Exhibit 99.1

Vivani Medical, Inc. Guaranteed Adherence. Better Outcomes. Nasdaq: VANI November 14, 2023 www.vivani.com

Disclaimers The following slides and any accompanying oral presentation contain forward - looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the "s afe harbor" created by those sections. All statements in this release that are not based on historical fact are "forward looking statements." These sta tements may be identified by words such as "estimates," "anticipates," "projects," "plans" or "planned," "strategy," “goal," "seeks," "may," "will," "expe cts ," "intends," "believes," "should," and similar expressions, or the negative versions thereof, and which also may be identified by their context. All statements that ad dress operating performance or events or developments that Vivani Medical, Inc. ("Vivani", the "Company", "we" or "us) expects or anticipates will occur in the future, such as stated objectives or goals, our products and their therapeutic potential and planned development, the indications that we intend to target, our te chnology, our business and strategy, milestones, addressable markets, or that are not otherwise historical facts, are forward - looking statements. While man agement has based any forward - looking statements included in this presentation on its current expectations, the information on which such expectations were based may change. Forward - looking statements involve inherent risks and uncertainties which could cause actual results to differ materially from t hose in the forward - looking statements as a result of various factors. These risks and uncertainties include, but are not limited to, that we may fail to complete any required pre - clinical activities for NPM - 119 or otherwise commence our planned clinical trial for this product under development; conduct any pre - clin ical activities of our other products; our products may not demonstrate safety or efficacy in clinical trials; we may fail to secure marketing approvals f or our products; there may be delays in regulatory approval or changes in regulatory framework that are out of our control; our estimation of addressable m ark ets of our products may be inaccurate; we may fail to timely raise additional required funding; more efficient competitors or more effective competing t rea tment may emerge; we may be involved in disputes surrounding the use of our intellectual property crucial to our success; we may not be able to attract a nd retain key employees and qualified personnel; earlier study results may not be predictive of later stage study outcomes; and we are dependent on third - pa rties for some or all aspects of our product manufacturing, research and preclinical and clinical testing. Additional risks and uncertainties are described in ou r Annual Report on Form 10 - K filed on March 31, 2023, and our subsequent filings with the SEC. We urge you to consider those risks and uncertainties in ev alu ating our forward - looking statements. We caution readers not to place undue reliance upon any such forward - looking statements, which speak only as of the date made. Except as otherwise required by the federal securities laws, we disclaim any obligation or undertaking to publicly release any updates or revisions to any fo rward - looking statement contained herein (or elsewhere) to reflect any change in our expectations with regard thereto, or any change in eve nts , conditions, or circumstances on which any such statement is based. Certain information contained in this presentation relates to or is based on studies, publications, surveys and other data obtained from third party sources and the Company’s own internal estimates and research. While we believe these third - party sources to be reliable as of the date of this presentation, we have not independently verified, and make no representation as to the adequacy, fairness, a ccu racy or completeness of, any information obtained from third - party sources. Finally, while we believe our own internal research is reliable, such research ha s not been verified by any independent source. All of our therapies are still investigational and have not been approved by any regulatory authority for an y use. 2

Vivani Executive Leadership Team • Co - founder/Co - inventor of Vivani technology • PhD Bioengineering (UCSF/UC Berkeley) • Management of Technology Certificate at Haas School of Business • Research focused on diabetes treatment • Formerly at Boston Scientific and Minimed Adam Mendelsohn PhD – CEO/Director • Numerous COO and Executive Positions at Device and Drug - Device Companies, including: • COO at Dance Biopharm , COO at Avid Bio • Exec VP at Prima Biomed, Sr. VP at Nektar Therapeutics (responsible for Exubera approval), and Worldwide VP at Johnson & Johnson Truc Le, MBA – Chief Operations Officer • Former Chief Medical Officer for Eiger BioPharmaceuticals and Dance BioPharm • Former VP of Medical Development for Amylin • Former Director at GSK, Global Head of Clinical Strategy for Avandia • Former Board member of ViaCyte , Inc. Lisa Porter, MD – Chief Medical Officer • Former Sr. VP and CFO Miramar Labs • Former Sr. VP and CFO AGA Medical • Former CFO Nektar Therapeutics, OraVax and Haemonetics • Current Board director: Quantum - Si and Aziyo Biologics • Involved in/Directed 2 IPOs, 2 reverse mergers and 1 SPAC Brigid A. Makes, MBA – Chief Financial Officer • Former Executive Director at AstraZeneca with leadership roles in drug development, commercial and business development • Former Vivani Board observer for AZ • Former PhaseBio Board observer for AZ (prior to IPO) • Former Director at Cephalon and Rhone Poulenc Rorer Donald Dwyer, MBA – Chief Business Officer 3

Vivani Medical, Inc. Lead programs NPM - 119 and NPM - 115 are miniature, six - month, GLP - 1 implants under development for the treatment of type 2 diabetes and chronic weight management in obese or overweight patients, respectively. Vivani’s pipeline also contains NPM - 139, using an undisclosed molecule, with the potential for once - yearly administration. An innovative, biopharmaceutical company developing a portfolio of miniature, long - term, drug implants to treat chronic disease. Our NanoPortal ™ platform technology enables the design of implants aimed at improving medication non - adherence and tolerability. Vivani is well - positioned to advance NPM - 119 and NPM - 115 towards potentially transformational milestones in 2024. 4

