UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

VIVANI MEDICAL, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined); | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

Vivani Medical, Inc.

5858 Horton Street, Suite 280

Emeryville, California 94608

April 18, 2023

Dear Stockholder:

It is my pleasure to invite you to attend Vivani Medical, Inc.’s 2023 Annual Meeting of Stockholders (the “Annual Meeting”), to be held on June 15, 2023, at 10:00 a.m. Pacific Time. The Annual Meeting will be held entirely online live via audio webcast. You will be able to attend and participate in the Annual Meeting online by first registering at www.proxydocs.com/VANI, where you will be able to listen to the Annual Meeting live, submit questions and vote.

Details regarding the business to be conducted at the Annual Meeting are more fully described in the accompanying Notice of Annual Meeting of Stockholders and proxy statement.

Your vote is important. Whether or not you expect to attend the Annual Meeting online, please date, sign and return your proxy card in the enclosed envelope or vote by using the Internet or by telephone according to the instructions in the proxy statement to assure that your shares will be represented and voted at the Annual Meeting. If you attend the Annual Meeting and follow the instructions in the proxy statement, you may vote your shares electronically during the Annual Meeting even though you have previously voted by proxy. If you hold your shares through an account with a brokerage firm, bank or other nominee, please follow the instructions you receive from your broker, bank, trustee or other nominee to vote your shares. Details about how to attend the Annual Meeting online and how to submit questions and cast your votes are posted at www.proxydocs.com/VANI and can be found in the proxy statement in the section entitled “About the Annual Meeting: Questions and Answers about this Proxy Material and Voting — How can I participate in the Annual Meeting? and How do I vote and what are the voting deadlines?”

On behalf of your Board of Directors, thank you for your continued support and interest.

| Sincerely, |

| /s/ Adam Mendelsohn |

| Adam Mendelsohn |

| Chief Executive Officer |

2

VIVANI MEDICAL, INC.

5858 Horton Street, Suite 280

Emeryville, California 94608

(818) 833-5000

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 15, 2023

To the Stockholders of Vivani Medical, Inc.:

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Vivani Medical, Inc., a California corporation (the “Company”), on June 15, 2023, at 10:00 a.m. Pacific Time. The Annual Meeting will be held entirely online live via audio webcast. You will be able to attend and participate in the Annual Meeting online by visiting www.proxydocs.com/VANI, where you will be able to listen to the Annual Meeting live, submit questions, and vote. There will not be a physical location for the Annual Meeting. The Annual Meeting will be held for the following purposes:

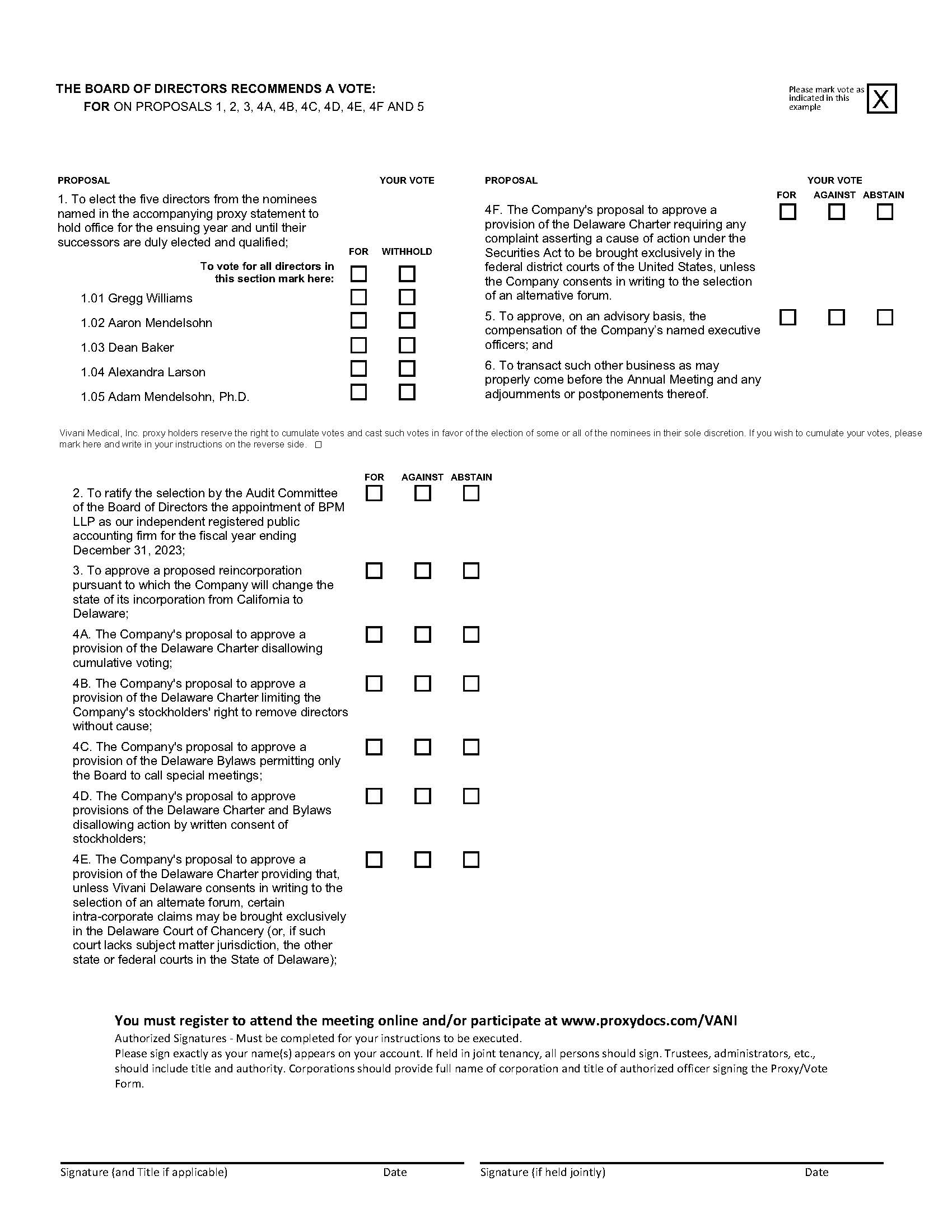

| 1. | Proposal No. 1: To elect the five directors from the nominees named in the accompanying proxy statement to hold office for the ensuing year and until their successors are duly elected and qualified; |

| 2. | Proposal No. 2: To ratify the selection by the Audit Committee of the Board of Directors the appointment of BPM LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023; |

| 3. | Proposal No. 3: To approve a proposed reincorporation pursuant to which the Company will change the state of its incorporation from California to Delaware; |

| 4. | Proposal No. 4A: To approve a provision of the Delaware Charter disallowing cumulative voting; |

| 5. | Proposal No. 4B: To approve a provision of the Delaware Charter limiting the Company’s stockholders’ right to remove directors without cause; |

| 6. | Proposal No. 4C: To approve a provision of the Delaware Bylaws permitting only the Board to call special meetings; | |

| 7. | Proposal No. 4D: To approve provisions of the Delaware Charter and Bylaws disallowing action by written consent of stockholders; |

| 8. | Proposal No. 4E: To approve a provision of the Delaware Charter providing that, unless Vivani Delaware consents in writing to the selection of an alternate forum, certain intra-corporate claims may be brought exclusively in the Delaware Court of Chancery (or, if such court lacks subject matter jurisdiction, the other state or federal courts in the State of Delaware); |

| 9. | Proposal No. 4F: To approve a provision of the Delaware Charter requiring any complaint asserting a cause of action under the Securities Act to be brought exclusively in the federal district courts of the United States, unless the Company consents in writing to the selection of an alternative forum; |

| 10. | Proposal No. 5: To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers; and |

To transact such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof.

