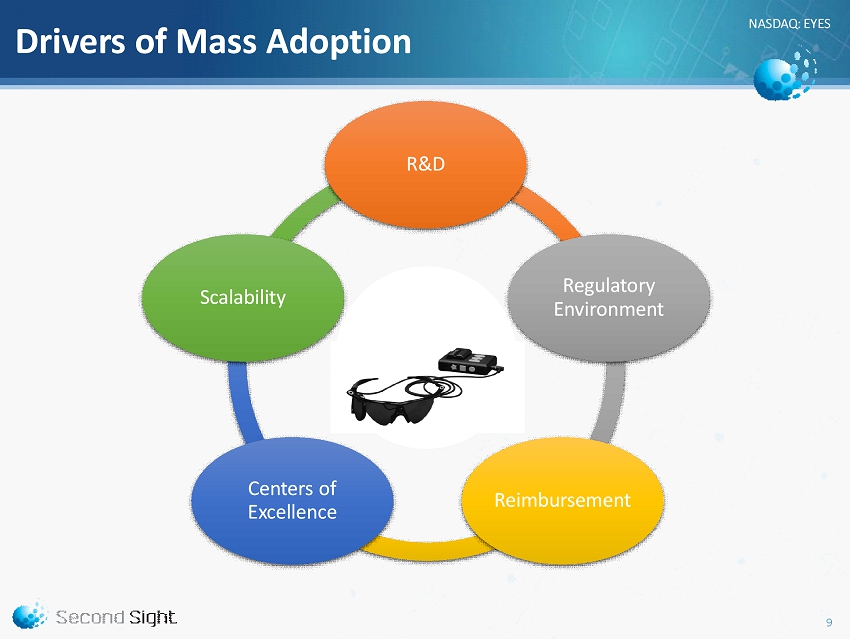

NASDAQ: EYES Drivers of Mass Adoption R&D Regulatory Environment Reimbursement Centers of Excellence Scalability 9

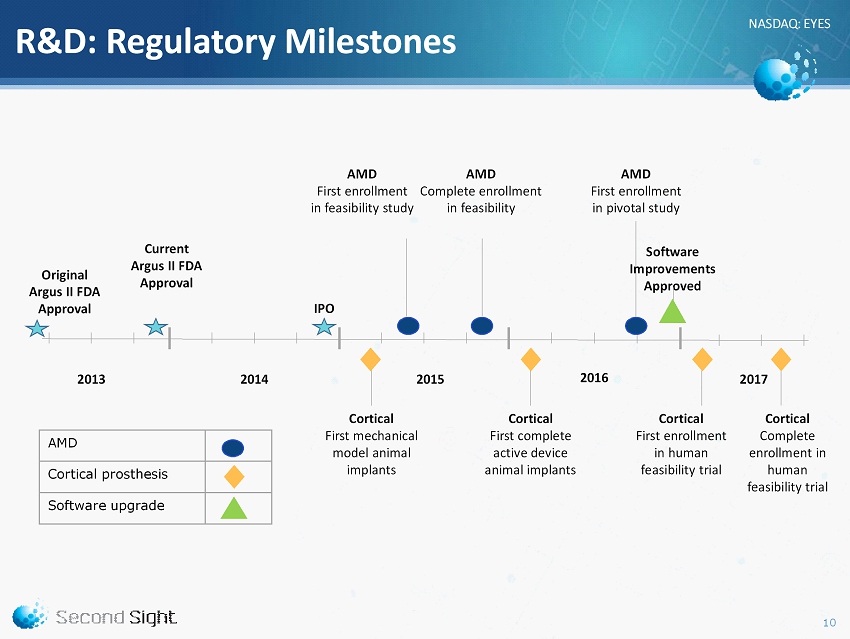

NASDAQ: EYES R&D: Regulatory Milestones AMD Cortical prosthesis Software upgrade 2014 2015 2016 2017 2013 AMD First enrollment in feasibility study AMD Complete enrollment in feasibility AMD First enrollment in pivotal study Cortical First mechanical model animal implants Cortical First complete active device animal implants Cortical First enrollment in human feasibility trial Cortical Complete enrollment in human feasibility trial IPO Original Argus II FDA Approval Software Improvements Approved Current Argus II FDA Approval 10

