Exhibit 99.2

February 8, 2022 Second Sight Medical Products Proposed Merger With Nano Precision Medical

Forward Looking Statement The following slides and any accompanying oral presentation contain forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended, which are intended to be covered by the "safe harbor" created by those sections . All statements in this release that are not based on historical fact are "forward looking statements . " These statements may be identified by words such as "estimates," "anticipates," "projects," "plans" or "planned," "strategy," “goal," "seeks," "may," "will," "expects," "intends," "believes," "should," and similar expressions, or the negative versions thereof, and which also may be identified by their context . All statements that address operating performance or events or developments that Second Sight expects or anticipates will occur in the future, such as stated objectives or goals, or that are not otherwise historical facts, are forward - looking statements . While management has based any forward - looking statements included in this release on its current expectations, the information on which such expectations were based may change . Forward - looking statements involve inherent risks and uncertainties which could cause actual results to differ materially from those in the forward - looking statements as a result of various factors, including those risks and uncertainties described in the Risk Factors and in Management's Discussion and Analysis of Financial Condition and Results of Operations sections of our Annual Report, on Form 10 - K, filed on March 16 , 2021 , Form 10 - Q filed on November 12 , 2021 , and our other reports filed from time to time with the Securities and Exchange Commission . We urge you to consider those risks and uncertainties in evaluating our forward - looking statements . We caution readers not to place undue reliance upon any such forward - looking statements, which speak only as of the date made . Except as otherwise required by the federal securities laws, we disclaim any obligation or undertaking to publicly release any updates or revisions to any forward - looking statement contained herein (or elsewhere) to reflect any change in our expectations with regard thereto, or any change in events, conditions, or circumstances on which any such statement is based .

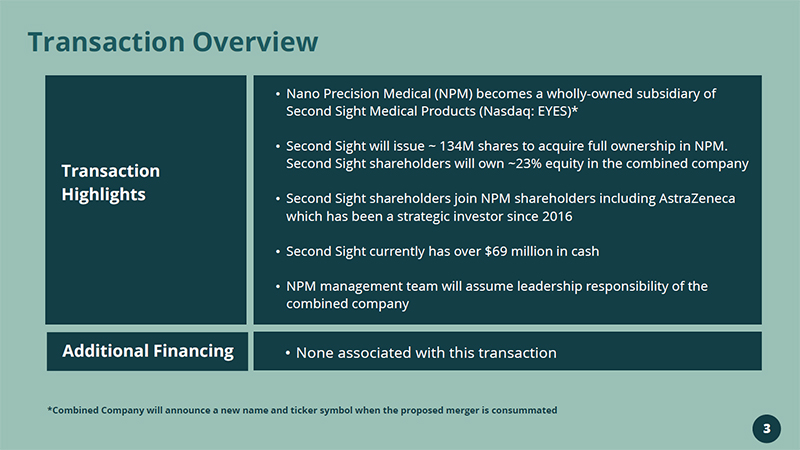

Additional Financing • None associated with this transaction Transaction Overview Transaction Highlights • Nano Precision Medical (NPM) becomes a wholly - owned subsidiary of Second Sight Medical Products (Nasdaq: EYES)* • Second Sight will issue ~ 134M shares to acquire full ownership in NPM. Second Sight shareholders will own ~23% equity in the combined company • Second Sight shareholders join NPM shareholders including AstraZeneca which has been a strategic investor since 2016 • Second Sight currently has over $69 million in cash • NPM management team will assume leadership responsibility of the combined company *Combined Company will announce a new name and ticker symbol when the proposed merger is consummated 3