This year, we have elected to use the Internet as our primary means of providing our proxy materials to stockholders. Consequently, most stockholders will not receive paper copies of our proxy materials. We will instead send to our stockholders a Notice of Internet Availability of Proxy Materials, which contains instructions on how to access our proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2022. The Notice of Internet Availability of Proxy Materials also includes instructions on how you can vote using the Internet, by telephone or at the virtual Annual Meeting via live webcast, and how you can request and receive, free of charge, a printed copy of our proxy materials. All stockholders who do not receive a Notice of Internet Availability of Proxy Materials will receive a paper copy of the proxy materials by mail. The Proxy Statement accompanying this Notice describes each of these items of business in detail. Our Board of Directors has fixed the close of business on April 18, 2023 as the record date (the “Record Date”) for the Annual Meeting. Only stockholders of record as of that date are entitled to notice of and to vote at the Annual Meeting. Please use this opportunity to take part in the affairs of the Company by voting on the business to come before this meeting. It is important that your shares are represented and voted at the Annual Meeting. We urge you to authorize your proxy in advance by following the instructions printed on it.

| By Order of the Board of Directors |

| /s/ Adam Mendelsohn |

| Adam Mendelsohn |

| Chief Executive Officer |

Dated: April 18, 2023

3

TABLE OF CONTENTS

4

Our board of directors solicits your proxy for the 2023 Annual Meeting of Stockholders (the “Annual Meeting”), and for any postponement or adjournment of the Annual Meeting, for the purposes described in the “Notice of Annual Meeting of Stockholders.” The table below shows some important details about the Annual Meeting and voting. Additional information is available in the “About the Annual Meeting: Questions and Answers” section of the proxy statement immediately below the table. We use the terms “Vivani,” “the Company,” “we,” “our” and “us” in this Proxy Statement to refer to Vivani Medical, Inc., a California corporation.

This Proxy Statement and the accompanying proxy card are first being delivered, on or about April 28, 2023, to owners of shares of common stock of Vivani Medical, Inc. in connection with the solicitation of proxies by our board of directors (“Board”) for our Annual Meeting to be held on June 15, 2023 at 10:00 a.m. Pacific Time online at www.proxydocs.com/VANI. The Annual Meeting will be a completely virtual meeting, which will be conducted via live audio webcast. This proxy procedure permits all stockholders to vote their shares at the Annual Meeting. Our Board encourages you to read this document thoroughly and to take this opportunity to vote on the matters to be decided at the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the 2023 Annual Meeting

This proxy statement and the 2022 Annual Report are available for viewing, printing and downloading at www.proxydocs.com/VANI and on the “Investors” section of our website at www.vivani.com. Certain documents referenced in the proxy statement are available on our website. However, we are not including the information contained on our website, or any information that may be accessed by links on our website, as part of, or incorporating it by reference into, this Proxy Statement.

| Meeting Details | June 15, 2023, 10:00 a.m. Pacific Time |

| Virtual Meeting | To participate in the Annual Meeting virtually via the Internet, please visit: www.proxydocs.com/VANI. To access the Annual Meeting, you will need the 12-digit control number included on your Notice of Internet Availability of Proxy Materials, included on your proxy card, or provided through your broker. Stockholders will be able to vote and submit questions during the Annual Meeting. |

| Record Date | April 18, 2023 |

| Shares Outstanding | There were 50,788,699 shares of common stock outstanding and entitled to vote as of the Record Date. |

| Eligibility to Vote | Holders of our common stock at the close of business on the Record Date are entitled to notice of, and to vote at, the Annual Meeting. Each stockholder is entitled to one vote for each share held as of the Record Date. |

| Quorum | A majority of the shares of common stock outstanding and entitled to vote, by proxy or via live webcast, as of the Record Date constitutes a quorum. A quorum is required to transact business at the Annual Meeting. |

| Voting Methods | Stockholders whose shares are registered in their names with Vstock Transfer, LLC, our transfer agent (referred to as “Stockholders of Record”) may vote by proxy via the Internet, phone, or mail by following the instructions on the accompanying proxy card. Stockholders of Record may also vote at the virtual Annual Meeting. Stockholders whose shares are held in “street name” by a broker, bank or other nominee (referred to as “Beneficial Owners”) must follow the voting instructions provided by their brokers or other nominees. See “What is the difference between holding shares as a Stockholder of Record and as a Beneficial Owner?” and “How do I vote and what are the voting deadlines?” below for additional information. |

5

| Inspector of Elections | We will appoint an independent Inspector of Elections to determine whether a quorum is present, and to tabulate the votes cast by proxy or at the Annual Meeting via live webcast. |

| Voting Results | We will announce preliminary results at the Annual Meeting. We will report final results on a Current Report on Form 8-K filed with the Securities and Exchange Commission (“SEC”) and post results at www.vivani.com as soon as practicable after the Annual Meeting. |

| Proxy Solicitation Costs | We will bear the costs of soliciting proxies from our stockholders. These costs include preparing, assembling, printing, mailing and distributing notices, proxy statements, proxy cards and Annual Reports. Our directors, officers and other employees may solicit proxies personally or by telephone, e-mail or other means of communication, and we will reimburse them for any related expenses. We will also reimburse brokers and other nominees for their reasonable out-of-pocket expenses for forwarding proxy materials to the Beneficial Owners of the shares that the nominees hold in their names. |

6

ABOUT THE ANNUAL MEETING: QUESTIONS AND ANSWERS

What matters am I voting on?

You will be voting on:

| ● | A proposal to elect five directors to hold office until the 2024 annual meeting of stockholders (the “2024 Annual Meeting”) or until their successors are duly elected and qualified; |

| ● | A proposal to ratify the appointment of BPM LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023; |

| ● | A proposal to approve the reincorporation pursuant to which the Company will change the state of its incorporation from California to Delaware; |

| ● | A proposal to approve a provision of the Delaware Charter disallowing cumulative voting; |

| ● | A proposal to approve a provision of the Delaware Charter limiting the Company’s stockholders’ right to remove directors without cause; |

| ● | A proposal to approve a provision of the Delaware Bylaws permitting only the Board to call special meetings; |

| ● | A proposal to approve provisions of the Delaware Charter and Bylaws disallowing action by written consent of stockholders; |

| ● | A proposal to approve a provision of the Delaware Charter providing that, unless Vivani Delaware consents in writing to the selection of an alternate forum, certain intracorporate claims may be brought exclusively in the Delaware Court of Chancery (or, if such court lacks subject matter jurisdiction, the other state or federal courts in the State of Delaware); |

| ● | A proposal to approve a provision of the Delaware Charter requiring any complaint asserting a cause of action under the Securities Act to be brought exclusively in the federal district courts of the United States, unless the Company consents in writing to the selection of an alternative forum; |

| ● | A proposal to approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers; and |

| ● | Any other business that may properly come before the Annual Meeting or any adjournment or postponement thereof. |

How does our board of directors recommend that I vote?

Our board of directors recommends that you vote:

| ● | FOR the election of the five directors nominated by our board of directors and named in this Proxy Statement as directors to serve for one-year terms; |

| ● | FOR the ratification of the appointment of BPM LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023; |

| ● | FOR the approval of reincorporation pursuant to which the Company will change the state of its incorporation from California to Delaware; |

| ● | FOR the approval of a provision of the Delaware Charter disallowing cumulative voting; |

| ● | FOR the approval of a provision of the Delaware Charter limiting the Company’s stockholders’ right to remove directors without cause; |

| ● | FOR the approval of a provision of the Delaware Bylaws permitting only the Board to call special meetings; |

| ● | FOR the approval of provisions of the Delaware Charter and Bylaws disallowing action by written consent of stockholders; |

| ● | FOR the approval of a provision of the Delaware Charter providing that, unless Vivani Delaware consents in writing to the selection of an alternate forum, certain intracorporate claims may be brought exclusively in the Delaware Court of Chancery (or, if such court lacks subject matter jurisdiction, the other state or federal courts in the State of Delaware); |

| ● | FOR the approval of a provision of the Delaware Charter requiring any complaint asserting a cause of action under the Securities Act to be brought exclusively in the federal district courts of the United States, unless the Company consents in writing to the selection of an alternative forum; and |

| ● | FOR, on a non-binding advisory basis, the approval of the compensation of our named executive officers. |

Why did I receive a notice in the mail regarding the Internet availability of proxy materials?