NASDAQ: EYES R&D: Software Upgrades • Controlling the relative stimulation applied to adjacent electrodes can produce spatial patterns of stimulation between electrodes ( virtual electrodes) • Potential resolution enhancement: 10x – 100x at the pixel level • Large body of work to draw upon in cochlear implant technology • Capital efficient path to resolution enhancement • Key variables: • Relative pulse amplitude in adjacent electrodes • Pulse shape • Pulse duration From Bonham and Litvak, “ Current Focusing and Steering, ” Hearing Research 242 (2008), 141 - 153. Resolution enhancement without adding electrodes 11

NASDAQ: EYES R&D: Expanding into AMD • Experimental work conducted in Armand Tanguay Jr.’s lab at USC indicated simulations with retinal prostheses in AMD patients may: • Improve time to grasp a target object and ability to avoid obstacles to grasping a target • Improve functional depth task performance • Allow blind patients to perform daily tasks with more ease, accuracy, and speed Preliminary data indicates Argus II may be an effective treatment for AMD Human experiments at Johns Hopkins produced phosphenes in two AMD patients 12

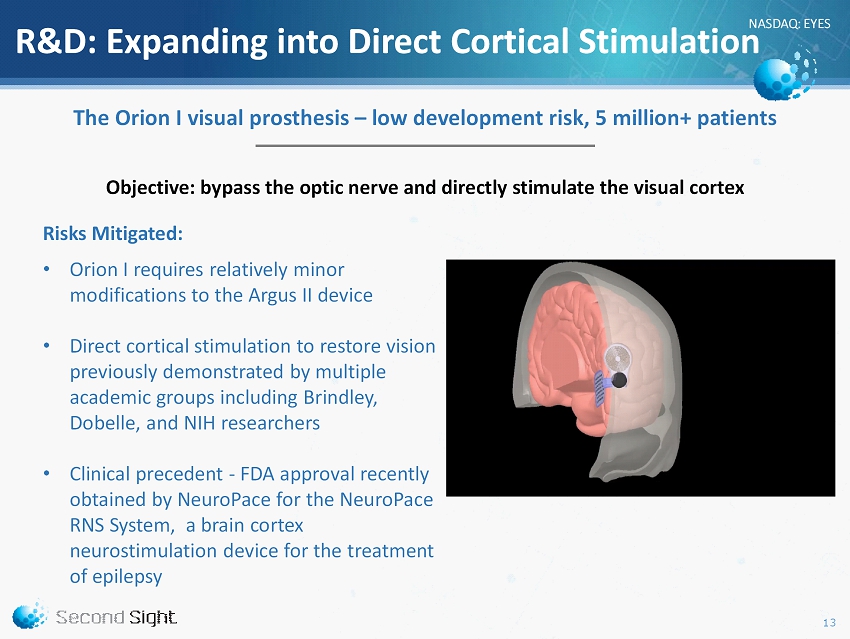

NASDAQ: EYES R&D: Expanding into Direct Cortical Stimulation Objective: bypass the optic nerve and directly stimulate the visual cortex Risks Mitigated : • Orion I requires relatively minor modifications to the Argus II device • Direct cortical stimulation to restore vision previously demonstrated by multiple academic groups including Brindley , Dobelle , and NIH researchers • Clinical precedent - FDA approval recently obtained by NeuroPace for the NeuroPace RNS System, a brain cortex neurostimulation device for the treatment of epilepsy The Orion I visual prosthesis – low development risk, 5 million+ patients 13

