Exhibit 99.1

Vivani Medical, Inc. Guaranteed Adherence. Better Outcomes. Nasdaq: VANI March 21, 2023 www.vivani.com

Disclaimers The following slides and any accompanying oral presentation contain forward - looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the "s afe harbor" created by those sections. All statements in this release that are not based on historical fact are "forward looking statements." These sta tements may be identified by words such as "estimates," "anticipates," "projects," "plans" or "planned," "strategy," “goal," "seeks," "may," "will," "expe cts ," "intends," "believes," "should," and similar expressions, or the negative versions thereof, and which also may be identified by their context. All statements that ad dress operating performance or events or developments that Vivani Medical, Inc. ("Vivani", the "Company", "we" or "us) expects or anticipates will occur in the future, such as stated objectives or goals, our product candidates and their therapeutic potential and planned development, the indications that we intend to t arg et, our technology, our business and strategy, milestones, addressable markets, or that are not otherwise historical facts, are forward - looking statemen ts. While management has based any forward - looking statements included in this presentation on its current expectations, the information on which such ex pectations were based may change. Forward - looking statements involve inherent risks and uncertainties which could cause actual results to differ materiall y from those in the forward - looking statements as a result of various factors. These risks and uncertainties include, but are not limited to, that we may fail to complete any required pre - clinical activities for NPM - 119 or otherwise commence our planned Phase 2 trial for this candidate; conduct any pre - clinical act ivities of our other product candidates; our product candidates may not demonstrate safety or efficacy in clinical trials; we may fail to secure marketing ap provals for our product candidates; there may be delays in regulatory approval or changes in regulatory framework that are out of our control; our es tim ation of addressable markets of our product candidates may be inaccurate; we may fail to timely raise additional required funding; more efficient competit ors or more effective competing treatment may emerge; we may be involved in disputes surrounding the use of our intellectual property crucial to our success; we may not be able to attract and retain key employees and qualified personnel; earlier study results may not be predictive of later stage study outcomes; and we are dependent on third - parties for some or all aspects of our product manufacturing, research and preclinical and clinical testing. Additional risks and uncertainties are described in our Annual Report on Form 10 - K filed on March 29, 2022, and in the Company’s Forms 10 - K/A filed on May 2, 2022, S - 4 filed on May 13, 2022, 10 - Q filed on May 16, 2022, 10 - Q filed on August 12, 2022, and 10 - Q filed on November 14 , 2022, and as thereafter amended. We urge you to consider those risks and uncertainties in evaluating our forward - looking statements. We caution readers not to place undue reliance upon any such forward - looking statements, which speak only as of the date made. Except as otherwise required by the federal securities laws, we disclaim any obligation or un der taking to publicly release any updates or revisions to any forward - looking statement contained herein (or elsewhere) to reflect any change in our expectations with regard thereto, or any change in events, conditions, or circumstances on which any such statement is based. Certain information contained in this presentation relates to or is based on studies, publications, surveys and other data obtained from third party sources and the Company’s own internal estimates a nd research. While we believe these third - party sources to be reliable as of the date of this presentation, we have not independently verified, and make no re presentation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third - party sources. Finally, while we believe ou r own internal research is reliable, such research has not been verified by any independent source. All of our therapies are still investigational and h ave not been approved by any regulatory authority for any use. 2

Vivani Executive Leadership Team • Co - founder/Co - inventor of Nano Precision Medical technology • PhD Bioengineering (UCSF/UC Berkeley) • Management of Technology Certificate at Haas School of Business • Research focused on diabetes treatment • Formerly at Boston Scientific and Minimed Adam Mendelsohn PhD – CEO/Director • Numerous COO and Executive Positions at Device and Drug - Device Companies, including: • COO at Dance Biopharm , COO at Avid Bio • Exec VP at Prima Biomed, Sr. VP at Nektar Therapeutics (responsible for Exubera approval), and Worldwide VP at Johnson & Johnson Truc Le, MBA – Chief Operations Officer • Former Chief Medical Officer for Eiger BioPharmaceuticals and Dance BioPharm • Former VP of Medical Development for Amylin • Former Director at GSK, Global Head of Clinical Strategy for Avandia • Former Board member of ViaCyte , Inc. Lisa Porter, MD – Chief Medical Officer • Former Sr. VP and CFO Miramar Labs • Former Sr. VP and CFO AGA Medical • Former CFO Nektar Therapeutics, OraVax and Haemonetics • Current Board director: Quantun - Si, Aziyo and Mind Medicine • Involved in/Directed 2 IPOs, 2 reverse mergers and 1 SPAC Brigid Makes MBA – Chief Financial Officer • Former Executive Director at AstraZeneca with leadership roles in drug development, commercial and business development • Former Nano Precision Medical Board observer for AZ • Former PhaseBio Board observer for AZ (prior to IPO) • Former Director at Cephalon and Rhone Poulenc Rorer Donald Dwyer, MBA – Chief Business Officer 3

Vivani Medical, Inc. Lead program NPM - 119 is a miniature, 6 - month, GLP - 1 implant for the treatment of patients with Type 2 Diabetes. A Phase 2 clinical study of NPM - 119 in patients is planned to initiate in 2023. In March, we announced the proposed initial public offering of our Neuromodulation Division, renamed Cortigent, Inc. This allows Vivani to focus on our drug implant business. An innovative, biopharmaceutical company developing novel, long - term, drug implant candidates to treat chronic disease. We leverage our proprietary, NanoPortal™ platform technology to design implants that address medication non - adherence, a primary reason why patients don’t receive the full potential benefit of their medicine. Vivani is well - positioned with new leadership and sufficient capital to support multiple milestones for NPM - 119 and our emerging pipeline of innovative therapeutic implants. 4