Instead of mailing printed copies to each of our stockholders, we have elected to provide access to our proxy materials over the Internet under the SEC’s “notice and access” rules. These rules allow us to make our stockholders aware of the Annual Meeting and the availability of our proxy materials by sending the Notice of Internet Availability of Proxy Materials, or the Notice, which provides instructions for how to access the full set of proxy materials through the Internet or make a request to have printed proxy materials delivered by mail. Accordingly, on or about April 28, 2023, we mailed the Notice to each of our stockholders. The Notice contains instructions on how to access our proxy materials, including our Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, each of which is available at www.proxydocs.com/VANI. The Notice also provides instructions on how to vote your shares through the Internet, by telephone, by mail or virtually at the Annual Meeting.

What is the purpose of complying with the SEC’s “notice and access” rules?

We believe compliance with the SEC’s “notice and access” rules allows us to provide our stockholders with the materials they need to make informed decisions, while lowering the costs of printing and delivering those materials and reducing the environmental impact of our Annual Meeting. However, if you would prefer to receive printed proxy materials, please follow the instructions included in the Notice. If you have previously elected to receive our proxy materials electronically, you will continue to receive these materials electronically unless you elect otherwise.

Will there be any other items of business on the agenda?

If any other items of business or other matters are properly brought before the Annual Meeting, your proxy gives discretionary authority to the persons named on the proxy card with respect to those items of business or other matters. The persons named on the proxy card intend to vote the proxy in accordance with their best judgment. Our Board does not intend to bring any other matters to be voted on at the Annual Meeting, and we are not currently aware of any matters that may be properly presented by others for action at the Annual Meeting.

7

Who is entitled to vote at the Annual Meeting?

Holders of our common stock at the close of business on the Record Date are entitled to notice of, and to vote at, the Annual Meeting. Each stockholder is entitled to one vote for each share of our common stock held as of the Record Date. You may also cumulate your votes with respect to the election of directors. See “Is cumulative voting permitted with respect to the election of directors” below.

A complete list of the stockholders entitled to vote at the Annual Meeting will be available at our headquarters, located at 5858 Horton Street, Suite 280, Emeryville, CA 94608, during regular business hours for the ten days prior to the Annual Meeting. This list will also be available during the Annual Meeting at this location. Stockholders may examine the list for any legally valid purpose related to the Annual Meeting.

Is cumulative voting permitted with respect to the election of directors?

Yes. You may choose to cumulate your vote in the election of directors. Cumulative voting applies only to the election of directors and allows you to allocate among the director nominees, as you see fit, the total number of votes equal to the number of director positions to be filled multiplied by the number of shares you hold. For example, if you own 100 shares of stock and there are five directors to be elected at the Annual Meeting, you may allocate 500 “FOR” votes (5 times 100) among as few or as many of the five nominees to be voted on at the Annual Meeting as you choose. You may not cumulate your votes withheld against a nominee.

If you are a stockholder of record and choose to cumulate your votes, you will need to submit a proxy card and make an explicit statement of your intent to cumulate your votes by so indicating in writing on the proxy card. If you hold shares beneficially through a broker, trustee or other nominee and wish to cumulate votes, you should contact your broker, trustee or nominee.

If you vote by proxy card or voting instruction card and sign your card with no further instructions, Adam Mendelsohn or Brigid Makes, as proxy holders, may cumulate and cast your votes in favor of the election of some or all of the applicable nominees in their sole discretion, except that none of your votes will be cast for any nominee as to whom you withheld a vote.

What is the difference between holding shares as a Stockholder of Record and as a Beneficial Owner?

Stockholders of Record. If, at the close of business on the Record Date, your shares are registered directly in your name with Vstock Transfer, LLC, our transfer agent, you are considered the Stockholder of Record with respect to those shares. As the Stockholder of Record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or to vote at the Annual Meeting via live webcast.

Beneficial Owners. If your shares are held in a stock brokerage account or by a bank or other nominee on your behalf, you are considered the Beneficial Owner of shares held in “street name.” As the Beneficial Owner, you have the right to direct your broker or nominee how to vote your shares by following the voting instructions your broker or other nominee provides. In general, if you do not provide your broker or nominee with instructions on how to vote your shares, your broker or nominee may, in its discretion, vote your shares with respect to routine matters (e.g., the ratification of the appointment of our independent auditor), but may not vote your shares with respect to any non-routine matters (e.g., the election of directors). Please see “What if I do not specify how my shares are to be voted?” for additional information.

How can I participate in the Annual Meeting?

Our stockholders may participate in the Annual Meeting by visiting the following website: www.proxydocs.com/VANI. You will need the 12-digit control number included on your proxy card to attend and vote at the Annual Meeting. If you are the Beneficial Owner of your shares, your 12-digit control number may be included in the voting instructions form that accompanied your proxy materials. If your nominee did not provide you with a 12-digit control number in the voting instructions form that accompanied your proxy materials, you may be able to log onto the website of your nominee prior to the start of the Annual Meeting, which will automatically populate your 12-digit control number in the virtual Annual Meeting interface. Stockholders who have obtained a 12-digit control number as described above may vote or submit questions while participating in the live webcast of the Annual Meeting. However, even if you plan to attend the Annual Meeting virtually, we recommend that you vote your shares in advance, so that your vote will be counted if you later decide not to attend the Annual Meeting via live webcast.

8

How do I vote and what are the voting deadlines?

Stockholders of Record. Stockholders of Record can vote by proxy or by attending the Annual Meeting virtually by visiting www.proxydocs.com/VANI, where votes can be submitted via live webcast. If you vote by proxy, you can vote by Internet, telephone or by mail as described below.

| ● | You may vote via the Internet or by telephone. To vote via the Internet or by telephone, follow the instructions provided in the Notice or in the proxy card that accompanies this proxy statement. If you vote via the Internet or by telephone, you do not need to return a proxy card by mail. Internet and telephone voting are available 24 hours a day. Votes submitted through the Internet or by telephone must be received by 11:59 p.m. Eastern Time on June 14, 2023. Alternatively, you may request a printed proxy card by following the instructions provided in the Notice. |

| ● | You may vote by mail. If you would like to vote by mail, you need to complete, date and sign the proxy card that accompanies this Proxy Statement and promptly mail it in the enclosed postage-paid envelope so that it is received no later than June 14, 2023. You do not need to put a stamp on the enclosed envelope if you mail it from within the United States. The persons named on the proxy card will vote the shares you own in accordance with your instructions on the proxy card you mail. If you return the proxy card, but do not give any instructions on a particular matter to be voted on at the Annual Meeting, the persons named on the proxy card will vote the shares you own in accordance with the recommendations of our board of directors. Our board of directors recommends that you vote FOR each of Proposal Nos. 1, 2, 3, 4A, 4B, 4C, 4D, 4E, 4F, and 5. |

| ● | You may vote at the Annual Meeting. If you choose to vote at the Annual Meeting virtually, you will need the 12-digit control number included on your Notice or on your proxy card. If you are the beneficial owner of your shares, your 12-digit control number may be included in the voting instructions form that accompanied your proxy materials. If your nominee did not provide you with a 12-digit control number in the voting instructions form that accompanied your proxy materials, you may be able to log onto the website of your nominee prior to the start of the Annual Meeting, on which you will need to select the stockholder communications mailbox link through to the Annual Meeting, which will automatically populate your 12-digit control number in the virtual Annual Meeting interface. The method you use to vote will not limit your right to vote at the virtual Annual Meeting. All shares that have been properly voted and not revoked will be voted at the Annual Meeting. |

Beneficial Owners. If you are the Beneficial Owner of shares held of record by a broker or other nominee, you will receive voting instructions from your broker or other nominee. You must follow the voting instructions provided by your broker or other nominee in order to instruct your broker or other nominee how to vote your shares. The availability of telephone and Internet voting options will depend on the voting process of your broker or other nominee. As discussed above, if you received your 12-digit control number in the voting instructions form that accompanied your Notice or your proxy materials, or if you are able to link through to the Annual Meeting from the website of your nominee and populate your 12-digit control number in the virtual Annual Meeting interface, you will be able to vote virtually at the Annual Meeting.