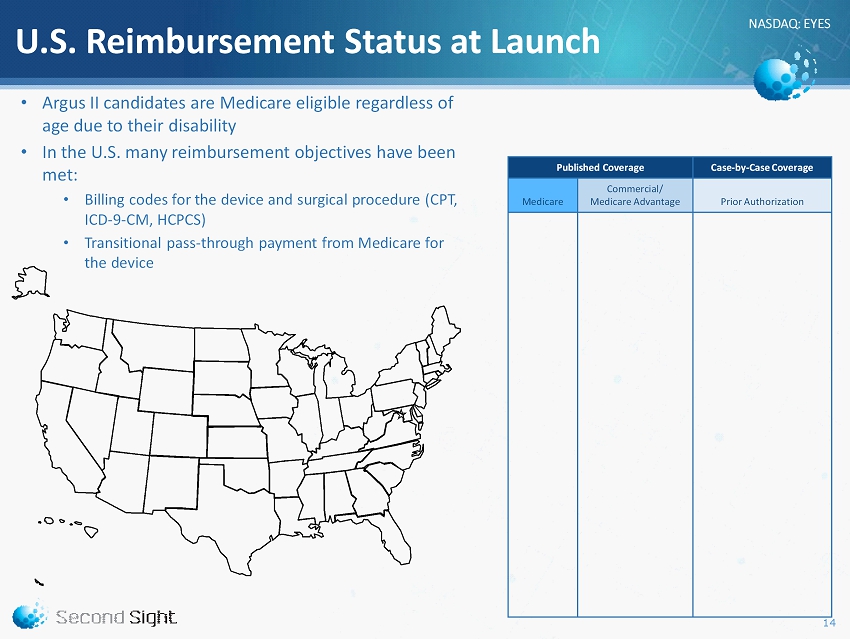

NASDAQ: EYES U.S. Reimbursement Status at Launch • Argus II candidates are Medicare eligible regardless of age due to their disability • In the U.S. many reimbursement objectives have been met: • Billing codes for the device and surgical procedure (CPT, ICD - 9 - CM, HCPCS ) • Transitional pass - through payment from Medicare for the device 14 Published Coverage Case - by - Case Coverage Medicare Commercial/ Medicare Advantage Prior Authorization

