|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 |

| FORM |

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported):

(Exact name of Registrant as Specified in Its Charter)

|

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

(Address of principal executive offices, including zip code)

(Telephone number, including area code, of agent for service)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| The |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

Vivani Medical, Inc. (the “Company”) is disclosing selected preliminary financial information for the second quarter ended June 30, 2025. The Company had approximately $6.8 million (unaudited) in cash and cash equivalents, excluding restricted cash, as of June 30, 2025. Including two equity purchase agreements entered into in March 2025 and May 2025, an additional $11.25 million of committed capital will be contributed through March 2026.

The above information is preliminary financial information for the second quarter ended June 30, 2025 and may change, and were prepared by the Company’s management, based upon its estimates, a number of assumptions and currently available information, and are subject to revision based upon, among other things, quarter and year-end closing procedures and/or adjustments, the completion of the Company’s consolidated financial statements and other operational procedures. This preliminary financial information is the responsibility of management and has been prepared in good faith on a consistent basis with prior periods. However, the Company has not completed its financial closing procedures for the second quarter ended June 30, 2025, and its actual results could be materially different from this preliminary financial information, which preliminary information should not be regarded as a representation by the Company or its management as to its actual results for the second quarter ended June 30, 2025. In addition, BPM, LLP, the Company’s independent registered public accounting firm, has not audited, reviewed, compiled, or performed any procedures with respect to this preliminary financial information and does not express an opinion or any other form of assurance with respect to this preliminary financial information. During the course of the preparation of the Company’s financial statements and related notes as of and for the second quarter ended June 30, 2025, the Company may identify items that would require it to make material adjustments to this preliminary financial information. As a result, prospective investors should exercise caution in relying on this information and should not draw any inferences from this information. This preliminary financial information should not be viewed as a substitute for full financial statements prepared in accordance with United States generally accepted accounting principles and reviewed by the Company’s auditors.

Item 7.01 Regulation FD Disclosure.

LIBERATE-1 Clinical Data Announcement

On August 5, 2025, the Company issued a press release titled “Vivani Medical Announces Rapid Advancement of NPM-139, a Novel Semaglutide Implant, Following Positive Weight Loss Data from an Ongoing Preclinical Study of NPM-139 and Promising Results from the LIBERATE-1 Phase 1 Clinical Study of NPM-115.” A copy of the press release in connection with the announcement is being furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in Item 7.01 of this Current Report on Form 8-K (including Exhibit 99.1 attached hereto) is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 8.01 Other Events.

The information included in Item 2.02 is incorporated herein by reference.

LIBERATE-1 Clinical Data Press Release

On August 5, 2025, the Company issued a press release to report results from the LIBERATE-1 clinical study, the Phase 1 study of the exenatide GLP-1 implant NPM-115 representing the first-in-human test of the Company’s proprietary NanoPortal™ implant technology. The Company also reported new feasibility data for NPM-139 (semaglutide implant) from an ongoing preclinical study, supporting prioritization of the semaglutide implant in the Company’s pipeline and clinical development strategy. Semaglutide is the active ingredient in blockbuster drug products Ozempic®, Wegovy®, and Rybelsus®.

The decision to prioritize NPM-139 is supported by several factors. These include the Company’s belief that the development timelines for the NPM-115 and NPM-139 programs are comparable, the increased confidence in NPM-139 due to the fact that semaglutide products have already established compelling weight loss data in humans, and the strong commercial performance of semaglutide-based products, including Ozempic®, Wegovy®, and Rybelsus®, which have generated over $29B in sales in 2024 and are expected to have continued growth into the foreseeable future.

LIBERATE-1 Study Results

The LIBERATE-1 Phase 1 study successfully met its primary objectives, which were to evaluate the NPM-115 implant’s safety and tolerability profile and to characterize the pharmacokinetic (PK) profile of the implant over a 9-week duration. Throughout the study, the implant was generally well tolerated, and drug release from the implant without any clinically meaningful burst was supported by PK analysis and by the absence of gastrointestinal adverse events in subjects with the implant. No serious adverse events were observed in the study. The release profile observed from the implants over 9 weeks provides encouragement regarding the potential for this technology to provide durable delivery over the 6-month duration that has already been established in preclinical studies of both NPM-115 and NPM-139.