May I change my vote or revoke my proxy?

Stockholders of Record. If you are a Stockholder of Record, you may revoke your proxy or change your proxy instructions at any time before your proxy is voted at the Annual Meeting by:

| ● | entering a new vote by Internet or telephone; | |

| ● | signing and returning a new proxy card with a later date; | |

| ● | delivering a written revocation to our Secretary at the address listed on the front page of this proxy statement; or |

| ● | attending the Annual Meeting and voting via live webcast. |

9

Beneficial Owners. If you are the beneficial owner of your shares, you must contact the broker or other nominee holding your shares and follow their instructions to change your vote or revoke your proxy.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our board of directors. The persons named on the proxy card have been designated as proxy holders by our board of directors. When a proxy is properly dated, executed and returned, the shares represented by the proxy will be voted at the Annual Meeting in accordance with the instruction of the stockholder. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our board of directors (as shown on the first page of the proxy statement). If any matters not described in the proxy statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote your shares. If the Annual Meeting is postponed or adjourned, the proxy holders can vote your shares on the new meeting date, unless you have properly revoked your proxy, as described above.

What if I do not specify how my shares are to be voted?

Stockholders of Record. If you are a Stockholder of Record and you submit a proxy, but you do not provide voting instructions, your shares will be voted:

| ● | FOR the election of the five directors nominated by our board of directors and named in this Proxy Statement as directors to serve for one-year terms (Proposal No. 1); | |

| ● | FOR the ratification of the appointment of BPM LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023(Proposal No. 2); | |

| ● | FOR the approval of the reincorporation pursuant to which the Company will change the state of its incorporation from California to Delaware (Proposal No. 3); | |

| ● | FOR the approval of a provision of the Delaware Charter disallowing cumulative voting (Proposal No. 4A); | |

| ● | FOR the approval of a provision of the Delaware Charter limiting the Company’s stockholders’ right to remove directors without cause (Proposal No. 4B); | |

| ● | FOR the approval of a provision of the Delaware Bylaws permitting only the Board to call special meetings (Proposal No. 4C); | |

| ● | FOR the approval of provisions of the Delaware Charter and Bylaws disallowing action by written consent of stockholders (Proposal No. 4D); | |

| ● | FOR the approval of a provision of the Delaware Charter providing that, unless Vivani Delaware consents in writing to the selection of an alternate forum, certain intracorporate claims may be brought exclusively in the Delaware Court of Chancery (or, if such court lacks subject matter jurisdiction, the other state or federal courts in the State of Delaware) (Proposal No. 4E); | |

| ● | FOR the approval of a provision of the Delaware Charter requiring any complaint asserting a cause of action under the Securities Act to be brought exclusively in the federal district courts of the United States, unless the Company consents in writing to the selection of an alternative forum (Proposal No. 4F); | |

| ● | FOR, on a non-binding advisory basis, the approval of the compensation of our named executive officers (Proposal No. 5); and | |

| In the discretion of the named proxy holders regarding any other matters properly presented for a vote at the Annual Meeting. |

Beneficial Owners. If you are a Beneficial Owner and you do not provide your broker or other nominee that holds your shares with voting instructions, your broker or other nominee will determine if it has discretion to vote on each matter. In general, brokers and other nominees do not have discretion to vote on non-routine matters. Each of Proposal No. 1 (election of directors), Proposal No. 3 (reincorporation to change the Company’s state of incorporation from California to Delaware), Proposal No. 4A (provision of the Delaware Charter disallowing cumulative voting), Proposal No. 4B (provision of the Delaware Charter limiting the Company’s stockholders’ right to remove directors without cause), Proposal No. 4C (provision of the Delaware Bylaws permitting only the Board to call special meetings), Proposal No. 4D (provisions of the Delaware Charter and Bylaws disallowing action by written consent of stockholders), Proposal No. 4E (provision of the Delaware Charter providing that, unless Vivani Delaware consents in writing to the selection of an alternate forum, certain intra-corporate claims may be brought exclusively in the Delaware Court of Chancery (or, if such court lacks subject matter jurisdiction, the other state or federal courts in the State of Delaware)), Proposal No. 4F (provision of the Delaware Charter requiring any complaint asserting a cause of action under the Securities Act to be brought exclusively in the federal district courts of the United States, unless the Company consents in writing to the selection of an alternative forum) and Proposal No. 5 (endorsement of executive compensation) is a non-routine matter, while Proposal No. 2 (ratification of appointment of independent registered public accounting firm) is a routine matter. As a result, if you do not provide voting instructions to your broker or other nominee, your broker or other nominee cannot vote your shares with respect to Proposal Nos. 1, 3, 4A to 4F and 5, which would result in a “broker non-vote,” but may, in its discretion, vote your shares with respect to Proposal No. 2. For additional information regarding broker non-votes, see “What are the effects of abstentions and broker non-votes?” below.

What is a quorum?

A quorum is the minimum number of shares required to be present at the Annual Meeting for the meeting to be properly held under our bylaws and Delaware law. A majority of the shares of common stock outstanding and entitled to vote, by proxy or at the Annual Meeting via live webcast, constitutes a quorum for the transaction of business at the Annual Meeting. As noted above, as of the Record Date, there were at total of 50,788,699 shares of common stock outstanding, which means that at least 25,394,351 shares of common stock must be represented by proxy or virtually via live webcast at the Annual Meeting to have a quorum. If there is no quorum, a majority of the shares present at the Annual Meeting may adjourn the meeting to a later date.

Abstentions and broker non-votes will be counted towards the quorum requirement.

10

What are the effects of abstentions and broker non-votes?

An abstention represents a stockholder’s affirmative choice to decline to vote on a proposal. Abstentions will be counted for purposes of determining the presence or absence of a quorum.

The outcome of Proposal No. 1 (election of directors) will be determined by a plurality of the voting power of the shares represented and voting at the Annual Meeting, thus abstentions will have no impact on the outcome of the proposal as long as a quorum exists. The outcome of Proposal Nos. 2 and 5 will be determined by the affirmative vote of a majority of the shares of common stock represented and voting at the Annual Meeting if the quorum is present, thus abstentions will have no effect, unless there are insufficient votes in favor of the proposal, such that the affirmative votes constitute less than a majority of the required quorum. In such cases, abstentions will have the same effect as a vote against such proposals. The outcome of Proposal Nos. 3, 4A, 4B, 4C, 4D, 4E, and 4F will be determined by the affirmative vote of a majority of the outstanding shares of common stock entitled to vote, thus abstentions will have the same effect as a vote against such proposals.

A broker non-vote occurs when a broker or other nominee holding shares for a Beneficial Owner does not vote on a particular proposal because the broker or other nominee does not have discretionary voting power with respect to such proposal and has not received voting instructions from the Beneficial Owner of the shares. Broker non-votes will be counted for purposes of calculating whether a quorum is present at the Annual Meeting but will not be counted for purposes of determining the number of votes cast. Therefore, a broker non-vote will make a quorum more readily attainable but will not affect the outcome of the vote on Proposal Nos. 1, 2, 3, 4A to 4F or 5.