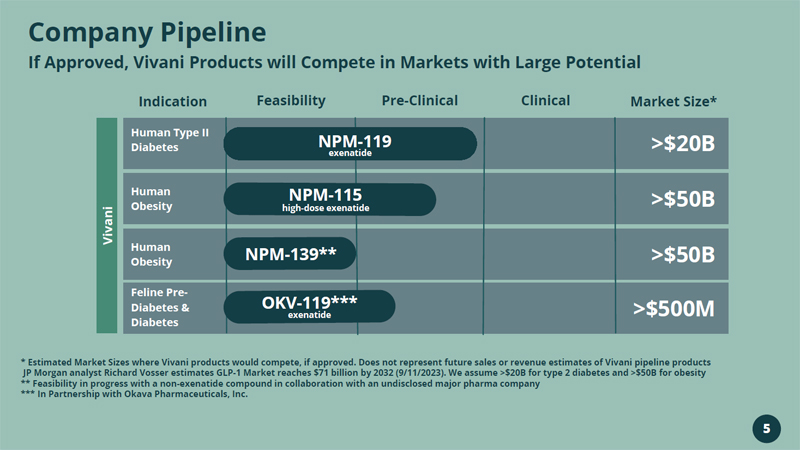

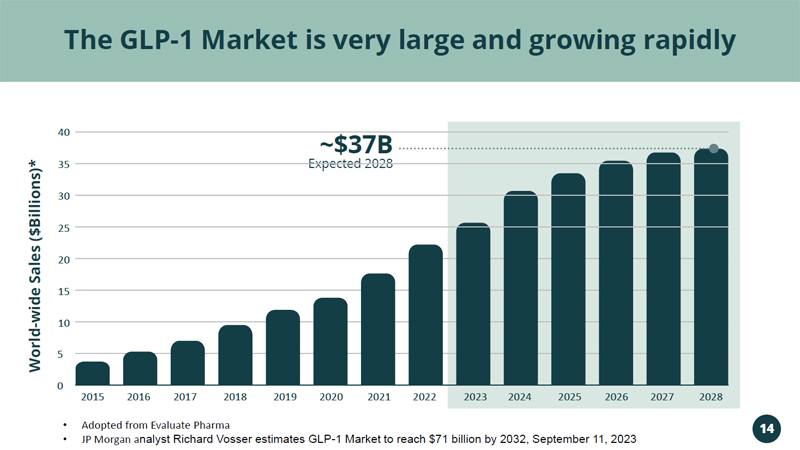

Feline Pre - Diabetes & Diabetes >$500M Human Obesity >$50B 5 Company Pipeline If Approved, Vivani Products will Compete in Markets with Large Potential Indication Feasibility Pre - Clinical Clinical Market Size* Human Type II Diabetes Human Obesity NPM - 119 exenatide >$20B >$50B NPM - 139** Vivani * Estimated Market Sizes where Vivani products would compete, if approved. Does not represent future sales or revenue estimat es of Vivani pipeline products JP Morgan analyst Richard Vosser estimates GLP - 1 Market reaches $71 billion by 2032 (9/11/2023). We assume >$20B for type 2 diabetes and >$50B for obesity ** Feasibility in progress with a non - exenatide compound in collaboration with an undisclosed major pharma company *** In Partnership with Okava Pharmaceuticals, Inc. OKV - 119*** exenatide NPM - 115 h igh - dose exenatide

Drug Implants Proprietary Platform Technology

Potential application with many molecular types Designed to Assure Adherence Minimally - fluctuating and tunable delivery profiles NanoPortal: Innovative Delivery Technology Drug Reservoir Nanotube Membrane 7

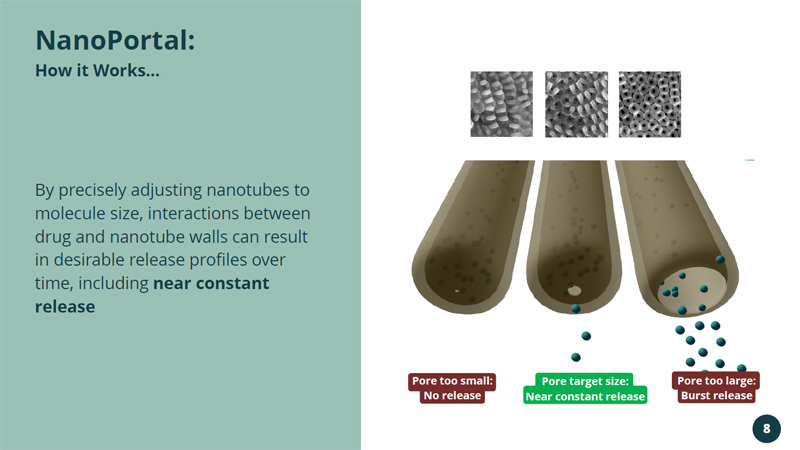

By precisely adjusting nanotubes to molecule size, interactions between drug and nanotube walls can result in desirable release profiles over time, including near constant release NanoPortal : How it Works... Pore too small: No release Pore target size: Near constant release Pore too large: Burst release 8

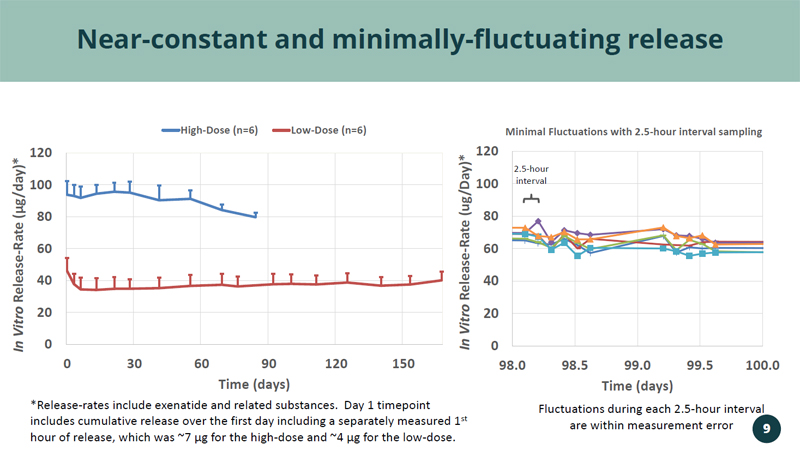

0 20 40 60 80 100 120 98.0 98.5 99.0 99.5 100.0 In Vitro Release - Rate (ug/Day)* Time (days) Minimal Fluctuations with 2.5 - hour interval sampling Near - constant and minimally - fluctuating release *Release - rates include exenatide and related substances. Day 1 timepoint includes cumulative release over the first day including a separately measured 1 st hour of release, which was ~7 µg for the high - dose and ~4 µg for the low - dose. Fluctuations during each 2.5 - hour interval are within measurement error 2.5 - hour interval 0 20 40 60 80 100 120 0 30 60 90 120 150 In Vitro Release - Rate ( µ g/day)* Time (days) High-Dose (n=6) Low-Dose (n=6) 9