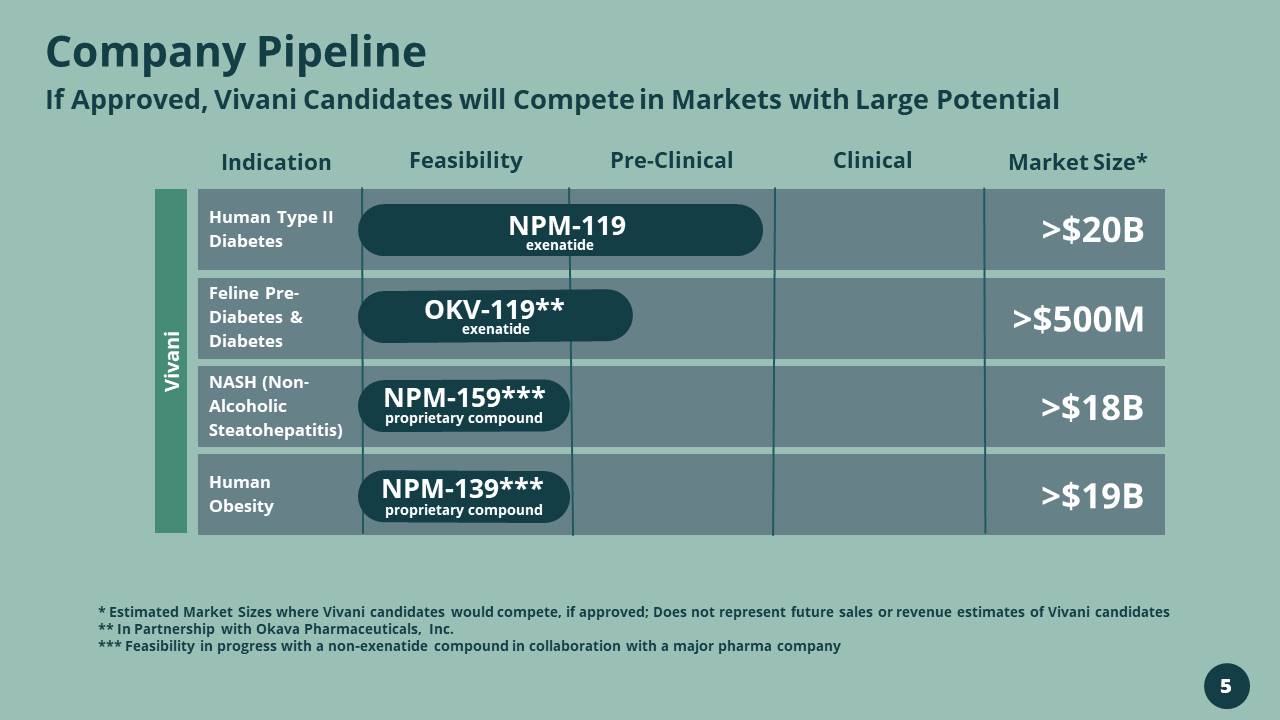

Company Pipeline If Approved, Vivani Candidates will Compete in Markets with Large Potential * Estimated Market Sizes where Vivani candidates would compete, if approved; Does not represent future sales or revenue estim ate s of Vivani candidates ** In Partnership with Okava Pharmaceuticals, Inc. *** Feasibility in progress with a non - exenatide compound in collaboration with a major pharma company Indication Feasibility Pre - Clinical Clinical Market Size* Human Type II Diabetes Feline Pre - Diabetes & Diabetes NASH (Non - Alcoholic Steatohepatitis) Human Obesity NPM - 119 exenatide >$20B >$500M >$18B >$19B NPM - 159*** proprietary compound NPM - 139*** proprietary compound Vivani OKV - 119** exenatide 5

Drug Implants Proprietary Platform Technology

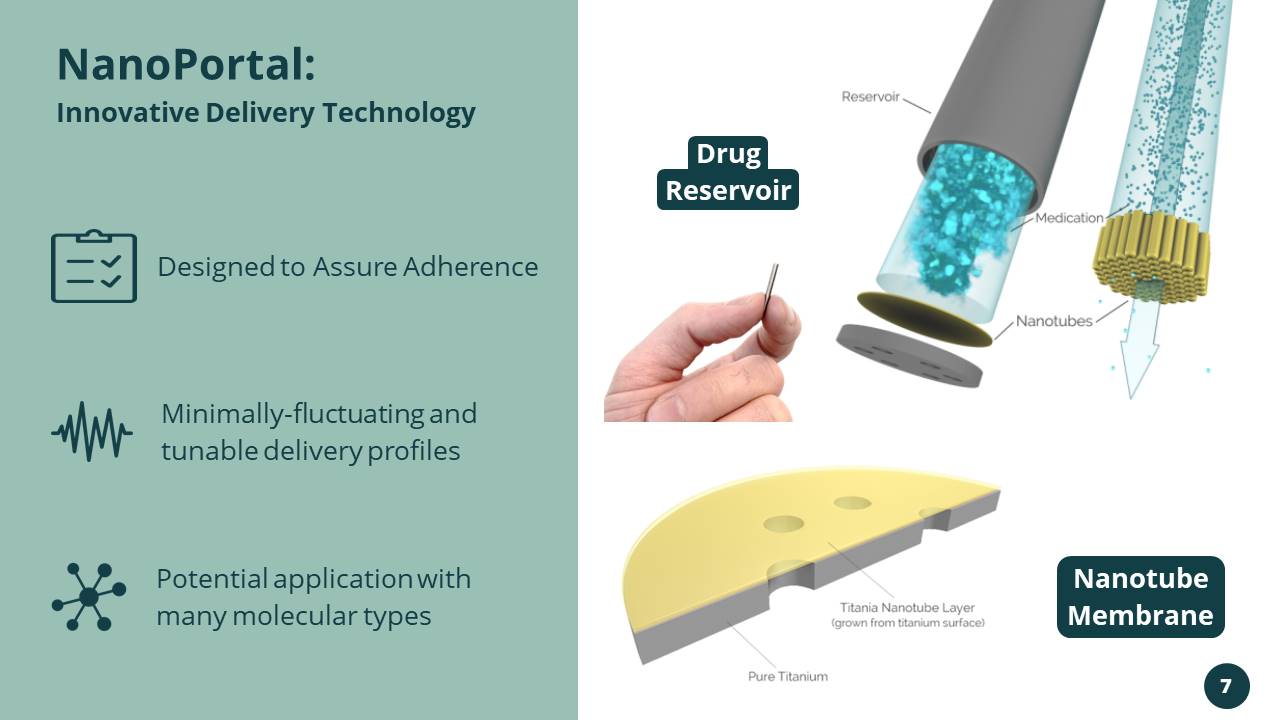

Potential application with many molecular types Designed to Assure Adherence Minimally - fluctuating and tunable delivery profiles NanoPortal: Innovative Delivery Technology Drug Reservoir Nanotube Membrane 7

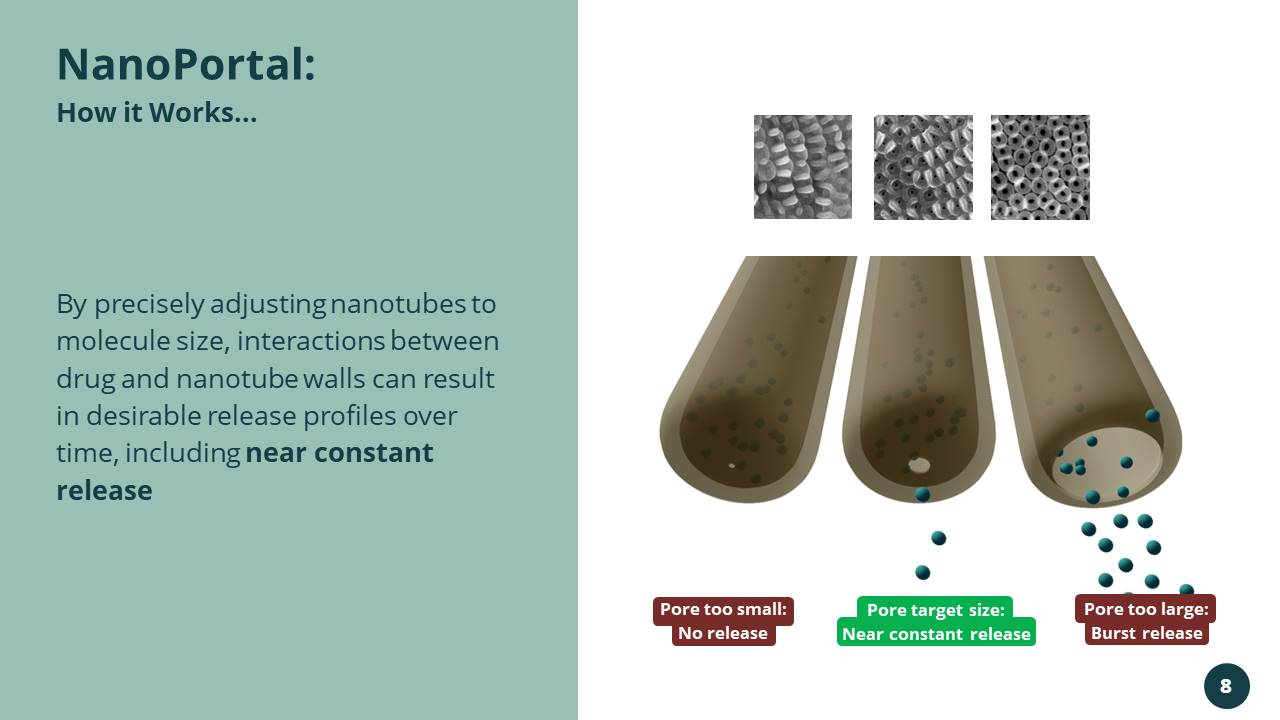

By precisely adjusting nanotubes to molecule size, interactions between drug and nanotube walls can result in desirable release profiles over time, including near constant release NanoPortal : How it Works... Pore too small: No release Pore target size: Near constant release Pore too large: Burst release 8