How many votes are needed for approval of each proposal?

| Proposal | Vote Required | Effect of Abstentions |

Routine or non-routine Broker Non-Votes |

| Proposal No. 1—Election of directors | Plurality of votes cast | No effect | This is not a routine matter. Broker non-votes will have no effect. |

| Proposal No. 2—Ratification of the appointment of the independent registered public accounting firm | Affirmative vote of a majority of the shares of common stock represented and voting at the annual meeting if the quorum is present (which shares voting affirmatively also constitute at least a majority of the required quorum) | Will have no effect, unless there are insufficient votes in favor of the proposal, such that the affirmative votes constitute less than a majority of the required quorum. In such cases, abstentions will have the same effect as a vote against such proposals. | This is a routine matter. Broker non-votes are not expected. |

| Proposal No. 3—Reincorporation from California to Delaware | Affirmative vote of a majority of the outstanding shares of common stock entitled to vote | Same effect as an “Against” vote | This is not a routine matter. Broker non-votes will have the same effect as an “Against” vote. |

| Proposal No. 4A— Provision of the Delaware Charter disallowing cumulative voting | Affirmative vote of a majority of the outstanding shares of common stock entitled to vote | Same effect as an “Against” vote | This is not a routine matter. Broker non-votes will have the same effect as an “Against” vote. |

| Proposal No. 4B—Provision of the Delaware Charter limiting the Company’s stockholders’ right to remove directors without cause | Affirmative vote of a majority of the outstanding shares of common stock entitled to vote | Same effect as an “Against” vote | This is not a routine matter. Broker non-votes will have the same effect as an “Against” vote. |

| Proposal No. 4C—Provision of the Delaware Bylaws permitting only the Board to call special meetings | Affirmative vote of a majority of the outstanding shares of common stock entitled to vote | Same effect as an “Against” vote | This is not a routine matter. Broker non-votes will have the same effect as an “Against” vote. |

| Proposal No. 4D— Provisions of the Delaware Charter and Bylaws disallowing action by written consent of stockholders | Affirmative vote of a majority of the outstanding shares of common stock entitled to vote | Same effect as an “Against” vote | This is not a routine matter. Broker non-votes will have the same effect as an “Against” vote. |

| Proposal No. 4E—Provision of the Delaware Charter providing that, unless Vivani Delaware consents in writing to the selection of an alternate forum, certain intracorporate claims may be brought exclusively in the Delaware Court of Chancery (or, if such court lacks subject matter jurisdiction, the other state or federal courts in the State of Delaware) | Affirmative vote of a majority of the outstanding shares of common stock entitled to vote | Same effect as an “Against” vote | This is not a routine matter. Broker non-votes will have the same effect as an “Against” vote. |

| Proposal No. 4F—Provision of the Delaware Charter requiring any complaint asserting a cause of action under the Securities Act to be brought exclusively in the federal district courts of the United States, unless the Company consents in writing to the selection of an alternative forum | Affirmative vote of a majority of the outstanding shares of common stock entitled to vote | Same effect as an “Against” vote | This is not a routine matter. Broker non-votes will have the same effect as an “Against” vote. |

| Proposal No. 5—Endorsement of the compensation of executive officers | Affirmative vote of a majority of the shares of common stock represented and voting at the annual meeting if the quorum is present (which shares voting affirmatively also constitute at least a majority of the required quorum) | No effect, unless there are insufficient votes in favor of the proposal, such that the affirmative votes constitute less than a majority of the required quorum. In such cases, abstentions will have the same effect as a vote against such proposals. | This is not a routine matter. Broker non-votes will have no effect. |

With respect to Proposal No. 1, you may vote (i) FOR any or all of the nominees, or (ii) WITHHOLD your vote as to any or all nominees. The five nominees receiving the most FOR votes will be elected. Cumulative voting is permitted with respect to the election of directors. See “Is cumulative voting permitted with respect to the election of directors?” above. If you WITHHOLD your vote as to all nominees, your vote will be treated as if you had ABSTAINED from voting on Proposal No. 1, and your abstention will have no effect on the outcome of the vote.

If you ABSTAIN from voting on Proposal Nos. 2 or 5, the abstention will have no effect, unless there are insufficient votes in favor of the proposal, such that the affirmative votes constitute less than a majority of the required quorum. In such cases, abstentions will have the same effect as a vote against such proposals.

If you ABSTAIN from voting on Proposals Nos. 3, 4A, 4B, 4C, 4D, 4E, or 4F, the abstention will have the same effect as a vote AGAINST the proposal.

How are proxies solicited for the Annual Meeting and who is paying for the solicitation?

The board of directors is soliciting proxies for use at the Annual Meeting by means of this proxy statement. We will bear the entire cost of the proxy solicitation, including the preparation, assembly, printing, mailing and distribution of the proxy materials. Copies of solicitation materials will also be made available upon request to brokers and other nominees to forward to the Beneficial Owners of the shares held of record by the brokers or other nominees. We will reimburse brokers or other nominees for reasonable expenses that they incur in sending these proxy materials to Beneficial Owners.

11

This solicitation of proxies may be supplemented by solicitation by telephone, electronic communication, or other means by our directors, officers, employees or agents. No additional compensation will be paid to these individuals for any such services, although we may reimburse such individuals for their reasonable out-of-pocket expenses in connection with such solicitation. We do not plan to retain a proxy solicitor to assist in the solicitation of proxies.

Is my vote confidential?

Proxy instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within Vivani or to third parties, except as necessary to meet applicable legal requirements, to allow for the tabulation of votes and certification of the vote, or to facilitate a successful proxy solicitation.

Will members of the board of directors attend the Annual Meeting?

We encourage our board members to attend the Annual Meeting. Because this year’s Annual Meeting will be completely virtual, those board members who do attend will not be available to answer questions from stockholders.

I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

We have adopted an SEC-approved procedure called “householding,” under which we can deliver a single copy of the Notice and, if applicable, the proxy materials to multiple stockholders who share the same address unless we received contrary instructions from one or more of the stockholders. This procedure reduces our printing and mailing costs. Stockholders of Record who participate in householding will be able to access and receive separate proxy cards. Upon written or oral request, we will promptly deliver a separate copy of the Notice and, if applicable, the proxy materials to any stockholder at a shared address to which we delivered a single copy of these documents. To receive a separate copy, or, if you are receiving multiple copies, to request that Vivani only send a single copy of the next year’s Notice and, if applicable, the proxy materials, you may contact us as follows:

Vivani

Medical, Inc.

5858 Horton Street, Suite 280

Emeryville,

CA 94608

(818) 833-5000

Stockholders who hold shares in street name may contact their brokerage firm, bank, broker-dealer or other nominee to request information about householding.

Further Questions

Who can help answer my questions?

If you have any questions about the Annual Meeting or how to vote or revoke your proxy, you should contact Adam Mendelsohn, our Chief Executive Officer at adam.mendelsohn@vivani.com.

12

Our business, property and affairs are managed by, or under the direction of, our Board, in accordance with the California Corporations Code and our Bylaws. Members of the Board are kept informed of our business through discussions with the Chief Executive Officer and other key members of management, by reviewing materials provided to them by management, and by participating in regular and special meetings of the Board and its Committees. Stockholders may communicate with the members of the Board, either individually or collectively, or with any independent directors as a group by writing to the Board at 5858 Horton Street, Suite 280, Emeryville, CA 94608. These communications will be reviewed by the office of the Corporate Secretary who, depending on the subject matter, will (a) forward the communication to the director or directors to whom it is addressed or who is responsible for the topic matter, (b) attempt to address the inquiry directly (for example, where it is a request for publicly available information or a stock related matter that does not require the attention of a director), or (c) not forward the communication if it is primarily commercial in nature or if it relates to an improper or irrelevant topic. At each meeting of the Nominating and Governance Committee, the Corporate Secretary presents a summary of communications received and will make those communications available to any director upon request.

Independence of Directors

The Nasdaq Marketplace Rules require a majority of a listed company’s Board of Directors to be comprised of independent directors. In addition, the Nasdaq Marketplace Rules require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and corporate governance committees be independent and that audit committee members also satisfy independence criteria set forth in Rule 10A-3 under the Exchange Act.