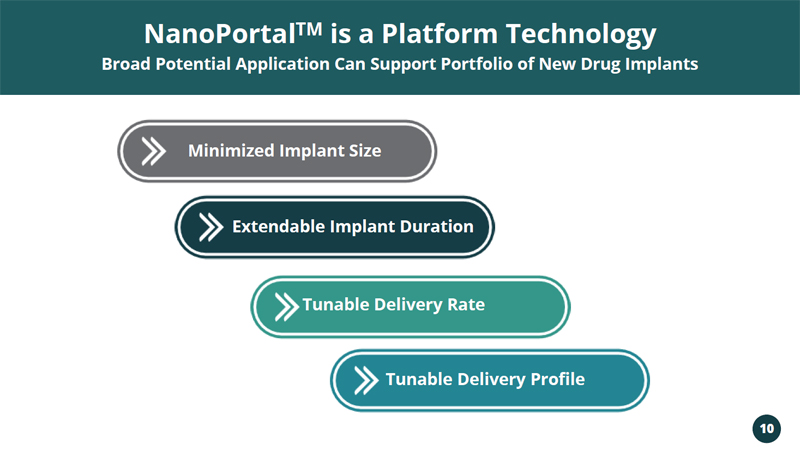

Minimized Implant Size Extendable Implant Duration Tunable Delivery Rate Tunable Delivery Profile NanoPortal TM is a Platform Technology Broad Potential Application Can Support Portfolio of New Drug Implants 10

Targeting the Rapidly Growing GLP - 1 RA Market Vivani’s Lead Program NPM - 119

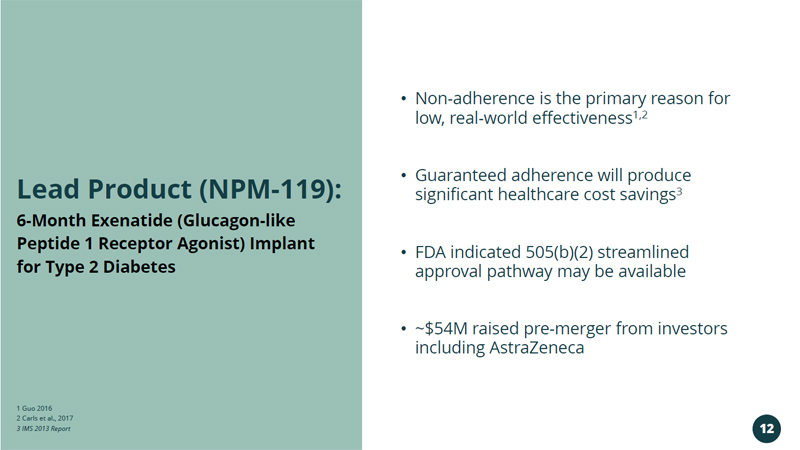

1 Guo 2016 2 Carls et al., 2017 3 IMS 2013 Report • Non - adherence is the primary reason for low, real - world effectiveness 1,2 • Guaranteed adherence will produce significant healthcare cost savings 3 • FDA indicated 505(b)(2) streamlined approval pathway may be available • ~$54M raised pre - merger from investors including AstraZeneca 6 - Month Exenatide (Glucagon - like Peptide 1 Receptor Agonist) Implant for Type 2 Diabetes Lead Product (NPM - 119): 12

NPM - 119 Implant and Applicator 13

2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 40 20 15 10 5 0 Expected 2028 ~$37B The GLP - 1 Market is very large and growing rapidly World - wide Sales ($Billions)* • Adopted from Evaluate Pharma • JP Morgan a nalyst Richard Vosser estimates GLP - 1 Market to reach $71 billion by 2032, September 11, 2023 14 35 30 25

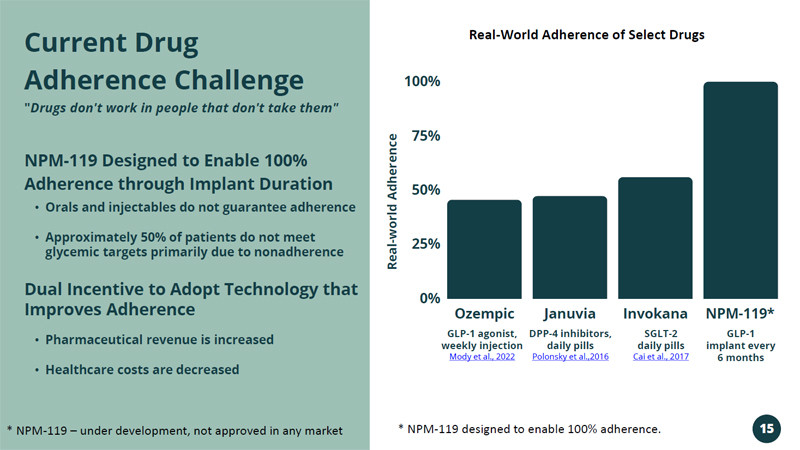

Ozempic Januvia Invokana NPM - 119* 100% 75% 50% 25% 0% GLP - 1 agonist, weekly injection Mody et al., 2022 DPP - 4 inhibitors, daily pills Polonsky et al.,2016 SGLT - 2 daily pills Cai et al., 2017 GLP - 1 implant every 6 months • Orals and injectables do not guarantee adherence • Approximately 50% of patients do not meet glycemic targets primarily due to nonadherence NPM - 119 Designed to Enable 100% Adherence through Implant Duration Dual Incentive to Adopt Technology that Improves Adherence • Pharmaceutical revenue is increased • Healthcare costs are decreased Current Drug Adherence Challenge " Drugs don't work in people that don't take them" Real - world Adherence * NPM - 119 – under development, not approved in any market * NPM - 119 designed to enable 100% adherence. Real - World Adherence of Select Drugs 15