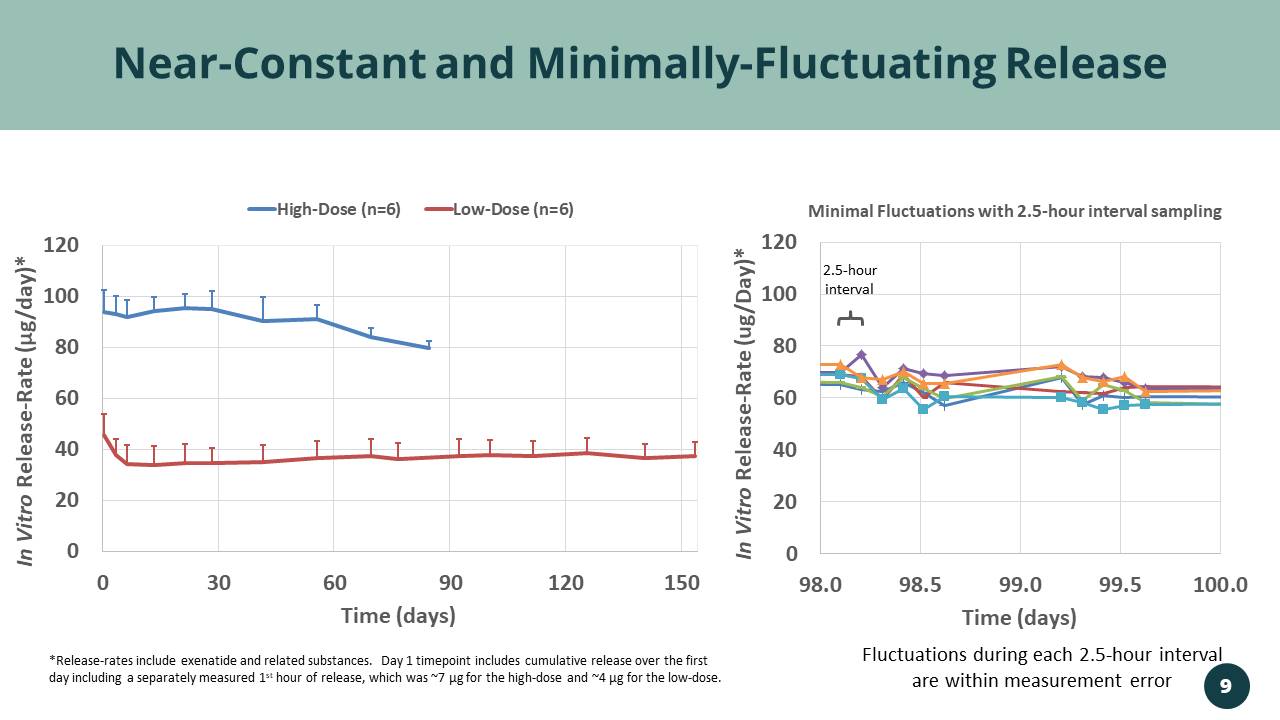

0 20 40 60 80 100 120 0 30 60 90 120 150 In Vitro Release - Rate ( µ g/day)* Time (days) High-Dose (n=6) Low-Dose (n=6) 0 20 40 60 80 100 120 98.0 98.5 99.0 99.5 100.0 In Vitro Release - Rate (ug/Day)* Time (days) Minimal Fluctuations with 2.5 - hour interval sampling Near - Constant and Minimally - Fluctuating Release *Release - rates include exenatide and related substances. Day 1 timepoint includes cumulative release over the first day including a separately measured 1 st hour of release, which was ~7 µg for the high - dose and ~4 µg for the low - dose. 9 Fluctuations during each 2.5 - hour interval are within measurement error 2.5 - hour interval

Minimized Implant Size Extendable Implant Duration Tunable Delivery Rate Tunable Delivery Profile NanoPortal TM is a Platform Technology Broad Potential Application Can Support Portfolio of New Drug Implants 10

Targeting the Rapidly Growing GLP - 1 RA Market $13B in 2020 & $23B Expected in 2026 Vivani’s Lead Program NPM - 119

1 Guo 2016 2 Carls et al., 2017 3 IMS 2013 Report • Non - adherence is the primary reason for low, real - world effectiveness 1,2 • Guaranteed adherence will produce significant healthcare cost savings 3 • FDA indicated 505(b)(2) streamlined approval pathway may be available • ~$54M raised pre - merger from investors including AstraZeneca 6 - Month Exenatide (Glucagon - like Peptide 1 Receptor Agonist) Implant for Type 2 Diabetes Lead Product (NPM - 119): 12

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 25 20 15 10 5 0 Expected 2026 ~$23B GLP - 1 Market Opportunity* World - wide Sales ($Billions) * Evaluate Pharma 08 June 2021 13

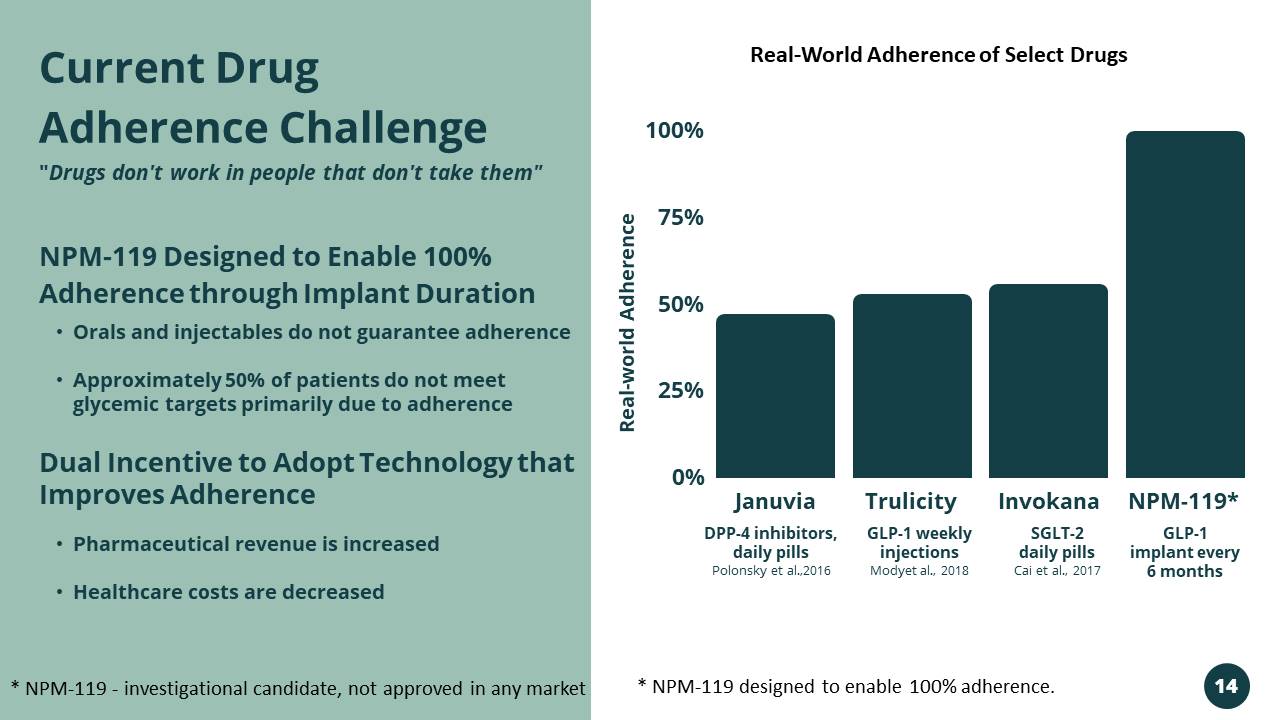

Januvia Trulicity Invokana NPM - 119* 100% 75% 50% 25% 0% DPP - 4 inhibitors, daily pills Polonsky et al.,2016 GLP - 1 weekly injections Modyet al., 2018 SGLT - 2 daily pills Cai et al., 2017 GLP - 1 implant every 6 months • Orals and injectables do not guarantee adherence • Approximately 50% of patients do not meet glycemic targets primarily due to adherence NPM - 119 Designed to Enable 100% Adherence through Implant Duration Dual Incentive to Adopt Technology that Improves Adherence • Pharmaceutical revenue is increased • Healthcare costs are decreased Current Drug Adherence Challenge " Drugs don't work in people that don't take them" Real - world Adherence * NPM - 119 - investigational candidate, not approved in any market * NPM - 119 designed to enable 100% adherence. Real - World Adherence of Select Drugs 14

