UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities

Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

SECOND SIGHT MEDICAL PRODUCTS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ¨ | Fee paid previously with preliminary materials. | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

Second Sight Medical Products, Inc.

12744 San Fernando Road, Suite 400

Sylmar, California 91342

April 15, 2016

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Second Sight Medical Products, Inc. to be held at 9:00 a.m., local time, on Tuesday, May 10, 2016, at the Hyatt Regency Valencia, 24500 Town Center Drive, Valencia, California, USA, 91355.

We look forward to your attending either in person or by proxy. Further details regarding the matters to be acted upon at this meeting appear in the accompanying Notice of 2016 Annual Meeting and Proxy Statement. Please give this material your careful attention.

| Sincerely, | |

| /s/ Jonathan Will McGuire | |

| Jonathan Will McGuire | |

| President and Chief Executive Officer |

SECOND SIGHT MEDICAL PRODUCTS, INC.

12744 San Fernando Road, Suite 400

Sylmar, California 91342

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 10, 2016

To the Stockholders of Second Sight Medical Products, Inc.:

NOTICE IS HEREBY GIVEN that the 2016 Annual Meeting of Stockholders of Second Sight Medical Products, Inc., a California corporation, will be held on Tuesday, May 10, 2016 at 9:00 a.m., local time, at the Hyatt Regency Valencia, 24500 Town Center Drive, Valencia, California, USA, 91355, for the following purposes:

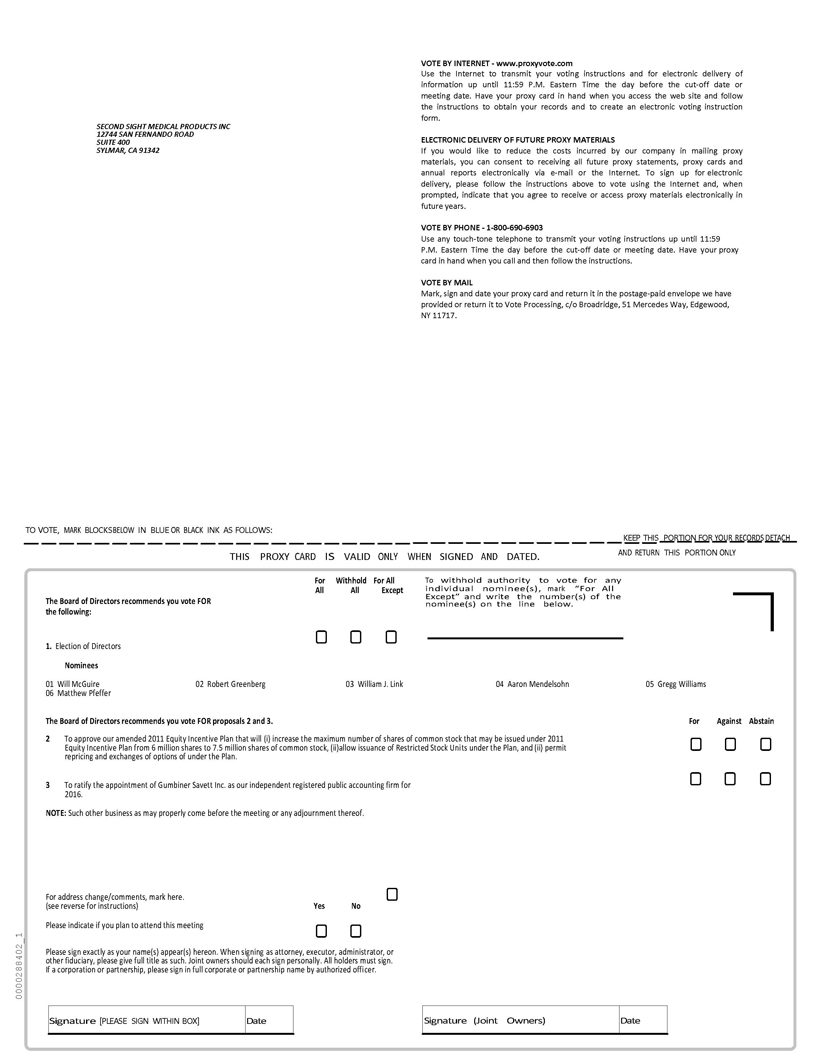

1. To elect six directors to serve until the 2017 Annual Meeting of Stockholders.

2. To approve an amended Second Sight 2011 Equity Incentive Plan that will (i) increase the maximum number of shares of common stock that may be issued under the Plan from 6 million shares to 7.5 million shares of common stock, (ii) allow issuance of Restricted Stock Units, and (iii) permit repricing and exchanges of options.

3. To ratify the appointment of Gumbiner Savett Inc. as our independent registered public accounting firm for 2016.

4. To transact such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof.

Only stockholders of record at the close of business on April 7, 2016, the record date fixed by the Board of Directors, are entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof. If you plan to attend the Annual Meeting and you require directions, please call us at (818) 833-5000.

Whether or not you plan to attend the meeting, please complete, sign, date and return the enclosed proxy in the envelope provided as soon as possible.

| By Order of the Board of Directors | |

| /s/ Jonathan Will McGuire | |

| Jonathan Will McGuire | |

| President and Chief Executive Officer |

Dated: April 15, 2016

| 2 |

TABLE OF CONTENTS

This Proxy Statement and the accompanying proxy card are first being mailed, on or about April 18, 2016, to owners of shares of common stock of Second Sight Medical Products, Inc. (which may be referred to in this Proxy Statement as “we,” “us,” “Second Sight” or the “Company”) in connection with the solicitation of proxies by our board of directors (“Board”) for our Annual Meeting of stockholders to be held on May 10, 2016 at 9:00 a.m. PDT at the Hyatt Regency Valencia, 24500 Town Center Drive, Valencia, California, USA, 91355 (referred to as the “Annual Meeting”). This proxy procedure permits all stockholders, many of whom are unable to attend the Annual Meeting, to vote their shares at the Annual Meeting. Our Board encourages you to read this document thoroughly and to take this opportunity to vote on the matters to be decided at the Annual Meeting.

IMPORTANT NOTICE

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, YOU ARE REQUESTED TO MARK, DATE AND SIGN THE ENCLOSED PROXY CARD AND RETURN IT AS PROMPTLY AS POSSIBLE IN THE ENCLOSED ENVELOPE. SIGNING AND RETURNING A PROXY WILL NOT PREVENT YOU FROM VOTING IN PERSON AT THE MEETING.

THANK YOU FOR ACTING PROMPTLY.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 10, 2016:

The Notice of Annual Meeting, Proxy Statement and 2015 Annual Report on Form 10-K may also be accessed via our website at www.secondsight.com.

| 3 |

Second Sight Medical Products, Inc.

12744 San Fernando Road, Suite 400

Sylmar, California 91342

(818) 833-5000

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD AT 9:00 A.M. ON MAY 10, 2016

INTRODUCTION

This Proxy Statement and the accompanying Proxy Card is first being mailed on or about April 18, 2016. We are sending it to you to solicit proxies for voting at the Annual Meeting of our stockholders.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

Proxy Materials

Q: Why am I being asked to review these materials?

A: Second Sight Medical Products, Inc., also referred to herein as “Second Sight”, the “Company” or “we”, is providing these proxy materials to you in connection with the solicitation of proxies by the Company’s Board of Directors for use at an Annual Meeting of Stockholders (the “Annual Meeting”). The Annual Meeting will be held at the Hyatt Regency Valencia, 24500 Town Center Drive, Valencia, California, USA, 91355, at 9:00 a.m., Pacific Standard Time on May 10, 2016. If necessary the meeting may be continued at a later time. Stockholders are invited to attend the Annual Meeting and are requested to vote on the proposals described in this proxy statement.

Q: What information is contained in these materials?