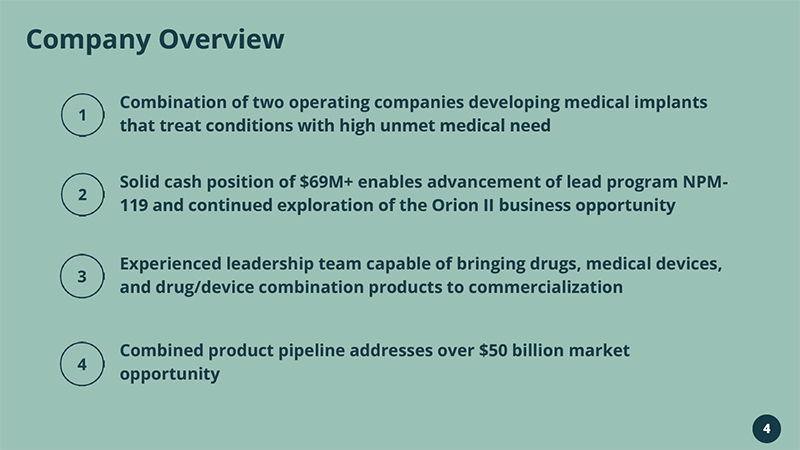

Company Overview 4 Combined product pipeline addresses over $50 billion market opportunity Solid cash position of $69M+ enables advancement of lead program NPM - 119 and continued exploration of the Orion II business opportunity Experienced leadership team capable of bringing drugs, medical devices, and drug/device combination products to commercialization Combination of two operating companies developing medical implants that treat conditions with high unmet medical need

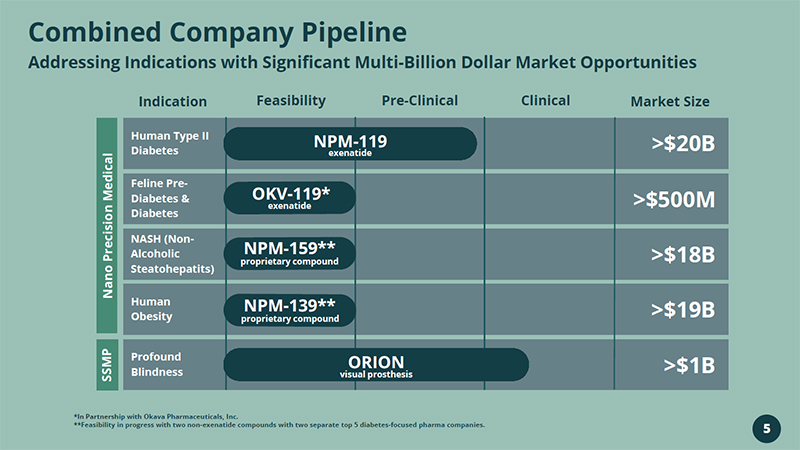

Combined Company Pipeline Addressing Indications with Significant Multi - Billion Dollar Market Opportunities *In Partnership with Okava Pharmaceuticals, Inc. **Feasibility in progress with two non - exenatide compounds with two separate top 5 diabetes - focused pharma companies. Indication Feasibility Pre - Clinical Clinical Market Size Human Type II Diabetes Feline Pre - Diabetes & Diabetes NASH (Non - Alcoholic Steatohepatits ) Human Obesity Profound Blindness NPM - 119 exenatide >$20B >$500M >$18B >$19B >$1B SSMP NPM - 159** proprietary compound NPM - 139** proprietary compound ORION visual prosthesis 5 Nano Precision Medical OKV - 119* exenatide