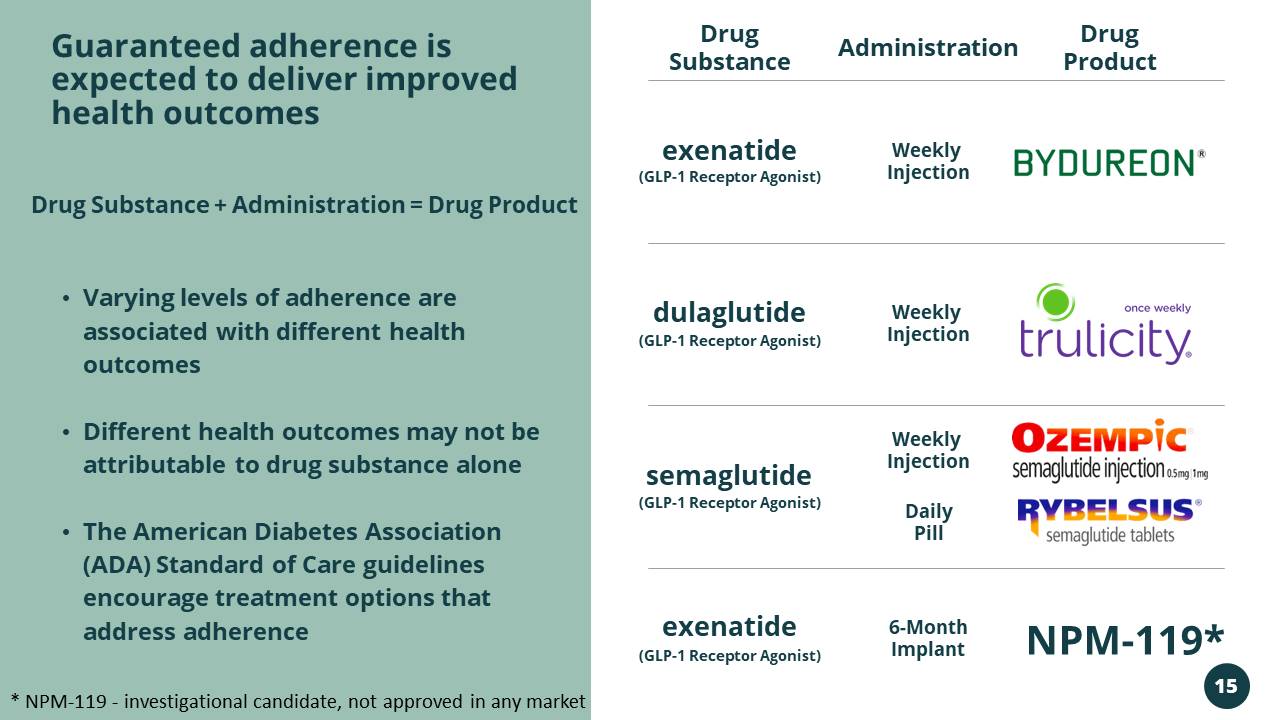

• Varying levels of adherence are associated with different health outcomes • Different health outcomes may not be attributable to drug substance alone • The American Diabetes Association (ADA) Standard of Care guidelines encourage treatment options that address adherence Guaranteed adherence is expected to deliver improved health outcomes Drug Substance + Administration = Drug Product NPM - 119* Drug Substance Drug Product Administration Weekly Injection 6 - Month Implant Weekly Injection Weekly Injection Daily Pill exenatide (GLP - 1 Receptor Agonist) dulaglutide (GLP - 1 Receptor Agonist) semaglutide (GLP - 1 Receptor Agonist) exenatide (GLP - 1 Receptor Agonist) * NPM - 119 - investigational candidate, not approved in any market 15

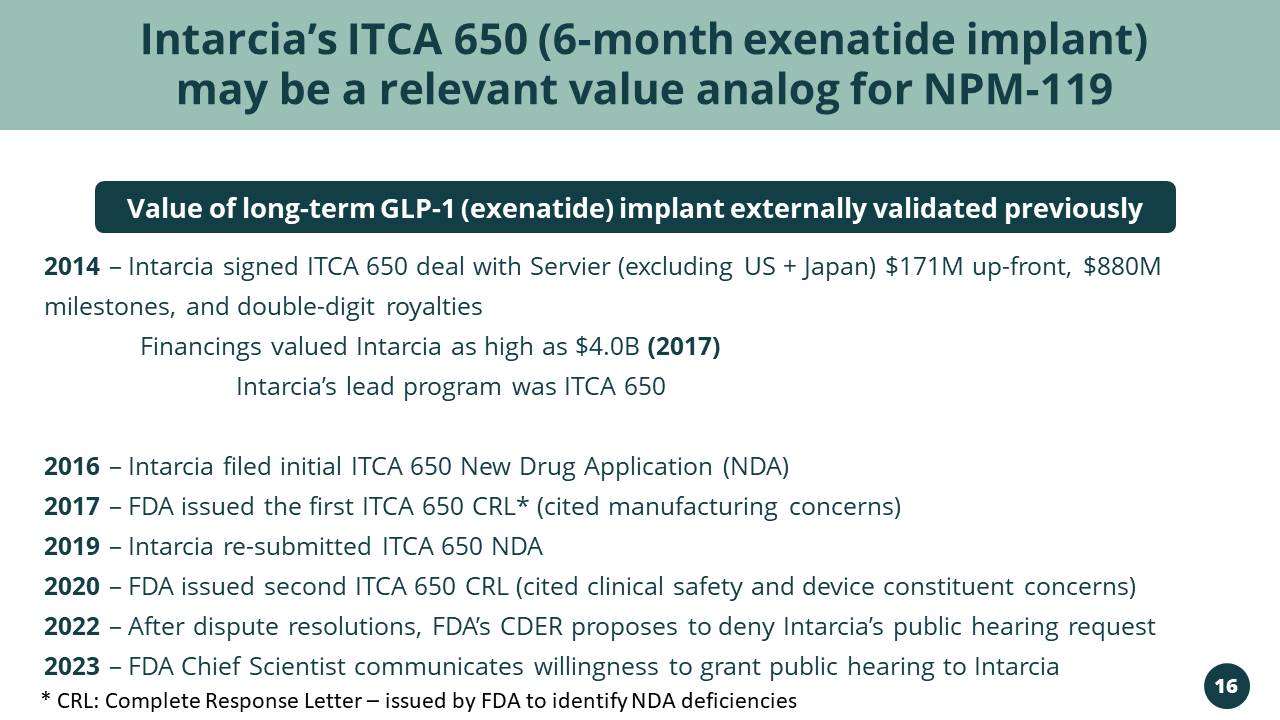

Intarcia’s ITCA 650 (6 - month exenatide implant) may be a relevant value analog for NPM - 119 2014 – Intarcia signed ITCA 650 deal with Servier (excluding US + Japan) $171M up - front, $880M milestones, and double - digit royalties Financings valued Intarcia as high as $4.0B (2017) Intarcia’s lead program was ITCA 650 2016 – Intarcia filed initial ITCA 650 New Drug Application (NDA) 2017 – FDA issued the first ITCA 650 CRL* (cited manufacturing concerns) 2019 – Intarcia re - submitted ITCA 650 NDA 2020 – FDA issued second ITCA 650 CRL (cited clinical safety and device constituent concerns) 2022 – After dispute resolutions , FDA’s CDER proposes to deny Intarcia’s public hearing request 2023 – FDA Chief Scientist communicates willingness to grant public hearing to Intarcia Value of long - term GLP - 1 (exenatide) implant externally validated previously * CRL: Complete Response Letter – issued by FDA to identify NDA deficiencies 16