Under Rule 5605(a)(2) of the Nasdaq Marketplace Rules, a director will only qualify as an “independent director” if, in the opinion of our Board of Directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In order to be considered independent for purposes of Rule 10A-3 of the Exchange Act, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the Board of Directors, or any other Board committee, accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries or otherwise be an affiliated person of the listed company or any of its subsidiaries.

Our Board of Directors has reviewed the composition of our Board of Directors and the independence of each director. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our Board has determined that each of the directors currently serving on the Board with the exception of Adam Mendelsohn who is employed as Chief Executive Officer of the Company, and Aaron Mendelsohn, who is Adam Mendelsohn’s father, are independent directors under NASDAQ’s rules.

Our Board of Directors also determined that the directors who serve on our audit committee, our compensation committee, and our nominating and corporate governance committee satisfy the independence standards for such committees established by the SEC and the Nasdaq Marketplace Rules, as applicable. In making such determinations, our Board of Directors considered the relationships that each such non-employee director has with our company and all other facts and circumstances our Board of Directors deemed relevant in determining independence, including the beneficial ownership of our capital stock by each non-employee director.

Board Diversity

Our Nominating and Governance Committee believes that backgrounds and qualifications of the directors considered as a group should provide a significant breadth of experience, knowledge and abilities that shall assist the Board in fulfilling its responsibilities. Although the Nominating and Corporate Governance Committee does not have a formal diversity policy and does not follow any ratio or formula with respect to diversity in order to determine the appropriate composition of the Board, the Nominating and Corporate Governance Committee is committed to creating a Board that promotes our strategic objectives and fulfills its responsibilities to our stockholders, and considers diversity (including diversity of gender, race, ethnicity, age, sexual orientation and gender identity) education, professional experience, and differences in viewpoints and skills when evaluating proposed director candidates.

We comply with Nasdaq Rule 5605 by having one diverse director who self-identifies as female. As required by Nasdaq Rule 5606, we are providing additional information about the gender and demographic diversity of our directors in the format required by such rule. The information in the matrix below is based solely on information provided by our directors about their gender and demographic self-identification.

| Board Diversity Matrix (As of April 14, 2023) | ||||

| Total Number of Directors | 5 | |||

| Female | Male | Non-Binary | Did Not Disclose Gender | |

| Part I: Gender Identity | ||||

| Directors | 1 | 4 | ||

| Part II: Demographic Background | ||||

| African American or Black | ||||

| Alaskan Native or Native American | ||||

| Asian | ||||

| Hispanic or Latinx | ||||

| Native Hawaiian or Pacific Islander | ||||

| White | 1 | 4 | ||

| Two or More Races or Ethnicities | ||||

| LGBTQ+ | ||||

| Did Not Disclose Demographic Background | ||||

Board Meetings and Committees of our Board

The Board has three standing committees each of which has the composition described below and responsibilities that satisfy the independence standards of the Securities Exchange Act of 1934 and NASDAQ’s rules: the Audit Committee, the Compensation Committee, and the Nominating and Governance Committee. During the year ended December 31, 2022, the Board held 7 meetings, the Audit Committee held 4 meetings, the Compensation Committee held 4 meetings, and the Nominating and Governance Committee held 1 meeting that was conducted through unanimous written consent. Each of our directors attended 75% of the combined Board meetings and meetings of the Board committees of which they are a member. We do not have a policy with regard to Board attendance at the Annual Meeting.

13

Committees of the Company’s Board of Directors

Our Board of Directors has an Audit Committee, a Compensation Committee and a Corporate Governance and Nominating Committee, each of which has the composition and the responsibilities described below.

Audit Committee

The Audit Committee is comprised of Dean Baker, as chair, Gregg Williams and Alexandra Larson, each of whom is “independent” as defined under section 5605(a)(2) of the Nasdaq Listing Rules. In addition, the board of directors has determined that Mr. Baker is an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K promulgated under the Securities Act. The role of the Audit Committee is to:

| ● | oversee management’s preparation of Vivani’s financial statements and management’s conduct of the accounting and financial reporting processes; |

| ● | oversee management’s maintenance of internal controls and procedures for financial reporting; |

| ● | oversee Vivani’s compliance with applicable legal and regulatory requirements, including without limitation, those requirements relating to financial controls and reporting; |

| ● | select a firm to serve as the independent registered public accounting firm to audit Vivani’s financial statements; |

| ● | oversee the independent auditor’s qualifications and independence; |

| ● | oversee the performance of the independent auditors, including the annual independent audit of Vivani’s financial statements; |

| ● | prepare the report required by the rules of the SEC to be included in Vivani’s Proxy Statement; and |

| ● | discharge such duties and responsibilities as may be required of the Committee by the provisions of applicable law, rule or regulation. |

A copy of the charter of the Audit Committee is available on our website at www.vivani.com (under “Investors – Governance”).

Compensation Committee

The Compensation Committee is comprised of Dean Baker, as chair, Alexandra Larson and Gregg Williams, each of whom we deem to be “independent” as defined in section 5605(a)(2) of the Nasdaq Listing Rules.

The role of the Compensation Committee is to:

| ● | review annually Vivani’s overall compensation strategy, including base salary, incentive compensation and equity-based grants, to assure that it promotes stockholder interests and supports Vivani’s strategic and tactical objectives; |

| ● | review annually and approve the factors to be considered in determining the compensation of the Chief Executive Officer of Vivani and Vivani’s other executive officers; |

| ● | review, approve and recommend to the Board the annual compensation (base salary, bonus, equity compensation and other benefits) for Vivani’s Chief Executive Officer and other executive officers; |

| ● | review, approve and recommend to the Board the annual compensation (base salary, bonus, equity compensation and other benefits) for all of Vivani’s executive officers; |

| ● | review, annually, and, if necessary, approve or recommend to the Board the aggregate number of equity awards to be granted to employees below the executive level; |

| ● | oversee Vivani’s compliance with regulatory requirements associated with compensation matters; and |

| ● | prepare certain portions of Vivani’s annual Proxy Statement, including an annual report on executive compensation. |

14

A copy of the charter of the Compensation Committee is available on Vivani’s website at www.vivani.com (under “Investors—Governance”).

The Compensation Committee may form and delegate a subcommittee consisting of one or more members to perform the functions of the Compensation Committee. The Compensation Committee may engage outside advisers, including outside auditors, attorneys and consultants, as it deems necessary to discharge its responsibilities. The Compensation Committee has sole authority to retain and terminate any compensation expert or consultant to be used to provide advice on compensation levels or assist in the evaluation of director, President/Chief Executive Officer or senior executive compensation, including sole authority to approve the fees of any expert or consultant and other retention terms. In addition, the Compensation Committee considers, but is not bound by, the recommendations of Vivani’s Chief Executive Officer with respect to the compensation packages of our other executive officers.

Nominating and Governance Committee

The Nominating and Corporate Governance Committee is comprised of Gregg Williams, as chair, Dean Baker and Alexandra Larson, each of whom we deemed to be “independent” as defined in section 5605(a)(2) of the Nasdaq Listing Rules.

The role of the Nominating and Governance Committee is to:

| ● | evaluate from time to time the appropriate size (number of members) of the Board and recommend any increase or decrease; |

| ● | determine the desired skills and attributes of members of the Board, considering the needs of the business and listing standards; |

| ● | establish criteria for prospective members, conduct candidate searches, interview prospective candidates, and oversee programs to introduce the candidate to Vivani, Vivani’s management, and operations; |

| ● | review planning for succession to the position of Chairman of the Board and Chief Executive Officer and other senior management positions; |

| ● | annually recommend to the Board persons to be nominated for election as directors; |

| ● | recommend to the Board the members of all standing Committees; |

| ● | adopt or develop for Board consideration corporate governance principles and policies; and |

| ● | periodically review and report to the Board on the effectiveness of corporate governance procedures and the Board as a governing body. |

A copy of the charter of the Nominating and Governance Committee is available on Vivani’s website www.vivani.com (under “Investors — Governance”).