Business Overview

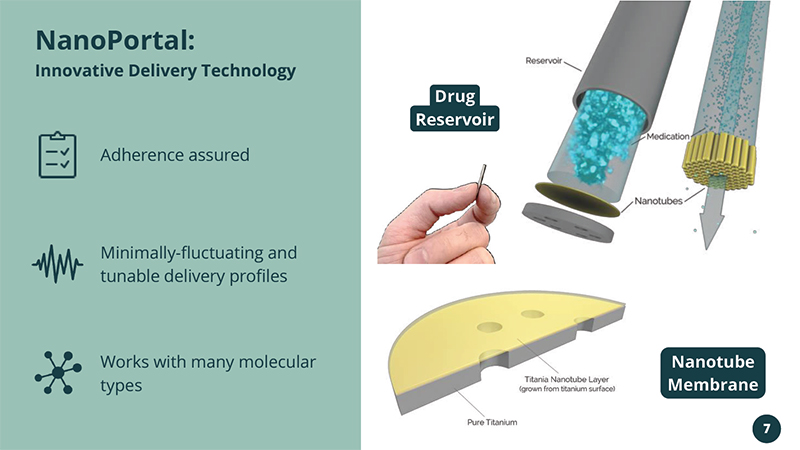

Works with many molecular types Adherence assured Minimally - fluctuating and tunable delivery profiles NanoPortal: Innovative Delivery Technology Drug Reservoir Nanotube Membrane 7

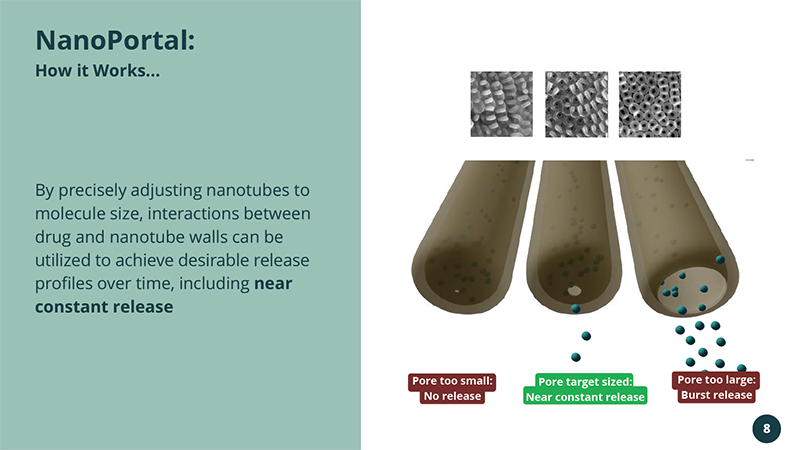

By precisely adjusting nanotubes to molecule size, interactions between drug and nanotube walls can be utilized to achieve desirable release profiles over time, including near constant release NanoPortal : How it Works... Pore too small: No release Pore target sized: Near constant release Pore too large: Burst release 8

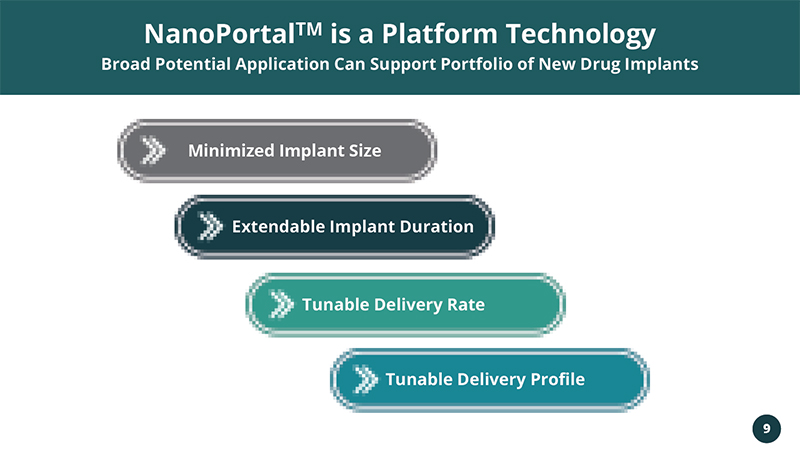

Minimized Implant Size Extendable Implant Duration Tunable Delivery Rate Tunable Delivery Profile 9 NanoPortal TM is a Platform Technology Broad Potential Application Can Support Portfolio of New Drug Implants