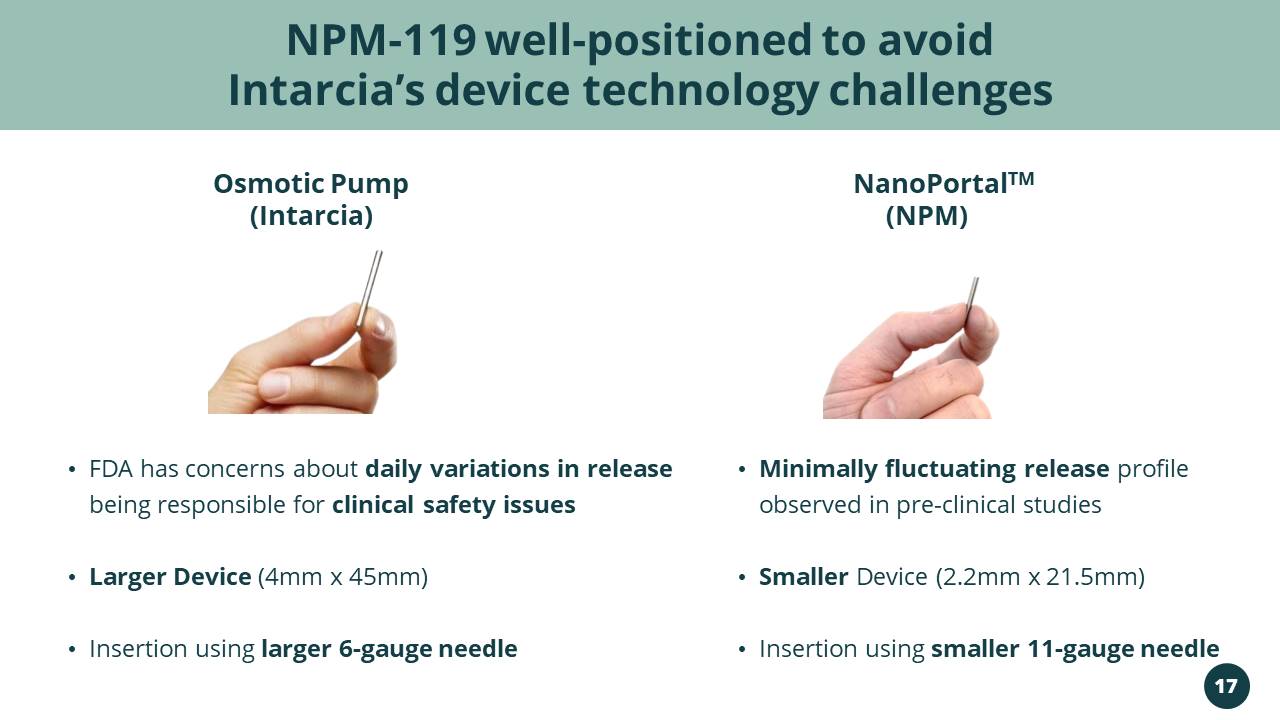

(Intarcia) • FDA has concerns about daily variations in release being responsible for clinical safety issues • Larger Device (4mm x 45mm) • Insertion using larger 6 - gauge needle • Minimally fluctuating release profile observed in pre - clinical studies • Smaller Device (2.2mm x 21.5mm) • Insertion using smaller 11 - gauge needle NPM - 119 well - positioned to avoid Intarcia’s device technology challenges NanoPortal TM Osmotic Pump (NPM) 17

NPM - 119 Clinical and Regulatory Pathway

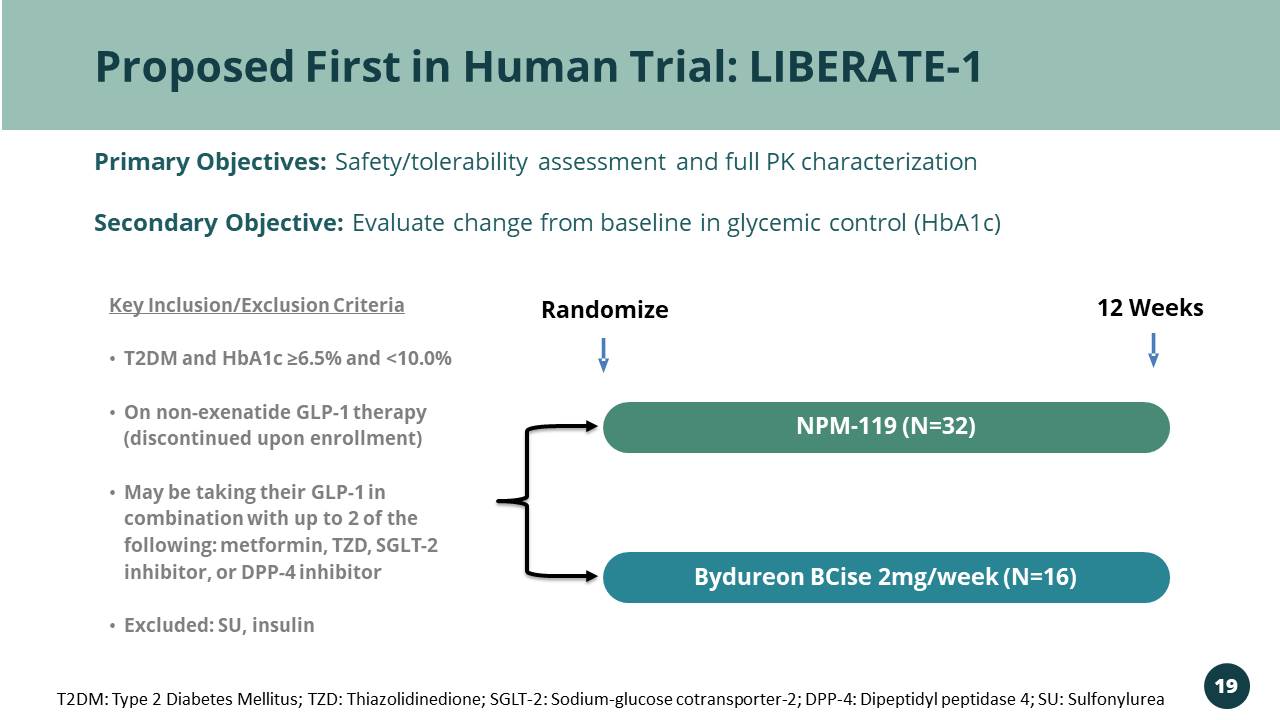

Proposed First in Human Trial: LIBERATE - 1 Randomize 12 Weeks Key Inclusion/Exclusion Criteria • T2DM and HbA1c ≥6.5% and <10.0% • On non - exenatide GLP - 1 therapy (discontinued upon enrollment) • May be taking their GLP - 1 in combination with up to 2 of the following: metformin, TZD, SGLT - 2 inhibitor, or DPP - 4 inhibitor • Excluded: SU, insulin NPM - 119 (N=32) Bydureon BCise 2mg/week (N=16) Primary Objectives: Safety/tolerability assessment and full PK characterization Secondary Objective: Evaluate change from baseline in glycemic control (HbA1c) T2DM: Type 2 Diabetes Mellitus; TZD: Thiazolidinedione; SGLT - 2: Sodium - glucose cotransporter - 2; DPP - 4: Dipeptidyl peptidase 4; S U: Sulfonylurea 19