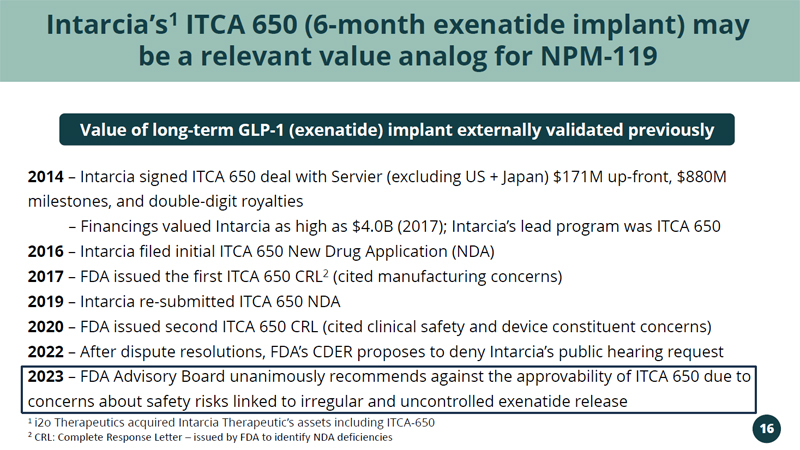

Intarcia’s 1 ITCA 650 (6 - month exenatide implant) may be a relevant value analog for NPM - 119 2014 – Intarcia signed ITCA 650 deal with Servier (excluding US + Japan) $171M up - front, $880M milestones, and double - digit royalties – Financings valued Intarcia as high as $4.0B (2017); Intarcia’s lead program was ITCA 650 2016 – Intarcia filed initial ITCA 650 New Drug Application (NDA) 2017 – FDA issued the first ITCA 650 CRL 2 (cited manufacturing concerns) 2019 – Intarcia re - submitted ITCA 650 NDA 2020 – FDA issued second ITCA 650 CRL (cited clinical safety and device constituent concerns) 2022 – After dispute resolutions, FDA’s CDER proposes to deny Intarcia’s public hearing request 2023 – FDA Advisory Board unanimously recommends against the approvability of ITCA 650 due to concerns about safety risks linked to irregular and uncontrolled exenatide release Value of long - term GLP - 1 (exenatide) implant externally validated previously 1 i2o Therapeutics acquired Intarcia Therapeutic’s assets including ITCA - 650 2 CRL: Complete Response Letter – issued by FDA to identify NDA deficiencies 16

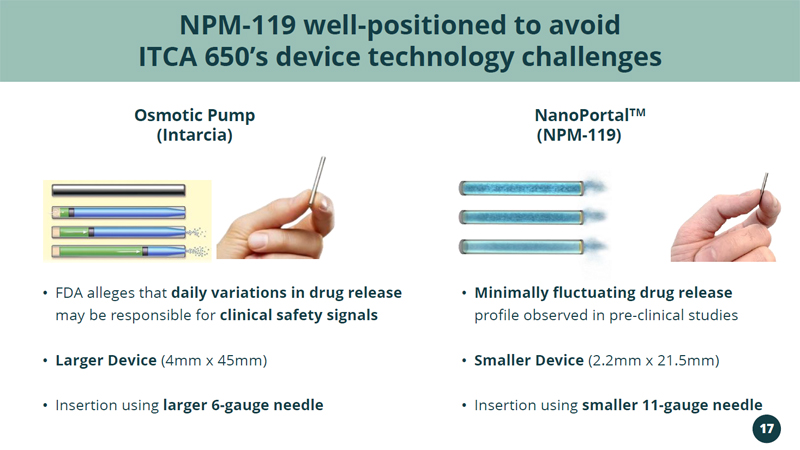

(Intarcia) • FDA alleges that daily variations in drug release may be responsible for clinical safety signals • Larger Device (4mm x 45mm) • Insertion using larger 6 - gauge needle • Minimally fluctuating drug release profile observed in pre - clinical studies • Smaller Device (2.2mm x 21.5mm) • Insertion using smaller 11 - gauge needle NPM - 119 well - positioned to avoid ITCA 650’s device technology challenges NanoPortal TM Osmotic Pump (NPM - 119) 17

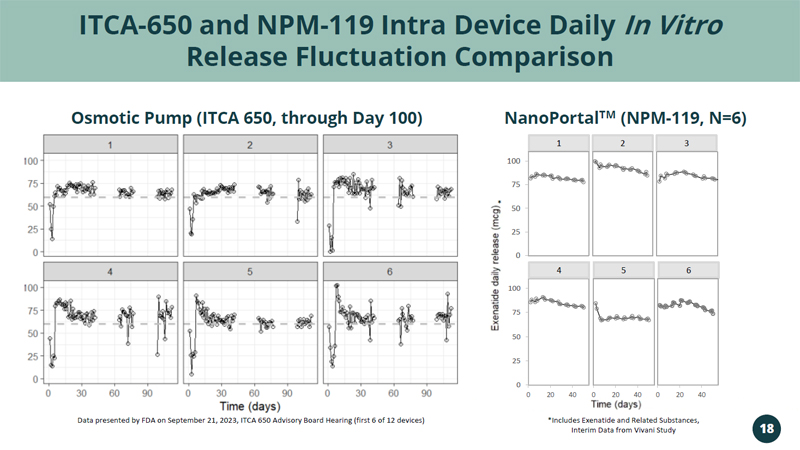

ITCA - 650 and NPM - 119 Intra Device Daily In Vitro Release Fluctuation Comparison Data presented by FDA on September 21, 2023, ITCA 650 Advisory Board Hearing (first 6 of 12 devices) NanoPortal TM (NPM - 119, N=6) Osmotic Pump (ITCA 650, through Day 100) 0 25 50 75 100 0 20 40 5 0 20 40 4 3 1 6 2 0 20 40 * 0 25 50 75 100 *Includes Exenatide and Related Substances, Interim Data from Vivani Study 18