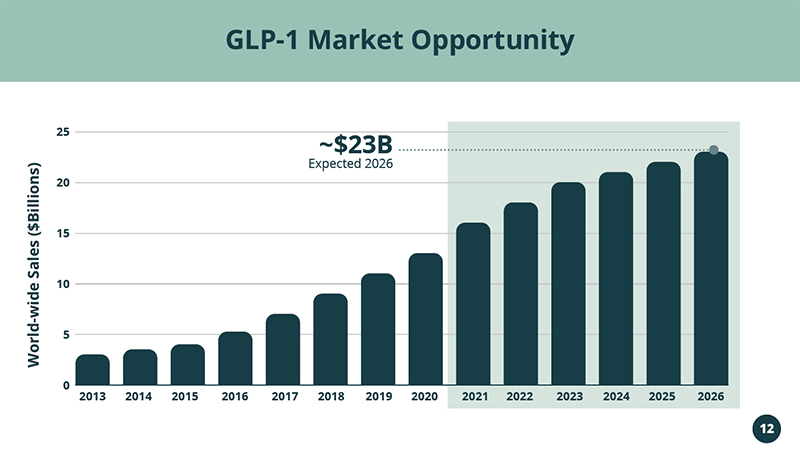

Addressing the Rapidly Growing GLP - 1 RA Market $13B in 2020 & $23B Expected in 2026 NPM - 119

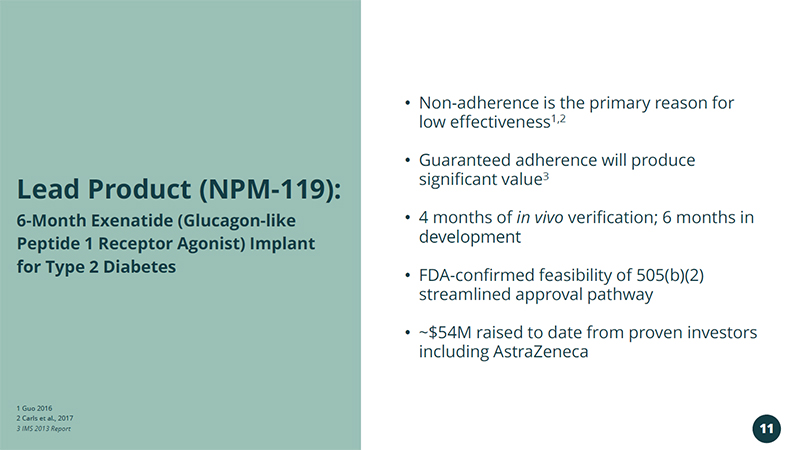

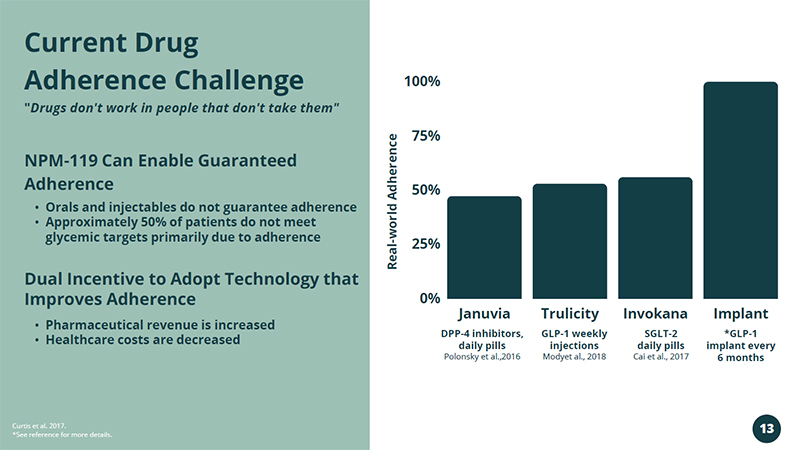

1 Guo 2016 2 Carls et al., 2017 3 IMS 2013 Report • Non - adherence is the primary reason for low effectiveness 1,2 • Guaranteed adherence will produce significant value 3 • 4 months of in vivo verification; 6 months in development • FDA - confirmed feasibility of 505(b)(2) streamlined approval pathway • ~$54M raised to date from proven investors including AstraZeneca 6 - Month Exenatide (Glucagon - like Peptide 1 Receptor Agonist) Implant for Type 2 Diabetes Lead Product (NPM - 119): 11