A: The proxy materials include:

• our proxy statement for the Annual Meeting of Stockholders;

• our 2015 Annual Report, which includes our Annual Report on Form 10-K for the fiscal year ended December 31, 2015; and

• a proxy card or a voting instruction card for the Annual Meeting.

Q: What information is contained in this proxy statement?

A: The information in this proxy statement relates to the proposals to be voted on at the Annual Meeting, the voting process, the Board and Board committees, the compensation of our directors and certain executive officers for fiscal 2015 and other required information.

Q: How may I obtain a paper copy of the proxy materials?

A: You may request paper copies of the proxy materials for the Annual Meeting by telephoning (818) 833-5000, or by sending an e-mail to investors@secondsight.com .

Q: I share an address with another stockholder, and we received more than one paper copy of the proxy materials. How do we obtain a single copy in the future?

A: Stockholders of record sharing an address who are receiving multiple copies of the proxy materials and who wish to receive a single copy of such materials in the future may contact our transfer agent whose contact information is provided below. Beneficial owners of shares held through a broker, trustee or other nominee sharing an address who are receiving multiple copies of the proxy materials and who wish to receive a single copy of such materials in the future may contact Tom Miller at:

| 4 |

Second Sight Medical Products, Inc.

12744 San Fernando Road, Suite 400

Sylmar, California 91342

Q: What does it mean if I received more than one proxy or voting instruction form?

A: You may receive more than one notice, or more than one paper copy of the proxy materials, including multiple paper copies of this proxy statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate notice or a separate voting instruction card for each brokerage account in which you hold shares. If you are a stockholder of record and your shares are registered in more than one name, you may receive more than one notice, or more than one proxy card. To vote all of your shares by proxy, you must complete, sign, date and return each proxy card and voting instruction card that you receive to vote the shares represented by each notice that you receive (unless you have requested and received a proxy card or voting instruction card for the shares represented by one or more of those notices).

Q: How may I obtain a copy of the Company’s 2015 Form 10-K and other financial information?

A: Stockholders may request a free copy of our 2015 Annual Report, which includes our 2015 Form 10-K, from:

Second Sight Medical Products, Inc.

12744 San Fernando Road, Suite 400

Sylmar, California 91342

Alternatively, a copy of our Form 10-K is available at the Investor Relations section of our website: http://investors.secondsight.com/sec.cfm

We also will furnish any exhibit to our Form 10-K for 2015 if specifically requested.

Voting Information

Q: What matters will the Company stockholders vote on at the Annual Meeting?

A: There are four proposals to be considered and voted on at the meeting. The proposals to be voted on are:

Proposal 1 — To elect six directors to serve until the 2017 Annual Meeting of Stockholders or until the election and qualification of their successors;

Proposal 2 — To approve an amended Second Sight 2011 Equity Incentive Plan that will (i) increase the maximum number of shares of common stock that may be issued under the Plan from 6 million shares to 7.5 million shares of common stock, (ii) allow issuance of Restricted Stock Units , and (iii) permit repricing and exchanges of options;

Proposal 3 — To ratify the appointment of Gumbiner Savett Inc. as our independent registered public accounting firm for the fiscal year ending December 31, 2016; and

Proposal 4 — To transact such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof.

For a more detailed discussion of each of these proposals, please see the information included elsewhere in the proxy statement relating to these proposals.

Q: What are the Board’s voting recommendations?

A: The Board of Directors recommends that you vote your shares as follows:

• “FOR” the election of the nominated directors (see Proposal 1);

• “FOR” ratification of an amended 2011 Equity Incentive Plan that will (i) increase the maximum number of shares of common stock that may be issued under the Plan from 6 million shares to 7.5 million shares of common stock, (ii) allow issuance of Restricted Stock Units , and (iii) permit repricing and exchanges of options (Proposal 2); and

• “FOR” the ratification of Gumbiner Savett Inc. as our independent registered public accounting firm for the fiscal year ending December 31, 2016 (Proposal 3).

| 5 |

With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the Board or, if no recommendation is given, in their own discretion.

If you sign and return your proxy card but do not specify how you want to vote your shares, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board.

Q: Who is entitled to vote at the Annual Meeting?

A: Each holder of shares of our common stock issued and outstanding as of the close of business on April 7, 2016, the record date for the Annual Meeting, is entitled to cast one vote per share on all items being voted upon at the Annual Meeting. You may cumulate your votes in favor of one or more director nominees. Please see “Is cumulative voting permitted for the election of directors” below on page 7. You may vote all shares owned by you as of this time, including shares held for you as the beneficial owner through a broker, trustee or other nominee.

On the record date, the Company had approximately 36,019,086 shares of common stock issued and outstanding.

Q: What is the difference between a stockholder of record and a stockholder who holds stock in street name?

A: Most of our stockholders hold their shares through a broker, trustee or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

• Stockholder of Record—If your shares are registered directly in your name with our transfer agent, you are considered, with respect to those shares, the “stockholder of record.” As the stockholder of record, you have the right to grant your voting proxy directly to the Company or to a third party, or to vote your shares during the meeting.

• Beneficial Owner—If your shares are held in a brokerage account, by a trustee or by another nominee (that is, in “street name”), you are considered the “beneficial owner” of those shares. As the beneficial owner of those shares, you have the right to direct your broker, trustee or nominee how to vote, or to vote your shares during the Annual Meeting (which must be voted prior to the Annual Meeting).

Q: If I hold my shares in street name through my broker, will my broker vote these shares for me?

A: If you provide instructions on how to vote by following the instructions provided to you by your broker, your broker will vote your shares as you have instructed. If you do not provide your broker with voting instructions, your broker will vote your shares only if the proposal is a “routine” management proposal on which your broker has discretion to vote. Under Nasdaq Stock Market Business Conduct Rules, to which your broker is subject, your broker may refrain from voting uninstructed shares for elections of directors and other matters such as those involving the proposals in this proxy statement without instruction from you, in which case a broker non-vote will occur and your shares will not be voted on these matters.

Q: How do I vote?

A: You may vote over the Internet, by mail or in person at the Annual Meeting. Please be aware that if you vote over the Internet, you may incur costs such as Internet access charges for which you will be responsible.

Vote by Internet. You can vote via the Internet by following the instructions on your proxy card. You will need to use the control number appearing on your proxy card to vote via the Internet. You can use the Internet to transmit your voting instructions up until 11:59 p.m. Eastern Time on Monday, May 9, 2016. Internet voting is available 24 hours a day. If you vote via the Internet, you do not need to vote in person or return a proxy card.

Vote by Mail. If you received a printed proxy card, you can vote by marking, dating and signing it, and returning it in the postage-paid envelope that is provided. Please mail your proxy card promptly to ensure that it is received before closing of the polls at the Annual Meeting.

Vote in Person at the Meeting. If you attend the Annual Meeting and plan to vote in person, we will provide you with a ballot at the Annual Meeting. If your shares are registered directly in your name, you are considered the stockholder of record and you have the right to vote in person at the Annual Meeting. If your shares are held in the name of your broker or other nominee, you are considered the beneficial owner of shares held in street name. As a beneficial owner, if you wish to vote at the Annual Meeting, you will need to bring to the Annual Meeting a legal proxy from your broker or other nominee authorizing you to vote those shares.

| 6 |

If you vote by Internet or by mail, you will be designating Will McGuire, our President and Chief Executive Officer, and/or Tom Miller, our Chief Financial Officer and Corporate Secretary, as your proxy(ies). They may act together or individually on your behalf, and will have the authority to appoint a substitute to act as proxy.

Submitting a proxy will not affect your right to attend the Annual Meeting and vote in person. If your shares are held in the name of a bank, broker or other nominee, you will receive separate voting instructions from your bank, broker or other nominee describing how to vote your shares. The availability of Internet voting will depend on the voting process of your bank, broker or other nominee. Please check with your bank, broker or other nominee and follow the voting instructions it provides.