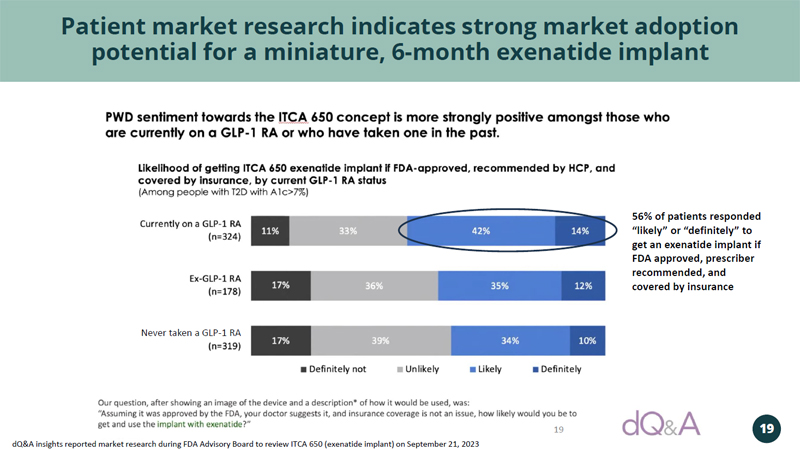

19 Patient market research indicates strong market adoption potential for a miniature, 6 - month exenatide implant dQ&A insights reported market research during FDA Advisory Board to review ITCA 650 (exenatide implant) on September 21, 2023 19 Never taken a GLP - 1 RA 56% of patients responded “likely” or “definitely” to get an exenatide implant if FDA approved, prescriber recommended, and covered by insurance

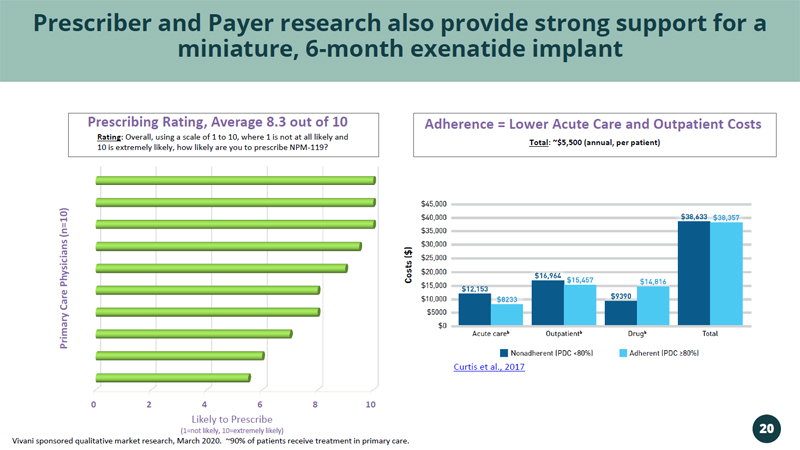

0 2 4 6 8 10 Likely to Prescribe (1=not likely, 10=extremely likely) Primary Care Physicians (n=10) Prescribing Rating, Average 8.3 out of 10 Prescriber and Payer research also provide strong support for a miniature, 6 - month exenatide implant Rating : Overall, using a scale of 1 to 10, where 1 is not at all likely and 10 is extremely likely, how likely are you to prescribe NPM - 119? Vivani sponsored qualitative market research, March 2020. ~90% of patients receive treatment in primary care. Total : ~$5,500 (annual, per patient) Adherence = Lower Acute Care and Outpatient Costs Curtis et al., 2017 20

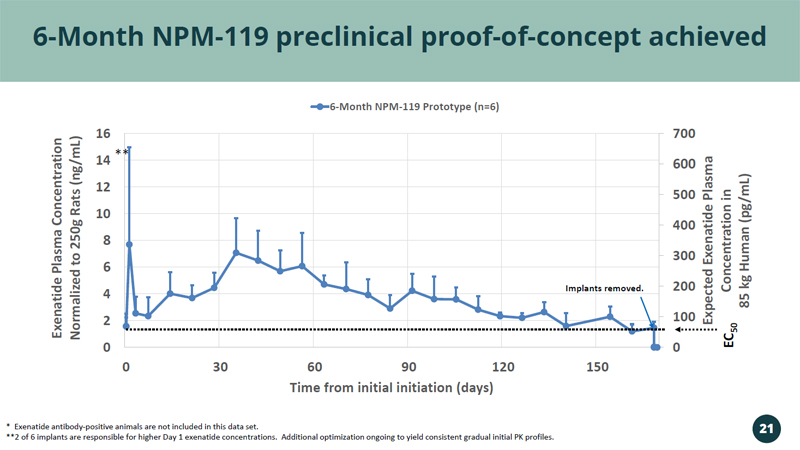

0 100 200 300 400 500 600 700 0 2 4 6 8 10 12 14 16 0 30 60 90 120 150 Expected Exenatide Plasma Concentration in 85 kg Human ( pg /mL) Exenatide Plasma Concentration Normalized to 250g Rats (ng/mL) Time from initial initiation (days) 6-Month NPM-119 Prototype (n=6) 6 - Month NPM - 119 preclinical proof - of - concept achieved EC 50 * Exenatide antibody - positive animals are not included in this data set. **2 of 6 implants are responsible for higher Day 1 exenatide concentrations. Additional optimization ongoing to yield consis ten t gradual initial PK profiles. Implants removed. ** 21