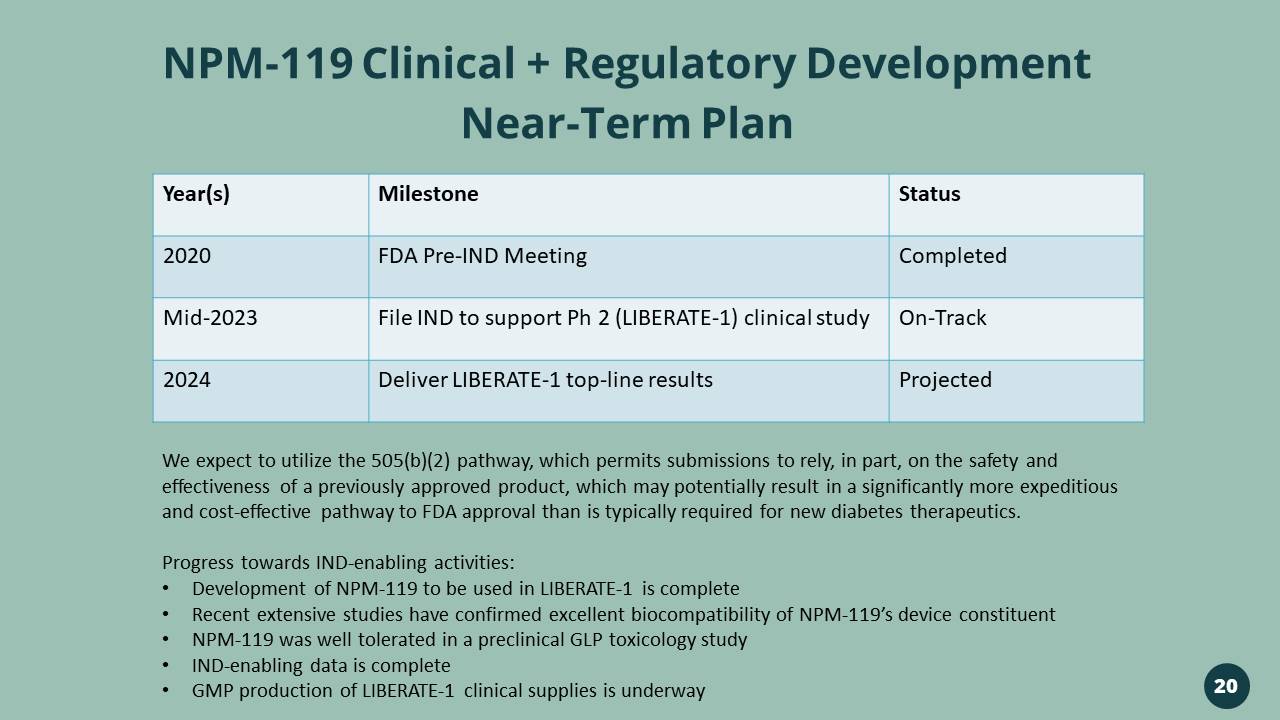

NPM - 119 Clinical + Regulatory Development Near - Term Plan Year(s) Milestone Status 2020 FDA Pre - IND Meeting Completed Mid - 2023 File IND to support Ph 2 (LIBERATE - 1) clinical study On - Track 2024 Deliver LIBERATE - 1 top - line results Projected We expect to utilize the 505(b)(2) pathway, which permits submissions to rely, in part, on the safety and effectiveness of a previously approved product, which may potentially result in a significantly more expeditious and cost - effective pathway to FDA approval than is typically required for new diabetes therapeutics. Progress towards IND - enabling activities: • Development of NPM - 119 to be used in LIBERATE - 1 is complete • Recent extensive studies have confirmed excellent biocompatibility of NPM - 119’s device constituent • NPM - 119 was well tolerated in a preclinical GLP toxicology study • IND - enabling data is complete • GMP production of LIBERATE - 1 clinical supplies is underway 20

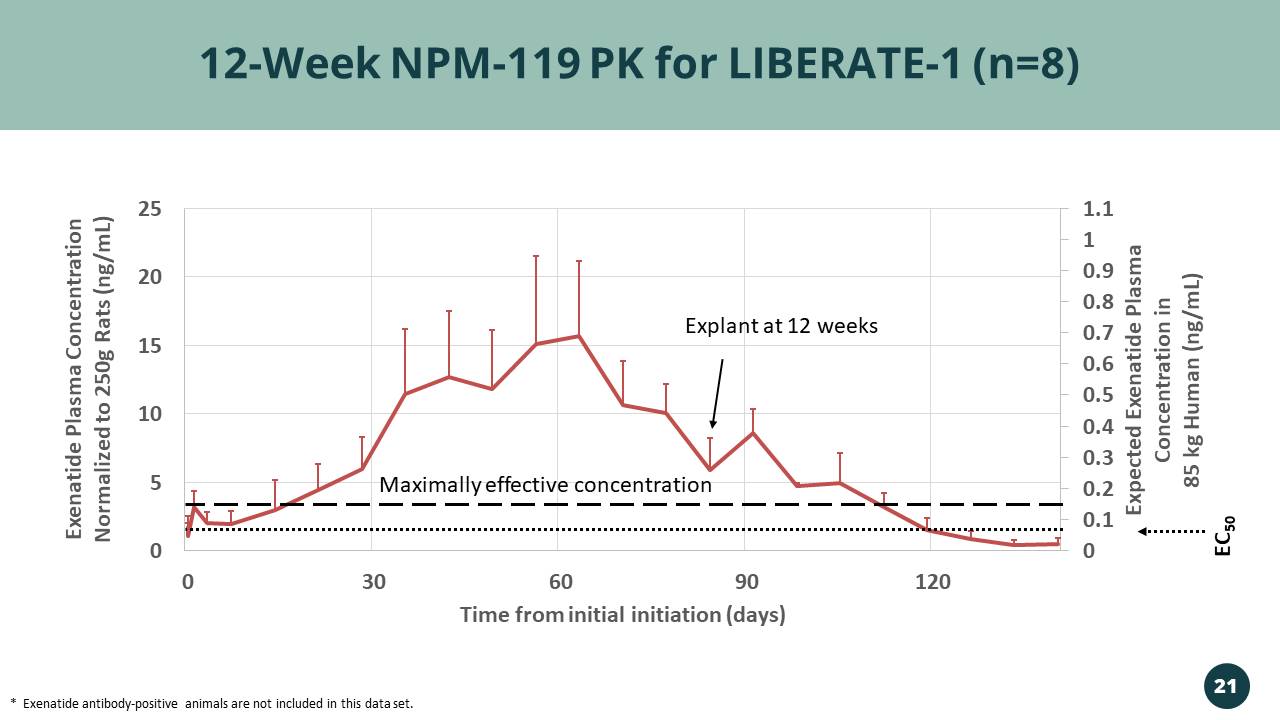

0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1 1.1 0 5 10 15 20 25 0 30 60 90 120 Expected Exenatide Plasma Concentration in 85 kg Human (ng/mL) Exenatide Plasma Concentration Normalized to 250g Rats (ng/mL) Time from initial initiation (days) 12 - Week NPM - 119 PK for LIBERATE - 1 (n=8) * Exenatide antibody - positive animals are not included in this data set. Explant at 12 weeks 21 EC 50 Maximally effective concentration