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 25 20 15 10 5 0 12 Expected 2026 ~$23B GLP - 1 Market Opportunity Data consolidated by Evaluate. World - wide Sales ($Billions)

Januvia Trulicity Invokana Implant 100% 75% 50% 25% 0% DPP - 4 inhibitors, daily pills Polonsky et al.,2016 GLP - 1 weekly injections Modyet al., 2018 SGLT - 2 daily pills Cai et al., 2017 *GLP - 1 implant every 6 months • Orals and injectables do not guarantee adherence • Approximately 50% of patients do not meet glycemic targets primarily due to adherence NPM - 119 Can Enable Guaranteed Adherence Curtis et al. 2017. *See reference for more details. Dual Incentive to Adopt Technology that Improves Adherence • Pharmaceutical revenue is increased • Healthcare costs are decreased Current Drug Adherence Challenge " Drugs don't work in people that don't take them" Real - world Adherence 13

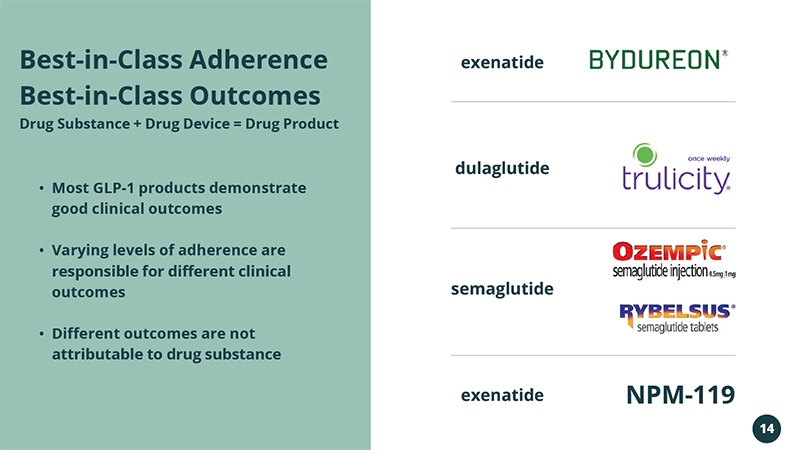

• Most GLP - 1 products demonstrate good clinical outcomes • Varying levels of adherence are responsible for different clinical outcomes • Different outcomes are not attributable to drug substance Best - in - Class Adherence Best - in - Class Outcomes Drug Substance + Drug Device = Drug Product NPM - 119 exenatide dulaglutide semaglutide exenatide 14

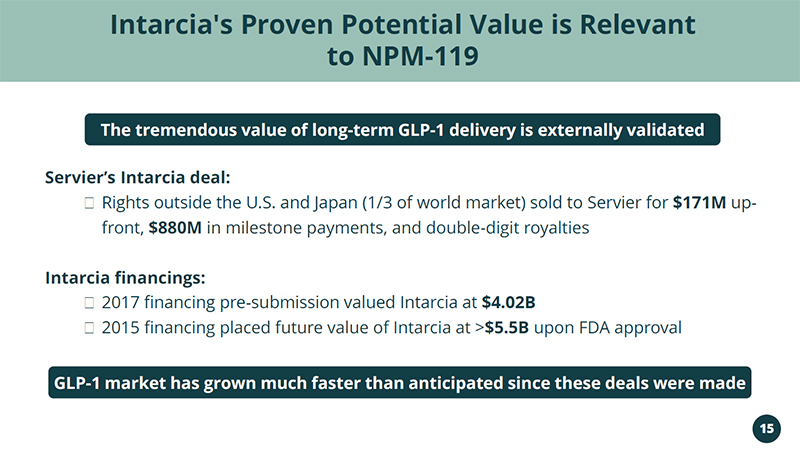

Intarcia's Proven Potential Value is Relevant to NPM - 119 Servier’s Intarcia deal: ⚬ Rights outside the U.S. and Japan (1/3 of world market) sold to Servier for $171M up - front, $880M in milestone payments, and double - digit royalties Intarcia financings: ⚬ 2017 financing pre - submission valued Intarcia at $4.02B ⚬ 2015 financing placed future value of Intarcia at > $5.5B upon FDA approval Baron et al., 2017. The tremendous value of long - term GLP - 1 delivery is externally validated GLP - 1 market has grown much faster than anticipated since these deals were made 15