NPM - 119 Clinical and Regulatory Pathway

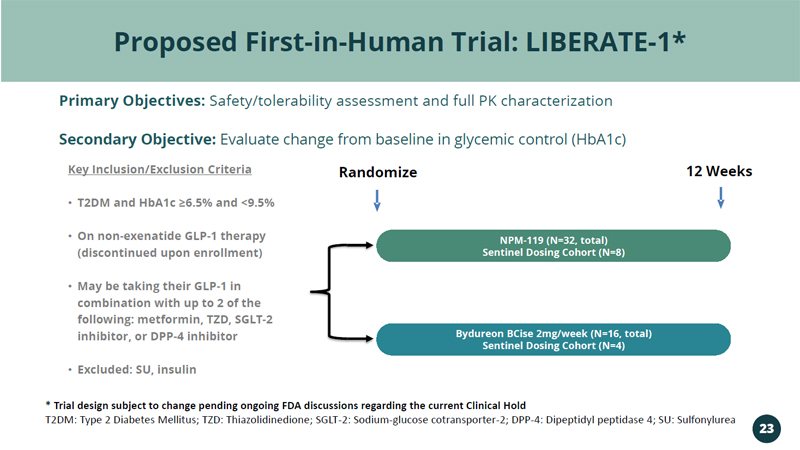

Proposed First - in - Human Trial: LIBERATE - 1* Primary Objectives: Safety/tolerability assessment and full PK characterization Secondary Objective: Evaluate change from baseline in glycemic control (HbA1c) Randomize 12 Weeks Key Inclusion/Exclusion Criteria • T2DM and HbA1c ≥6.5% and <9.5% • On non - exenatide GLP - 1 therapy (discontinued upon enrollment) • May be taking their GLP - 1 in combination with up to 2 of the following: metformin, TZD, SGLT - 2 inhibitor, or DPP - 4 inhibitor • Excluded: SU, insulin NPM - 119 (N=32, total) Sentinel Dosing Cohort (N=8) Bydureon BCise 2mg/week (N=16, total) Sentinel Dosing Cohort (N=4) * Trial design subject to change pending ongoing FDA discussions regarding the current Clinical Hold T2DM: Type 2 Diabetes Mellitus; TZD: Thiazolidinedione; SGLT - 2: Sodium - glucose cotransporter - 2; DPP - 4: Dipeptidyl peptidase 4; S U: Sulfonylurea 23

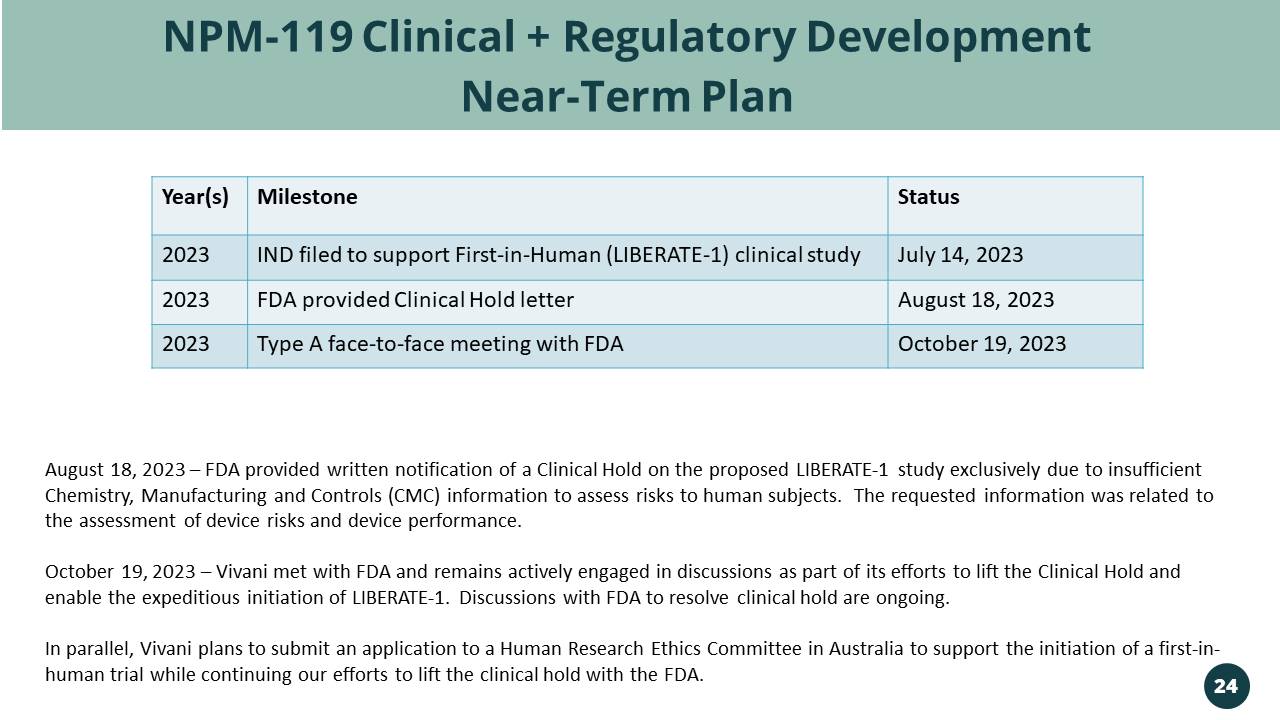

NPM - 119 Clinical + Regulatory Development Near - Term Plan Year(s) Milestone Status 2023 IND filed to support First - in - Human (LIBERATE - 1) clinical study July 14, 2023 2023 FDA provided Clinical Hold letter August 18, 2023 2023 Type A face - to - face meeting with FDA October 19, 2023 August 18, 2023 – FDA provided written notification of a Clinical Hold on the proposed LIBERATE - 1 study primarily due to insuffi cient Chemistry, Manufacturing and Controls (CMC) information to assess risks to human subjects. The requested information was rel ate d to the assessment of device risks and device performance. October 19, 2023 – Vivani met with FDA and remains actively engaged in discussions as part of its efforts to lift the Clinical Hold and enable the expeditious initiation of LIBERATE - 1. Discussions with FDA to resolve clinical hold are ongoing. In parallel, Vivani plans to submit an application to a Human Research Ethics Committee in Australia to support the initiatio n o f a first - in - human trial while continuing our efforts to lift the clinical hold with the FDA. 24

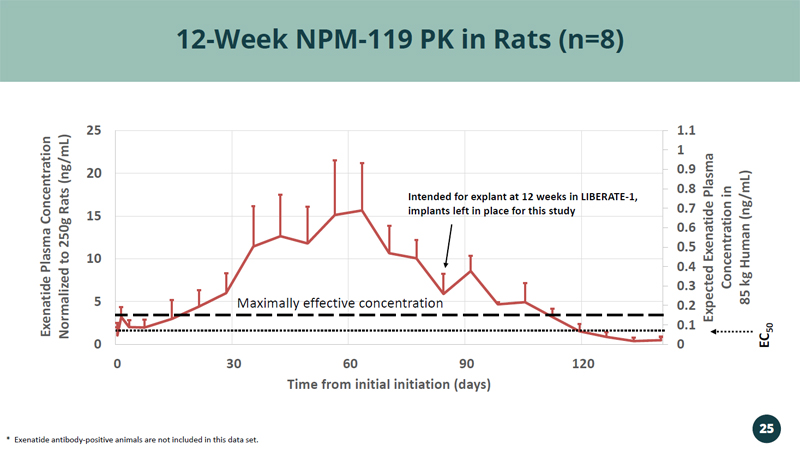

0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1 1.1 0 5 10 15 20 25 0 30 60 90 120 Expected Exenatide Plasma Concentration in 85 kg Human (ng/mL) Exenatide Plasma Concentration Normalized to 250g Rats (ng/mL) Time from initial initiation (days) 12 - Week NPM - 119 PK in Rats (n=8) * Exenatide antibody - positive animals are not included in this data set. 25 EC 50 Maximally effective concentration Intended for explant at 12 weeks in LIBERATE - 1, implants left in place for this study