Q: What is a proxy?

A: A proxy is a person you appoint to vote on your behalf. By using the methods discussed above, you will be appointing Will McGuire, our President and Chief Executive Officer, and/or Tom Miller, our Chief Financial Officer and Corporate Secretary, as your proxies. They may act together or individually to vote on your behalf, and will have the authority to appoint a substitute to act as proxy. If you are unable to attend the Annual Meeting, please vote by proxy so that your shares of common stock may be voted.

Q: Is my vote confidential?

A: Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed, either within the Company or to third parties, except: (1) as necessary to meet applicable legal requirements; (2) to allow for the tabulation of votes and certification of the vote; and (3) to facilitate a successful proxy solicitation. Occasionally, stockholders provide on their proxy card written comments, which are then forwarded to management.

Q: How are votes counted, and what effect do abstentions and broker non-votes have on the proposals?

A: In the election of directors, you may vote “FOR,” “AGAINST” or “ABSTAIN” with respect to each of the nominees. If you elect to abstain in the election of directors, the abstention will not impact the election of directors. In tabulating the voting results for the election of directors, only “FOR” and “AGAINST” votes are counted. You also may cumulate your votes as described below.

For the other items of business, you may vote “FOR,” “AGAINST” or “ABSTAIN.”

If you are the beneficial owner of shares held in the name of a broker, trustee or other nominee and do not provide that broker, trustee or other nominee with voting instructions, your shares may constitute “broker non-votes.” Generally, broker non-votes occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner and instructions are not given. Under the rules of the New York Stock Exchange, brokers, trustees or other nominees may generally vote on routine matters but cannot vote on non-routine matters. Only Proposal No. 3 (ratifying the appointment of the independent registered public accounting firm) is considered a routine matter. The other proposals are not considered routine matters, and without your instructions, your broker cannot vote your shares. In tabulating the voting results for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal. Thus, broker non-votes will not affect the outcome of any matter being voted on at the meeting. If you provide specific instructions with regard to certain items, your shares will be voted as you instruct on such items. If you vote by proxy card or voting instruction card and sign the card without giving specific instructions, your shares will be voted in accordance with the recommendations of the Board (FOR all of our nominees to the Board, FOR the approval of an amended 2011 Equity Incentive Plan that will (i) increase the maximum number of shares of common stock that may be issued under the Plan from 6 million shares to 7.5 million shares of common stock, (ii) allow issuance of Restricted Stock Units, and (iii) permit repricing and exchanges of options, and FOR ratification of the appointment of our independent registered public accounting firm).

Q: What is the voting requirement to approve each of the proposals?

A: In the election of directors, each director will be elected by the vote of the majority of votes cast with respect to that director nominee. A majority of votes cast means that the number of votes cast for a nominee’s election must exceed the number of votes cast against such nominee’s election. Each nominee receiving more votes “for” his or her election than votes “against” his or her election will be elected. Approval of each of the other proposals requires the affirmative vote of a majority of the shares present, in person or represented by proxy, and entitled to vote on that proposal at the Annual Meeting.

Q: Is cumulative voting permitted for the election of directors?

A: Yes, you may choose to cumulate your vote in the election of directors. Cumulative voting applies only to the election of directors and allows you to allocate among the director nominees, as you see fit, the total number of votes equal to the number of director positions to be filled multiplied by the number of shares you hold. For example, if you own 100 shares of stock and there are 6 directors to be elected at the Annual Meeting, you may allocate 600 “FOR” votes (6 times 100) among as few or as many of the 6 nominees to be voted on at the Annual Meeting as you choose. You may not cumulate your votes against a nominee.

| 7 |

If you are a stockholder of record and choose to cumulate your votes, you will need to submit a proxy card and make an explicit statement of your intent to cumulate your votes by so indicating in writing on the proxy card. If you hold shares beneficially through a broker, trustee or other nominee and wish to cumulate votes, you should contact your broker, trustee or nominee.

If you vote by proxy card or voting instruction card and sign your card with no further instructions, Will McGuire or Tom Miller, as proxy holders, may cumulate and cast your votes in favor of the election of some or all of the applicable nominees in their sole discretion, except that none of your votes will be cast for any nominee as to whom you vote against or abstain from voting.

Q: What percentage of our common stock do our directors and officers own?

A: As of March 31, 2016, our current directors and executive officers beneficially owned approximately 34.7% of our common stock outstanding. See the discussion under the heading “Security Ownership of Certain Beneficial Owners and Management” on pages 25-26 for more details.

Q: What if I have questions for our transfer agent?

A: Please contact our information agent, at the phone number or address listed below, with questions concerning stock certificates, dividend checks, transfer of ownership or other matters pertaining to your stock account.

VStock Transfer, LLC

18 Lafayette Place

Woodmere, New York 11598

Phone: (212) 828-8436

Q: What happens if I abstain?

A: Abstentions are counted as present at the meeting for purposes of determining whether there is a quorum but are not counted as votes cast.

Q: May I change my vote or revoke my proxy?

A: You may change your vote or revoke your proxy at any time prior to the vote during the Annual Meeting.

If you are the stockholder of record, you may change your vote by: (1) granting a new proxy bearing a later date (which automatically revokes the earlier proxy); (2) providing a written notice of revocation to the Corporate Secretary at the address below prior to your shares being voted; or (3) participating in the Annual Meeting and voting your shares electronically during the Annual Meeting. Participation in the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically make that request. For shares you hold beneficially in the name of a broker, trustee or other nominee, you may change your vote by submitting new voting instructions to your broker, trustee or nominee, or by participating in the meeting and electronically voting your shares during the Annual Meeting.

Corporate Secretary

Second Sight Medical Products, Inc.

12744 San Fernando Road, Suite 400

Sylmar, California 91342

Annual Meeting Information

Q: How can I attend the Annual Meeting?

A: You are invited to attend this year’s Annual Meeting that will be held at Hyatt Regency Valencia, 24500 Town Center Drive, Valencia, California, USA, 91355. You are entitled to participate in the Annual Meeting only if you were the Company’s stockholder or joint holder as of the close of business on April 7, 2016 or if you hold a valid proxy for the Annual Meeting.

| 8 |

Q: What are the quorum requirements for the meeting?

A: The quorum requirement for holding the Annual Meeting and transacting business is that holders of a majority of shares of the Company common stock entitled to vote must be present in person or represented by proxy. Both abstentions and broker non-votes are counted for the purpose of determining the presence of a quorum.

Q: What if a quorum is not present at the Annual Meeting?

A: If a quorum is not present at the scheduled time of the Annual Meeting, then either the chairman of the Annual Meeting or the stockholders by vote of the holders of a majority of the stock present in person or represented by proxy at the Annual Meeting are authorized by our Bylaws to adjourn the Annual Meeting until a quorum is present or represented.

Q: What happens if additional matters are presented at the Annual Meeting?

A: Other than the four items of business described in this proxy statement, we are not aware of any other business to be acted upon at the Annual Meeting. If you grant a proxy, the persons named as proxy holders, Will McGuire and Tom Miller, will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting. If for any reason any of the nominees named in this proxy statement is not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by the Board.

Q: Who will count the votes?

A: Our Chief Financial Officer and Corporate Secretary, Tom Miller, will act as the inspector of election and tabulate all votes, affirmative and negative, as well as abstentions and broker non-votes.

Q: Where can I find the voting results of the Annual Meeting?

A: We intend to announce preliminary voting results at the Annual Meeting and publish final results in a Current Report on Form 8-K to be filed with the SEC within four business days of the Annual Meeting.

Stockholder Proposals, Director Nominations and Related Bylaw Provisions

Q: What is the deadline to propose actions (other than director nominations) for consideration at next year’s Annual Meeting of stockholders?