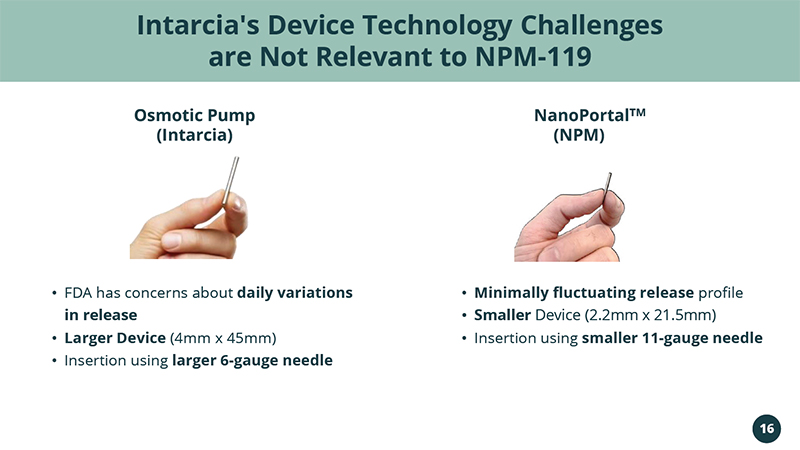

(Intarcia) • FDA has concerns about daily variations in release • Larger Device (4mm x 45mm) • Insertion using larger 6 - gauge needle • Minimally fluctuating release profile • Smaller Device (2.2mm x 21.5mm) • Insertion using smaller 11 - gauge needle Intarcia's Device Technology Challenges are Not Relevant to NPM - 119 NanoPortal TM Osmotic Pump (NPM) 16

Clinical and Regulatory Pathway

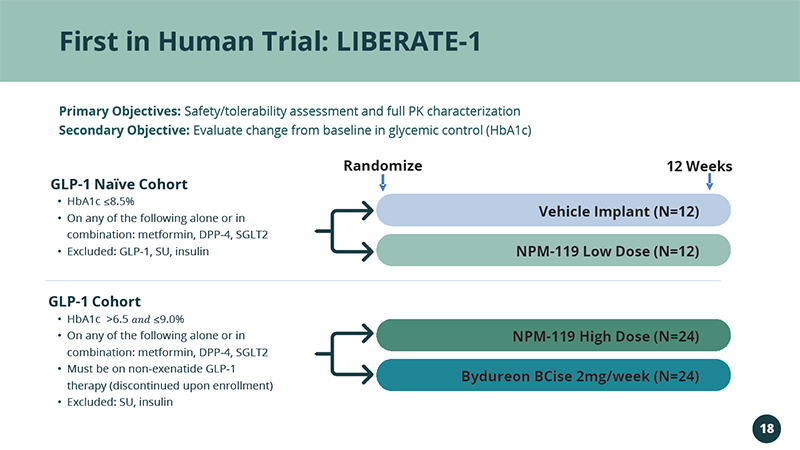

First in Human Trial: LIBERATE - 1 Randomize 12 Weeks • HbA1c ≤8.5% • On any of the following alone or in combination: metformin, DPP - 4, SGLT2 • Excluded: GLP - 1, SU, insulin • HbA1c >6.5 ܽ ݊ ݀ ≤9.0% • On any of the following alone or in combination: metformin, DPP - 4, SGLT2 • Must be on non - exenatide GLP - 1 therapy (discontinued upon enrollment) • Excluded: SU, insulin GLP - 1 Cohort GLP - 1 Naïve Cohort Vehicle Implant (N=12) NPM - 119 Low Dose (N=12) NPM - 119 High Dose (N=24) Bydureon BCise 2mg/week (N=24) 18 Primary Objectives: Safety/tolerability assessment and full PK characterization Secondary Objective: Evaluate change from baseline in glycemic control (HbA1c)