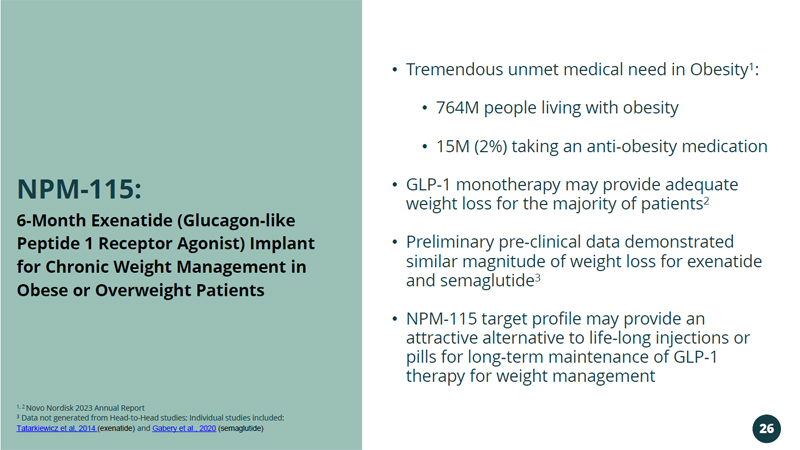

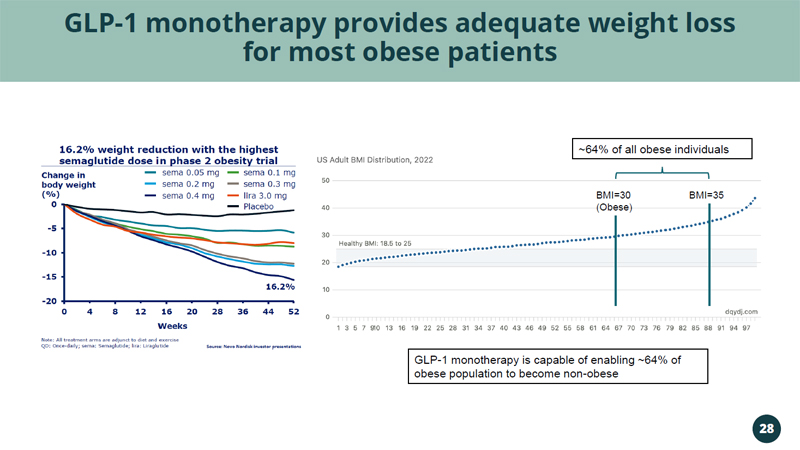

• Tremendous unmet medical need in Obesity 1 : • 764M people living with obesity • 15M (2%) taking an anti - obesity medication • GLP - 1 monotherapy may provide adequate weight loss for the majority of patients 2 • Preliminary pre - clinical data demonstrated similar magnitude of weight loss for exenatide and semaglutide 3 • NPM - 115 target profile may provide an attractive alternative to life - long injections or pills for long - term maintenance of GLP - 1 therapy for weight management 6 - Month Exenatide (Glucagon - like Peptide 1 Receptor Agonist) Implant for Chronic Weight Management in Obese or Overweight Patients NPM - 115: 26 1, 2 Novo Nordisk 2023 Annual Report 3 Data not generated from Head - to - Head studies; Individual studies included: Tatarkiewicz et al, 2014 (exenatide) and Gabery et al., 2020 (semaglutide)

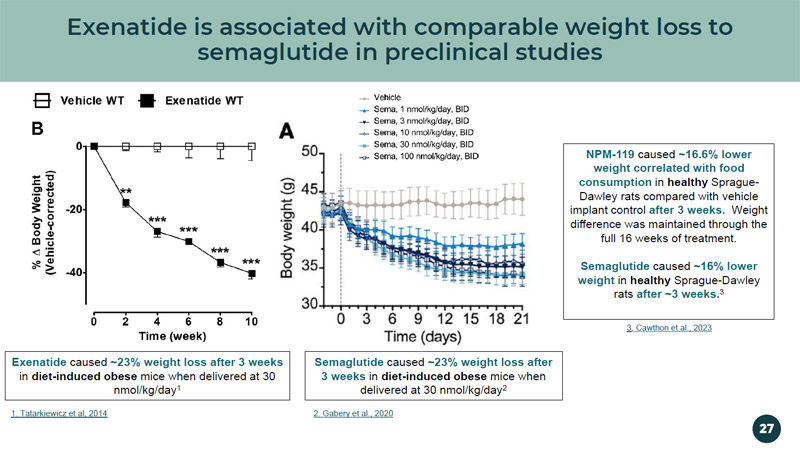

Exenatide is associated with comparable weight loss to semaglutide in preclinical studies Exenatide caused ~23% weight loss after 3 weeks in diet - induced obese mice when delivered at 30 nmol/kg/day 1 Semaglutide caused ~23% weight loss after 3 weeks in diet - induced obese mice when delivered at 30 nmol/kg/day 2 NPM - 119 caused ~16.6% lower weight correlated with food consumption in healthy Sprague - Dawley rats compared with vehicle implant control after 3 weeks. Weight difference was maintained through the full 16 weeks of treatment. Semaglutide caused ~16% lower weight in healthy Sprague - Dawley rats after ~3 weeks. 3 1. Tatarkiewicz et al, 2014 2. Gabery et al., 2020 3 . Cawthon et al., 2023 27

GLP - 1 monotherapy provides adequate weight loss for most obese patients GLP - 1 monotherapy is capable of enabling ~64% of obese population to become non - obese BMI=30 (Obese) BMI=35 ~64% of all obese individuals 28