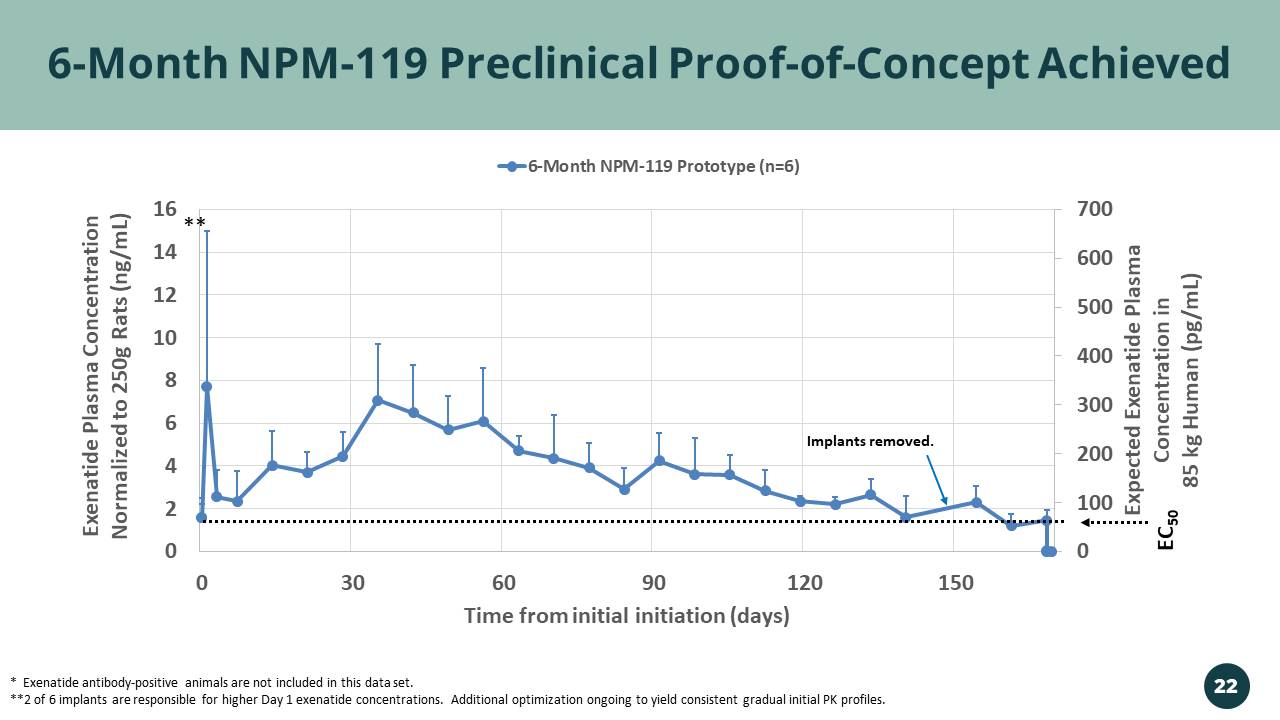

0 100 200 300 400 500 600 700 0 2 4 6 8 10 12 14 16 0 30 60 90 120 150 Expected Exenatide Plasma Concentration in 85 kg Human ( pg /mL) Exenatide Plasma Concentration Normalized to 250g Rats (ng/mL) Time from initial initiation (days) 6-Month NPM-119 Prototype (n=6) 6 - Month NPM - 119 Preclinical Proof - of - Concept Achieved EC 50 * Exenatide antibody - positive animals are not included in this data set. **2 of 6 implants are responsible for higher Day 1 exenatide concentrations. Additional optimization ongoing to yield consis ten t gradual initial PK profiles. Implants removed. ** 22

Vivani Medical, Inc. Financial Information

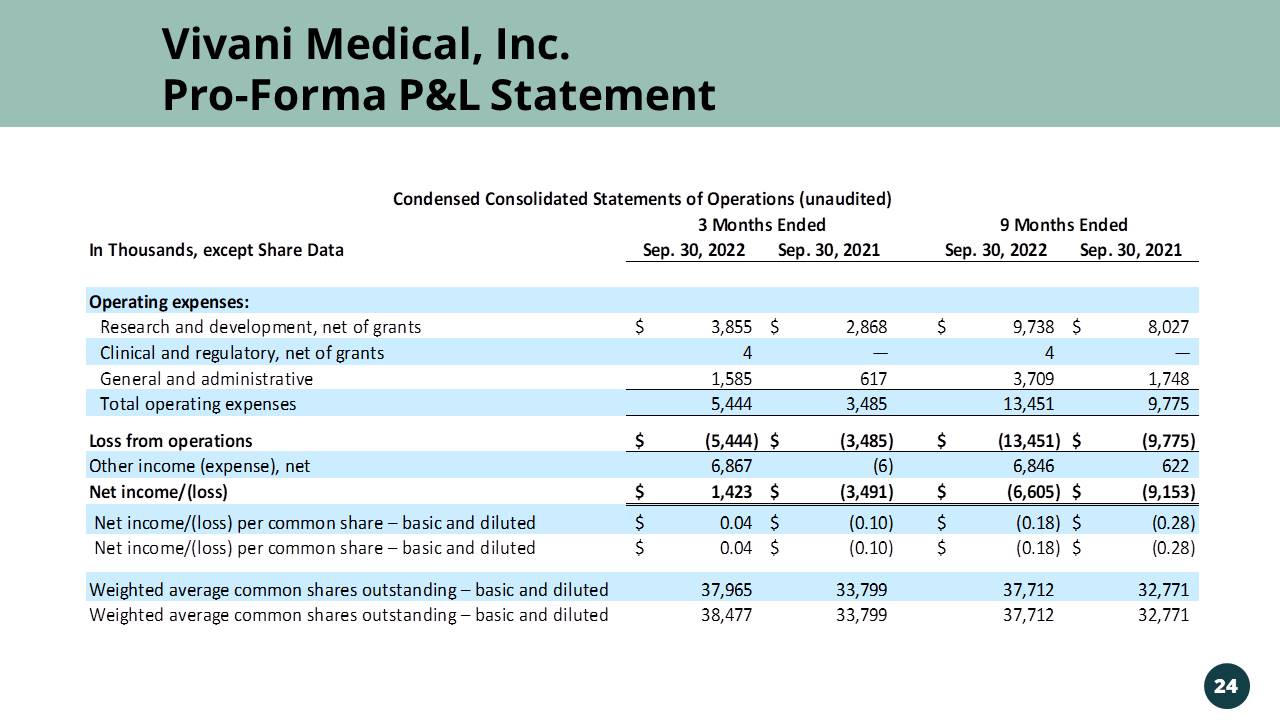

Vivani Medical, Inc. Pro - Forma P&L Statement 24 In Thousands, except Share Data Sep. 30, 2022 Sep. 30, 2021 Sep. 30, 2022 Sep. 30, 2021 Operating expenses: Research and development, net of grants 3,855$ 2,868$ 9,738$ 8,027$ Clinical and regulatory, net of grants 4 — 4 — General and administrative 1,585 617 3,709 1,748 Total operating expenses 5,444 3,485 13,451 9,775 Loss from operations (5,444)$ (3,485)$ (13,451)$ (9,775)$ Other income (expense), net 6,867 (6) 6,846 622 Net income/(loss) 1,423$ (3,491)$ (6,605)$ (9,153)$ Net income/(loss) per common share – basic and diluted 0.04$ (0.10)$ (0.18)$ (0.28)$ Net income/(loss) per common share – basic and diluted 0.04$ (0.10)$ (0.18)$ (0.28)$ Weighted average common shares outstanding – basic and diluted 37,965 33,799 37,712 32,771 Weighted average common shares outstanding – basic and diluted 38,477 33,799 37,712 32,771 3 Months Ended 9 Months Ended Condensed Consolidated Statements of Operations (unaudited)