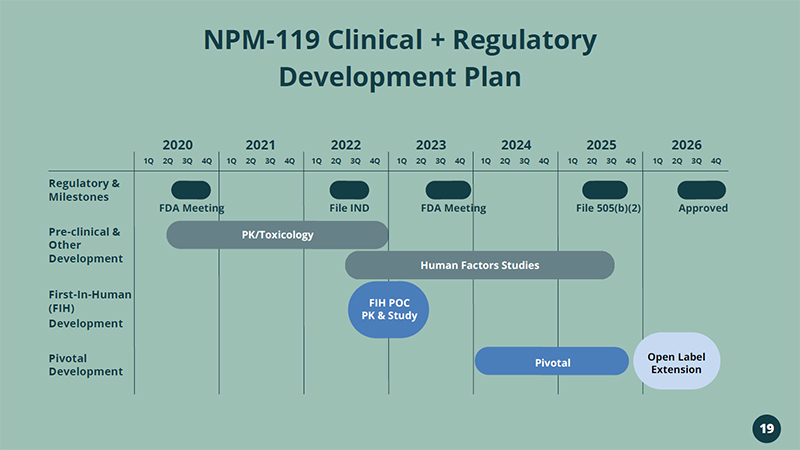

NPM - 119 Clinical + Regulatory Development Plan 2020 2021 2024 2025 First - In - Human (FIH) Development Regulatory & Milestones 2022 2023 2026 Pre - clinical & Other Development Pivotal Development 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q FDA Meeting PK/Toxicology File IND FDA Meeting File 505(b)(2) Approved FIH POC PK & Study Pivotal Open Label Extension Human Factors Studies 19

Neurostimulation Implant Technology to Treat Blindness ORION II

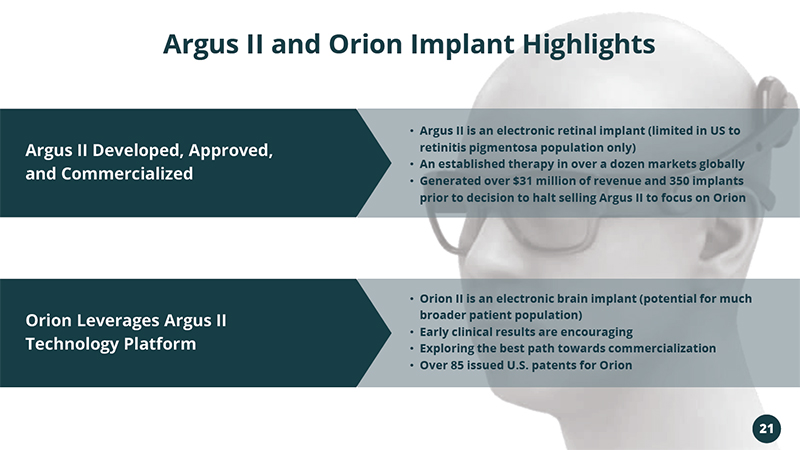

21 Argus II Developed, Approved, and Commercialized Argus II and Orion Implant Highlights Orion Leverages Argus II Technology Platform • Orion II is an electronic brain implant (potential for much broader patient population) • Early clinical results are encouraging • Exploring the best path towards commercialization • Over 85 issued U.S. patents for Orion • Argus II is an electronic retinal implant (limited in US to retinitis pigmentosa population only) • An established therapy in over a dozen markets globally • Generated over $31 million of revenue and 350 implants prior to decision to halt selling Argus II to focus on Orion