A: You may submit proposals for consideration at future stockholder meetings. For a stockholder proposal to be considered for inclusion in our proxy statement for the Annual Meeting next year, the Corporate Secretary must receive the written proposal at our principal executive offices no later than December 19, 2016. Such proposals also must comply with SEC regulations under Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Proposals should be addressed to:

Corporate Secretary

Second Sight Medical Products, Inc.

12744 San Fernando Road, Suite 400

Sylmar, California 91342

Deadlines for the nomination of director candidates are discussed below.

Q: How may I recommend individuals to serve as directors and what is the deadline for a director recommendation?

A: You may recommend director candidates for consideration by the Nominating and Governance Committee of the Board. Any such recommendations should include verification of the stockholder status of the person submitting the recommendation and the nominee’s name and qualifications for Board membership and should be directed to the Corporate Secretary at the address of our principal executive offices set forth above. See “Proposal No. 1—Election of Directors—Director Nominee Experience and Qualifications” for more information regarding our Board membership criteria.

A stockholder may send a recommended director candidate’s name and information to the Board at any time. Generally, such proposed candidates are considered at the first or second Board meeting prior to the issuance of the proxy statement for our Annual Meeting.

Q: How may I obtain a copy of the provisions of our Bylaws regarding stockholder proposals and director nominations?

A: You may contact the Corporate Secretary at our principal executive offices for a copy of the relevant Bylaws provisions regarding the requirements for making stockholder proposals and nominating director candidates.

Our Bylaws also are available on the SEC website as Exhibit 3.2 to our Registration Statement on Form S-1 filed on August 12, 2014.

| 9 |

Further Questions

Q: Who can help answer my questions?

A: If you have any questions about the Annual Meeting or how to vote or revoke your proxy, you should contact our Corporate Secretary and Chief Financial Officer, Tom Miller.

Our business, property and affairs are managed by, or under the direction of, our Board, in accordance with the California Corporations Code and our Bylaws. Members of the Board are kept informed of our business through discussions with the Chief Executive Officer and other key members of management, by reviewing materials provided to them by management, and by participating in meetings of the Board and its Committees.

Stockholders may communicate with the members of the Board, either individually or collectively, or with any independent directors as a group by writing to the Board at 12744 San Fernando Road, Suite 400, Sylmar, California 91342. These communications will be reviewed by the office of the Corporate Secretary who, depending on the subject matter, will (a) forward the communication to the director or directors to whom it is addressed or who is responsible for the topic matter, (b) attempt to address the inquiry directly (for example, where it is a request for publicly available information or a stock related matter that does not require the attention of a director), or (c) not forward the communication if it is primarily commercial in nature or if it relates to an improper or irrelevant topic. At each meeting of the Nominating and Governance Committee, the Corporate Secretary presents a summary of communications received and will make those communications available to any director upon request.

Independence of Directors

In determining the independence of our directors, we apply the definition of “independent director” provided under the listing rules of The NASDAQ Stock Market LLC (“NASDAQ”). After considering all relevant facts and circumstances, the Board affirmatively determined that all of the directors currently serving on the Board, including those nominated for election at the Annual Meeting with the exception of Will McGuire, who is employed as our Chief Executive Officer and President, and Robert J. Greenberg, who is employed as our Chairman of the Board, are independent directors under NASDAQ’s rules.

Board Meetings and Committees of our Board

The Board has three standing committees each of which has the composition described below and responsibilities that satisfy the independence standards of the Securities Exchange Act of 1934 and NASDAQ’s rules: the Audit Committee, the Compensation Committee, and the Nominating and Governance Committee. Mr. Pfeffer is Chairman of the Audit Committee, Mr. Link is Chairman of the Compensation Committee, and Mr. Link is Chairman of the Nominating and Corporate Governance Committee. During the year ended December 31, 2015, the Board held five meetings, the Audit Committee held four meetings, the Compensation Committee held one meeting, and the Nomination and Governance Committee held no meetings. Each of our directors attended at least 75% of the aggregate Board meetings and meetings of the Board committee(s) of which he is a member, with exception of Matthew Pfeffer and Will McGuire who were appointed to our Board May 28, 2015 and August 18, 2015 respectively. Mr. Pfeffer and Mr. McGuire attended 100% of the Board meetings and the meetings of the committee(s) of which they are members. We do not have a policy with regard to Board attendance at the Annual Meeting.

Audit Committee

The Audit Committee consists of Matthew Pfeffer, William Link, Gregg Williams and Aaron Mendelsohn, since his appointment on September 3, 2015, four non-employee directors, all of whom are “independent” as defined under section 5605 (a)(2) of the NASDAQ Listing Rules. Mr. Pfeffer is a chair of the Audit Committee. Alfred E. Mann served as chair of the audit committee until he was replaced by Matthew Pfeffer upon Mr. Mann's resignation as the chair, tendered on May 28, 2015. Mr. Mann tendered his resignation as director on February 9, 2016. In addition, the Board has determined that Mr. Pfeffer, qualifies as an “audit committee financial expert” as defined in the rules of the Securities and Exchange Commission (SEC). The Audit Committee operates pursuant to a charter, which can be viewed on our website at www.secondsight.com (under “Investors”). The Audit Committee met four times during 2015 with all members in attendance at the meeting. The role of the Audit Committee is to:

| • | oversee management’s preparation of our financial statements and management’s conduct of the accounting and financial reporting processes; |

| • | oversee management’s maintenance of internal controls and procedures for financial reporting; |

| • | oversee our compliance with applicable legal and regulatory requirements, including without limitation, those requirements relating to financial controls and reporting; |

| 10 |

| • | oversee the independent auditor’s qualifications and independence; |

| • | oversee the performance of the independent auditors, including the annual independent audit of our financial statements; |

| • | prepare the report required by the rules of the SEC to be included in our Proxy Statement; and |

| • | discharge such duties and responsibilities as may be required of the Committee by the provisions of applicable law, rule or regulation. |

Compensation Committee

The Compensation Committee consists of William Link, Gregg Williams and Matthew Pfeffer, three non-employee directors, all of whom are “independent” as defined in section 5605(a)(2) of the NASDAQ Listing Rules. The Compensation Committee met once during 2015. The role of the Compensation Committee is to:

| • | develop and recommend to the Board the annual compensation (base salary, bonus, stock options and other benefits) for our President/Chief Executive Officer; |

| • | review, approve and recommend to the Board the annual compensation (base salary, bonus and other benefits) for all of our executives; |

| • | review, approve and recommend to the Board the aggregate number of equity awards to be granted to employees below the executive level; |

| • | ensure that a significant portion of executive compensation is reasonably related to the long-term interest of our stockholders; and |

| • | prepare certain portions of our annual Proxy Statement, including an annual report on executive compensation. |

A copy of the charter of the Compensation Committee is available on our website at www.secondsight.com (under “About Us – Corporate Governance”).

The Compensation Committee may form and delegate a subcommittee consisting of one or more members to perform the functions of the Compensation Committee. The Compensation Committee may engage outside advisers, including outside auditors, attorneys and consultants, as it deems necessary to discharge its responsibilities. The Compensation Committee has sole authority to retain and terminate any compensation expert or consultant to be used to provide advice on compensation levels or assist in the evaluation of director, President/Chief Executive Officer or senior executive compensation, including sole authority to approve the fees of any expert or consultant and other retention terms. In addition, the Compensation Committee considers, but is not bound by, the recommendations of our Chief Executive Officer with respect to the compensation packages of our other executive officers.