Policy with Regard to Security Holder Recommendations

The Nominating and Governance Committee has a policy with regards to consideration of director candidates recommended by stockholders. For the recommendation of a security holder to be considered under this policy, the recommending stockholder or group of stockholders must have held at least three percent of Vivani’s voting common stock for at least one year as of the date the recommendation was made. For each annual meeting of stockholder, the Nominating and Governance Committee will accept for consideration only one recommendation from any stockholder or affiliated group of stockholders. The Nominating and Governance Committee will also consider the extent to which the stockholder making the nominating recommendation intends to maintain its ownership interest in Vivani. Any director nominated must represent the interests of all stockholders and not serve for the purpose of favoring or advancing the interests of any particular stockholder group or other constituency. All recommendations submitted by stockholders will be considered in the same manner and under the same process as any other recommendations submitted from other sources.

15

All stockholder nominating recommendations must be in writing. Submissions must be made by mail, courier or personal delivery, addressed to the Nominating and Governance Committee care of Vivani’s corporate secretary at Vivani’s principal offices. Recommendations must include certain information regarding the recommending stockholder(s) and the proposed nominee(s). The recommending stockholder(s) must state whether, in the view of the stockholder(s), the nominee(s), if elected, would represent all stockholders and not serve for the purpose of advancing or favoring any particular stockholder(s) or other constituency of Vivani. The nominating recommendation must be accompanied by the written consent of the proposed nominee(s) to: (a) be considered by the Nominating and Governance Committee and interviewed, and (b) if nominated and elected, to serve as a director.

If the Reincorporation proposal (Proposal No. 3) is approved by stockholders at the 2023 Annual Meeting, the Company’s Delaware Bylaws will provide further requirements for advance notice of stockholder nominations.

Policy on Trading, Pledging and Hedging of Company Stock

Our board of directors have adopted an Insider Trading Policy that applies to our board of directors, our officers and employees, the officers and employees of our subsidiaries, as well as to family members, other members of a person’s household, and entities controlled by a persons covered under the Insider Trading Policy. Certain transactions in our securities (such as purchases and sales of publicly traded put and call options, and short sales) create a heightened compliance risk or could create the appearance of misalignment between management and stockholders. In addition, securities held in a margin account or pledged as collateral may be sold without consent if the owner fails to meet a margin call or defaults on the loan, thus creating the risk that a sale may occur at a time when an officer or director is aware of material, non-public information or otherwise is not permitted to trade in Company securities. Therefore, as part of our Insider Trading Policy, we expressly prohibit the above-mentioned persons from engaging in certain prohibited transactions, including short sales, purchases or sales of derivative securities or hedging transactions, the use of our securities as collateral in a margin account, and pledging of our securities.

Director Qualifications and Diversity

The Board seeks independent directors who represent a diversity of backgrounds and experiences that will enhance the quality of the Board’s deliberations and decisions who each will represent the best interests of Vivani and its stockholders. Candidates should have substantial experience with one or more publicly traded companies or should have achieved a prominent level of distinction in their chosen fields. The Board is particularly interested in maintaining a mix that includes individuals who are active or retired executive officers and senior executives, particularly those with experience in medical devices, biotechnology, intellectual property, early-stage technology companies, research and development, strategic planning, business development, compensation, finance, accounting or banking.

The Board believes that the directors nominated collectively have the experience and skills effectively to oversee the management of Vivani, including a high level of personal and professional integrity, an ability to exercise sound business judgement on a broad range of issues, sufficient experience and background to have an appreciation of the issues facing Vivani, and a willingness to devote the necessary time to Board duties.

Role of Board in Risk Oversight

Enterprise risks are identified and prioritized by management and each prioritized risk is assigned to a board committee or the full board for oversight as follows:

Full Board — Risks and exposures associated with strategic, financial and execution risks and other current matters that may present material risk to Vivani’s operations, plans, prospects or reputation.

Audit Committee — Risks and exposures associated with financial matters, particularly financial reporting, tax, accounting, disclosure, internal control over financial reporting, financial policies, investment guidelines and credit and liquidity matters.

Nominating and Governance Committee — Risks and exposures relating to corporate governance and management and director succession planning.

Compensation Committee — Risks and exposures associated with leadership assessment and compensation programs and arrangements, including incentive plans that compare to market and target employee retention.

Code of Business Conduct and Ethics

The Company adopted a Code of Business Conduct and Ethics (“Code of Ethics”) applicable to its principal executive officer. In addition, the Code of Ethics applies to Vivani’s employees, officers, directors, agents and representatives. The Code of Ethics requires, among other things, that Vivani’s employees avoid conflicts of interest, comply with all laws and other legal requirements, conduct business in an honest and ethical manner, and otherwise act with integrity and in our best interest. The Code of Ethics is available on our website at www.vivani.com (under “Investors — Governance — Governance Documents — Code of Business Conduct and Ethics”).

16

PROPOSALS

THE

BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR EACH OF

PROPOSALS Nos. 1, 2, 3, 4A to 4F and 5 BELOW.

PROPOSAL No. 1 — ELECTION OF DIRECTORS

Nominees for Election

The Company’s Board of Directors currently has five members. Our Board has nominated our five incumbent directors for election at the Annual Meeting to terms expiring at the 2024 annual meeting of stockholders and until their successors are duly elected and qualified, subject to earlier resignation or removal. If any nominee is unable or declines to stand for election, which circumstance we do not anticipate, the Board may designate a substitute. In that event, shares represented by proxies may be voted for a substitute nominee.

Our Director Qualifications and Diversity guidelines contain the current Board membership criteria that apply to nominees recommended for a position on the Board. Under those criteria, members of the Board should have the highest professional and personal ethics and values, consistent with our longstanding values and standards. They should have broad experience at the policy-making level in business, government, education, technology or public service. They should be committed to enhancing stockholder value and should have sufficient time to perform their duties and to provide insight and practical wisdom based on experience. In addition, the Nominating and Governance Committee considers a potential director’s ability to contribute to the diversity of background and experience represented on the Board, and it reviews its effectiveness in balancing these considerations when assessing the composition of the Board. Directors’ service on other boards of public companies should be limited to a number that permits them, given their individual circumstances, to perform responsibly all director duties. Each director must represent the interests of all of our stockholders. Although the Board uses these and other criteria as appropriate to evaluate potential nominees, it has no stated minimum criteria for nominees.

The Board believes that all the nominees named below are highly qualified and have the skills and experience required for effective service on the Board. The nominees’ individual biographies below contain information about their experience, qualifications and skills that led the Board to nominate them:

Nominee’s or Director’s Name |

Age | Year First Became Director |

Position with the Company | |||

| Gregg Williams (1)(2)(3*) | 64 | 2009 | Independent Director, Chairman of the Board | |||

| Aaron Mendelsohn | 71 | 1998 | Director | |||

| Dean Baker(1*)(2*)(3) | 80 | 2021 | Independent Director | |||

| Alexandra Larson(1)(2)(3) | 43 | 2021 | Independent Director | |||

| Adam Mendelsohn | 41 | 2022 | Director, Chief Executive Officer |

(1) Member of the Audit Committee of the Board of Directors

(2) Member of the Compensation Committee of the Board of Directors

(3) Member of the Nominating and Corporate Governance Committee of the Board of Directors

* Chair of the respective committee.