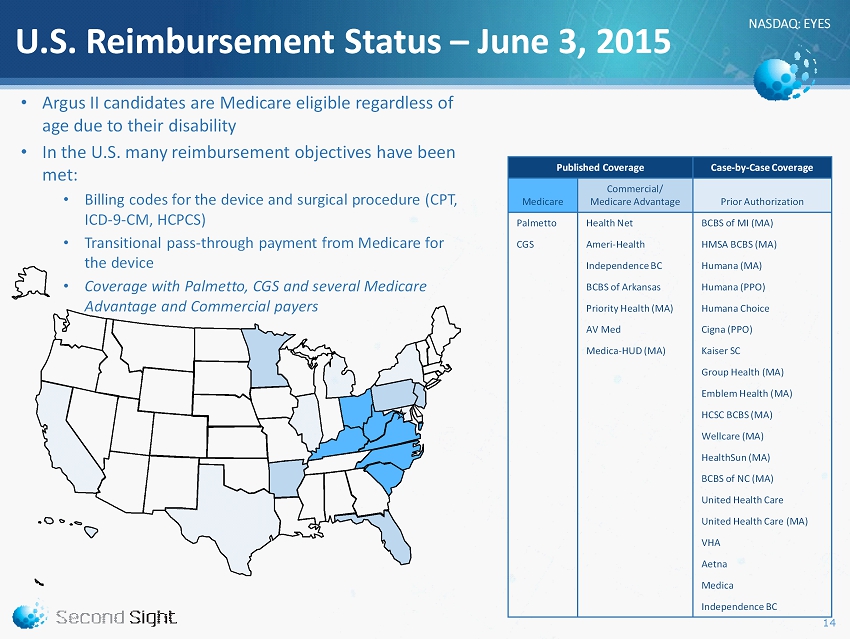

NASDAQ: EYES U.S. Reimbursement Status – June 3, 2015 • Argus II candidates are Medicare eligible regardless of age due to their disability • In the U.S. many reimbursement objectives have been met: • Billing codes for the device and surgical procedure (CPT, ICD - 9 - CM, HCPCS ) • Transitional pass - through payment from Medicare for the device • Coverage with Palmetto, CGS and several Medicare Advantage and Commercial payers 14 Published Coverage Case - by - Case Coverage Medicare Commercial/ Medicare Advantage Prior Authorization Palmetto Health Net BCBS of MI (MA) CGS Ameri - Health HMSA BCBS (MA) Independence BC Humana (MA) BCBS of Arkansas Humana (PPO) Priority Health (MA) Humana Choice AV Med Cigna (PPO) Medica - HUD (MA) Kaiser SC Group Health (MA) Emblem Health (MA) HCSC BCBS (MA) Wellcare (MA) HealthSun (MA) BCBS of NC (MA) United Health Care United Health Care (MA) VHA Aetna Medica Independence BC

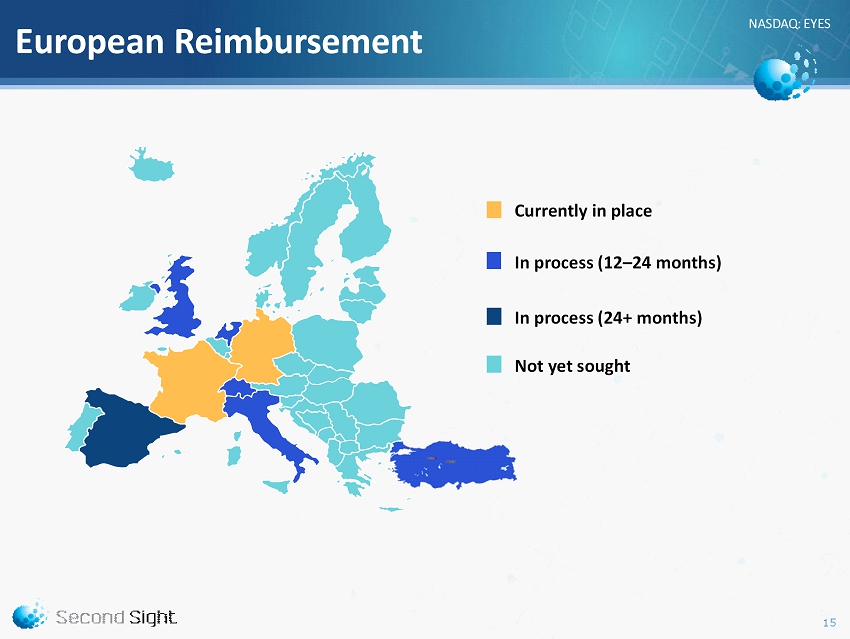

NASDAQ: EYES European Reimbursement Currently in place In process (24 + months) Not yet sought In process (12 – 24 months) 15

NASDAQ: EYES North America Kellogg – Univ . Michigan Univ . Southern California Toronto Western Hospital Wills Eye – Philadelphia Duke Eye Center Texas Retina Assoc . – Dallas Bascom Palmer – Univ . Miami Wilmer – Johns Hopkins Emory University Univ . Illinois Chicago Mayo Clinic – Minnesota Retina Consultants of Hawaii - Honolulu University of Minnesota Germany University Aachen University Cologne University Hamburg University Lübeck City Karlsruhe Clinic Sulzbach Saudi Arabia King Khaled Eye Specialist Hospital Implanting Centers Worldwide France CHU Bordeaux CHU Strasbourg CHNO des XV - XX (Paris) • North America – 13 centers; in discussions with 12 more • EU/Middle East – 12 centers; in discussions with 12 more • Asia partnerships anticipated as technology platform matures Italy Firenze Camposanpierro (Venice) 16