Nominating and Governance Committee

The Nominating and Governance Committee consists of William Link and Gregg Williams, two non-employee directors, both of whom are “independent” as defined in section 5605(a)(2) of the NASDAQ Listing Rules. The Nominating and Governance Committee did not meet during 2015. The role of the Nominating and Governance Committee is to:

| • | evaluate from time to time the appropriate size (number of members) of the Board and recommend any increase or decrease; |

| • | determine the desired skills and attributes of members of the Board, taking into account the needs of the business and listing standards; |

| • | establish criteria for prospective members, conduct candidate searches, interview prospective candidates, and oversee programs to introduce the candidate to us, our management, and operations; |

| • | review planning for succession to the position of Chairman of the Board and Chief Executive Officer and other senior management positions; |

| • | annually recommend to the Board persons to be nominated for election as directors; |

| • | recommend to the Board the members of all standing Committees; |

| • | adopt or develop for Board consideration corporate governance principles and policies; and |

| • | periodically review and report to the Board on the effectiveness of corporate governance procedures and the Board as a governing body, including conducting an annual self-assessment of the Board and its standing committees. |

| 11 |

A copy of the charter of the Nominating and Governance Committee is available on our website www.secondsight.com (under “About Us – Corporate Governance”).

Policy with Regard to Security Holder Recommendations

The Nominating and Governance Committee does not presently have a policy with regard to consideration of any director candidates recommended by security holders. No security holder (other than members of the Nominating and Governance Committee) has recommended a candidate to date. The Nominating and Governance Committee plans to adopt a policy prior to the next Annual Meeting of our security holders.

Director Qualifications and Diversity

The Board seeks independent directors who represent a diversity of backgrounds and experiences that will enhance the quality of the Board’s deliberations and decisions. Candidates should have substantial experience with one or more publicly traded companies or should have achieved a high level of distinction in their chosen fields. The Board is particularly interested in maintaining a mix that includes individuals who are active or retired executive officers and senior executives, particularly those with experience in medical devices, bio-technology, intellectual property, early stage high technology companies, research and development, strategic planning, business development, compensation, finance, accounting and banking.

In evaluating nominations to the Board of Directors, the Nominating and Governance Committee also looks for certain personal attributes, such as integrity, ability and willingness to apply sound and independent business judgment, comprehensive understanding of a director’s role in corporate governance, availability for meetings and consultation on Company matters, and the willingness to assume and carry out fiduciary responsibilities. The Nominating and Governance Committee took these specifications into account in formulating and re-nominating its present Board members.

Compensation Committee Interlocks and Insider Participation

During 2015, Alfred E. Mann, William Link, Gregg Williams and Matthew Pfeffer, since his appointment on September 3, 2015, served on the Compensation Committee. Mr. Mann tendered his resignation as director on February 9, 2016. None of these individuals has ever been an executive officer or employee of ours. In addition, none of our executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our Board or the Compensation Committee.

Code of Conduct

We adopted a Code of Business Conduct and Ethics (“Code of Ethics”) applicable to our principal executive officer and principal financial and accounting officer and any persons performing similar functions. In addition, the Code of Ethics applies to our employees, officers, directors, agents and representatives. The Code of Ethics requires, among other things, that our employees avoid conflicts of interest, comply with all laws and other legal requirements, conduct business in an honest and ethical manner, and otherwise act with integrity and in our best interest. The Code of Ethics is available on our website at www.secondsight.com (under “About Us – Code of Business Conduct and Ethics”).

Risk Oversight

Enterprise risks are identified and prioritized by management and each prioritized risk is assigned to a Board committee or the full Board for oversight as follows:

Full Board — Risks and exposures associated with strategic, financial and execution risks and other current matters that may present material risk to our operations, plans, prospects or reputation.

Audit Committee — Risks and exposures associated with financial matters, particularly financial reporting, tax, accounting, disclosure, internal control over financial reporting, financial policies, investment guidelines and credit and liquidity matters.

Governance Committee — Risks and exposures relating to corporate governance and management and director succession planning.

Compensation Committee — Risks and exposures associated with leadership assessment, and compensation programs and arrangements, including incentive plans.

Board Leadership Structure

The Chairman of the Board presides at all meetings of the Board.

| 12 |

Review, Approval or Ratification of Transactions with Related Persons

The Nominating and Corporate Governance Committee reviews issues involving potential conflicts of interest, other than Related Party transactions, which are reviewed by the Audit Committee.

Compliance with Section 16 of the Exchange Act

Based solely upon a review of Forms 3 and 4 furnished to the Company, the Company believes that all of its directors, officers and applicable stockholders timely filed these reports.

PROPOSALS

THE

BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR EACH OF

PROPOSALS 1 THROUGH 4 BELOW.

PROPOSAL 1 — ELECTION OF DIRECTORS

Nominees for Election

The Board currently has six members. Our Board has nominated each of our incumbent directors for re-election at the Annual Meeting. Each nominee has agreed, if elected, to serve a one-year term or until the election and qualification of his successor. If any nominee is unable to stand for election, which circumstance we do not anticipate, the Board may designate a substitute. In the latter event, shares represented by proxies may be voted for a substitute nominee.

Our Director Qualifications and Diversity guidelines contain the current Board membership criteria that apply to nominees recommended for a position on the Board. Under those criteria, members of the Board should have the highest professional and personal ethics and values, consistent with our longstanding values and standards. They should have broad experience at the policy-making level in business, government, education, technology or public service. They should be committed to enhancing stockholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. In addition, the Nominating and Governance Committee takes into account a potential director’s ability to contribute to the diversity of background and experience represented on the Board, and it reviews its effectiveness in balancing these considerations when assessing the composition of the Board. Directors’ service on other boards of public companies should be limited to a number that permits them, given their individual circumstances, to perform responsibly all director duties. Each director must represent the interests of all of our stockholders. Although the Board uses these and other criteria as appropriate to evaluate potential nominees, it has no stated minimum criteria for nominees.

The Board believes that all the nominees named below are highly qualified and have the skills, integrity, experience and sound judgment required for effective service on the Board. The nominees’ individual biographies below contain information about their experience, qualifications and skills that led the Board to nominate them:

| Nominee’s or Director’s Name |

Year First Became Director |

Position with the Company | ||

| Will McGuire | 2015 | President, Chief Executive Officer and Director | ||

| Robert J. Greenberg, M.D., Ph.D. | 1998 | Chairman of the Board and Director | ||

| William J. Link | 2003 | Director | ||

| Aaron Mendelsohn | 1998 | Director | ||

| Gregg Williams | 2009 | Director | ||

| Matthew Pfeffer | 2015 | Director |

Will McGuire, 53, Chief Executive Officer, President and Director

Biographical information for Mr. McGuire is set forth under “Executive Compensation and Related Information”. Our board believes that Mr. McGuire’s executive and managerial experience together with his leadership skills make him well qualified to continue serving as one of our directors.

Robert J. Greenberg, 48, Chairman of the Board of Directors

Biographical information for Dr. Greenberg is set forth under “Executive Compensation and Related Information”. Our board believes that Dr. Greenberg’s extensive scientific and technical expertise, his executive and managerial experience together with his leadership skills and familiarity with our business as one of our founders, make him well qualified to continue serving as one of our directors.

| 13 |

William J. Link, 70, Director and Chairman of the Compensation Committee

Mr. Link has been a member of our Board of Directors since 2003. Mr. Link is a co-founder and managing director of Versant Ventures, a venture capital firm specializing in early-stage investing in healthcare companies, since its inception in 1999. Prior to co-founding Versant Ventures, Mr. Link was a general partner at Brentwood Venture Capital from 1998 to present. Mr. Link also founded and served as chairman and CEO of Chiron Vision, a subsidiary of Chiron Corporation specializing in ophthalmic surgical products, from 1986 to 1997 which was sold to Bausch and Lomb in 1997. Prior to Chiron Vision, Mr. Link founded in 1978 and served as President of American Medical Optics (AMO), a division of American Hospital Supply Corporation, which was sold to Allergan in 1986. Mr. Link also served on the Board of AMO’s successor company, Advanced Medical Optics (AMO) which was acquired by Abbott in 2009, from 2002 to 2009. Mr. Link was an Assistant Professor in the Department of Surgery at the Indiana University School of Medicine from 1973 to 1976. Mr. Link received his BSc, MSc and Ph.D. from Purdue University. Our board has concluded that Mr. Link’s senior executive history with a focus on medical products as well as his extensive financial and other experience with technology companies in general, including his experience of serving on other boards of directors make him a qualified and valued member of our board.