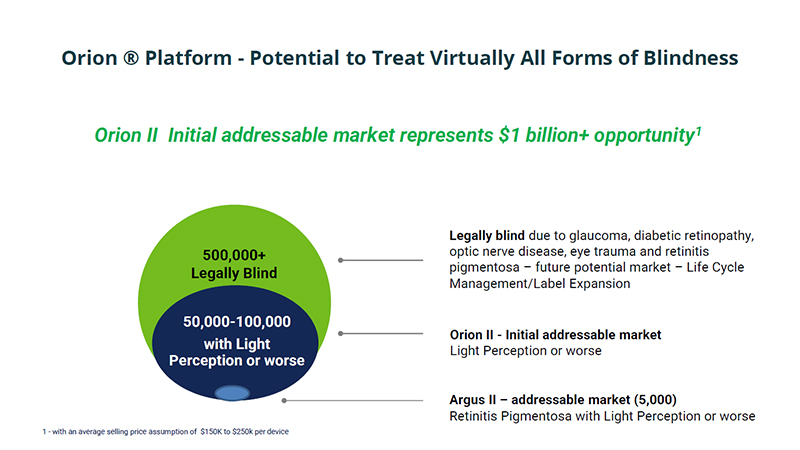

Orion ® Platform - Potential to Treat Virtually All Forms of Blindness Orion II Initial addressable market represents $1 billion+ opportunity 1 500,000+ Legally Blind 50,000 - 100,000 with Light Perception or worse Legally blind due to glaucoma, diabetic retinopathy, optic nerve disease, eye trauma and retinitis pigmentosa – future potential market – Life Cycle Management/Label Expansion Orion II - Initial addressable market Light Perception or worse 1 - with an average selling price assumption of $150K to $250k per device Argus II – addressable market (5,000) Retinitis Pigmentosa with Light Perception or worse

Orion II Potential Path Forward Regulatory, Clinical and Commercialization Considerations • Initial clinical pilot study at UCLA and Baylor College of Medicine on - going; 3 - year data encouraging • Argus II learnings will inform development programs • Patient Preference Study – Part one – informs potential target patient population and adoption • Market Access, Reimbursement and Long - term Support Programs critical for long - term success 23 • Patient Preference Study – Part two – defines safety endpoints required for approval • New Leadership Team to develop strategic options for commercialization

24 Executive Leadership Team • Co - founder/Co - inventor of NPM technology • PhD Bioengineering (UCSF/UC Berkeley) • Management of Technology Certificate at Haas School of Business • Research focused on diabetes treatment • Formerly at Boston Scientific and Minimed Adam Mendelsohn PhD – CEO/Director • Numerous COO and Executive Positions at Device and Drug - Device Companies, including: • COO at Dance Biopharm , COO at Avid Bio • Exec VP at Prima Biomed , Sr. VP at Nektar Therapeutics (responsible for Exubera approval), and Worldwide VP at Johnson & Johnson Truc Le, MBA – Chief Operations Officer • Former Chief Medical Officer for Eiger BioPharmaceuticals and Dance BioPharm • Former VP of Medical Development for Amylin • Former Director at GSK, Global Head of Clinical Strategy for Avandia • Current Board member of ViaCyte , Inc. Lisa Porter, MD – Chief Medical Officer • Former Sr. VP and CFO Miramar Labs • Former Sr. VP and CFO AGA Medical • Former CFO Oravax , Nektar Therapeutics and Haemonetics • Current Board member at Quantun - Si, Aziyo , Mind Medicine • Involved in 2 IPOs, 2 reverse mergers and 1 SPAC Brigid Makes MBA – Chief Financial Officer • Former Executive Director at AstraZeneca with leadership roles in drug development, commercial and business development • Former NPM Board observer for AZ • Former PhaseBio Board observer (prior to IPO) • Sr. Director at Cephalon and Rhone Poulenc Rorer Don Dwyer, MBA – Chief Business Officer

25 Summary of Proposed Merger Combined product pipeline addresses over $50 billion market opportunity Solid cash position of $69M+ enables advancement of lead program NPM - 119 and continued exploration of the Orion II business opportunity Experienced leadership team capable of bringing drugs, medical devices, and drug/device combination products to commercialization Combination of two operating companies developing medical implants that treat conditions with high unmet medical need