This study paves the way for future clinical development of the implant technology not just for exenatide (NPM-115 and NPM-119) but also for semaglutide (NPM-139) and any other application of NanoPortal technology that Vivani may pursue in the future.

Semaglutide Implant Preclinical Feasibility Data

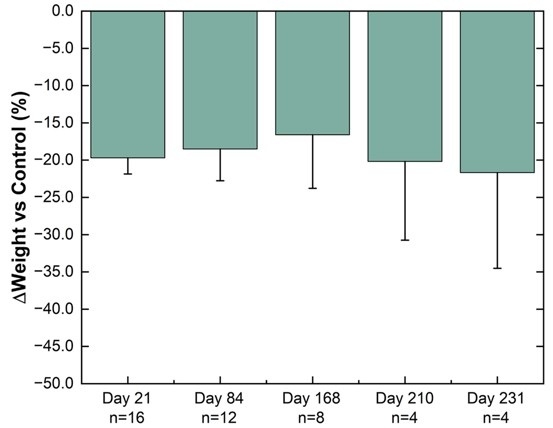

In an ongoing preclinical study, substantial progress in the development of a miniature, ultra long-acting, semaglutide implant, NPM-139 has been established by showing weight loss from a single administration for over 231 days.

NPM-139 (Semaglutide Implant)

Weight difference versus control group in healthy Sprague-Dawley rats. The percentage weight change from baseline for NPM-139 (semaglutide implant) corrected to control (sham implant). Implants from 4 animals were removed on each of Day 21, Day 84, and Day 168 for characterization. Values are mean ± standard error.

While the emerging preclinical data on the Company’s semaglutide implant currently supports the initial target profile of bi-annual dosing, the Company continues to anticipate that a semaglutide implant candidate may be able to support annual dosing in the future. Vivani’s near-term efforts are focused on completion of PK optimization activities and preparation of data to enable the submission of an Investigational New Drug application for NPM-139.

Forward-Looking Statements

This Current Report on Form 8-K contains certain “forward-looking statements” within the meaning of the “safe harbor” provisions of the US Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “target,” “believe,” “expect,” “will,” “may,” “anticipate,” “estimate,” “would,” “planned,” “positioned,” “future,” and other similar expressions that in this press release, including statements regarding the Company’s business, products in development, including the therapeutic potential thereof, the planned development therefor, the completion of the LIBERATE-1 Phase 1 study and reporting of study results, the Company’s emerging development plans for NPM-115, NPM-139, NPM-119 or the Company’s plans with respect to its spin-off, technology, strategy, cash position and financial runway. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on the Company’s current beliefs, expectations, and assumptions. Because forward-looking statements relate to the future, they are subject to additional inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Company’s control. Actual results and outcomes may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause actual results and outcomes to differ materially from those indicated in the forward-looking statements include, among others, risks related to the development and commercialization of the Company’s products, including NPM-115, NPM-139 and NPM-119; delays and changes in the development of the Company’s products, including as a result of applicable laws, regulations and guidelines, potential delays in submitting and receiving regulatory clearance or approval to conduct the Company’s development activities, including the Company's ability to commence clinical development of NPM-139; risks related to the initiation, enrollment and conduct of the Company’s planned clinical studies and the results therefrom; the Company’s history of losses and the Company’s ability to access additional capital or otherwise fund the Company’s business. The foregoing sets forth many, but not all, of the factors that could cause actual results to differ from our expectations in any forward-looking statement. There may be additional risks that the Company considers immaterial, or which are unknown. A further list and description of risks and uncertainties can be found in the Company’s most recent Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (“SEC”) on March 31, 2025, as updated by the Company’s subsequent Quarterly Reports on Form 10-Q and in other reports that the Company has filed with the SEC. Any forward-looking statement made by the Company in this Current Report on Form 8-K is based only on information currently available to the Company and speaks only as of the date on which it is made. The Company undertakes no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of added information, future developments or otherwise, except as required by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. | Description | |

| 99.1 | Press release issued by Vivani Medical, Inc. on August 5, 2025. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

VIVANI MEDICAL, INC. |

|

|

|

|

|

Date: August 5, 2025 |

By: |

/s/ Donald Dwyer |

|

|

Name: |

Donald Dwyer |

|

|

Title: |

Chief Business Officer |