Aaron Mendelsohn, 64, Director

Mr. Mendelsohn is a founder and has been a director of Second Sight since inception. Mr. Mendelsohn served on the board of Advanced Bionics since shortly after its founding in 1993 until its sale in 2004. Mr. Mendelsohn was also a founder and director of MRG from its inception in 1998 until its sale in 2001 to Medtronic, Inc. Mr. Mendelsohn serves on the board of directors for the Alfred E. Mann Institute for Biomedical Engineering at the University of Southern California since its inception in 1998 and is a member of its Executive Committee. Mr. Mendelsohn is a founder and since 2007 a director of Nanoprecision Holding Company, Inc., a world leader in manipulating materials at nanometer scale. He is also a founder and director of Nanoprecision Medical, Inc, a drug delivery company working in nanotechnology, since its inception in 2011. Mr. Mendelsohn is a founder and serves as Chairman of the Maestro Foundation since it was organized in 1983. The Maestro Foundation is a leading non-profit musical philanthropic organization which hosts a premier chamber music series and lends professional-level instruments and bows to young, career-bound classical musicians. Mr. Mendelsohn received his B.A. from UCLA and J.D. from The Loyola Law School Los Angeles at Loyola Marymount University. Our board believes that Mr. Mendelsohn’s business experience, including his experience as a founder, board member and executive officer of medical device companies, combined with his financial experience, business acumen and judgment provide our Board with valuable managerial and operational expertise and leadership skills making him well qualified to continue serving as one of our directors.

Gregg Williams, 57, Director

Mr. Williams has been a member of our Board of Directors since June 2009. Mr. Williams has been the Chief Executive Officer at Williams International Corporation, a leading developer and manufacturer of small gas turbine engines, since April 2005. Mr. Williams serves as the Chairman and President of Williams International Corporation and served as its Chief Operating Officer. Mr. Williams received a Bachelor of Science in Engineering from the University of Utah in 1982. Our board believes that Mr. William’s executive and managerial experience together with his leadership skills make him well qualified to continue serving as one of our directors.

Matthew Pfeffer, 57, Director and Chairman of Audit Committee

Mr. Pfeffer serves as Chief Executive Officer and Chief Financial Officer of MannKind Corporation since January 2016. Previously, he served as the Corporate Vice President and Chief Financial Officer of MannKind Corporation from April 2008 until January 2016. Mr. Pfeffer served as Chief Financial Officer and Senior Vice President of Finance and Administration of VaxGen, Inc. from March 2006 until April 2008, with responsibility for finance, tax, treasury, human resources, IT, purchasing and facilities functions. Prior to VaxGen, Mr. Pfeffer served as Chief Financial Officer of Cell Genesys, Inc. During his nine year tenure at Cell Genesys, Mr. Pfeffer served as Director of Finance before being named Chief Financial Officer in 1998. Prior to that, Mr. Pfeffer served in a variety of financial management positions at other companies, including roles as Corporate Controller, Manager of Internal Audit and Manager of Financial Reporting. Mr. Pfeffer began his career at Price Waterhouse. Mr. Pfeffer graduated from the University of California, Berkeley and is a Certified Public Accountant. Our board believes that Mr. Pfeffer’s experience as a chief executive officer, chief financial officer and director of a publicly traded company as well as his other managerial, operational, financial and accounting expertise make him well qualified to continue serving as one of our directors.

Vote Required

Each director nominee who receives more “FOR” votes than “AGAINST” votes representing shares of our common stock present in person or represented by proxy and entitled to be voted at the Annual Meeting will be elected.

All of the nominees have indicated to us that they will be available to serve as directors. In the event that any nominee should become unavailable, the proxy holders, Will McGuire or Tom Miller, will vote for a nominee or nominees designated by the Board.

| 14 |

There are no family relationships among our executive officers and directors.

If you sign your proxy or voting instruction card but do not give instructions with respect to voting for directors, your shares will be voted by Will McGuire or Tom Miller, as proxy holders. If you wish to give specific instructions with respect to voting for directors, you may do so by indicating your instructions on your proxy or voting instruction card.

You may cumulate your votes in favor of one or more of the director nominees. If you wish to cumulate your votes, you will need to indicate explicitly your intent to cumulate your votes among the five persons who will be voted upon at the Annual Meeting. See “Questions and Answers—Voting Information—Is cumulative voting permitted for the election of directors?” for further information about how to cumulate your votes. Will McGuire or Tom Miller as proxy holders, reserve the right to cumulate votes and cast such votes in favor of the election of some or all of the applicable nominees in their sole discretion, except that a stockholder’s votes will not be cast for a nominee as to whom such stockholder instructs that such votes be cast “AGAINST” or “ABSTAIN.”

Our Board recommends a vote “FOR” each of the nominees.

Director Compensation for 2015

During 2015 our non-employee directors were paid an annual retainer of $50,000 and our Chairman of the Board an annual retainer of $75,000. Each of our non-employee directors who serves as a committee chair also will receive, $6,000 per year for his or her service as committee chair and non-chair committee members will receive $4,000 per year for each committee on which he serves; provided, however, the Audit Committee chair’s additional retainer is $16,000 per year and each non-chair Audit Committee member’s additional retainer is $8,000 per year. All fees will be paid in shares of our stock on June 1 of each year and the stock price per share value shall be determined by an average closing price of our stock for the preceding twenty trading days of our common stock on its principal exchange. Mr. Mann resigned as Chairman and was appointed Chairman Emeritus of our Board on August 18, 2015. As Chairman Emeritus, Mr. Mann continued being paid an annual retainer of $75,000.

The following Director Compensation Table sets forth information concerning compensation for services rendered by our non-employee directors for fiscal year 2015. The amounts represented in the “Fees Earned or Paid in Cash” column reflects the stock compensation expense recorded by the Company and does not necessarily equate to the income that will ultimately be realized by the directors for such awards in lieu of actual cash fees, as noted above.

| Name | Fees Earned or Paid in Cash ($) | Stock Award ($) | Total ($) | |||||||||

| Alfred E. Mann | 96,333 | 96,333 | ||||||||||

| William J. Link, Ph.D. | 67,083 | 67,083 | ||||||||||

| Aaron Mendelsohn | 52,000 | 52,000 | ||||||||||

| Gregg Williams | 67,583 | 67,583 | ||||||||||

| Matthew Pfeffer | 39,500 | 39,500 | ||||||||||

| 15 |

PROPOSAL 2 — APPROVAL OF AN AMENDed 2011 EQUITY INCENTIVE PLAN

We are asking our stockholders to consider and vote upon a proposal to approve an amended Second Sight Medical Products, Inc. 2011 Equity Incentive Plan (which, as amended from time to time, we refer to as the “Plan”).