Gregg Williams: Mr. Williams has served as a member of our Board of Directors since the Merger of our predecessor Second Sight Medical Products, Inc. (“Second Sight”) with Nano Precision Medical, Inc. (“NPM”) (the “Merger”) in 2022. Prior to that Mr. Williams served on the board of Second Sight since June 2009 and was appointed Chairman of the Second Sight board in March 2018. Mr. Williams was also a member of the board of directors of NPM until the Merger in 2022. Mr. Williams is the Chairman, President, and Chief Executive Officer at Williams International Co., LLC (“Williams International”) (www.williams-int.com), a leading developer and manufacturer of gas turbine engines and one of the largest privately owned companies in the aviation industry, positions he has held since July 1999. Previously, Mr. Williams held several key managerial positions within Williams International including serving as its President and Chief Operating Officer, Vice President, Advanced Technology, Director, Program Management and Director, Engineering. In addition, Mr. Williams is Chairman and majority owner of Ramos Arizpe Manufacturing (www.ram-mx.com), a high-volume automotive engine parts manufacturing company located in Mexico. Mr. Williams received a Bachelor of Science in Mechanical Engineering from the University of Utah and holds numerous patents related to gas turbine engines, turbo machinery, rocket engines and control systems. He is a board member of General Aviation Manufacturers Association and former member of the Henry Ford Hospital Board. We believe Mr. Williams is qualified to serve on our Board due to his business and senior management experience, extensive knowledge of our operations and deep background in technology-focused manufacturing companies which is highly relevant to us.

17

Aaron Mendelsohn: Mr. Mendelsohn has served as a member of our Board of Directors since the Merger in 2022. He was a founder and has previously served as a director of Second Sight since its inception in 2003 till the Merger in 2022. He was also a founder and director of NPM from 2011 till the Merger in 2022. Mr. Mendelsohn served on the board of Advanced Bionics, a global leader in developing advanced cochlear implant systems, since shortly after its founding in 1993 until its sale in 2004 to Boston Scientific Corp. Mr. Mendelsohn was also a founder and director of Medical Research Group, Inc., a company that designed and manufactured implantable technologies primarily for the treatment of diabetes, from its inception in 1998 until its sale in 2001 to Medtronic, Inc. Mr. Mendelsohn previously served on the board of directors for the Alfred E. Mann Institute for Biomedical Engineering at the University of Southern California since its inception in 1998 until 2016. Mr. Mendelsohn is a founder and has served as Chairman of the Maestro Foundation since it was organized in 1983. The Maestro Foundation is a leading non-profit musical philanthropic organization which hosts a premier chamber music series and lends professional-level instruments and bows to young, career-bound classical musicians. Mr. Mendelsohn received his B.A. from UCLA and J.D. from Loyola University School of Law Los Angeles. We believe that Mr. Mendelsohn’s business experience, including his experience as a founder, board member and executive officer of medical device companies, combined with his financial experience, business acumen, and judgment provide our Board with valuable managerial and operational expertise and leadership skills making him professionally qualified to continue serving as one of our directors.

Dean Baker: Dr. Baker has served as a member of our Board of Directors since the Merger in 2022. Dr. Baker has served on the Board of Directors of NPM from 2013 till the Merger in 2022 and currently serves on the Board of Directors of Transonic Imaging, a medical imaging startup, since 2018. Mr. Baker served on the Board of Directors of Advanced Bionics, a global leader in developing advanced cochlear implant systems, prior to its sale to Boston Scientific, a manufacturer of medical devices. In addition, he was the founding director of the Alfred E. Mann Institute for Biomedical Engineering at USC and served for nine years on the Board of Directors (including serving on compensation, audit, and governance committees) for Semtech, a publicly traded semiconductor company. Dr. Baker was also a vice president of Northrop Grumman, a multinational aerospace and defense technology company, for 16 years from 1983 to 1999 including overseeing a division with $1 billion in annual sales. We believe Dr. Baker is qualified to serve on our Board because of his experience as a director on multiple boards and his scientific background.

Alexandra L.P. Larson: Ms. Larson has served as a member of our Board of Directors since the Merger in 2022. She was previously a director at Second Sight from 2021 until the Merger in 2022. She serves as Senior Vice President and General Counsel of Williams International, a privately held designer and manufacturer in the aerospace and defense industry, since January 2019. Prior to Williams International, from 2013 to January 2019, Ms. Larson was Legal Director and Associate General Counsel at Amcor, a global packaging company. Ms. Larson also served as Corporate Counsel at Compuware Corporation, a software company with products aimed at the information technology departments of large businesses, from 2012 to 2013, and Associate in the mergers & acquisitions practice of the global law firm Baker and McKenzie, in its New York office, from 2008 to 2012. Ms. Larson has also held roles at the New York Stock Exchange, and the United States Department of Justice, Antitrust Division. Ms. Larson is a graduate of the University of Michigan Law School (Ann Arbor), Hamilton College in Clinton, New York, and the University of Tennessee, Knoxville Haslam College of Business’s Aerospace & Defense MBA Program. We believe Ms. Larson is qualified to serve on our Board due to her legal and business experience, and leadership skills.

Adam Mendelsohn, Ph.D.: Dr. Mendelsohn has served as our Chief Executive Officer and as a member of our Board of Directors since the Merger in 2022. Prior to this, Dr. Mendelsohn served as the Chief Executive Officer of NPM between from 2009 till 2022. Dr. Mendelsohn received his Ph.D. in bioengineering at the UC San Francisco/UC Berkeley Joint Graduate Group in Bioengineering, Class of 2011, during which he was awarded an NSF fellowship to perform research at Kyoto University and published multiple peer-reviewed articles describing new treatment options for Type 1 diabetes through the immuno-isolated transplantation of insulin-producing cells under the direction of Professor Tejal A. Desai. While in graduate school, Dr. Mendelsohn served as the director for the Venture Innovation Program in Life Sciences and completed his certificate in Management of Technology with the Haas School of Business. Dr. Mendelsohn has served as a Technical Advisor to the Alfred E. Mann Institute for Biomedical Engineering at USC, a fellow of the Startup Leadership Program, the President of UCSF’s Graduate Division Alumni Association and is currently a board member of the Maestro Foundation. We believe Dr. Mendelsohn is qualified to serve on the combined company’s board of directors because of his scientific background and his senior management experience in the biotechnology industry.

18

Vote Required and Recommendation

Each of the director nominees in this Proposal No. 1 is elected by the affirmative vote of a plurality of the voting power represented at the annual meeting. Each director nominee who receives more “FOR” votes than “AGAINST” votes representing shares of our common stock present in person or represented by proxy and entitled to be voted at the Annual Meeting will be elected. Abstentions from voting on the proposal and broker non-votes will not be counted as votes cast and accordingly will have no effect upon the outcome of this proposal. It is anticipated that Proposal No. 1 will be a non-discretionary proposal considered non-routine under the rules of NYSE.

All of the nominees have indicated to us that they will be available to serve as directors. In the event that any nominee should become unavailable, the proxy holders, Adam Mendelsohn or Brigid Makes will vote for a nominee or nominees designated by the Board.

Apart from Aaron Mendelsohn and Adam Mendelsohn who are family members, there are no family relationships among our executive officers and directors. Aaron Mendelsohn is the father of Adam Mendelsohn.

If you sign your proxy or voting instruction card but do not give instructions with respect to voting for directors, your shares will be voted by Adam Mendelsohn or Brigid Makes, as proxy holders. If you wish to give specific instructions with respect to voting for directors, you may do so by indicating your instructions on your proxy or voting instruction card.

You may cumulate your votes in favor of one or more of the director nominees. If you wish to cumulate your votes, you will need to indicate explicitly your intent to cumulate your votes among the five persons who will be voted upon at the Annual Meeting. See “Questions and Answers—Voting Information—Is cumulative voting permitted for the election of directors?” for further information about how to cumulate your votes. Adam Mendelsohn or Brigid Makes as proxy holders, reserve the right to cumulate votes and cast such votes in favor of the election of some or all of the applicable nominees in their sole discretion, except that a stockholder’s votes will not be cast for a nominee as to whom such stockholder instructs that such votes be cast “AGAINST” or “ABSTAIN.”

Our Board recommends a vote “FOR” each of the nominees.

Director Compensation

Non-Employee Director Compensation Program

During 2022, we adopted a non-employee director compensation policy, which is designed to enable us to attract and retain on a long-term basis, highly qualified non-employee directors. Under the policy, our non-employee directors are eligible to receive cash retainers (which will be prorated for partial years of service) and equity awards as follows:

| Annual Retainer | ||||

| Board of Directors: | ||||

| All nonemployee members | $ | 35,000 | ||