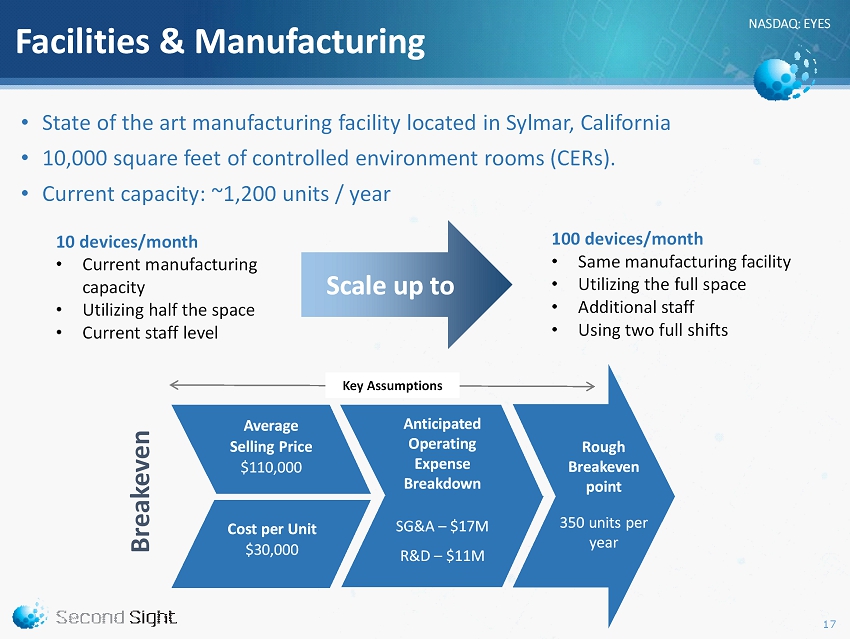

NASDAQ: EYES Facilities & Manufacturing • State of the art manufacturing facility located in Sylmar, California • 10,000 square feet of controlled environment rooms (CERs). • Current capacity: ~ 1,200 units / year 10 devices/month • Current manufacturing capacity • Utilizing half the space • Current staff level 100 devices/month • Same manufacturing facility • U tilizing the full space • Additional staff • Using two full shifts Scale up to Cost per Unit $30,000 Average Selling Price $110,000 Rough Breakeven point 350 units per year Anticipated Operating Expense Breakdown SG&A – $17M R&D – $ 11M Key Assumptions Breakeven 17