On July 15, 2011 our Board adopted the Plan, and our stockholders approved the adoption of the Plan on July 21, 2011. The Plan was further amended in 2012 and 2015 to increase the maximum number of shares of common stock that may be issued under the Plan. On April 4, 2016, the Board adopted amendments to the Plan that, contingent on and subject to approval of our stockholders at the Annual Meeting, would among other things:

| (i) | Increase the maximum number of shares of common stock that may be issued under the Plan by 1,500,000 shares – from 6,000,000 shares to 7,500,000 shares; |

| (ii) | Add the ability for the Company to grant restricted stock units (“RSUs”) under the Plan; and |

| (iii) | Permit the Company, at any time in its discretion, to reprice or exchange outstanding options under the Plan. |

If the stockholders approve the amended Plan, it will become effective on the date of Annual Meeting, which is scheduled for May 10, 2016. If the stockholders fail to approve the amended Plan, the Plan will continue and remain as is without any changes thereto, and compensatory option grants will continue to be granted thereunder to the extent of shares of common stock available for issuance. As of March 31, 2016, approximately 1,149,000 shares of common stock remained available for issuance under the Plan (without giving effect to additional shares that may become available upon the future expiration, forfeiture, or cancellation of outstanding awards). Our Board believes that if the amended Plan is not approved, our ability to align the interests of key service providers with stockholders through equity-based compensation would be compromised, disrupting our compensation program and impairing our ability to recruit and retain key employees or requiring us to shift our compensation plan to include more cash compensation.

Summary of the Material Terms of the Plan, As Amended

A summary of the material terms of the amended Plan is set forth below. This summary is qualified in its entirety by the detailed provisions of the Plan, as amended, a copy of which is attached as Appendix A to this Proxy Statement and which is incorporated by reference into this proposal. We encourage our stockholders to read and refer to the complete plan document in Appendix A for a more complete description of the Plan, as amended.

Purpose

The Plan is intended to encourage the key service providers of the Company to have a proprietary and vested interest in the growth and performance of the Company and to generate an increased incentive to contribute to the Company’s future success and prosperity, thus enhancing the value of the Company for the benefit of its equity owners.

Administration

The Plan is administered by the Compensation Committee, which consists of William J. Link, Gregg Williams and Matthew Pfeffer appointed by our Board. The Compensation Committee has the authority to determine the terms and conditions of awards and to interpret and administer the Plan.

Share Reserve and Limitations

The maximum number of shares of common stock reserved for issuance under the Plan is 6,000,000 shares or, if the amendment to the Plan is approved, will be increased by 1,500,000 shares to 7,500,000 shares of common stock. As of April 14, 2016 the fair market value of a share of common stock was $5.37.

No employee of the Company may be eligible to be granted options covering more than 1,000,000 shares of common stock during any calendar year.

Types of Awards; Eligibility

The Plan permits the Company to grant options and, if the amended Plan is approved as presented in this Proposal 2, RSUs (“awards”) to our employees and to employees of our controlled subsidiaries. From time to time, the Company may also elect to grant awards to non-employees who are natural persons where it is determined that such grant is in the best interests of the Company. As of the date of this Proxy Statement, approximately 115 employees of the Company and our controlled subsidiaries and approximately six non-employees are eligible to participate in the Plan.

| 16 |

Options

The Compensation Committee may grant options under the Plan. The term of an option may not exceed 10 years. The Compensation Committee determines the exercise price of an option. Payment of the exercise price may be made in cash, shares, or other property acceptable to the Compensation Committee, as well as other types of consideration permitted by applicable law. After the termination of service of a participant, he or she (or, if applicable, his or her estate or beneficiary) may exercise his or her option for the period of time stated in his or her award agreement. Generally, if termination is due to death or disability, the option will remain exercisable for at least six months. In all other cases, the option will generally remain exercisable for at least 30 days following the termination of service. However, in no event may an option be exercised later than the expiration of its term. Subject to the provisions of the Plan, the Compensation Committee determines the other terms of options. Unless the Compensation Committee provides otherwise, the Plan generally does not allow for the transfer of options, and only the participant may exercise an option during his or her lifetime.

RSUs

If the amended Plan is approved, the Compensation Committee may grant RSUs under the Plan. Subject to the provisions of the Plan, the Compensation Committee will determine the terms and conditions of RSUs, including the restricted period for all or a portion of the award and the restrictions and/or forfeiture events applicable to the award. RSUs may vest solely by the passage of time and/or pursuant to achievement of performance goals, and the restrictions and/or the restricted period may differ with respect to each award of RSUs. During the period, if any, when RSUs are non-transferable or forfeitable or prior to the satisfaction of any other restrictions prescribed by the Compensation Committee, a participant is prohibited from selling, transferring, assigning, pledging, or otherwise encumbering or disposing of his or her RSUs. Participants holding RSUs will have no voting or dividend rights or other rights associated with share ownership.

Adjustments to Awards

In the event of certain changes in our capitalization, to prevent diminution or enlargement of the benefits or potential benefits available under the Plan, the Compensation Committee will adjust (i) the aggregate number, class, and kind of shares that may be delivered under the Plan, in the aggregate or to any one participant, and/or (ii) the number, class, and kind of shares subject to outstanding awards and the option price of options.

Change in Control

Unless the Compensation Committee provides otherwise in an applicable award agreement, upon the occurrence of a “change in control” (as defined in the Plan): (i) the vesting of all outstanding awards shall accelerate automatically immediately prior to the consummation of the change in control and (ii) awards may either be assumed or substituted for or be cancelled in exchange for consideration. If options will be not assumed or substituted for, the Compensation Committee must provide written notice not less than 15 days prior to the effective date of the proposed change in control.

Term; Amendment and Termination

Our stockholders adopted the Plan on July 21, 2011 and no options under the Plan may be granted after May 31, 2021. Our Board has the authority to amend or terminate the Plan or an award agreement, provided such action does not impair the existing rights of any participant.

Repricing

If the amended Plan is approved, as presented in this Proposal 2, the Company may, at any time in its discretion, (i) amend the terms of outstanding options to reduce the exercise price; (ii) cancel outstanding options in exchange for or substitution of options with an exercise price that is less than the exercise price of the original options; or (iii) cancel outstanding options with an exercise price above the current fair market value in exchange for cash or other securities.

Summary of Certain Material U.S. Federal Income Tax Consequences

The U.S. federal income tax consequences of awards under the Plan for participants and the Company will depend on the type of award granted. The following summary description of certain material U.S. federal income tax consequences is intended only for the general information of our stockholders. This summary is not intended to be exhaustive, and the exact tax consequences to any participant depend upon his or her particular circumstances and other facts. Plan participants should consult their tax advisor with respect to any state, local and non-U.S. tax considerations or relevant federal tax implications of awards granted under the Plan.

| 17 |

Non-qualified Stock Options. An option holder generally recognizes no U.S. federal taxable income as a result of the grant of the option. On the exercise of a non-qualified stock option, the option holder normally recognizes ordinary income in the amount equal to the difference between the exercise price and the fair market value of the shares of common stock on the exercise date. Where the option holder is an employee, such ordinary income generally is subject to withholding of income and employment taxes. On the sale of shares of common stock acquired by the exercise of a non-qualified stock option, any gain or loss (based on the difference between the sale price and the fair market value on the exercise date), is taxed as a capital gain or loss. If we comply with applicable reporting requirements and with the restrictions of Section 162(m) of the Internal Revenue Code of 1986, as amended, we will be entitled to a business expense deduction in the same amount and generally at the same time as the option holder recognizes ordinary income.

RSUs. A holder of RSUs generally recognizes no U.S. federal taxable income as a result of the grant of the RSUs. A holder of RSUs will be required to recognize ordinary income in an amount equal to the fair market value of shares issued, or in the case of a cash-settled award, the amount of the cash payment made, to such holder at the end of the restriction period or, if later, the payment date. If we comply with applicable reporting requirements and with the restrictions of Section 162(m) of the Internal Revenue Code of 1986, as amended, we will be entitled to a business expense deduction in the same amount and generally at the same time as the holder recognizes ordinary income.

New Plan Benefits

The benefits or amounts that are to be allocated to any participant or group of participants are indeterminable as of the date of this Proxy Statement because participation and the types of awards (including options) available under the Plan are subject to the discretion of the Compensation Committee. Therefore, no new plan benefits table can be provided at this time.