Vivani Medical, Inc. Financial Information

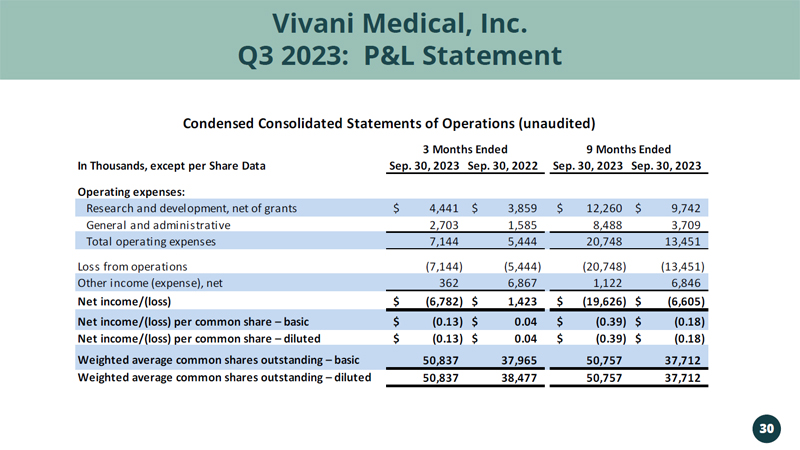

Vivani Medical, Inc. Q3 2023: P&L Statement 30 In Thousands, except per Share Data Sep. 30, 2023 Sep. 30, 2022 Sep. 30, 2023 Sep. 30, 2023 Operating expenses: Research and development, net of grants 4,441$ 3,859$ 12,260$ 9,742$ General and administrative 2,703 1,585 8,488 3,709 Total operating expenses 7,144 5,444 20,748 13,451 Loss from operations (7,144) (5,444) (20,748) (13,451) Other income (expense), net 362 6,867 1,122 6,846 Net income/(loss) (6,782)$ 1,423$ (19,626)$ (6,605)$ Net income/(loss) per common share – basic (0.13)$ 0.04$ (0.39)$ (0.18)$ Net income/(loss) per common share – diluted (0.13)$ 0.04$ (0.39)$ (0.18)$ Weighted average common shares outstanding – basic 50,837 37,965 50,757 37,712 Weighted average common shares outstanding – diluted 50,837 38,477 50,757 37,712 3 Months Ended 9 Months Ended Condensed Consolidated Statements of Operations (unaudited)

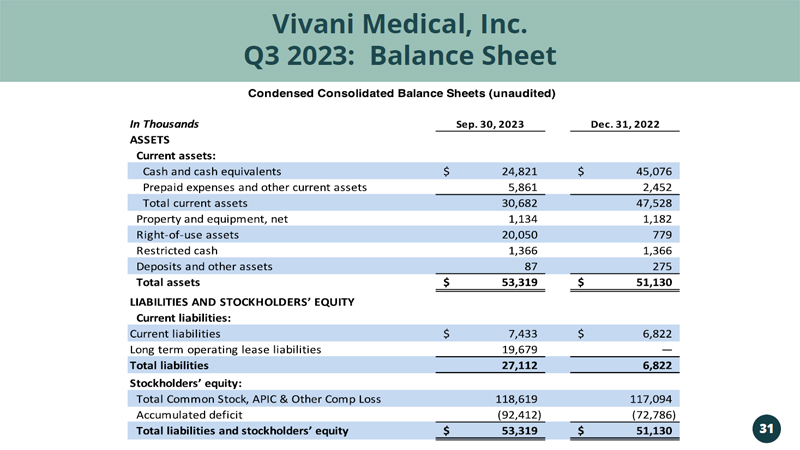

Vivani Medical, Inc. Vivani Medical, Inc. Q3 2023: Balance Sheet 31

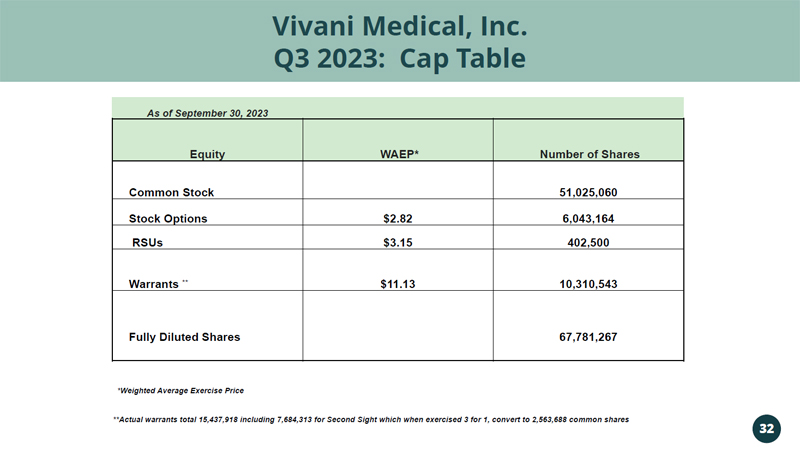

Vivani Medical, Inc. Q3 2023: Cap Table 32 As of September 30, 2023 Equity WAEP* Number of Shares Common Stock 51,025,060 Stock Options $2.82 6,043,164 RSUs $3.15 402,500 Warrants ** $11.13 10,310,543 Fully Diluted Shares 67,781,267 *Weighted Average Exercise Price **Actual warrants total 15,437,918 including 7,684,313 for Second Sight which when exercised 3 for 1, convert to 2,563,688 co mmo n shares

Vivani Medical, Inc. Lead programs NPM - 119 and NPM - 115 are miniature, six - month, GLP - 1 implants under development for the treatment of type 2 diabetes and chronic weight management in obese or overweight patients, respectively. Vivani’s pipeline also contains NPM - 139, using an undisclosed molecule, with the potential for once - yearly administration. An innovative, biopharmaceutical company developing a portfolio of miniature, long - term, drug implants to treat chronic disease. Our NanoPortal ™ platform technology enables the design of implants aimed at improving medication non - adherence and tolerability. Vivani is well - positioned to advance NPM - 119 and NPM - 115 towards potentially transformational milestones in 2024. 33 For more information, please contact: Adam Mendelsohn, PhD, CEO: adam@vivani.com Don Dwyer, MBA, Chief Business Officer: don@vivani.com Website: www.vivani.com