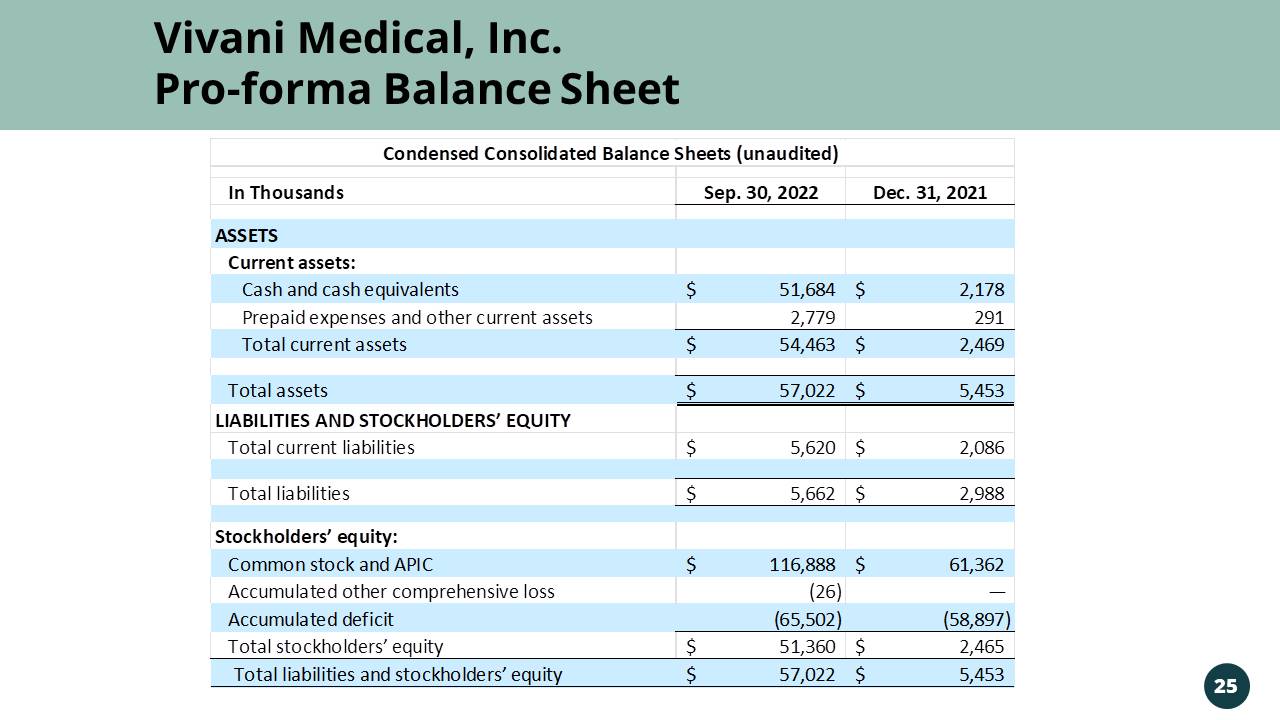

Vivani Medical, Inc. Vivani Medical, Inc. Pro - forma Balance Sheet In Thousands Sep. 30, 2022 Dec. 31, 2021 ASSETS Current assets: Cash and cash equivalents 51,684$ 2,178$ Prepaid expenses and other current assets 2,779 291 Total current assets 54,463$ 2,469$ Total assets 57,022$ 5,453$ LIABILITIES AND STOCKHOLDERS’ EQUITY Total current liabilities 5,620$ 2,086$ Total liabilities 5,662$ 2,988$ Stockholders’ equity: Common stock and APIC 116,888$ 61,362$ Accumulated other comprehensive loss (26) — Accumulated deficit (65,502) (58,897) Total stockholders’ equity 51,360$ 2,465$ Total liabilities and stockholders’ equity 57,022$ 5,453$ Condensed Consolidated Balance Sheets (unaudited) 25

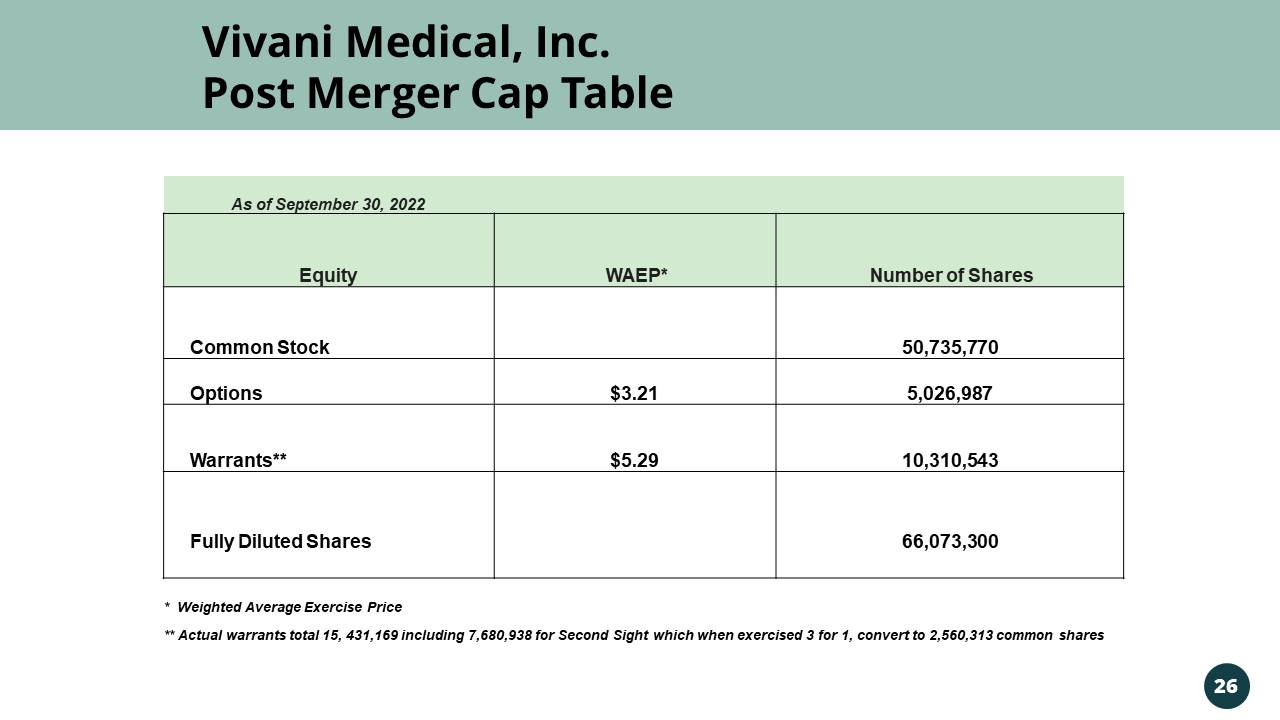

Vivani Medical, Inc. Post Merger Cap Table As of September 30, 2022 Equity WAEP* Number of Shares Common Stock 50,735,770 Options $3.21 5,026,987 Warrants** $5.29 10,310,543 Fully Diluted Shares 66,073,300 * Weighted Average Exercise Price ** Actual warrants total 15, 431,169 including 7,680,938 for Second Sight which when exercised 3 for 1, convert to 2,560,313 com mon shares 26

Vivani Medical, Inc. Lead program NPM - 119 is a miniature, 6 - month, GLP - 1 implant for the treatment of patients with Type 2 Diabetes. A Phase 2 clinical study of NPM - 119 in patients is planned to initiate in 2023. In March, we announced the proposed initial public offering of our Neuromodulation Division, renamed Cortigent, Inc. This allows Vivani to focus on our drug implant business. An innovative, biopharmaceutical company developing novel, long - term, drug implant candidates to treat chronic disease. We leverage our proprietary , NanoPortal™ platform technology to design implants that address medication non - adherence, a primary reason why patients don’t receive the full potential benefit of their medicine. Vivani is well - positioned with new leadership and sufficient capital to support multiple milestones for NPM - 119 and our emerging pipeline of innovative therapeutic implants. 27