Vote Required and Recommendation

The affirmative vote of the holders of shares of common stock entitled to vote must exceed the votes cast against the proposal for the proposal to be approved.

Our Board unanimously recommends that stockholders vote “FOR” the approval of the proposed amended Plan as described in this Proposal 2.

REPORT OF THE AUDIT COMMITTEE

The following Report of the Audit Committee shall not be deemed incorporated by reference into any of our filings under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent we specifically incorporate it by reference therein.

The Audit Committee of the Board has:

| • | reviewed and discussed the Company’s audited financial statements for the year ended December 31, 2015 with management; |

| • | discussed with the Company’s independent auditors the matters required to be discussed by Auditing Standard No 16, communications with Audit Committee, issued by the Public Company Accounting Oversight Board |

| • | received the written disclosures and letter from the independent auditors required by the applicable requirements of the Public Accounting Oversight Board regarding the independent auditors communications with the Audit Committee concerning independence, and has discussed with Gumbiner Savett Inc. matters relating to its independence. |

In reliance on the review and discussions referred to above, the Audit Committee recommended to the Board that the financial statements audited by Gumbiner Savett Inc. for the fiscal year ended December 31, 2015 be included in the Company’s Annual Report on Form 10-K for such fiscal year.

Audit Committee of the Board

Matthew Pfeffer

Gregg Williams

William J. Link, Ph.D.

Aaron Mendelsohn

| 18 |

PROPOSAL

3 — RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board has reappointed Gumbiner Savett Inc. as our independent registered public accounting firm to audit our financial statements for the fiscal year ending December 31, 2016. Gumbiner Savett Inc. has served as our independent registered public accounting firm since 2014.

Stockholder ratification of the selection of Gumbiner Savett Inc. as our independent registered public accounting firm is not required by our Bylaws or the California Corporations Code. The Board seeks such ratification as a matter of good corporate practice. Should the stockholders fail to ratify the selection of Gumbiner Savett Inc. as our independent registered public accounting firm, the Board will reconsider whether to retain that firm for fiscal year 2016. Even if the selection is ratified, the Audit Committee of the Board in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

Principal Accounting Fees and Services

The following table represents aggregate fees billed to the Company for fiscal years ended December 31, 2015 and 2014 by Gumbiner Savett Inc.:

| December 31, | ||||||||

| 2015 | 2014 | |||||||

| Audit Fees(1) | $ | 97,500 | $ | 165,000 | ||||

| Audit Related Fees(2) | — | — | ||||||

| Tax Fees(3) | — | — | ||||||

| All Other Fees(4) | 5,400 | 94,356 | ||||||

| Total Fees | $ | 102,900 | $ | 259,356 | ||||

| 1. | “Audit Fees” are the aggregate fees of Gumbiner Savett Inc. attributable to professional services rendered to us for the audit of our annual financial statements and review of quarterly financial information, including our registration statement on Form S-1 in 2014. |

| 2. | “Audit-Related Fees” consist of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements and are not reported above under “Audit Fees.” Gumbiner Savett Inc. has not billed us for any Audit-Related Fees for each of the last two fiscal years. |

| 3. | Tax Fees” consist of fees billed for services related to tax compliance, tax advice, and tax planning. Gumbiner Savett Inc. did not bill us for any Tax Fees for each of the last two fiscal years. |

| 4. | “All Other Fees” consist of fees billed for services other than the services reported in Audit Fees, Audit-Related Fees, and Tax Fees. In 2015, Gumbiner Savett Inc. provided services in connection with our registration statement on Form S-8 related to employee benefit plans. In 2014, Gumbiner Savett Inc. provided customary services in connection with our initial public offering. |

Pre-Approval Policies and Procedures

The Audit Committee is required to review and approve in advance the retention of the independent auditors for the performance of all audit and lawfully permitted non-audit services and the fees for such services. The Audit Committee may delegate to one or more of its members the authority to grant pre-approvals for the performance of non-audit services, and any such Audit Committee member who pre-approves a non-audit service must report the pre-approval to the full Audit Committee at its next scheduled meeting. To date no such non-audit services have been requested of or performed by Gumbiner Savett, Inc.

Gumbiner Savett Inc. Representatives at Annual Meeting

We expect that representatives of Gumbiner Savett Inc. will not be present at the Annual Meeting.

Vote Required and Recommendation

The affirmative vote of a majority of the votes cast on this matter is required for the ratification of the appointment of Gumbiner Savett Inc. as our independent registered public accounting firm. Abstentions and broker non-votes, if any, will not be counted as votes cast.

The Board recommends that stockholders vote “FOR” ratification of the appointment of Gumbiner Savett Inc. as our independent registered public accounting firm for the fiscal year ending December 31, 2016 as described in this Proposal 3.

| 19 |

EXECUTIVE COMPENSATION AND RELATED INFORMATION

Compensation Discussion

Overview

The Compensation Committee of the Board of Directors administers our executive compensation and benefit programs. The Compensation Committee is comprised exclusively of independent directors and oversees all compensation and benefit programs and actions that affect our executive officers.

Compensation Process and Role of Management

The Compensation Committee is responsible for determining and approving all compensation for our executive officers. Pursuant to its charter, the Compensation Committee recommends to the full Board the salary, annual incentive compensation or bonus, long-term incentive compensation in the form of stock options or stock grants, and all other employment, severance and change-in-control agreements applicable to executive officers. Our Chief Executive Officer assists the Compensation Committee in its deliberations with respect to the compensation payable to our other executive officers, and typically recommends specific compensation packages for our executive officers based upon his assessment and evaluation of their performance.

Following the end of each fiscal year, our Chief Executive Officer evaluates executive officer performance for the prior fiscal year, other than his own performance, and discusses the results of such evaluations with the Compensation Committee. The Chief Executive Officer assesses each executive officer’s performance for the prior fiscal year based upon subjective factors concerning such officer’s individual business goals and objectives, and the contributions made by the executive officer to our overall results. The Chief Executive Officer then makes specific recommendations to the Compensation Committee for adjustments to base salary and the grant of a target bonus and/or equity award, if appropriate, as part of the compensation packages for each executive officer, other than himself, for the next fiscal year.

The Compensation Committee reviews the performance of the Chief Executive Officer and determines all compensation for the Chief Executive Officer. The Chief Executive Officer is not present at the time the Compensation Committee reviews his performance and discusses his compensation.

Executive Officers

Robert J. Greenberg, 48, Chairman of the Board

Dr. Greenberg has been Chairman of our Board from August 2015. Prior to that, Dr. Greenberg was a founder and served as the President, Chief Executive Officer and Director of Second Sight Medical Products, Inc. since its inception until August 2015. Prior to the formation of Second Sight, Dr. Greenberg worked co-managing the Alfred E. Mann Foundation and since February 2007 he has been chairman of that foundation. From 1997 to 1998, he served as lead reviewer for IDEs and 510(k)s at the Office of Device Evaluation at the US Food and Drug Administration in the Neurological Devices Division. In 1998, he received his medical degree from The Johns Hopkins School of Medicine. From 1991 to 1997, Dr. Greenberg conducted pre-clinical trials demonstrating the feasibility of retinal electrical stimulation in patients with retinitis pigmentosa. This work was done at the Wilmer Eye Institute at Johns Hopkins in Baltimore and led to the granting of his Ph.D. from the Johns Hopkins Department of Biomedical Engineering. His undergraduate degree was in Electrical Engineering and Biomedical Engineering from Duke University. Dr. Greenberg currently is also the chairman of the Board of Directors of the Southern California Biomedical Council and the Alfred Mann Foundations. In addition he is a member of the board of directors of Pulse Biosciences, a development stage medical device company .

Will McGuire, 53, President, Chief Executive Officer and Director