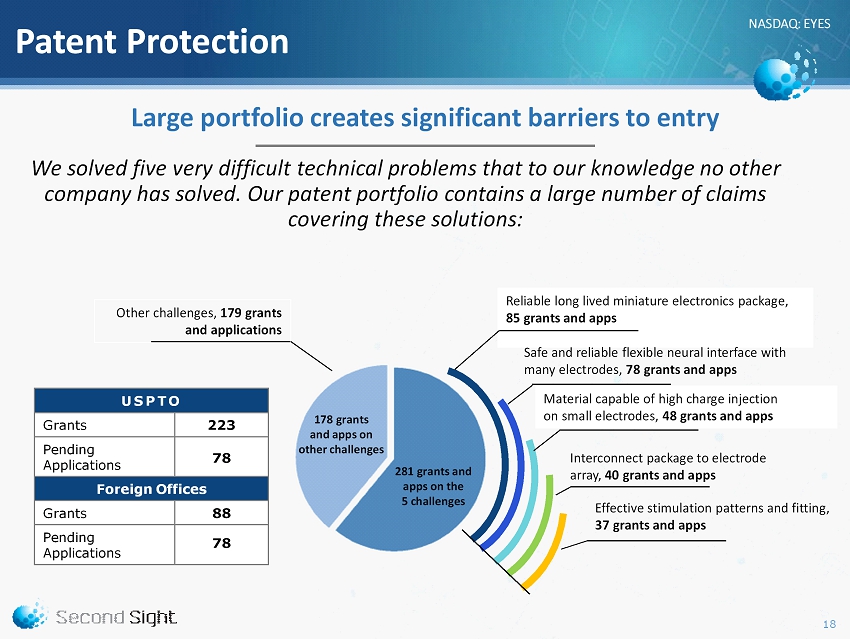

NASDAQ: EYES Patent Protection We solved five very difficult technical problems that to our knowledge no other company has solved. Our patent portfolio contains a large number of claims covering these solutions: Other challenges, 179 grants and applications Reliable long lived miniature electronics package, 85 grants and apps Safe and reliable flexible neural interface with many electrodes, 78 grants and apps Interconnect package to electrode array, 40 grants and apps Material capable of high charge injection on small electrodes, 48 grants and apps Effective stimulation patterns and fitting, 37 grants and apps USPTO Grants 223 Pending Applications 78 Foreign Offices Grants 88 Pending Applications 78 Large portfolio creates significant barriers to entry 178 grants a nd apps on other challenges 281 grants and apps on the 5 challenges 18

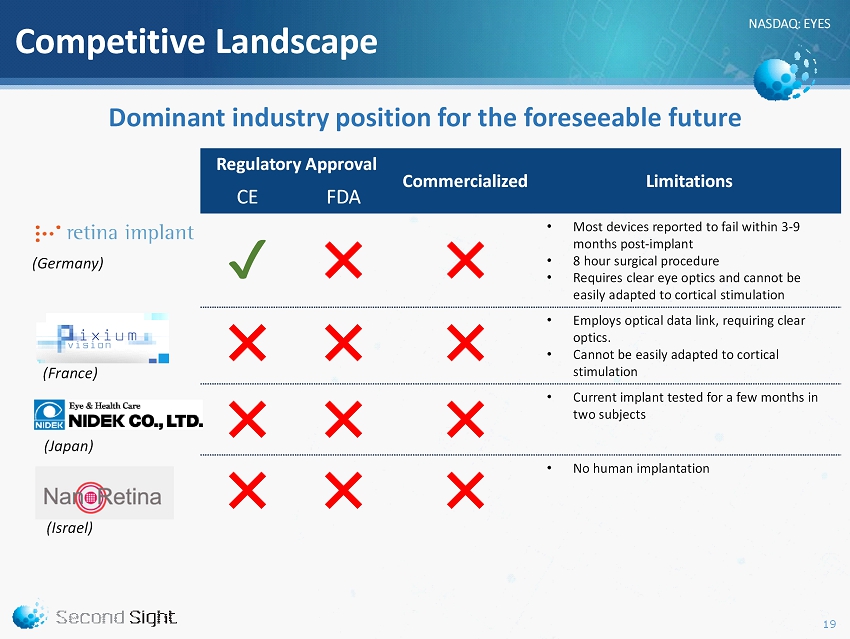

NASDAQ: EYES Competitive Landscape Regulatory Approval Commercialized Limitations CE FDA ✔ ✖ ✖ • Most devices reported to fail within 3 - 9 months post - implant • 8 hour surgical procedure • Requires clear eye optics and cannot be easily adapted to cortical stimulation ✖ ✖ ✖ • Employs optical data link, requiring clear optics. • Cannot be easily adapted to cortical stimulation ✖ ✖ ✖ • Current implant tested for a few months in two subjects ✖ ✖ ✖ • No human implantation Dominant industry position for the foreseeable future (Germany) (France) (Japan) (Israel) 19

NASDAQ: EYES Major Awards & Recognition 20

NASDAQ: EYES Investment Highlights • Restoring vision to the blind with the Argus II platform technology • Targeting significant addressable market of over 8 million people • Securing our market leading position with strong patent protection • Ensuring first mover advantage as the only device with U.S. FDA approval • Demonstrating reimbursement success in the U.S. and Europe • Enhancing financial flexibility to execute strategic objectives with successful IPO and strong balance sheet 21

NASDAQ: EYES Retail Investor Relations Matt Hayden Chairman MZ North America Direct: 949 - 259 - 4986 Matt.Hayden@mzgroup.us Second Sight Medical Products, Inc. 12744 San Fernando Road Building 3 Sylmar, CA 91342 Direct: 818 - 833 - 5000 www.secondsight.com Institutional Investor Relations Lisa Wilson President In - Site Communications, Inc. Direct: 212 - 452 - 2793 lwilson@insitecony.com Contact 22